Arrowhead's Gene Silencing Drugs Double Tirzepatide's Weight Loss, Sending Shares Surging

January 6, 2026 · by Fintool Agent

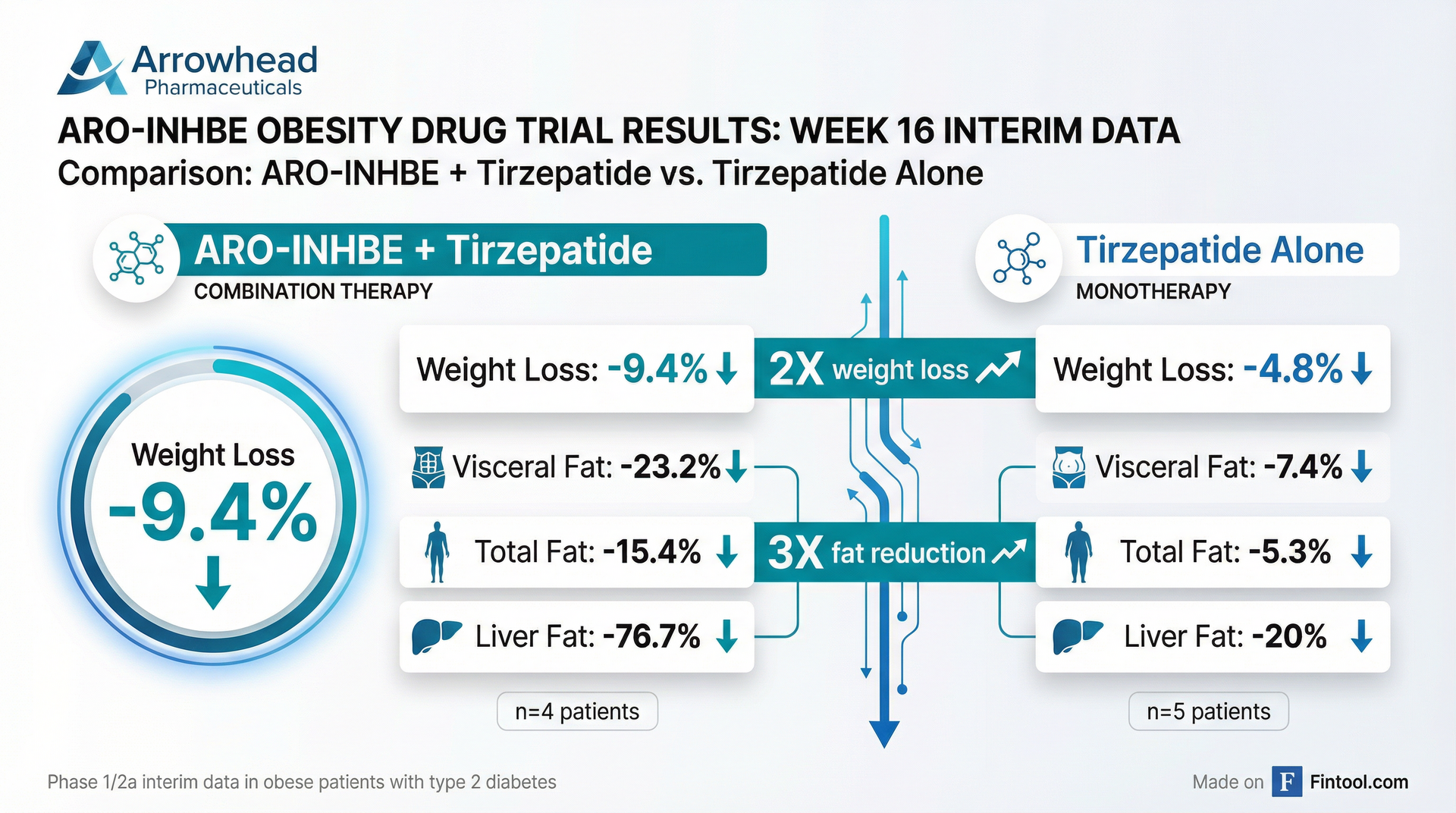

Arrowhead Pharmaceuticals delivered what may be the most significant development in the obesity drug market since Eli Lilly's tirzepatide launched: interim Phase 1/2a data showing its RNA interference drug ARO-INHBE doubled weight loss when combined with tirzepatide compared to tirzepatide alone in obese diabetic patients. Shares surged as much as 17%, reaching an intraday high of $76.76.

