Alaska Airlines Places Largest Order in Its 92-Year History—110 Boeing Jets Worth Billions

January 7, 2026 · by Fintool Agent

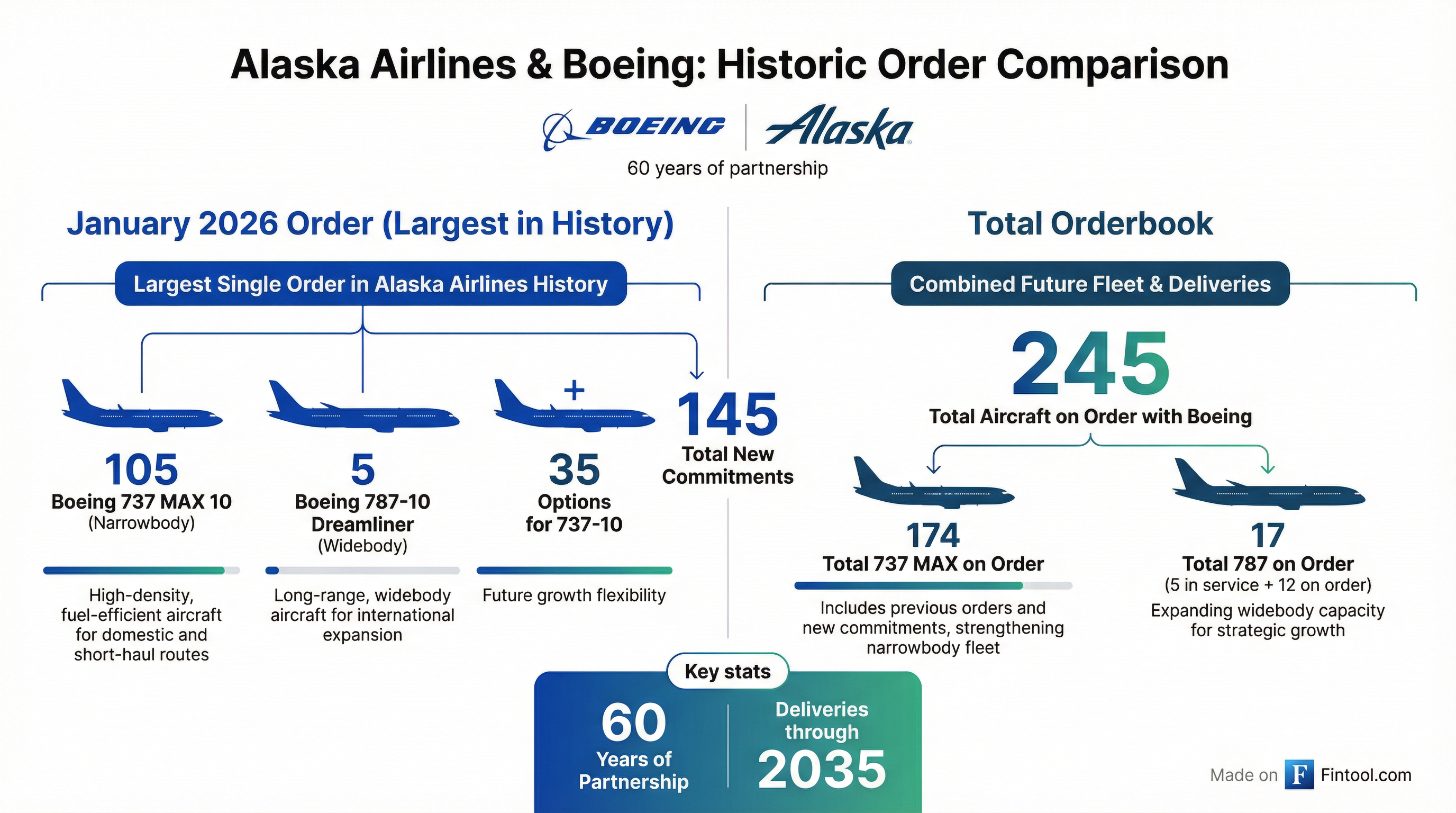

Alaska Air Group is betting big on Boeing. The Seattle-based carrier announced its largest aircraft order ever—110 new jets—marking a decisive vote of confidence in its Pacific Northwest neighbor exactly two years after a door plug blew off one of its 737 MAX 9 aircraft mid-flight.

