Earnings summaries and quarterly performance for WEST BANCORPORATION.

Executive leadership at WEST BANCORPORATION.

Board of directors at WEST BANCORPORATION.

Research analysts who have asked questions during WEST BANCORPORATION earnings calls.

NR

Nathan Race

Piper Sandler & Co.

5 questions for WTBA

Also covers: ALRS, BSVN, BWB +18 more

Andrew Liesch

Piper Sandler

3 questions for WTBA

Also covers: AX, BANR, BOH +13 more

DW

David Welch

Private Investor

2 questions for WTBA

NJ

Nathan James Race

Piper Sandler

2 questions for WTBA

PV

Paul Vishal

South

1 question for WTBA

Recent press releases and 8-K filings for WTBA.

West Bancorporation Reports Q4 and Full-Year 2025 Results

WTBA

Earnings

Dividends

Guidance Update

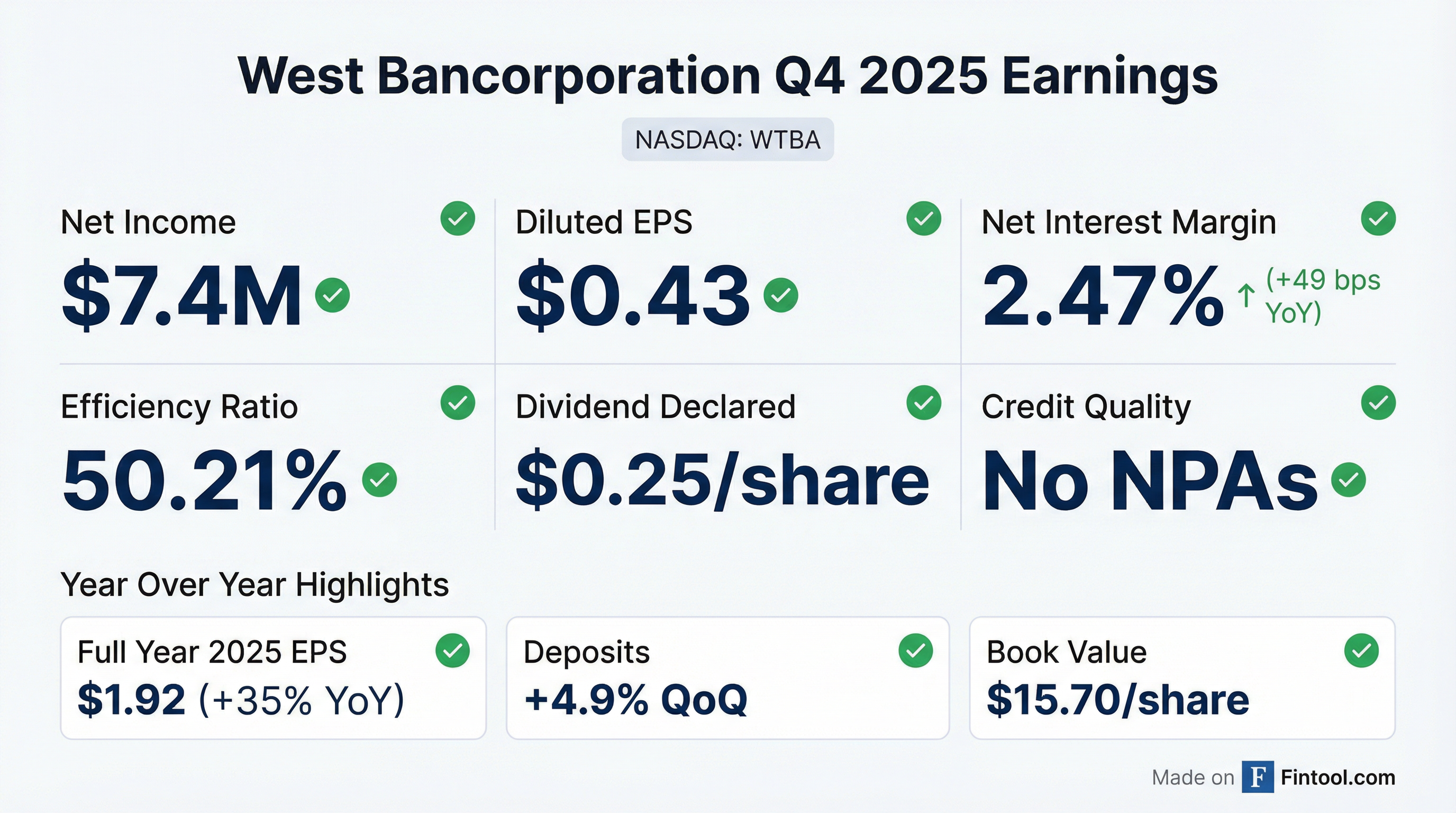

- West Bancorporation reported Q4 2025 net income of $7.4 million, with full-year 2025 net income increasing 35% to $32.6 million compared to $24.1 million in 2024.

- The company executed a securities loss trade in Q4 2025, realizing a $4 million pre-tax net loss on the sale of $64 million in securities, which was done to better position for 2026 and improve balance sheet flexibility.

- Net interest margin improved by 11 basis points compared to Q3 2025, and the cost of deposits declined 28 basis points quarter-over-quarter.

- Core deposit balances increased approximately $212 million in Q4 2025, while loan outstandings were slightly down at just under $3 billion due to elevated payoffs.

- Credit quality remains very strong at year-end 2025, with no past dues over 30 days, non-accruals, or substandard loans. The company also declared a $0.25 dividend payable February 25th to shareholders of record as of February 11th.

Jan 29, 2026, 8:00 PM

West Bancorporation Inc. Reports Q4 and Full-Year 2025 Results, Highlights Margin Expansion and Strong Credit Quality

WTBA

Earnings

Dividends

Guidance Update

- West Bancorporation Inc. reported net income of $7.4 million for Q4 2025 and $32.6 million for the full year 2025, representing a 35% increase over 2024.

- In Q4 2025, the company executed a securities loss trade, selling $64 million of available-for-sale securities and realizing a pre-tax net loss of $4 million, to improve balance sheet flexibility and long-term earnings.

- Net interest margin improved by 11 basis points compared to Q3 2025 and 49 basis points compared to Q4 2024, with the cost of deposits declining. The current margin is approximately 2.5%, with further improvement expected in 2026.

- Deposit balances increased by over $162 million in Q4 2025, driven by core, commercial, and retail deposits, while loan outstandings were slightly down at just under $3 billion as of December 31, 2025.

- Credit quality remains very strong with no past dues over 30 days, no nonaccruals, and no provision for credit losses recorded in Q4 2025. The company also declared a $0.25 dividend.

Jan 29, 2026, 8:00 PM

West Bancorporation Reports Q4 and Full-Year 2025 Results

WTBA

Earnings

Dividends

Guidance Update

- West Bancorporation reported net income of $7.4 million for Q4 2025 and $32.6 million for the full year 2025, representing a 35% increase over 2024.

- In Q4 2025, the company executed a securities loss trade, selling $64 million of securities and realizing a pre-tax net loss of $4 million, which impacted the quarter's net income.

- Credit quality remained strong as of year-end 2025, with no past dues over 30 days, no non-accruals, and no substandard loans, and no provision for credit losses was recorded in the quarter.

- Deposit balances increased just over $162 million in Q4 2025, with core deposits (excluding brokered funds) growing by approximately $212 million in Q4 and $223 million for the year.

- Net interest margin improved, increasing 11 basis points compared to Q3 and 49 basis points compared to Q4 last year, while the cost of deposits declined. The current margin is around 2.5%.

Jan 29, 2026, 8:00 PM

West Bancorporation Announces Strong Full-Year 2025 Earnings and Dividend Declaration

WTBA

Earnings

Dividends

Guidance Update

- **West Bancorporation (WTBA) reported Q4 2025 net income of $7.4 million and full-year 2025 net income of $32.6 million, representing a 35% increase over 2024. ** This includes a $4 million pre-tax net loss from a securities trade executed in Q4 2025, without which Q4 net income would have exceeded $10 million.

- **Credit quality remains very strong at year-end 2025, with no past dues over 30 days, non-accruals, or substandard loans, and no provision for credit losses was recorded in the quarter. **

- **Deposit balances increased by over $162 million in Q4 2025, and the net interest margin improved by 11 basis points compared to Q3 2025, with the cost of deposits declining by 28 basis points. ** The company also anticipates a yield pickup of around 1.5%-2% on just under $400 million in fixed-rate loans repricing in 2026.

- **WTBA declared a $0.25 dividend payable February 25th to shareholders of record as of February 11th. **

Jan 29, 2026, 8:00 PM

West Bancorporation Inc. Reports Q4 2025 Earnings and Declares Dividend

WTBA

Earnings

Dividends

Guidance Update

- Net income for Q4 2025 was $7.4 million, and full-year 2025 net income increased 35% to $32.6 million compared to 2024.

- The company executed a securities loss trade in Q4 2025, realizing a pre-tax net loss of $4 million on the sale of $64 million of securities to improve balance sheet flexibility. Without this transaction, Q4 net income would have exceeded $10 million.

- Deposit balances increased by $162 million in Q4 2025 and $223 million for the full year, contributing to an 11 basis point improvement in net interest margin compared to Q3 2025.

- Credit quality remains very strong at year-end 2025, with no past dues over 30 days, no other real estate owned, no nonaccruals, and no substandard loans.

- West Bank declared a $0.25 dividend, payable February 25th, 2026, to shareholders of record as of February 11th, 2026.

Jan 29, 2026, 8:00 PM

West Bancorporation, Inc. Reports Q4 and Full-Year 2025 Results, Highlights Strong Credit Quality and Deposit Growth

WTBA

Earnings

Dividends

- West Bancorporation, Inc. reported net income of $7.4 million for Q4 2025 and $32.6 million for the full year 2025, marking a 35% increase over 2024. This was despite a Q4 securities loss trade involving the sale of $64 million in securities, which resulted in a $4 million pre-tax net loss but is expected to improve balance sheet flexibility.

- The company maintained very strong credit quality at year-end 2025, with no past dues over 30 days, no nonaccruals, and no substandard loans, and recorded no provision for credit losses in the quarter. Deposit balances increased by over $162 million in Q4 2025, with core deposits growing by approximately $212 million in Q4 and $223 million for the year.

- Net interest margin improved by 11 basis points compared to Q3 and 49 basis points compared to Q4 last year, with the cost of deposits declining 28 basis points compared to Q3. The current margin is around 2.5% with room for improvement, and the company declared a $0.25 dividend payable February 25th.

Jan 29, 2026, 8:00 PM

West Bancorporation Announces Strong 2025 Financial Results and Quarterly Dividend

WTBA

Earnings

Dividends

Revenue Acceleration/Inflection

- West Bancorporation reported net income of $32.6 million or $1.92 per diluted common share for the full year 2025, an increase from $24.1 million or $1.42 per diluted common share in 2024. The company maintained strong credit quality with no loans on nonaccrual status and recorded no credit loss expense in 2025.

- For the fourth quarter of 2025, net income was $7.4 million or $0.43 per diluted common share. The net interest margin (on a fully tax-equivalent basis) improved to 2.47 percent in Q4 2025 from 1.98 percent in Q4 2024, and the efficiency ratio improved to 50.21 percent in Q4 2025 from 60.79 percent in Q4 2024.

- On January 28, 2026, the Board of Directors declared a regular quarterly dividend of $0.25 per common share, payable on February 25, 2026.

Jan 29, 2026, 1:30 PM

West Bancorporation, Inc. Announces Fourth Quarter and Full-Year 2025 Financial Results

WTBA

Earnings

Dividends

- West Bancorporation, Inc. reported net income of $7.4 million, or $0.43 per diluted common share, for the fourth quarter of 2025, and $32.6 million, or $1.92 per diluted common share, for the full year 2025.

- The Company's Board of Directors declared a regular quarterly dividend of $0.25 per common share, payable on February 25, 2026, to stockholders of record on February 11, 2026.

- The net interest margin (on a fully tax-equivalent basis) improved to 2.47 percent for the fourth quarter of 2025, compared to 2.36 percent for the third quarter of 2025 and 1.98 percent for the fourth quarter of 2024.

- The efficiency ratio (on a fully tax-equivalent basis) improved to 50.21 percent for the fourth quarter of 2025, compared to 54.06 percent for the third quarter of 2025 and 60.79 percent for the fourth quarter of 2024.

- The tangible common equity ratio was 6.42 percent as of December 31, 2025, an increase from 5.68 percent as of December 31, 2024.

Jan 29, 2026, 12:07 PM

West Bancorporation Inc. Reports Strong Q3 2025 Earnings and Declares Dividend

WTBA

Earnings

Dividends

Guidance Update

- West Bancorporation Inc. reported net income of $9.3 million for Q3 2025, marking a 16% increase over the prior quarter and a 55% increase over Q3 2024.

- The company's financial performance was primarily driven by an expanding net interest margin, which improved by nine basis points compared to the previous quarter, with the loan yield reaching 5.66% in Q3 2025 and the cost of deposits declining by two basis points.

- Credit quality remains very strong, with no past due loans, non-accrual loans, or provision for credit losses recorded in Q3 2025.

- Loan balances increased by approximately $43 million in Q3 2025 to just over $3 billion, while core deposit balances decreased by approximately $82 million. Management expects to maintain a mid-single-digit loan growth pace.

- The board declared a $0.25 per share quarterly dividend to common stockholders, payable on November 19, 2025.

Oct 23, 2025, 7:00 PM

West Bancorporation Inc. Reports Strong Q3 2025 Earnings and Dividend Declaration

WTBA

Earnings

Dividends

Guidance Update

- West Bancorporation Inc. reported net income of $9.3 million in Q3 2025, representing a 16% increase over the prior quarter and a 55% increase over Q3 2024, primarily driven by an expanding net interest margin which improved by nine basis points.

- The company's credit quality remains very strong, with no past due loans, OREO, non-accrual loans, doubtful accounts, or substandard loans, and no provision for credit losses was recorded in Q3 2025.

- Loan balances increased by approximately $43 million in Q3 2025, while core deposit balances decreased by approximately $82 million.

- The board declared a $0.25 per share quarterly dividend to common stockholders, payable on November 19, 2025.

- Management anticipates mid-single-digit loan growth to be achievable going forward and expects the effective tax rate to return to 22% to 23% in future quarters, similar to the first half of the year.

Oct 23, 2025, 7:00 PM

Quarterly earnings call transcripts for WEST BANCORPORATION.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more