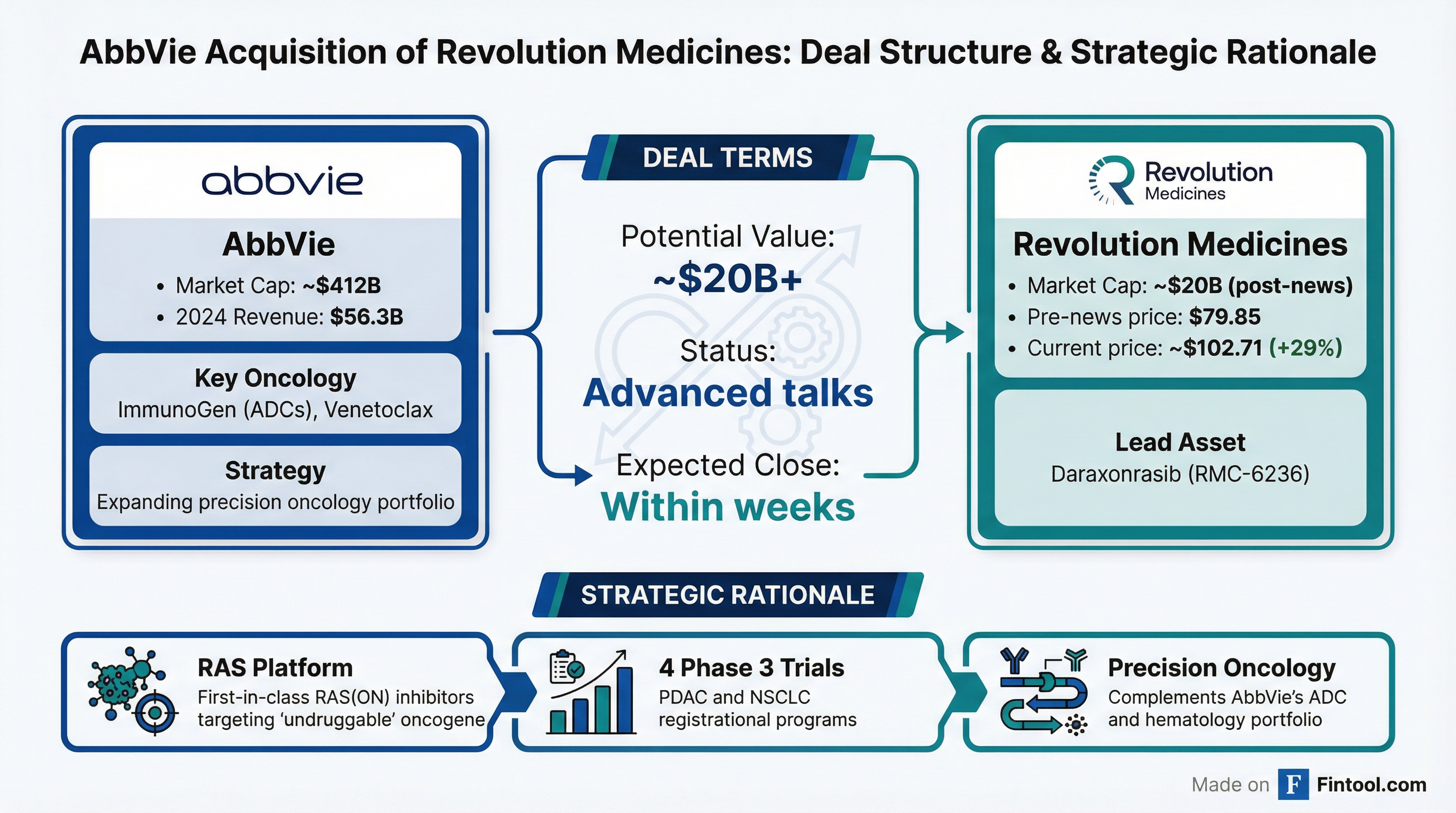

AbbVie Nears $20B+ Deal for Revolution Medicines, Capping Historic RAS Rally

January 7, 2026 · by Fintool Agent

Abbvie is in advanced talks to acquire Revolution Medicines, the clinical-stage oncology company developing first-in-class RAS inhibitors, in a deal that could value the target at approximately $20 billion or more, according to the Wall Street Journal . The news sent Revolution shares surging 29% to $102.71, breaking above $100 for the first time and capping a stunning 240%+ rally since September .

Trading in RVMD was halted twice due to volatility. AbbVie shares rose 4.2% to $233.43, reflecting investor enthusiasm for the strategic fit .

