American Airlines Misses Earnings by 54% as Government Shutdown and Historic Storm Collide

January 27, 2026 · by Fintool Agent

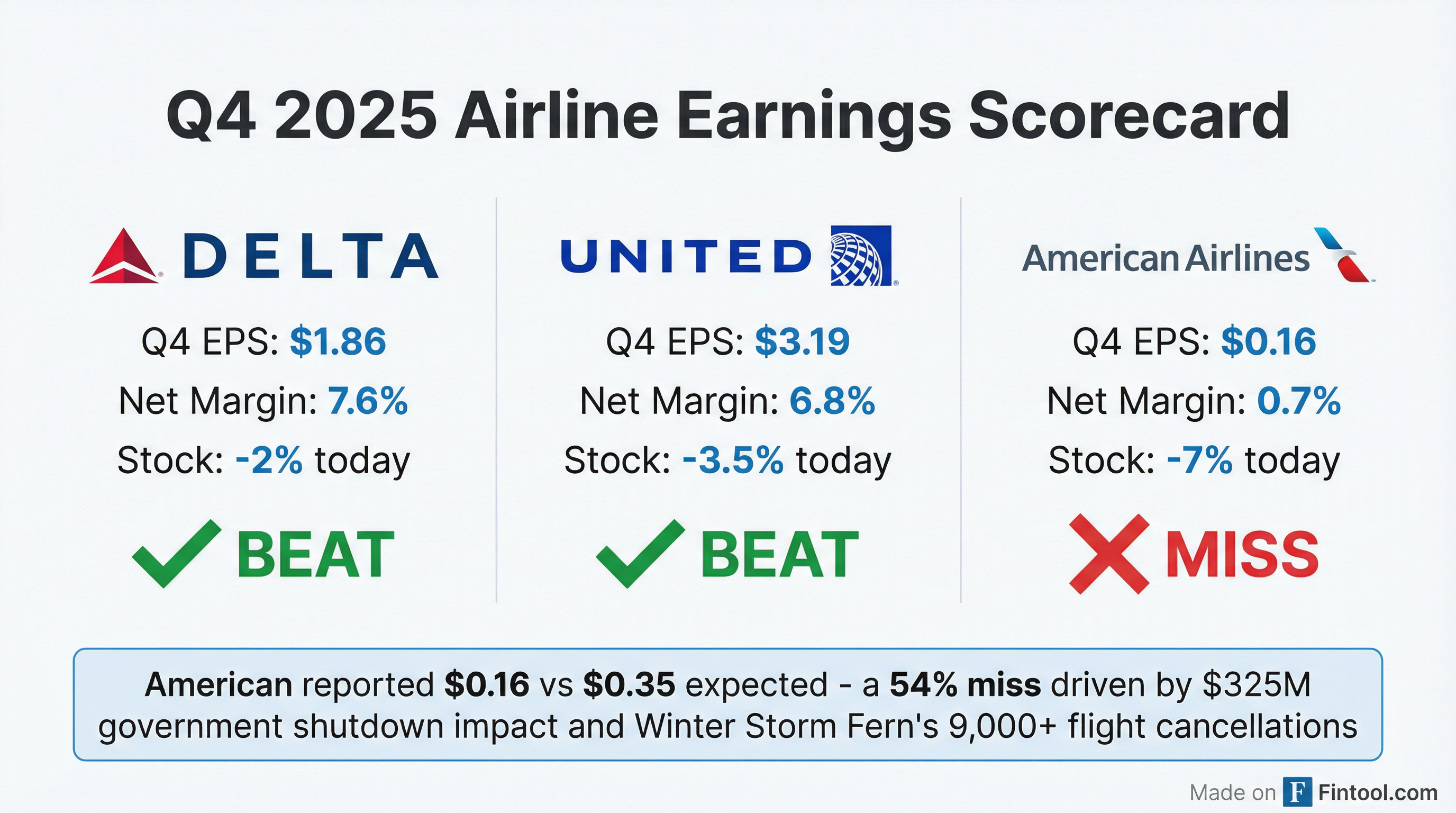

American Airlines stock plunged 7% Tuesday after the carrier reported Q4 earnings that missed Wall Street expectations by more than half, hammered by a $325 million hit from the government shutdown and what CEO Robert Isom called "the largest weather-related operational disruption in our history."

The Fort Worth-based airline posted adjusted earnings of $0.16 per share against consensus estimates of $0.35—a 54% miss that sent shares tumbling from $14.57 to $13.55. The results underscore American's continued struggle to keep pace with Big Three rivals Delta Air Lines and United Airlines, which both beat expectations and delivered substantially higher profits.

The Numbers: Record Revenue, Crumbling Margins

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $14.0B | $13.7B | +2.5% |

| Net Income (GAAP) | $99M | $590M | -83% |

| EPS (Adjusted) | $0.16 | $0.86 | -81% |

| Operating Margin | 3.2% | 8.3% | -5.1 pts |

Despite posting record fourth-quarter revenue of $14.0 billion, American's profit collapsed 83% year-over-year. The government shutdown, which disproportionately impacted American's Washington DCA hub—the most government-travel-dependent airport in its network—crushed domestic unit revenue.

