Apple Makes Second-Largest Acquisition Ever, Buying Israeli AI Startup Q.ai for ~$2 Billion

January 29, 2026 · by Fintool Agent

Apple+0.80% has acquired Israeli AI startup Q.ai in a deal valued at approximately $2 billion—its second-largest acquisition ever after the $3 billion Beats purchase in 2014. The deal brings back Aviad Maizels, the same entrepreneur who sold Apple his previous company PrimeSense in 2013, technology that became the foundation for iPhone's Face ID.

The acquisition arrives at a critical moment for Apple, which has faced mounting criticism over its delayed AI strategy and a struggling Siri overhaul pushed to 2026. Investors have called for Apple to make a bold AI move as megacap peers pour tens of billions into cutting-edge models and infrastructure.

"We're thrilled to acquire the company, with Aviad at the helm, and are even more excited for what's to come," said Johny Srouji, Apple's senior vice president of hardware technologies who leads the company's chip development, confirming the deal.

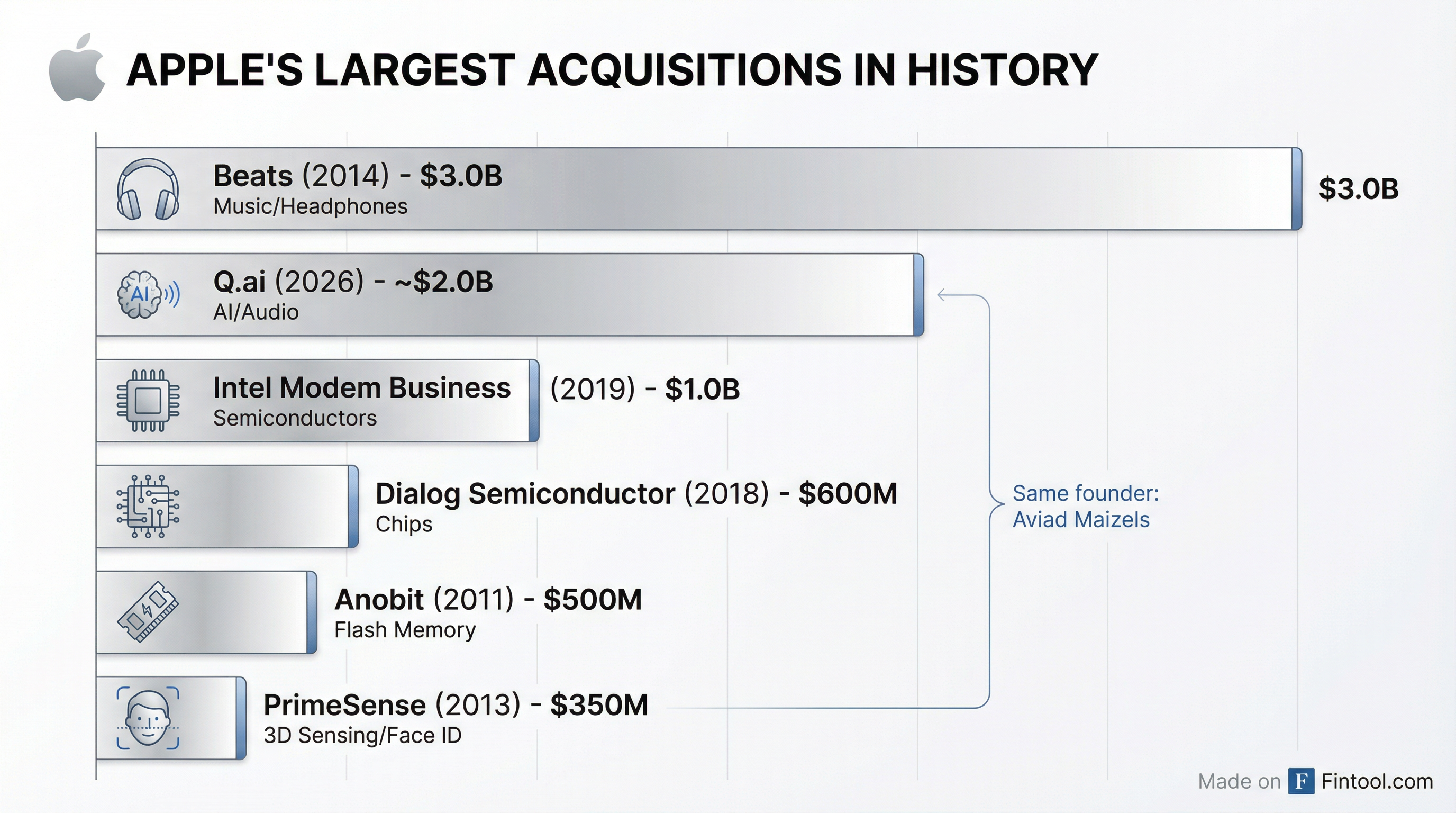

Apple's Major Acquisitions

The Q.ai deal marks a dramatic departure from Apple's typical M&A strategy. The company traditionally acquires smaller startups with specific technologies that can be quietly integrated into products—usually without disclosing deal terms. Apple's largest acquisitions prior to Q.ai tell the story of its strategic priorities:

| Acquisition | Year | Value | Technology |

|---|---|---|---|

| Beats Electronics | 2014 | $3.0B | Music streaming, headphones |

| Q.ai | 2026 | $2.0B | AI audio, silent speech |

| Intel Modem Business | 2019 | $1.0B | 5G modems, semiconductors |

| Dialog Semiconductor | 2018 | $600M | Power management chips |

| Anobit | 2011 | $500M | Flash memory controllers |

| PrimeSense | 2013 | $350M | 3D sensing, depth cameras |

Notably, both PrimeSense and Q.ai were founded by Maizels—making him the only entrepreneur to sell two companies to Apple at valuations in the hundreds of millions or billions.

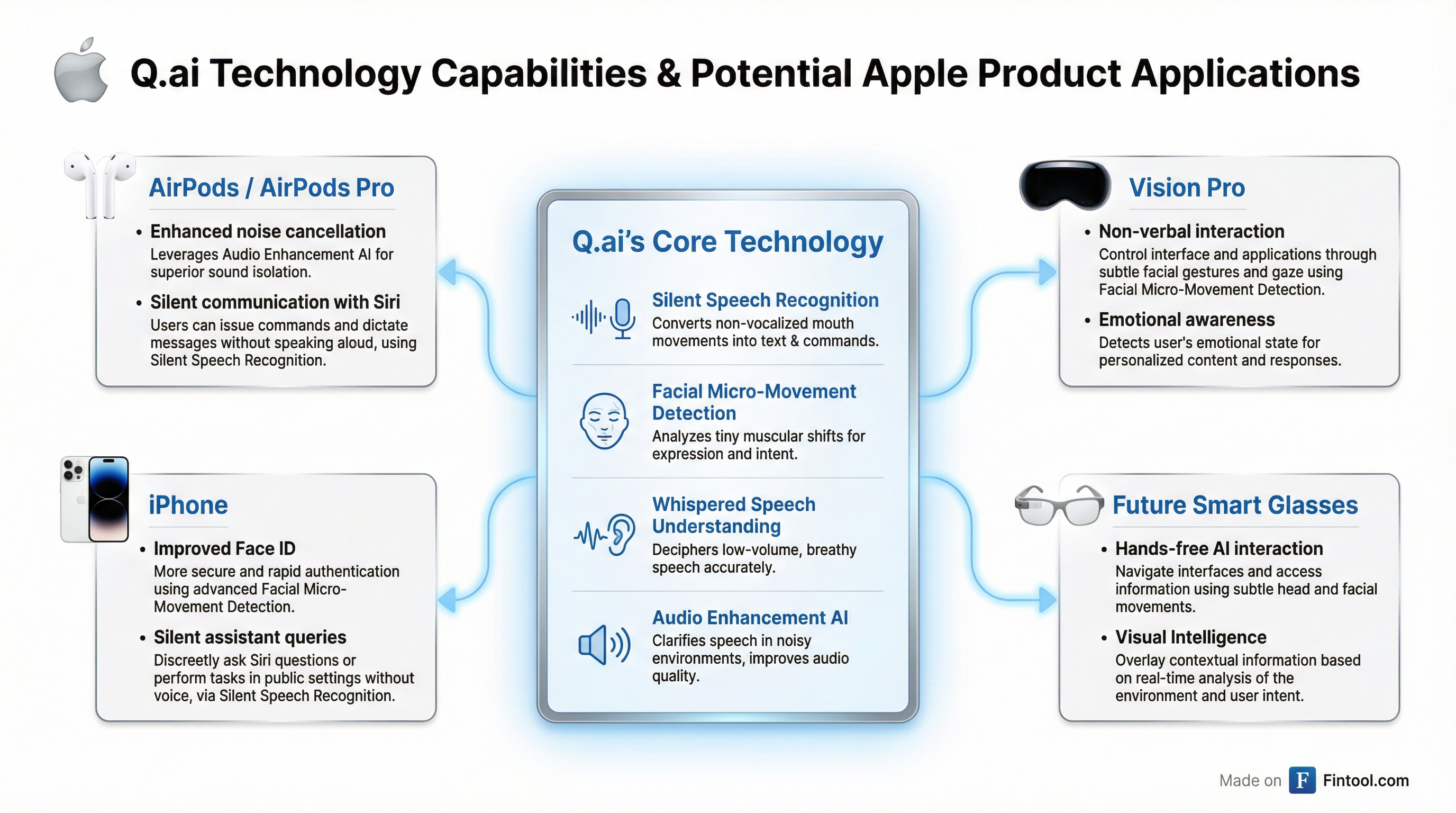

The Technology: Silent Speech and Beyond

Q.ai operated largely in stealth since its 2022 founding, but patent filings reveal the scope of its technology. The company developed AI that uses "facial skin micro-movements" to detect words that are mouthed or spoken silently, identify a person, and assess emotional state, heart rate, and respiration rate.

The technology could enable what GV (Google Ventures), one of Q.ai's backers, described as the "invisible interface"—computing that feels like an extension of yourself.

Q.ai's capabilities could enhance multiple Apple products:

- AirPods: Improved noise cancellation, ability to communicate with Siri via whispers or mouthed words

- Vision Pro: Non-verbal interaction capabilities, emotional awareness

- iPhone: Enhanced Face ID functionality, silent assistant queries

- Smart Glasses: Apple's rumored AI-powered glasses could use the technology for hands-free, voice-free AI interaction

"We sped research that should have taken 20 years," co-founder Yonatan Wexler wrote after the acquisition. The Q.ai team, which was backed by GV, Kleiner Perkins, Spark Capital, and Exor, will join Apple.

Timing: Apple's AI Moment of Truth

The acquisition comes as Apple faces its most significant AI challenge since the original Siri launch in 2011. The company's "more personal Siri" with advanced AI capabilities, first announced at WWDC 2024, has been delayed until 2026 after what Apple described as architectural issues with its V1 system.

Apple Intelligence, the company's AI suite announced in 2024, has delivered incremental features but hasn't produced the "super cycle" of iPhone upgrades investors hoped for. Meanwhile, competitors are moving aggressively:

- OpenAI acquired former Apple design chief Jony Ive's hardware startup IO for $6.5 billion

- Google's Gemini is now powering parts of Apple Intelligence, after Apple struck a deal earlier this month

- Meta and others are developing AI-powered devices that could challenge smartphone dominance