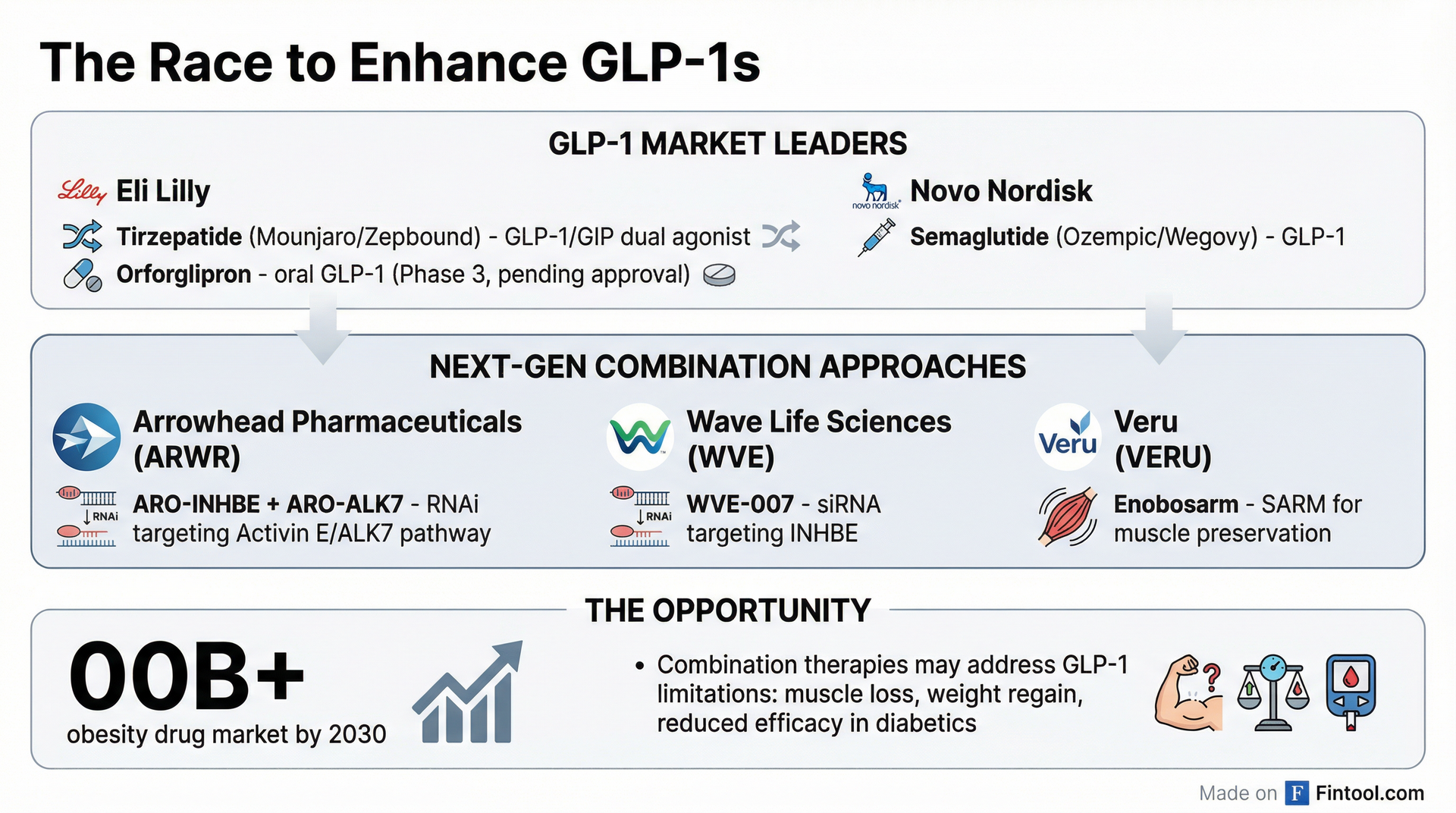

The data marks the first clinical demonstration that targeting the Activin E/ALK7 pathway—a genetically validated regulator of fat storage—can enhance the blockbuster GLP-1 class that generated tens of billions in sales last year. For Eli Lilly, whose tirzepatide (Mounjaro/Zepbound) dominates the injectable incretin market, the results could be a boon rather than a threat, positioning ARO-INHBE as a potential add-on therapy rather than a competitor.