"Fourth quarter, it hit us hard. The government shutdown hit us, it hit us harder than others," Isom acknowledged on CNBC's Squawk Box. "The good news on that is that as soon as the government shutdown got over, we've seen bookings return."

Winter Storm Fern: Unprecedented Disruption

Just as American was working through quarter-end, Winter Storm Fern delivered a devastating blow. The storm forced the cancellation of more than 9,000 flights—the largest weather-related disruption in the airline's century-long history.

"Ice and freezing rain have significantly reduced operations, especially at DFW and Charlotte, our largest hubs, for multiple days," Isom explained on the earnings call. "Over the past four days, we've had to cancel more than 9,000 flights."

The storm's impact will bleed into Q1 2026:

| Q1 2026 Storm Impact | Estimate |

|---|---|

| Capacity Reduction | 1.5 points |

| Revenue Hit | $150-200M |

| CASM-ex Impact | 1.5 points |

When asked why American was disproportionately affected compared to competitors who had minimal cancellations, Isom pointed to DFW's unique exposure: "Conditions here are still a skating rink. And let's face it, DFW is big in our operation. Almost a third of our team members reside in the area."

The Big Three Gap Widens

American's Q4 results throw into sharp relief the profitability gap between the three largest U.S. carriers:

| Metric | Delta | United | American |

|---|---|---|---|

| Q4 EPS | $1.86 | $3.19 | $0.16 |

| Q4 Net Income | $1.2B | $1.0B | $99M |

| Net Margin | 7.6%* | 6.8%* | 0.7% |

| Stock Move (1/27) | -2.0% | -3.5% | -7.0% |

*Values retrieved from S&P Global

Analyst Jamie Baker of JPMorgan pressed management on the relative positioning, noting that based on today's guidance, American's share of Big Three pretax profit would rise from about 4% in 2025 to roughly 12% in 2026. CFO Devon May acknowledged both macro tailwinds and company-specific initiatives would contribute, but couldn't quantify the split.

2026 Outlook: Premium Pivot in Focus

Despite the challenging quarter, management struck an optimistic tone about 2026, guiding to adjusted EPS of $1.70-$2.70 and free cash flow exceeding $2 billion.

| 2026 Guidance | Metric |

|---|---|

| Full-Year EPS | $1.70 - $2.70 |

| Free Cash Flow | >$2B |

| Q1 Revenue Growth | +7% to +10% YoY |

| Q1 EPS | ($0.10) to ($0.50) loss |

| Capacity Growth | Mid-single digits |

The optimism centers on American's premium strategy, which management says will "begin delivering results in 2026." Key initiatives include:

- Fleet premiumization: Lie-flat seats expected to increase 50%+ by 2030, with premium seat growth at 2x the rate of main cabin

- Flagship Suite rollout: New industry-leading business class product expanding across international fleet

- Free high-speed Wi-Fi: Launching this month for AAdvantage members, sponsored by AT&T

- Citi partnership: New 10-year exclusive co-branded credit card deal took effect January 1

CFO Devon May noted that premium unit revenue outpaced main cabin by 7 points in Q4, a trend that's remained consistent throughout the year. "We continue to see strength in our indirect channels, with managed corporate revenue up 12% year-over-year, which has strengthened further so far in 2026."

Balance Sheet Progress Continues

One bright spot: American continues to deleverage aggressively. The company reduced total debt by $2.1 billion in 2025 to $36.5 billion and now expects to hit its sub-$35 billion target a year ahead of schedule in 2026.

| Balance Sheet | YE 2025 | YE 2024 |

|---|---|---|

| Total Debt | $36.5B | $38.6B |

| Net Debt | $30.7B | $31.4B* |

| Cash + Investments | $5.8B | $7.0B* |

| Total Liquidity | $9.2B | N/A |

*Values retrieved from S&P Global

"With over $2 billion of free cash flow this year, we expect that by year-end, we will have our lowest level of net debt since the end of 2014," May stated.

However, when asked about returning capital to shareholders, May was clear the priority remains deleveraging: "We still have a lot of work to do before we shift our focus to any sort of shareholder remuneration. We need to get inside of 3x net debt to EBITDA."

Chicago: The Competitive Battleground

Management addressed the ongoing competitive intensity in Chicago, where American is scaling back up to 500-550 daily flights after pandemic cuts.

"We've been flying to Chicago for 100 years, and it was where our first flight took place, in fact, and it's going to be part of our system for the next 100 years," Isom said, pushing back on competitor claims about hub profitability.

In a pointed response to United's recent claims about Chicago profitability, Isom added: "I wouldn't be out there bragging about profitability in a hub when 80% of your team members make a lot less than the market rate. So we're doing right by our team members."

What to Watch

- January bookings: Management says system-wide revenue intakes for the first three weeks of 2026 are "up double digits year-over-year" with all-time records for the period

- DFW restructuring: 13-bank schedule change designed to improve reliability and reduce delays

- Premium revenue momentum: Q1 domestic and international unit revenue expected to be positive

- Government travel recovery: Management built in conservative assumptions; return could provide upside

As American marks its centennial year, the question remains whether 2026 will finally be the year its premium pivot translates into peer-level profitability—or whether the gap with Delta and United continues to widen.