Tim Cook signaled openness to acquisitions in July 2025: "We're very open to M&A that accelerates our roadmap."

The Maizels Connection: From Face ID to Silent Speech

Aviad Maizels has a unique track record with Apple. His first startup, PrimeSense, developed 3D sensing technology originally used in Microsoft's Xbox Kinect. Apple acquired PrimeSense in November 2013 for approximately $350 million, and the technology was integrated into iPhone's TrueDepth camera system, powering Face ID starting with iPhone X in 2017.

Now Maizels has built another Apple-worthy technology. GV's investment team described the acquisition as evidence that "when Apple makes a bet of this magnitude, it signals something truly generational."

The Q.ai team persevered through significant challenges. Following the October 7, 2023 attack on Israel, approximately 30% of the company was drafted into military service, and meetings were frequently interrupted by bomb shelter evacuations. Despite this, the team continued making technical breakthroughs.

Apple's Financial Position

Apple enters this acquisition from a position of strength. The company generated over $416 billion in revenue in fiscal 2025, with nearly $36 billion in cash on its balance sheet.

| Metric | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 |

|---|---|---|---|---|

| Revenue | $102.5B | $94.0B | $95.4B | $124.3B |

| Net Income | $27.5B | $23.4B | $24.8B | $36.3B |

| Cash Position | $35.9B | $36.3B | $28.2B | $30.3B |

Fiscal quarters ending September 2025 through December 2024

A $2 billion acquisition represents less than one month's profit for Apple—a rounding error financially but potentially transformative strategically.

What to Watch

Near-term catalysts:

- Apple's Q1 FY2026 earnings call (expected early February) for any additional color on AI strategy

- Integration timeline for Q.ai technology into existing products

- Updates on the delayed "more personal Siri" launch

Longer-term questions:

- Will Q.ai technology appear first in AirPods, Vision Pro, or the rumored smart glasses?

- Can silent speech recognition differentiate Siri from Google Assistant and Amazon Alexa?

- Will Apple need additional AI acquisitions, or does Q.ai fill the gap?

The Q.ai deal represents Apple's clearest acknowledgment yet that it needs to accelerate its AI efforts through acquisition, not just internal development. For investors, it signals that Apple's AI story may finally be entering a new chapter—one where the company is willing to pay premium prices for transformative technology.

Related

- Apple Inc. (aapl)+0.80% - Company Profile

- Alphabet Inc. (googl)-2.53% - Google Gemini Partnership