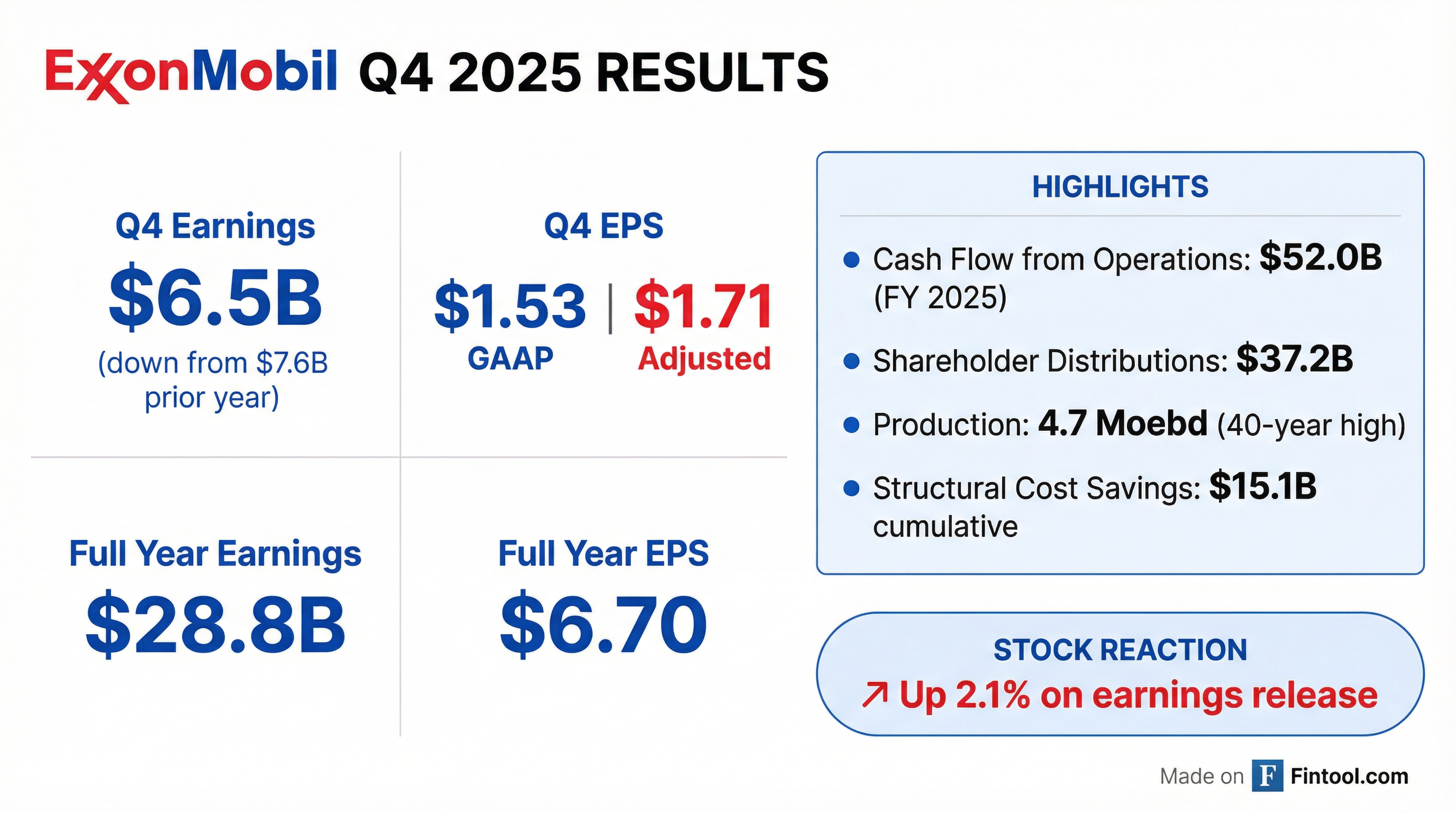

Earnings summaries and quarterly performance for EXXON MOBIL.

Executive leadership at EXXON MOBIL.

Board of directors at EXXON MOBIL.

Alexander Karsner

Director

Angela Braly

Director

Dina Powell McCormick

Director

Jeffrey Ubben

Director

John Harris II

Director

Joseph Hooley

Lead Independent Director

Kaisa Hietala

Director

Lawrence Kellner

Director

Maria Dreyfus

Director

Michael Angelakis

Director

Steven Kandarian

Director

Research analysts who have asked questions during EXXON MOBIL earnings calls.

Devin Mcdermott

Morgan Stanley

9 questions for XOM

Biraj Borkhataria

Royal Bank of Canada

8 questions for XOM

Jean Ann Salisbury

Bank of America

8 questions for XOM

Neil Mehta

Goldman Sachs

8 questions for XOM

Bob Brackett

Bernstein Research

7 questions for XOM

Paul Cheng

Scotiabank

7 questions for XOM

Ryan Todd

Simmons Energy

7 questions for XOM

Stephen Richardson

Evercore ISI

7 questions for XOM

Arun Jayaram

JPMorgan Chase & Co.

5 questions for XOM

Jason Gabelman

TD Cowen

5 questions for XOM

Betty Jiang

Barclays

4 questions for XOM

Doug Leggate

Wolfe Research

4 questions for XOM

Sam Margolin

Wells Fargo & Company

4 questions for XOM

Douglas George Blyth Leggate

Wolfe Research

3 questions for XOM

John Royall

JPMorgan Chase & Co.

3 questions for XOM

Roger Read

Wells Fargo & Company

3 questions for XOM

Alastair Syme

Citigroup

2 questions for XOM

Betty Zhang

Scotiabank

2 questions for XOM

Doug Leggett

Wolfe Research

2 questions for XOM

Neal Dingmann

Truist Securities

2 questions for XOM

Paul Sankey

Sankey Research

2 questions for XOM

Phillip Jungwirth

BMO Capital Markets

2 questions for XOM

Wei Jiang

Barclays

2 questions for XOM

Douglas Leggate

Wolfe Research

1 question for XOM

Josh Silverstein

UBS Group

1 question for XOM

Joshua Silverstein

UBS Group AG

1 question for XOM

Lloyd Byrne

Jefferies LLC

1 question for XOM

Recent press releases and 8-K filings for XOM.

- Exxon projects 13% earnings CAGR to 2030, delivering $25 billion of earnings improvement and $35 billion of operating cash flow uplift through growth in the Permian, Guyana and high-value products.

- A centralized operating model and technology focus has driven $15 billion of structural cost savings-to-date (target $20 billion by 2030) and unlocked $5 billion of supply-chain efficiencies via digital twins and logistics optimization.

- Product Solutions is expected to add $9 billion of earnings by 2030, assuming Q4 2025 mid-cycle margins, as major fuels, lubricants and chemicals projects in China, Singapore, the U.K. and Canada ramp.

- Capital allocation priorities include funding high-return growth, maintaining net debt/capital at 11%, growing the dividend for a 43rd consecutive year, and executing $20 billion of share buybacks in 2026.

- Exxon Mobil’s strategy focuses on growing production and reducing emissions by leveraging integrated scale, technology and centralized capabilities, driving projects such as the Singapore Residue Upgrade, Pioneer acquisition, Guyana developments and new graphite battery-anode materials.

- Outlook through 2030 includes 13% CAGR earnings growth, $25 B of earnings improvement and $35 B of operating cash flow improvement, underpinned by Permian expansion, Guyana output and high-value Product Solutions.

- Reorganized into central technology, projects, operations, trading and supply functions to leverage competitive strengths, achieving $15 B in cost savings to date and targeting $20 B by 2030.

- Permian production expected to rise from 1.2 to 2.5 MMbpd by 2030, driven by innovations such as lightweight proppant delivering ~20% uplift and $4 B in synergies from the Pioneer deal.

- Capital allocation prioritizes organic investment and a strong balance sheet (11% net debt/capital), 43 years of dividend growth, and $20 B in share buybacks planned for 2026.

- Projecting a 13% earnings CAGR through 2030, supported by $25 billion of earnings improvement and $35 billion of operating cash flow uplift from growth in Permian, Guyana and Product Solutions.

- Capital allocation emphasizes continued reinvestment, maintaining a strong balance sheet at 11% net debt to capital, extending a 43-year streak of dividend growth, and up to $20 billion in annual share buybacks.

- Key growth initiatives include Permian productivity gains via proprietary technologies; unlocking Guyana’s 11 billion boe resource with four FPSOs online and three more under construction (plus block expansion post-border resolution); and future LNG developments in Mozambique and Papua New Guinea (2030s).

- Leveraging technology by centralizing R&D, projects and operations functions, unifying global ERP into a single SAP instance, and piloting AI-enhanced seismic interpretation to unlock additional upside beyond current guidance.

- TotalEnergies signed a 20-year letter of intent to offtake 2 mtpa from the 20 mtpa Alaska LNG export project, conditional on the project’s final investment decision.

- The Alaska LNG project is 75% owned by Glenfarne and 25% by the State of Alaska, includes an 807-mile pipeline to the Pacific coast, completed primary FEED in late 2025, and secured permit renewal in December 2025.

