AMD Posts Record $10.3B Quarter, Stock Falls 5% as AI Expectations Outpace Results

February 3, 2026 · by Fintool Agent

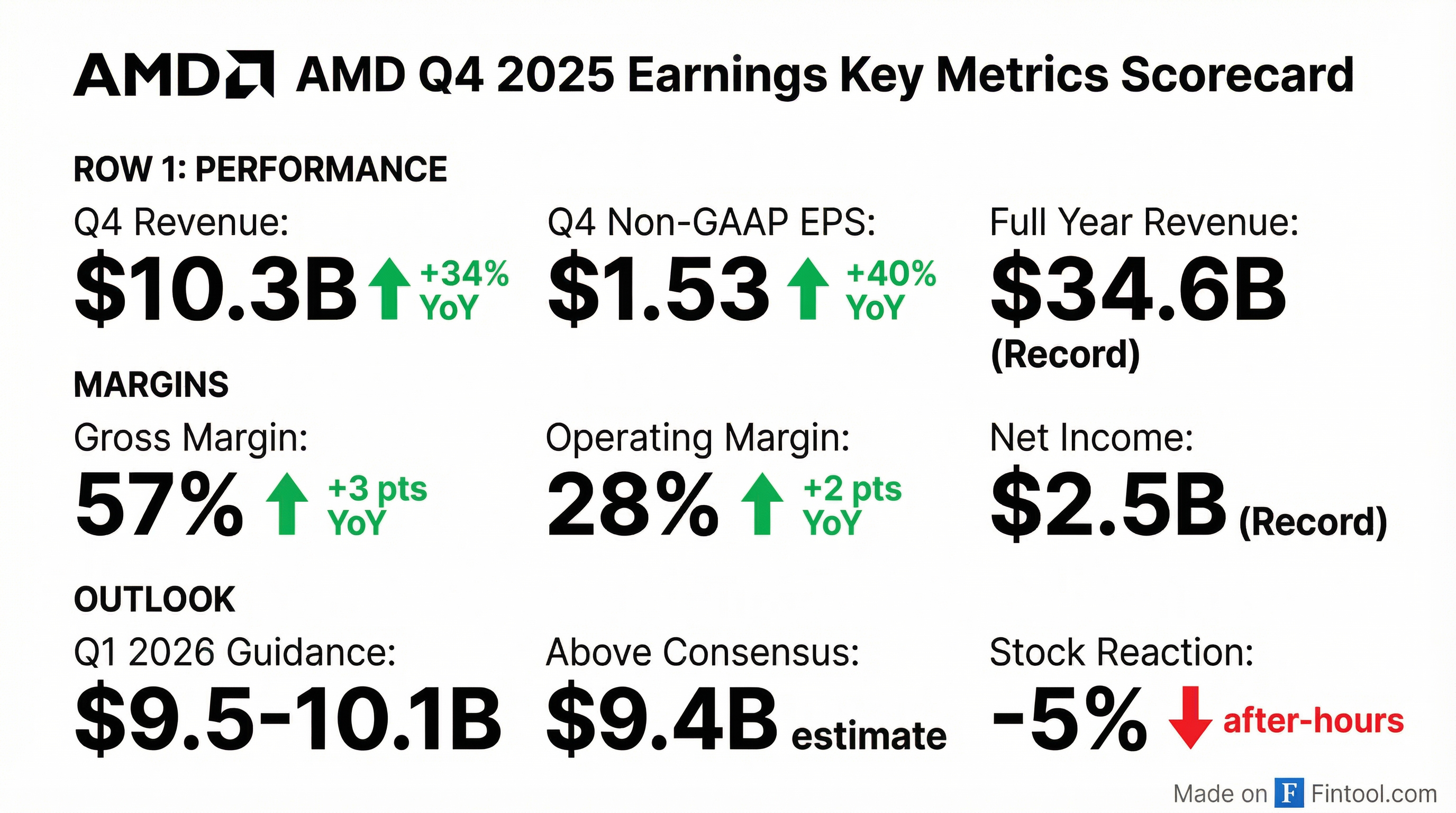

Advanced Micro Devices delivered a blowout fourth quarter—record revenue, record earnings, and guidance above consensus—yet shares still fell more than 5% in after-hours trading Tuesday. The reaction encapsulates the paradox facing AI chipmakers: even exceptional results can disappoint when expectations have grown even more exceptional.