The order includes 105 Boeing 737 MAX 10 narrowbody jets and five 787-10 Dreamliners, with options for 35 additional 737-10s. Deliveries will extend through 2035, enabling Alaska to grow its fleet from 413 aircraft today to more than 550 by decade's end.

Alaska shares traded at $49.99 on Wednesday, down 1.5% on the news, while Boeing rose 1% to $232.24—adding nearly $2 billion to its market cap as investors digested another major narrowbody order.

The Deal: Breaking It Down

| Component | Quantity | Purpose |

|---|---|---|

| 737 MAX 10 | 105 firm orders | High-density domestic routes, fleet renewal |

| 737 MAX 10 Options | 35 | Future flexibility |

| 787-10 Dreamliner | 5 firm orders | Long-haul international expansion |

| Total Firm Orders | 110 | Largest in Alaska's 92-year history |

| Total Orderbook | 245 aircraft | With Boeing through 2035 |

Alaska declined to disclose the value, but based on list prices—$148 million for the 737-10 and $338 million for the 787-10—the order would be worth approximately $17 billion before customary discounts that can reach 40-50% for large orders.

"This fleet investment builds on the strong foundation Alaska has created to support steady, scalable and sustained growth," CEO Ben Minicucci said. "We are incredibly proud to be partnering with Boeing, a Pacific Northwest neighbor and a company that stands as a symbol of American innovation and manufacturing."

Trust Rebuilt After Door Plug Incident

The order carries symbolic weight. On January 5, 2024, a door plug panel blew out of an Alaska Airlines 737 MAX 9 shortly after takeoff from Portland, Oregon. No one was seriously injured, but the incident triggered an FAA grounding, Congressional hearings, and a fundamental reckoning at Boeing over quality and safety.

Alaska's fleet chief Shane Jones addressed this directly: "Our trust in Boeing is a part of this order. It shows our confidence in the MAX 10 certification and our confidence in Boeing and their turnaround and their ability to produce quality aircraft on time."

For Boeing, the order validates CEO Kelly Ortberg's recovery strategy. In Q3 2025, Boeing stabilized 737 production at 38 per month and jointly agreed with the FAA in October to increase to 42 per month—the first production increase since the door plug incident.

| Boeing Q3 2025 Metrics | Value | Change |

|---|---|---|

| Commercial Deliveries | 160 | +38% YoY |

| Revenue | $23.3B | +30% YoY |

| Total Backlog | $636B | Record high |

| 737 Deliveries (YTD) | 330 | vs. 229 in 2024 |

"All of us at Boeing are proud of Alaska's success and are honored they have placed their trust in our people and our 737 and 787 airplanes to help grow their airline," said Stephanie Pope, president and CEO of Boeing Commercial Airplanes.

Alaska's Global Ambitions

The order underpins Alaska's transformation from a regional West Coast carrier into what Minicucci calls "the country's fourth largest global airline." The 787 Dreamliners will power international expansion from Seattle—a natural gateway to Asia and Europe—with at least 12 long-haul destinations planned by 2030.

International routes now available for booking:

| Destination | Frequency | Launch Date |

|---|---|---|

| London Heathrow | Daily, year-round | May 21, 2026 |

| Rome | Daily, seasonal | April 28, 2026 |

| Reykjavik | Daily, seasonal | May 28, 2026 |

| Tokyo Narita | Daily, year-round | In service |

| Seoul Incheon | 5x weekly, year-round | In service |

The carrier also unveiled a new "global livery" for its 787 fleet—a design inspired by the Aurora Borealis with deep midnight blues and emerald greens. Artists spent nearly 1,000 hours over 13 days painting the first aircraft.

Alaska's 2024 merger with Hawaiian Airlines provides additional scale. The combined carrier now operates hubs in Seattle, Honolulu, Portland, Anchorage, Los Angeles, San Diego, and San Francisco, with Hawaiian scheduled to join the oneworld alliance in spring 2026.

