Apollo's ARI Sells $9 Billion Loan Portfolio to Sister Company Athene, Validates Book Value at 23% Premium

January 28, 2026 · by Fintool Agent

Apollo Commercial Real Estate Finance (NYSE: ARI) announced this morning it will sell its entire ~$9 billion commercial real estate loan portfolio to Athene Holding, a subsidiary of parent company Apollo Global Management, for a purchase price based on 99.7% of total loan commitments.

The transaction validates ARI's book value at a moment when commercial mortgage REITs have traded at steep discounts for years—ARI averaged just 0.77x book value over the past four years. Post-transaction, ARI expects a common equity book value per share of approximately $12.05, representing a 23% premium to recent trading levels.

ARI shares, which closed at $10.12 on Monday, surged to $11.19 in after-hours trading—a gain of over 10%—as investors digested the book value validation and strategic optionality the deal creates.

The Transaction: Apollo Moving Assets Between Pockets

The deal structure is notable: Athene, which merged with Apollo Global Management in January 2022, already co-invests alongside ARI in nearly 50% of the loans in the portfolio. This means Apollo is effectively moving assets from one pocket to another—but at a price that proves ARI's book value to public market skeptics.

| Transaction Metric | Value |

|---|---|

| Portfolio Size | $9 billion |

| Purchase Price | 99.7% of loan commitments, net of CECL |

| Post-Transaction Book Value/Share | $12.05 |

| Premium to Trading Price | 23% |

| Net Cash Post-Close | $1.4 billion |

| REO Retained | $466 million |

| Go-Shop Period | 25 days (ends Feb. 21, 2026) |

| Expected Close | Q2 2026 |

"For a number of years, ARI's common stock, along with most of the commercial mortgage REIT peers, has traded at an average of 0.76 of net book value, despite the improving underlying credit quality and cash-generating nature of the portfolio," CEO Stuart Rothstein said on the conference call this morning.

Why Now? Institutional Demand vs. Public Market Skepticism

Rothstein was explicit about the motivation: the gap between how private institutional buyers value commercial real estate credit assets versus how public markets price mREIT stocks has become too wide to ignore.

"At the same time, attractive yield-generating assets, such as ARI's, are highly valued, in short supply, and continue to attract strong demand from the institutional market," Rothstein explained.

The timing also reflects ARI's improved portfolio quality. The company disclosed that over 40% of its loan book now consists of "new vintage" loans originated at more favorable terms, yet the stock still traded at a discount.

When pressed on whether other buyers were considered, Rothstein deferred to the proxy filing but noted the 25-day go-shop period: "There is still work to be done by the special committee and its advisors to consider any competing offers that may arise in the next 25 days from individual entities that now know that the portfolio is for sale."

Strategic Flexibility: New Asset Strategy, M&A, or Dissolution

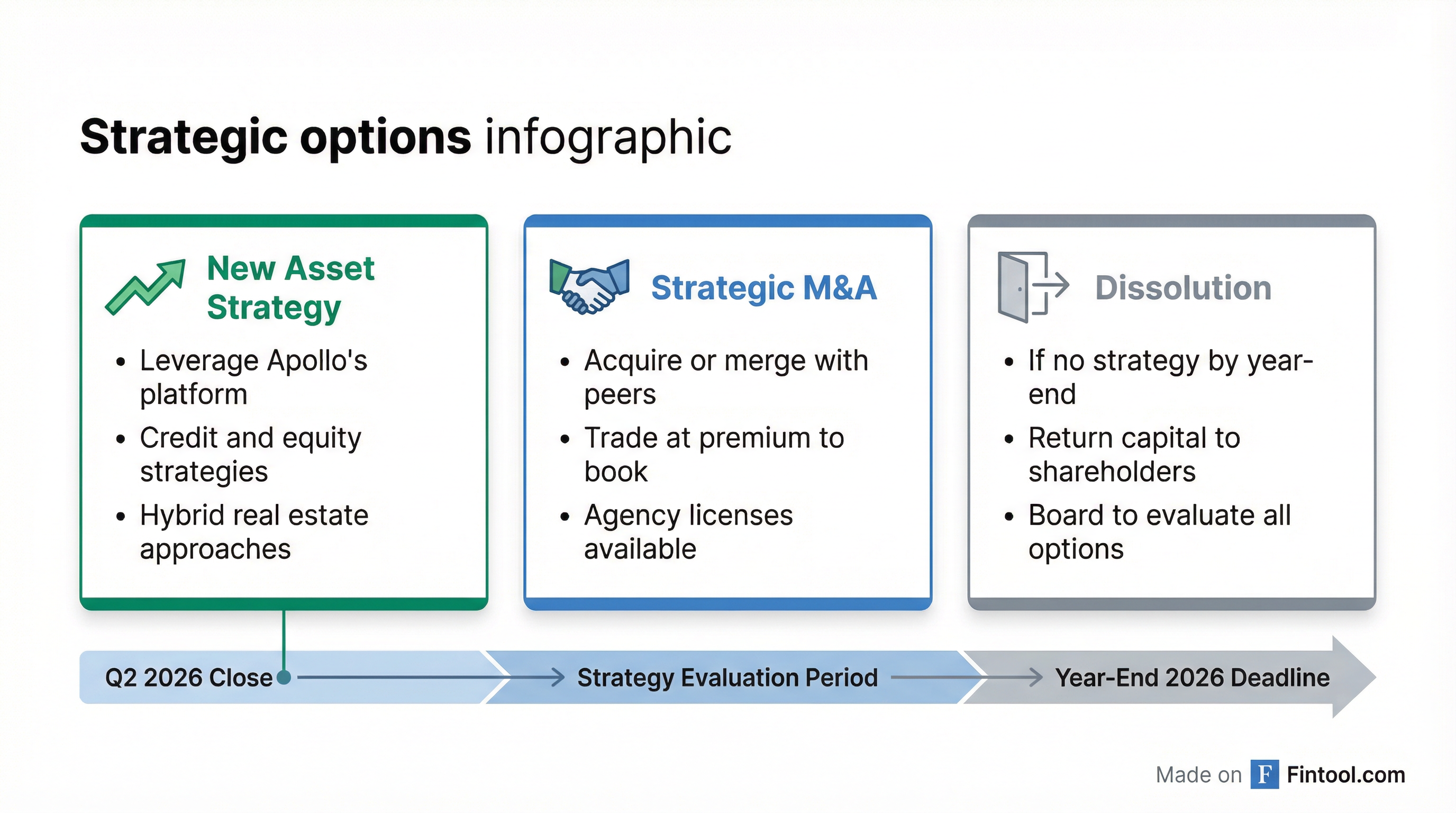

Post-closing, ARI becomes a REIT with $1.4 billion in cash and minimal legacy assets—a blank canvas. Management outlined three potential paths forward:

1. New Asset Strategy: Leverage Apollo's $120+ billion real estate platform to deploy capital into credit, equity, or hybrid strategies. Rothstein emphasized the company will take "as broad a view with respect to strategy as possible" while remaining a REIT for tax purposes.

2. Strategic M&A: When analyst Jade Rahmani suggested ARI could acquire agency licenses or distressed peers to build a multifamily business, Rothstein didn't dismiss it: "Strategic M&A is very much top of mind... I would also expect a fair number of inbound calls as well."

3. Dissolution: If no compelling strategy emerges by year-end 2026, Apollo "intends to recommend that ARI's board explore all strategic alternatives, including dissolution."

Management Fee Cut Aligns Apollo with Shareholders

During the strategic evaluation period, Apollo agreed to reduce ARI's annual management fee by 50%—from 1.5% to 0.75% of stockholders' equity—with the fee paid in ARI stock rather than cash.

This creates alignment: Apollo's incentive is to find a strategy that drives the stock price higher, as their fee compensation is tied directly to stock value during this period.

If ARI achieves a 7.5% return on equity for two consecutive quarters, the management fee reverts to 1.5% (paid in cash), and Apollo becomes eligible for a 20% incentive fee over an 8% ROE hurdle.

Dividend Continuity: Targeting 8% Yield on Book Value

ARI intends to declare a $0.25 per share dividend for Q1 2026—consistent with recent quarterly levels—and targets an approximately 8% annualized yield on post-transaction book value per share going forward.

At a $12.05 book value, that implies an annual dividend of roughly $0.96 per share, or $0.24 quarterly. The slight reduction from the $0.25 Q1 dividend reflects the transition period while the company evaluates its next chapter.

Commercial mREIT Sector Implications

The transaction sends a signal to the broader commercial mortgage REIT sector: institutional capital is hungry for high-quality CRE credit assets, even as public markets remain skeptical.

| Company | Ticker | Price | 52-Week Range | Market Cap |

|---|---|---|---|---|

| Apollo Commercial Real Estate Finance | ARI | $10.12 → $11.19 AH | $7.70 - $11.11 | $1.41B |

| Starwood Property Trust | STWD | $18.26 | $16.59 - $21.05 | $6.76B |

| Blackstone Mortgage Trust | BXMT | $19.34 | $16.51 - $21.24 | $3.32B |

| KKR Real Estate Finance | KREF | $8.20 | $7.55 - $11.53 | $0.54B |

| Ladder Capital | LADR | $11.14 | $9.68 - $11.92 | $1.42B |

Starwood Property Trust CEO Barry Sternlicht has been vocal about the valuation disconnect, arguing that STWD's diversified business model deserves a premium: "We should be trading at a dividend yield of 7.5%, not the 9.5% [that] reflects broken companies."

The ARI transaction may embolden other mREIT boards to consider similar strategic alternatives, particularly those trading at deeper discounts to book value.

REO Portfolio: Work to Be Done, Upside Potential

ARI retains all equity interest in its real estate owned properties, valued at $466 million as of September 30, 2025. These include The Brook, The Mayflower, Cortland Grand, and assets retained from The Stewart settlement.

"There is still both work and opportunity in terms of value creation with respect to both The Brook, The Mayflower, and to some extent, Cortland Grand as well," Rothstein said, signaling these aren't fire-sale candidates but assets with repositioning upside.

The decision to exclude REO from the sale also reflects capital efficiency considerations for Athene as an insurance buyer.

Key Dates and Next Steps

| Milestone | Date |

|---|---|

| Transaction Announced | January 28, 2026 |

| Go-Shop Period Ends | February 21, 2026 |

| Proxy Statement Filing | TBD (after go-shop) |

| Stockholder Vote | TBD |

| Expected Close | Q2 2026 |

| Strategy Deadline | Year-End 2026 |

BofA Securities is advising the ARI special committee, with Fried, Frank, Harris, Shriver & Jacobson as legal counsel. Clifford Chance is serving as ARI company counsel, while Sidley Austin represents Athene with Eastdil Secured as financial advisor.

What to Watch

During Go-Shop: Any competing offers would need to exceed the current deal's value while providing comparable certainty of execution. Given Athene's familiarity with the assets and lack of financing contingency, this is a high bar.

Strategic Review Period: Watch for signals about ARI's new direction—whether through SEC filings, conference presentations, or management commentary. The multifamily/agency licensing angle Rahmani raised could be an early indicator.

Peer Activity: If ARI's transaction validates book value, other mREITs trading at steep discounts may face pressure from shareholders or activists to pursue similar alternatives.

Dissolution Probability: The explicit mention of dissolution as a fallback option is unusual. It suggests Apollo and the board are committed to either creating meaningful shareholder value or returning capital—not perpetuating a value-destructive status quo.