The Numbers

AMD reported Q4 2025 revenue of $10.3 billion, up 34% year-over-year and 11% sequentially, marking a new quarterly record. Non-GAAP earnings per share came in at $1.53, crushing the $1.32 consensus by 16%.

For the full year, AMD delivered $34.6 billion in revenue—also a record—with non-GAAP net income of $6.8 billion and EPS of $4.17.

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Revenue | $10.3B | $7.7B | +34% |

| Non-GAAP Gross Margin | 57% | 54% | +3 pts |

| Non-GAAP Operating Income | $2.9B | $2.0B | +41% |

| Non-GAAP EPS | $1.53 | $1.09 | +40% |

| GAAP Net Income | $1.5B | $0.5B | +213% |

Source: AMD Investor Relations

Why the Stock Sold Off

The sell-off crystallizes a familiar AI-stock phenomenon: elevated buy-side expectations that exceed published consensus estimates. Several factors contributed to the decline:

Operating leverage concerns. Despite 34% revenue growth, operating margin expanded only modestly. Some investors had anticipated greater margin expansion as AI-related revenues scaled.

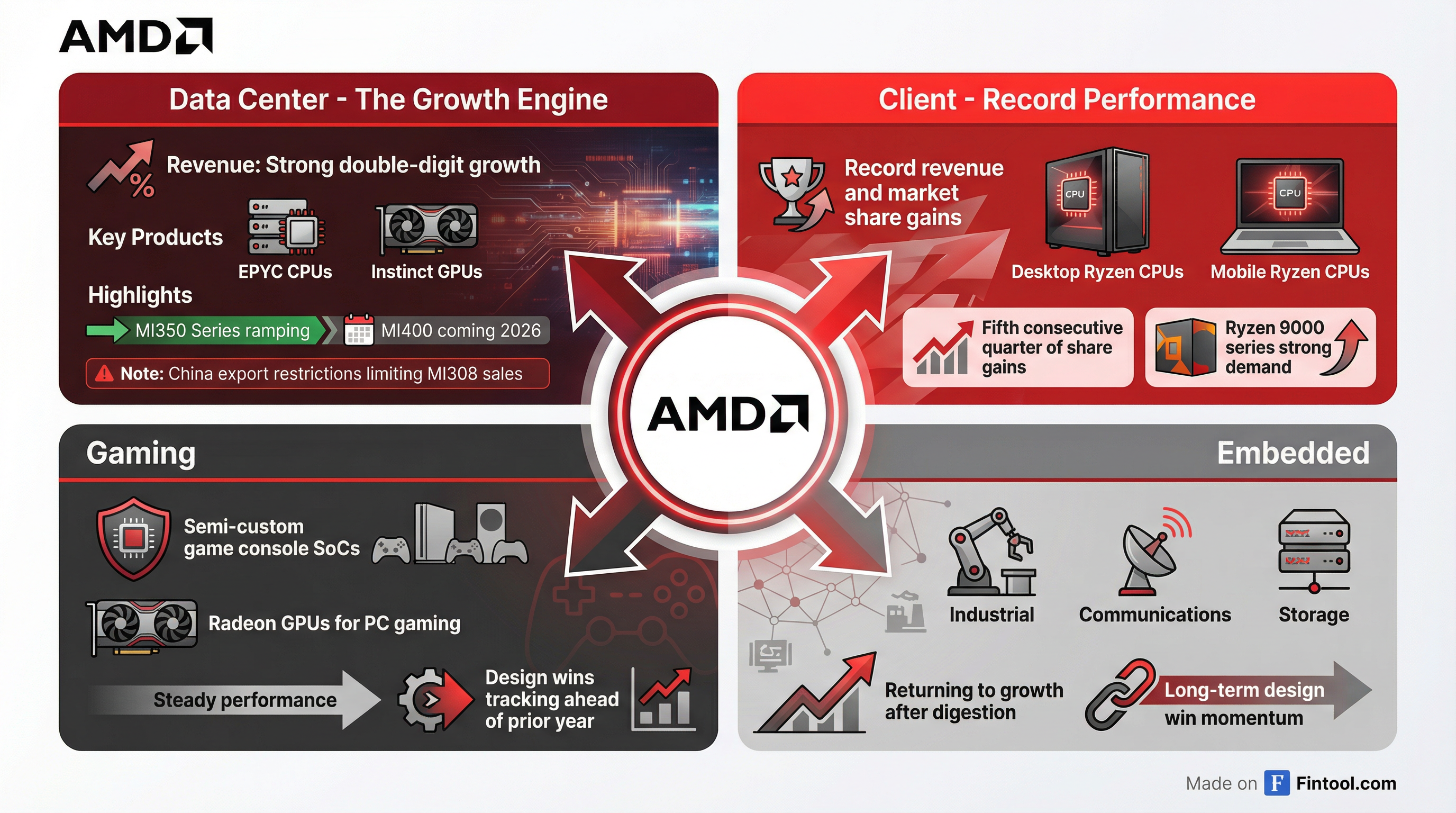

Data center GPU growth trajectory. While AMD's data center segment delivered strong double-digit growth, investors are increasingly benchmarking AMD against Nvidia's AI revenue trajectory, which has set a high bar for what constitutes exceptional performance.

Memory shortage overhang. AMD, like Intel, is contending with a global memory shortage that could force PC makers to raise prices, potentially leading to demand destruction that would pressure client and gaming segments.

China export restrictions. U.S. export restrictions continue to limit MI308 sales to China, with license applications still under review by the Department of Commerce.

The AI Story: MI350 Ramping, MI400 on Deck

The quarter's standout was AMD's accelerating AI position. CEO Lisa Su has emphasized the company's path to "scaling our AI business to tens of billions of dollars in annual revenue."

Key AI developments:

- MI350 Series began volume production ahead of schedule in mid-2025 and is now ramping at multiple customers, including a major Oracle deployment

- MI400 Series development is progressing well toward a 2026 launch, with what AMD calls "significant interest in large scale deployments from multiple high profile customers"

- Helios, AMD's rack-scale AI platform connecting up to 72 GPUs, is positioned to deliver "up to a 10x generational performance increase for the most advanced frontier models"