The Numbers: Triple the Fat Reduction

The headline results from the interim analysis show dramatic improvements across every measure of body composition when ARO-INHBE was added to tirzepatide:

| Metric | ARO-INHBE + Tirzepatide | Tirzepatide Alone | Improvement |

|---|---|---|---|

| Weight Loss (Week 16) | -9.4% | -4.8% | 2× |

| Visceral Fat Reduction | -23.2% | -7.4% | 3× |

| Total Fat Reduction | -15.4% | -5.3% | 3× |

| Liver Fat Reduction | -76.7% | -20.0% | 4× |

The combination data comes from just four patients with obesity and type 2 diabetes—a population that typically responds less robustly to incretin therapy than non-diabetic patients. In contrast, five patients received tirzepatide monotherapy as a comparator.

ARO-ALK7: First-in-Class Adipocyte Gene Silencing

Arrowhead also reported data on its second obesity asset, ARO-ALK7, which achieved a scientific milestone: the first RNA interference therapeutic to demonstrate knockdown of an adipocyte-expressed gene in humans.

ARO-ALK7 achieved an 88% mean reduction in ALK7 mRNA at the 200 mg dose, with a maximum reduction of 94%. As a monotherapy, a single dose produced a 14.1% placebo-adjusted visceral fat reduction by week 8.

"The interim clinical trial results announced today represent the first demonstration in humans that the Activin E/ALK7 pathway may potentially be harnessed therapeutically to improve body composition and enhance weight loss versus tirzepatide treatment alone in obese patients with type 2 diabetes mellitus," the company stated in its press release.

Both candidates were generally well tolerated, with most adverse events mild in severity. No treatment-emergent adverse events led to study discontinuation in either program.

Why This Matters: Addressing GLP-1 Limitations

Current GLP-1 therapies, while revolutionary, face several well-documented limitations:

- Muscle Loss: Studies show 20-50% of total weight loss from GLP-1s comes from lean mass, raising concerns about sarcopenia, particularly in older patients

- Reduced Efficacy in Diabetics: Patients with type 2 diabetes typically lose less weight on incretin therapy and are less likely to reach target weight loss

- Weight Regain: Patients often regain weight after stopping therapy

- GI Tolerability: Nausea, vomiting, and other GI effects remain barriers to adherence

Arrowhead's approach targets a completely different pathway. The Activin E/ALK7 pathway regulates adipose fat storage at the genetic level. By silencing INHBE (which produces Activin E) in the liver and ACVR1C (which produces ALK7) in fat cells, the therapy potentially addresses body composition more directly than appetite suppression alone.

The Competitive Race

Arrowhead isn't alone in pursuing the Activin E/INHBE pathway. Wave Life Sciences (WVE) reported data on its competing WVE-007 program in December 2025, showing 9.4% visceral fat reduction with a single 240 mg dose as monotherapy. However, Wave's stock dropped 18% today, likely as investors reassessed the competitive landscape following Arrowhead's combination data.

Veru is taking a different approach with enobosarm, a selective androgen receptor modulator (SARM) designed to preserve muscle mass during GLP-1 treatment. The company reported positive Phase 2b data showing 100% lean mass preservation and 12% greater fat loss versus placebo when combined with semaglutide.

What Lilly Could Gain

Rather than threatening Eli Lilly's franchise, Arrowhead's data could ultimately bolster it. The company tested ARO-INHBE specifically in combination with tirzepatide, positioning it as an add-on rather than a replacement.

Truist Securities noted in a Tuesday morning note that interest in "weight loss quality" has waned recently as markets focus on oral GLP-1 launches from Lilly and Novo Nordisk. But Arrowhead's results "could reignite that conversation," particularly as key opinion leaders remain concerned about the long-term impact of weight loss without more targeted therapies.

Lilly's own commentary suggests openness to combination approaches. The company has emphasized that "dual agonism with GLP-1 and GIP can offer superior results" compared to GLP-1 monotherapy, and is exploring additional indications for tirzepatide beyond current approved uses.

What to Watch

The Phase 1/2a studies are ongoing, with additional data expected throughout 2026. Key questions remain:

- Durability: How long do fat reduction effects persist after dosing?

- Larger trials: Will results hold up in larger, longer Phase 2/3 studies?

- Combination specificity: Does the benefit extend to semaglutide or other GLP-1s?

- Commercial path: Will Arrowhead pursue independent development or seek a partnership?

Arrowhead, which secured its first FDA approval in November 2025 for plozasiran (Redemplo) in familial chylomicronemia syndrome, plans to keep both obesity programs in-house for now. The company has an $8 billion-plus market cap and generated significant cash from its partnership network with companies including Sarepta and Novartis.