Anta Sports Snaps Up 29% of Puma for $1.8 Billion, Betting It Can Revive the Struggling German Brand

January 26, 2026 · by Fintool Agent

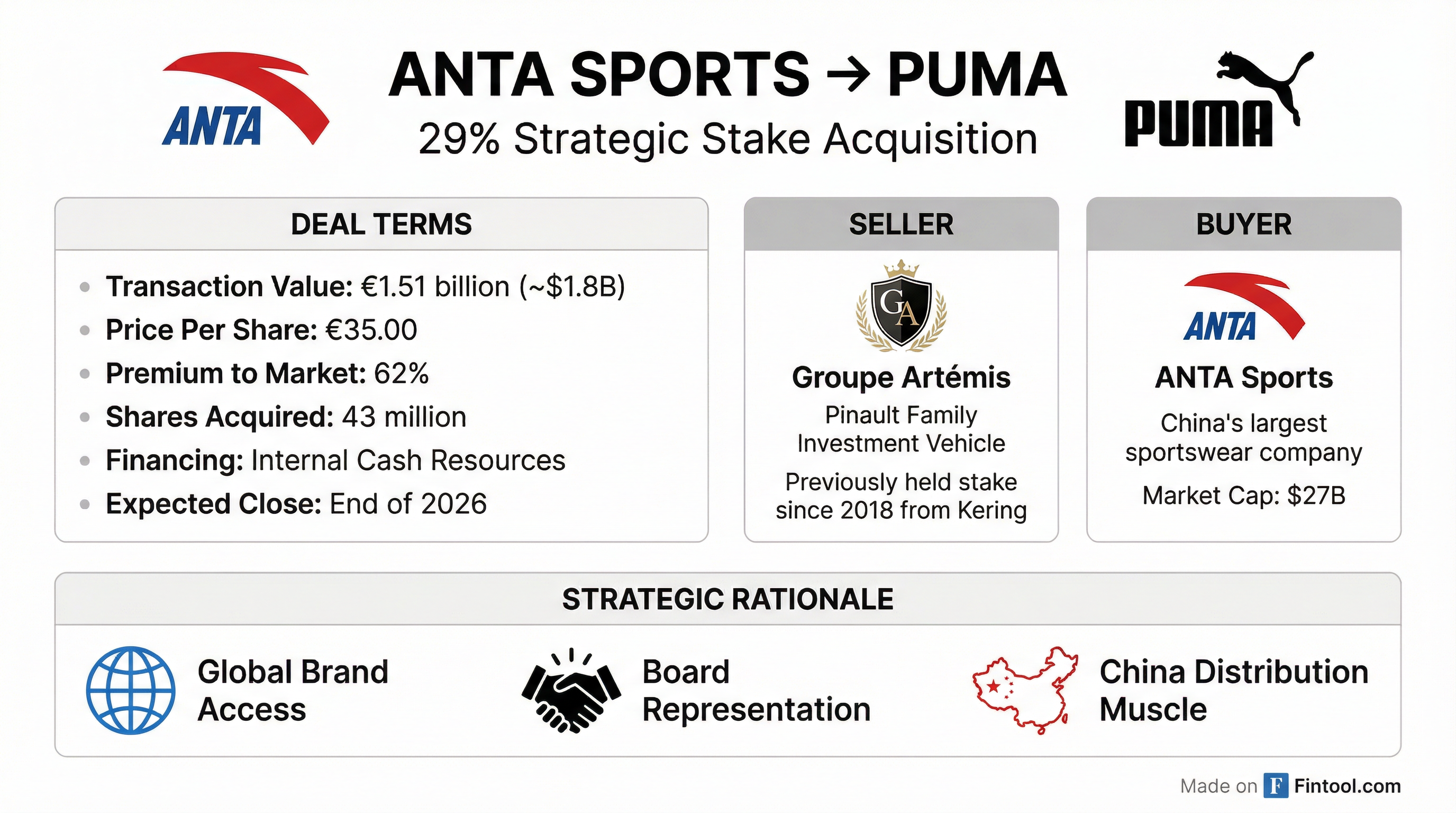

China's largest sportswear company is making its boldest move yet into Western brands. Anta Sports has agreed to acquire a 29% stake in Puma from the Pinault family for €1.51 billion ($1.79 billion), paying a hefty 62% premium to bet it can turn around the struggling German icon.

The deal—Anta's largest since the $5.2 billion Amer Sports acquisition in 2019—positions the Chinese conglomerate as Puma's largest shareholder and sets up what could be a multi-year brand revival project.

The Deal

Anta will pay €35 per share in cash for 43 million Puma shares held by Groupe Artémis, the investment vehicle of France's billionaire Pinault family. That's a 62% premium to Puma's €21.63 closing price on Monday—though still well below the €40+ per share that Artémis was reportedly seeking when talks stalled earlier this month.

The transaction will be funded entirely from Anta's internal cash resources—a testament to the company's strong balance sheet after years of profitable growth in China.

The Pinault family acquired the stake from Kering in 2018 when the luxury group repositioned itself as a pure luxury player. Artémis, led by François-Henri Pinault (chairman of Gucci-owner Kering), had described the Puma stake as "non-strategic" for months—but wasn't willing to sell at fire-sale prices as Puma's stock cratered.

Why Puma? Why Now?

"We believe Puma's share price over the past few months does not fully reflect the long-term potential of the brand," Anta Chairman Ding Shizhong said in the announcement. "We have confidence in its management team and strategic transformation."

Translation: Anta sees a buying opportunity in a storied brand trading at decade-low valuations.

Puma's struggles are well-documented. The company has been losing ground to rivals in an increasingly competitive sportswear market:

- Sales declined 15.3% in Q3 2025 as discounting intensified

- Stock down over 50% from 2021 highs

- Speedcat sneaker flopped despite celebrity endorsements from Blackpink's Rosé

- 1,400 job cuts (900 + 500 announced earlier) as part of restructuring

CEO Arthur Hoeld, a former Adidas sales chief who took over in July 2025, hasn't sugarcoated the challenges. "Puma has become too commercial, overexposed in the wrong channels, with too many discounts," he said in October. The company expects 2025 to be a loss year, 2026 a "transition year," with return to growth targeted for 2027.

The problem for Puma isn't just execution—it's positioning. While Nike is rebounding under company veteran Elliott Hill and Adidas continues riding its Samba and Gazelle wave under CEO Bjorn Gulden (himself a former Puma boss), Puma has been stuck in no-man's land: too discount-heavy to be premium, not hot enough to compete with upstarts like On Holding and Hoka.

Anta's Playbook: The Amer Sports Blueprint

Anta has been here before—and delivered.

In 2019, Anta led a consortium (including Tencent and FountainVest Partners) to acquire Amer Sports for $5.2 billion. Skeptics questioned whether a Chinese company could successfully manage premium Western outdoor brands. The results silenced them:

- Arc'teryx became a status symbol among Chinese consumers, with Greater China revenue growing at triple-digit rates

- Salomon scaled from 124 to 254 stores globally

- Amer Sports IPO'd on NYSE in February 2024 to strong demand

- Q3 2025 revenue up 30% year-over-year

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Amer Sports Revenue ($B) | $1.64 | $1.47 | $1.24 | $1.76* |

| Gross Margin | 56.1% | 57.8% | 58.5% | 56.8%* |

| EBIT Margin | 11.8% | 14.6% | 3.7% | 12.9%* |

*Values retrieved from S&P Global

The playbook is clear: acquire undervalued Western brands with strong heritage, leverage Anta's China distribution muscle, invest in premium positioning, and let the brands operate with autonomy.

What Anta Gets—and What It Won't Do

The deal gives Anta:

-

Global Brand Access: Puma operates in 120+ countries with established distribution, particularly strong in Europe, Latin America, Africa, and India—markets where Anta has limited presence

-

Board Representation: Anta intends to seek "adequate representation" on Puma's Supervisory Board

-

Complementary Portfolio: Puma's football, running, and motorsport positioning complements Anta's existing brands (Anta, FILA China, Descente, Kolon Sport, and the Amer Sports family)

What Anta explicitly won't do: take over Puma entirely.

"The Group currently has no plans to make a takeover offer for PUMA," the announcement stated. "ANTA Sports fully appreciates PUMA's management culture and independent governance as a German-listed company."

This arm's-length approach mirrors Anta's strategy with Amer Sports—providing capital, China expertise, and strategic support while letting Western management run the brands.

The Competitive Landscape

Puma's timing couldn't be more challenging. The sportswear industry has transformed in the past decade:

| Company | Recent Revenue | YoY Growth | Story |

|---|---|---|---|

| Nike | $12.4B (Q2 2026) | -8% (Q3 2025) | Turnaround under Elliott Hill |

| Adidas | €22B+ | +14% | Samba/Gazelle momentum |

| On Holding | $2.3B+ | +33% | Premium running boom |

| Hoka (Deckers) | $2B+ | +20% | Running category surge |

| Puma | €6B | -15.3% (Q3 2025) | Restructuring mode |

The upstarts are eating everyone's lunch. On Holding and Hoka have captured the premium running customer with innovative products and authentic performance credibility. New Balance has surged in popularity. Meanwhile, the legacy "big three" (Nike, Adidas, Puma) face questions about brand relevance among younger consumers.

Nike's recent performance shows even the Swoosh isn't immune—though Elliott Hill's turnaround is showing early signs of progress:

| Metric | Q3 2025 | Q4 2025 | Q1 2026 | Q2 2026 |

|---|---|---|---|---|

| Nike Revenue ($B) | $11.3 | $11.1 | $11.7 | $12.4 |

| Gross Margin | 41.5% | 40.3% | 42.2% | 40.6% |

| EBIT Margin | 7.0% | 2.9% | 7.9% | 8.1% |

What to Watch

The deal is expected to close by end of 2026, subject to:

- Antitrust clearances in relevant jurisdictions

- Anta shareholder approval at an extraordinary general meeting

- Regulatory approvals in China and other markets

Key questions for investors:

-

Can Hoeld's turnaround work? The former Adidas exec has set 2027 as the return-to-growth target. Anta's backing could accelerate—or complicate—those plans.

-

Will China embrace Puma? Arc'teryx became a status symbol in China under Anta's ownership. Puma's football and motorsport heritage could resonate differently.

-

Will Anta eventually bid for full control? Despite the explicit denial, strategic minority stakes often evolve. At €35 per share, a full takeover would cost around €5.2 billion.

-

What happens to Nike and Adidas? A revitalized Puma backed by deep-pocketed Chinese owners changes the competitive calculus for everyone.

Puma shares jumped nearly 17% on Monday ahead of the formal announcement, closing at €21.63. The question now is whether Anta can help the leaping cat find its feet again.

Related Companies: Nike | Amer Sports | Puma