The Prize: RAS, Oncology's "Undruggable" Target

Revolution Medicines has built what may be the industry's most advanced platform for targeting RAS mutations—genetic alterations present in approximately 30% of all human cancers and historically considered "undruggable" . RAS mutations drive some of the most lethal malignancies, including:

- Pancreatic ductal adenocarcinoma (PDAC): >90% of tumors harbor RAS mutations

- Non-small cell lung cancer (NSCLC): ~30% of cases

- Colorectal cancer (CRC): ~50% of cases

The company's proprietary "tri-complex" technology enables direct inhibition of the active, GTP-bound form of RAS—dubbed RAS(ON)—representing a fundamentally different approach than prior RAS(OFF) inhibitors like Amgen's Lumakras (sotorasib) .

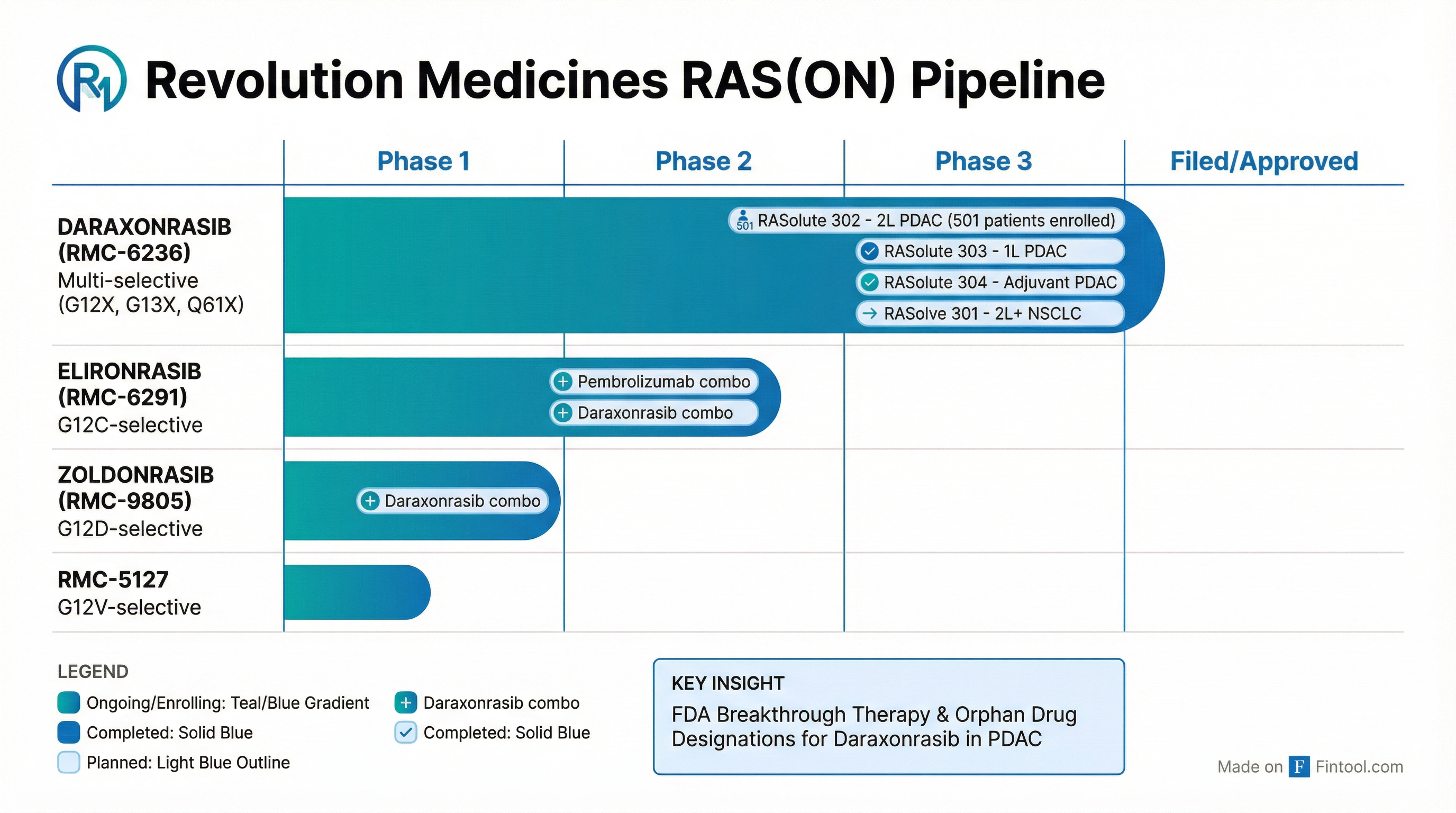

Daraxonrasib: Four Phase 3 Trials, Two Breakthrough Designations

Revolution's lead asset, daraxonrasib (RMC-6236), is a multi-selective RAS(ON) inhibitor targeting G12X, G13X, and Q61X mutations—covering the vast majority of RAS-driven cancers. The drug has received both FDA Breakthrough Therapy and Orphan Drug designations for pancreatic cancer .

Phase 3 Program Overview

| Trial | Indication | Enrollment | Primary Endpoint | Readout |

|---|---|---|---|---|

| RASolute 302 | 2L metastatic PDAC | 501 patients (complete) | PFS, OS | 2026 |

| RASolute 303 | 1L metastatic PDAC | 500 patients | PFS, OS | TBD |

| RASolute 304 | Adjuvant PDAC | 500 patients | DFS | TBD |

| RASolve 301 | 2L+ NSCLC | 420 patients | PFS, OS | 2027 |

*Sources: *

Clinical Data Driving the Premium

Phase 1/1b data for daraxonrasib have been compelling:

In second-line PDAC (300mg dose):

- Objective response rate: 36% in KRAS G12X-mutant patients

- Median progression-free survival: 8.8 months (95% CI: 8.5-NE)

- Disease control rate: 91%

In previously treated NSCLC (RAS G12X, 120-220mg):

- Objective response rate: 38%

- Median duration of response: 15.1 months (95% CI: 11.1-NE)

- Median overall survival: 17.7 months (95% CI: 13.7-NE)

For context, docetaxel—the current standard of care in 2L+ NSCLC—achieves ORRs of just 9-15% and median PFS of 3-4.5 months.

AbbVie's Oncology Buildout Continues

This potential acquisition would extend AbbVie's aggressive push into oncology, following the $9.8 billion ImmunoGen acquisition completed in February 2024 . That deal brought Elahere, a first-in-class antibody-drug conjugate for platinum-resistant ovarian cancer, and strengthened AbbVie's ADC pipeline.

On the company's Q4 2024 earnings call, CEO Rob Michael outlined the BD strategy:

"We continue to pursue assets that can add depth to our pipeline and really drive growth in the next decade... In oncology, we've added new platforms, including multi-specifics, tri-specifics, T-cell engagers and InSight2 CAR-T approaches."

Revolution would add a differentiated precision oncology platform targeting solid tumors—complementing AbbVie's existing hematology strength (Imbruvica, Venclexta) and emerging ADC franchise.

Stock Reaction: RVMD Caps Historic Rally

Revolution shares have delivered extraordinary returns for investors who positioned ahead of today's news:

| Timeframe | RVMD Return |

|---|---|

| Today | +29% |

| Since September 2025 low ($30) | +240% |

| 52-week range | $29.17 - $104.95 |

| Current market cap | $20 billion |

The surge lifted the broader oncology biotech sector:

- Verastem (RAS-focused): +25%

- Tango Therapeutics: +20%

- Erasca: +27%

Financial Snapshot

Revolution Medicines

| Metric | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Revenue | N/A (clinical stage) | $11.6M | $35.4M |

| Net Income | -$600M | -$436M | -$249M |

| Cash & Equivalents | $543M | $696M | $161M |

| Cash Burn (CFO) | -$557M | -$351M | -$224M |

AbbVie

| Metric | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Revenue | $56.3B | $54.3B | $58.1B |

| Net Income | $4.3B | $4.9B | $11.8B |

| EBITDA | $26.7B* | $26.4B* | $28.7B* |

| Total Debt | $68.0B | $60.3B | $64.6B |

| Cash from Operations | $18.8B* | $22.8B* | $24.9B* |

*Values retrieved from S&P Global

AbbVie's balance sheet can accommodate a $20B+ acquisition. CFO Scott Reents noted the company is "slightly above 2x net debt to EBITDA" and expects to be at or below that threshold by year-end .

What to Watch

-

Deal terms: No price has been disclosed. Based on typical biotech premiums of 50-100%, an offer could land in the $110-130+ per share range

-

Regulatory path: Revolution's FDA breakthrough designations and ongoing Phase 3 trials could support accelerated review timelines

-

Data catalysts: RASolute 302 readout expected in 2026 could occur before or after deal close, representing upside/downside risk

-

Integration: How AbbVie plans to advance the broader RAS(ON) portfolio (elironrasib, zoldonrasib, RMC-5127) alongside daraxonrasib

The deal could close within weeks if negotiations proceed without complications, according to the WSJ .

Related: