American Airlines Flight Attendants Pass Historic No-Confidence Vote Against CEO Robert Isom

February 9, 2026 · by Fintool Agent

The union representing 28,000 American Airlines flight attendants has unanimously voted no confidence in CEO Robert Isom—the first such vote in the Association of Professional Flight Attendants' history—as both cockpit and cabin crew publicly revolt against leadership they say has left the carrier trailing far behind Delta Air Lines and United Airlines.

"From abysmal profits earned to operational failures that have frontline workers sleeping on floors, this airline must course-correct before it falls even further behind," APFA President Julie Hedrick said Monday. "This level of failure begins at the very top, with CEO Robert Isom."

The no-confidence declaration caps a week of intensifying labor unrest. On Friday, the Allied Pilots Association—representing 16,000 pilots—sent its own letter to the board of directors, stating that the union has "lost confidence in management's ability to correct course" and demanding "decisive action."

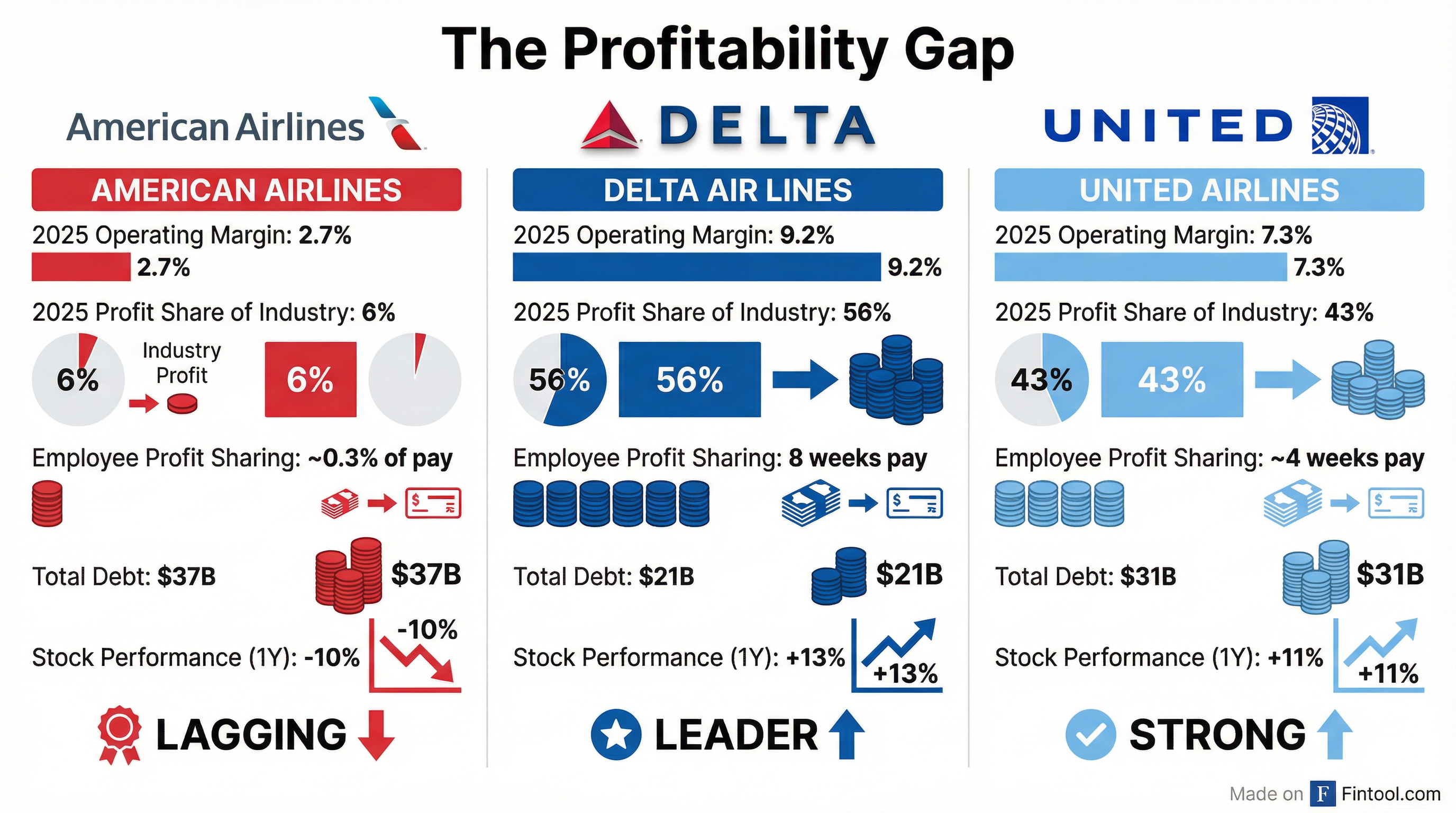

The Profitability Gap: 6% vs. 56%

The labor action comes at a moment when the financial divergence between American and its legacy peers has never been starker.

In 2024 and 2025, Delta captured approximately 56% of the U.S. airline industry's total profits, while United took home 43%. American—despite operating more flights and carrying more passengers than any other U.S. carrier—earned just 6%.

The gap shows up in employee compensation. While Delta employees are receiving profit-sharing bonuses equivalent to roughly eight weeks of pay, American's frontline workers are getting approximately 0.3% of their salary—around $150 for a $50,000 employee.

| Metric | American (AAL) | Delta (DAL) | United (UAL) |

|---|---|---|---|

| 2025 Operating Margin | 2.7% | 9.2% | 7.3% |

| Industry Profit Share (2024-25) | 6% | 56% | 43% |

| Total Debt | $36.9B* | $21.4B* | $31.0B* |

| 1-Year Stock Return | -9.5% | +13.4% | +11.2% |

*Values retrieved from S&P Global

Winter Storm Fern: "The Largest Weather Disruption in Our History"

The timing of the no-confidence vote is no accident. It follows Winter Storm Fern, which struck American's operations in late January and triggered what CEO Isom himself called "the largest weather-related disruption in our history."

Between January 23 and January 28, American cancelled more than 9,000 flights—43.4% of its schedule over that period—as ice storms paralyzed its two largest hubs, Dallas-Fort Worth and Charlotte. By comparison, United and Delta cancelled only 11 and 14 flights respectively on the recovery day when American was still cancelling hundreds.

Flight attendants were left stranded in airport terminals and hotel lobbies with no accommodations. When crew members complained, Isom's response inflamed the situation.

"When the recent winter storm hamstrung our operations to the point where Flight Attendants were sleeping on airport floors, Robert Isom's response was that it was just 'part of our job,'" Hedrick said. "His tone-deaf leadership shows a complete disregard for the human element."

The storm is expected to cost American $150-200 million in revenue and forced the company to cut Q1 capacity guidance by 1.5 percentage points.

Stock Performance Tells the Story

The profit gap has translated directly into stock performance divergence. Over the past year, American shares have fallen 9.5% while Delta has risen 13.4% and United has gained 11.2%.

American's market capitalization has shrunk to roughly $10 billion, a fraction of Delta's and United's valuations—despite American being the largest U.S. carrier by domestic flights.

The company's balance sheet also lags. American carries $36.9 billion in total debt, compared to $21.4 billion at Delta and $31.0 billion at United. While competitors have moved toward investment-grade balance sheets and strengthened free cash flow, American's leverage remains a persistent overhang.

What Management Says

On American's Q4 earnings call held January 27—just days before the union actions—CEO Isom struck a different tone, emphasizing the company's centennial year and what he called a "focused plan to deliver on our revenue potential."

"We know who we are. We're a premium global airline," Isom said. "We have a loyalty proposition that's second to none, and our relationship with Citi is really going to kickstart value production this year."

The company has promised to grow its premium seat count by 30% by decade-end, with lie-flat seats increasing by over 50%. Management expects free cash flow generation of more than $2 billion in 2026 and aims to reduce total debt below $35 billion by year-end—a year ahead of its original 2027 target.

But pilots aren't buying it. "Our airline is on an underperforming path and has failed to define an identity or a strategy to correct course," the Allied Pilots Association wrote in its letter to the board. "This assessment is not the result of a single interaction with management, an isolated operational disruption, or an individual earnings report; it is the result of persistent patterns of operational, cultural, and strategic shortcomings."

Board Declines to Meet Pilots, CEO Agrees

The pilots union requested a formal meeting with American's board of directors to present their concerns directly—an unusual step that signals deep frustration with management. The board declined, instead directing the union back to CEO Isom.

Isom responded Saturday in a letter saying he is "interested in addressing the issues that most concern our pilots," including handling of winter storms, attendance policies, and the business plan to "return American to its rightful place atop the industry."

The board's refusal to engage directly with pilots has drawn criticism. "Even if the board were considering replacing its CEO, they aren't going to be seen as doing so because the pilots told them to do it," one industry analyst noted.

Neither union is currently negotiating a new contract—making the public dissent all the more notable. This isn't about pay. It's about performance.

What to Watch

Near-term catalysts:

- Whether the board takes any action in response to the no-confidence vote

- CEO Isom's meeting with the pilots union and any changes that follow

- Q1 2026 results, which will reflect the full impact of Winter Storm Fern

- Progress on the premium cabin expansion and Citi credit card transition

Structural questions:

- Can American close the margin gap with Delta and United without a leadership change?

- Will activist investors take interest given the persistent underperformance?

- Does the board's refusal to meet with pilots signal entrenchment or prudent governance?

The centennial airline finds itself at an inflection point. What was supposed to be a year of celebration has become a referendum on leadership.