Financial Foundation

Alaska's order is backed by improving fundamentals:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $3.53B | $3.14B | $3.70B | $3.77B |

| Net Income | $71M | -$166M | $172M | $73M |

| EBITDA Margin | 8.5%* | 2.7%* | 14.4%* | 11.0%* |

| Total Debt | $6.39B | $6.28B | $6.37B | $6.47B |

*Values retrieved from S&P Global

Trailing twelve-month revenue now exceeds $14 billion, with quarterly EBITDA margins recovering after Q1 seasonality and Hawaiian integration costs. The carrier spent approximately $1.4 billion on capital expenditures in the first three quarters of 2025, setting the stage for this expanded order book.

The 737 MAX 10: Still Not Certified

There's one significant caveat: the 737 MAX 10 still hasn't received FAA certification.

The largest variant of the 737 MAX family, the MAX 10 seats up to 230 passengers and offers the lowest cost per seat of any single-aisle aircraft. But certification has been delayed for years, caught up in regulatory changes following the two fatal 737 MAX crashes in 2018 and 2019.

Alaska's fleet chief Jones told CNBC the airline expects FAA certification "this year" with deliveries beginning in 2027. The airline retains flexibility to adjust to a different 737 model if necessary.

For Boeing, MAX 10 certification remains critical. The company's Q3 2025 filing noted that it "jointly agreed with the FAA in October to increase to 42 per month" for 737 production, but this applies to currently certified variants. The MAX 10 represents a significant chunk of Boeing's 5,900+ commercial backlog.

60 Years of Partnership

The order kicks off the 60th year of the Boeing-Alaska partnership, which began when Boeing delivered a 727 to Alaska Airlines in 1966.

Today, Alaska operates 248 Boeing 737s—the only narrowbody type in its mainline fleet until the Hawaiian merger brought Airbus A321s and A330s. The carrier has remained a Boeing loyalist even as competitors diversified:

| Carrier | Primary Narrowbody | Primary Widebody |

|---|---|---|

| Alaska Airlines | Boeing 737 MAX | Boeing 787 |

| Delta | Airbus A321neo | Airbus A350 |

| United | Both MAX & A321neo | Boeing 787 |

| American | Both MAX & A321neo | Boeing 787 |

The 105 737-10s ordered today bring Alaska's total MAX orderbook to 174 aircraft. Combined with 94 MAX jets already in service, Boeing's narrowbody family will dominate Alaska's fleet for decades.

What It Means for Boeing

For Boeing, Alaska's order adds to a growing pile of commercial wins as the company claws back from its annus horribilis:

Recent Major 737 Orders:

- Turkish Airlines: 50 787s (Q3 2025)

- Norwegian: 30 737-8s (Q3 2025)

- Alaska Airlines: 105 737-10s + 5 787-10s (Today)

Boeing's commercial backlog now stands at $535 billion with over 5,900 aircraft—the highest in years. But the company remains deeply unprofitable, posting net losses of $5.3 billion in Q3 2025 alone.

| Boeing Commercial Metrics | Q3 2025 |

|---|---|

| Revenue | $11.1B |

| Operating Loss | -$5.4B |

| Deliveries | 160 aircraft |

| Backlog | $535B / 5,900+ aircraft |

The Alaska order demonstrates that airlines are willing to commit billions to Boeing's future—even with certification delays and fresh memories of the door plug incident. The question is whether Boeing can execute on production ramps while maintaining the quality standards that brought it so much trouble.

The Bottom Line

Alaska's 110-plane order is a landmark deal for both companies. For Alaska, it secures fleet slots through 2035 and underwrites ambitions to become a true global carrier. For Boeing, it's validation that customers still believe in its turnaround—and are willing to bet billions on the 737 MAX 10 even before it's certified.

The partnership is deeper than business. Boeing's 737 factory sits 10 miles from Alaska's Seattle headquarters. Ben Minicucci called Boeing "a Pacific Northwest neighbor and a company that stands as a symbol of American innovation and manufacturing."

Now both companies need to deliver. Alaska needs full planes on profitable international routes. Boeing needs certified aircraft rolling off the line on schedule.

Sixty years into this partnership, the stakes have never been higher.