- TotalEnergies was the #1 U.S. LNG exporter in 2025, shipping 19 mt (≈18% of U.S. production), and this offtake will enhance its Asia-oriented LNG portfolio.

- Glenfarne Alaska LNG and TotalEnergies signed a Letter of Intent for the offtake of 2 MTPA of LNG from the Alaska LNG project.

- Alaska LNG is designed to produce 20 MTPA of LNG; Glenfarne intends to contract 80% (16 MTPA) to finance the project and has 13 MTPA already committed under preliminary long-term agreements.

- TotalEnergies was the #1 exporter of US LNG in 2025, shipping 19 MT (18% of US production).

- The project includes an 807-mile, 42-inch pipeline and is being developed in two phases (domestic supply and export); ownership is 75% Glenfarne and 25% State of Alaska.

- Exxon Mobil warns the EU’s proposed methane-emissions framework could increase crude import costs by about $9 per barrel (13%).

- The company estimates 80% of the EU’s current crude imports would not meet the standards by 2027, narrowing the supply pool for refiners.

- Required measurement, reporting, and verification (MRV) may create a two-tier market, with cleaner, verified barrels commanding a premium and others facing reduced access.

- Senior energy executives, including Exxon’s Matt Crocker, will meet EU officials in Antwerp alongside French President Macron and German Chancellor Merz to discuss energy affordability and competitiveness.

- Best-ever annual results with customer count up over 30% and multiple eight-figure contracts signed, positioning its system as the official emissions record across the full value chain.

- Solution now trusted by major energy firms including ExxonMobil, Chevron, and Phillips 66 for reliable, AI-enabled emissions data and monitoring.

- Operational efficiency improved—data delivery cycle shortened by 48%—helping clients rapidly shift from detection to mitigation.

- Global footprint expanded to 6 countries in 2025, with plans to cover 10+ countries by 2026 using LiDAR-based standardized monitoring.

- Ongoing R&D investment in advanced analytics, AI/ML, and core monitoring technologies to drive faster, more accurate decision-making.

- ExxonMobil Guyana acquired FPSO ONE GUYANA for US$2.32 billion, closing the transaction ahead of its August 2027 lease expiry.

- SBM Offshore used the net proceeds to fully repay US$1.74 billion in project financing, materially reducing its net debt.

- The FPSO, on hire since August 2025, will remain under SBM Offshore’s operation and maintenance through 2035.

- The deal’s financial impact will be included in SBM Offshore’s 2026 guidance in the Full Year 2025 earnings release on February 26, 2026.

- ExxonMobil achieved its 2030 emission targets early, cutting corporate GHG intensity by >20%, upstream intensity by >40%, and flaring by >60% in 2025.

- Upstream production averaged 4.7 million boe/d, including record Q4 Permian output of 1.8 million boe/d and Guyana production of 875,000 bbl/d.

- All 10 key 2025 projects were brought online, underpinning growth in advantaged assets and technology platforms (e.g., Proxima Systems expansion, carbon capture capacity of ~9 Mt CO₂/yr).

- Five-year annualized shareholder return was 29%, with $150 billion of distributions and $20 billion of share repurchases in 2025.

- 2025 corporate GHG intensity down >20%, upstream GHG intensity down >40%, flaring intensity down >60%; expects 2030 methane target by end of 2026.

- Upstream production averaged 4.7 M boe/d in 2025; Q4 Guyana output ~875 k bpd and Permian record of 1.8 M boe/d.

- Completed all 10 key projects in 2025, delivered industry-leading cost savings, and repurchased $20 B of shares, contributing to a 29% annualized shareholder return over five years.

- Advanced technology deployment: lightweight proppant in ~25% of Permian wells (target 50% by end-2026) and battery-grade graphite anode delivering 30% faster charging.

- Expanded carbon capture network with first third-party CCS storing 2 Mt/year, secured seven contracts, totaling ~9 Mt/year sequestration capacity.

Fintool News

In-depth analysis and coverage of EXXON MOBIL.

Supreme Court to Decide Fate of Billions in Climate Lawsuits Against Big Oil

US Forces Board Tanker in Indian Ocean After 15,000 km Pursuit from Caribbean

Modi Agrees to Cut Off Russian Oil as Trump Slashes India Tariffs to 18%

Oil Crashes 3% as Trump Says Iran 'Seriously Talking' on Nuclear Deal

Iran-US Tensions Escalate: Your Monday Market Playbook

IEA Warns of 4.25 Million Barrel Daily Surplus in Q1 2026 — Largest in Years

Quarterly earnings call transcripts for EXXON MOBIL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more