At CES 2026, Su showcased AMD's upcoming MI500 series GPUs, which the company claims offer up to a 1,000x increase in AI performance versus older MI300X chips—a clear shot at NVIDIA's Vera Rubin-powered NVL72 offering.

Guidance: Above Consensus, But Is It Enough?

AMD guided Q1 2026 revenue of $9.5 billion to $10.1 billion, with the $9.8 billion midpoint comfortably above the $9.4 billion consensus.

The guidance implies:

- Strong Data Center growth driven by MI350 ramp

- Client segment increasing sequentially

- Embedded segment returning to growth

- Non-GAAP gross margin of approximately 54%

Yet the sequential decline from Q4's $10.3 billion record—even if driven by normal seasonality—gave some investors pause in a market accustomed to unbroken AI momentum.

What Wall Street Says

Analyst reaction remained broadly supportive despite the stock decline:

| Firm | Rating | Price Target |

|---|---|---|

| KeyBanc | Overweight | $270 |

| Bank of America | Buy | — |

| JPMorgan | Neutral | $270 |

| Barclays | Neutral | $300 |

KeyBanc upgraded AMD ahead of earnings, citing the company's dominant data center position and projecting AI-related revenues could reach $14-15 billion in 2026. Bank of America noted increased visibility on the MI400 Series and Helios rack, highlighting OpenAI's 1 gigawatt contractual deployment and Oracle's 500 megawatt installation as potential drivers of more than $20 billion in net revenue for AMD.

The Bigger Picture

AMD's Q4 underscores both the strength of its competitive position and the challenge of managing expectations in the AI gold rush. The company has successfully:

- Diversified beyond PC/gaming into a multi-segment growth story

- Established credible AI credentials with hyperscaler adoption of Instinct GPUs

- Delivered consistent execution with five consecutive quarters of client market share gains

- Built a compelling roadmap with MI350, MI400, and Helios positioning the company for 2026 and beyond

Yet the stock reaction signals that investors now expect not just strong results, but acceleration. In a market where NVIDIA remains the benchmark, AMD's "very strong" is measured against NVIDIA's "extraordinary."

What to Watch

Near-term catalysts:

- Q1 2026 earnings (early May): Look for MI350 adoption metrics and AI revenue disclosure

- Analyst Day (expected Spring 2026): Could include updated long-term AI revenue targets

- China license decisions: Any clarity on MI308 export licenses could unlock incremental revenue

Risks:

- Memory shortage impacting PC/gaming demand

- Continued export restrictions limiting China opportunity

- NVIDIA maintaining AI performance leadership

Related Companies: