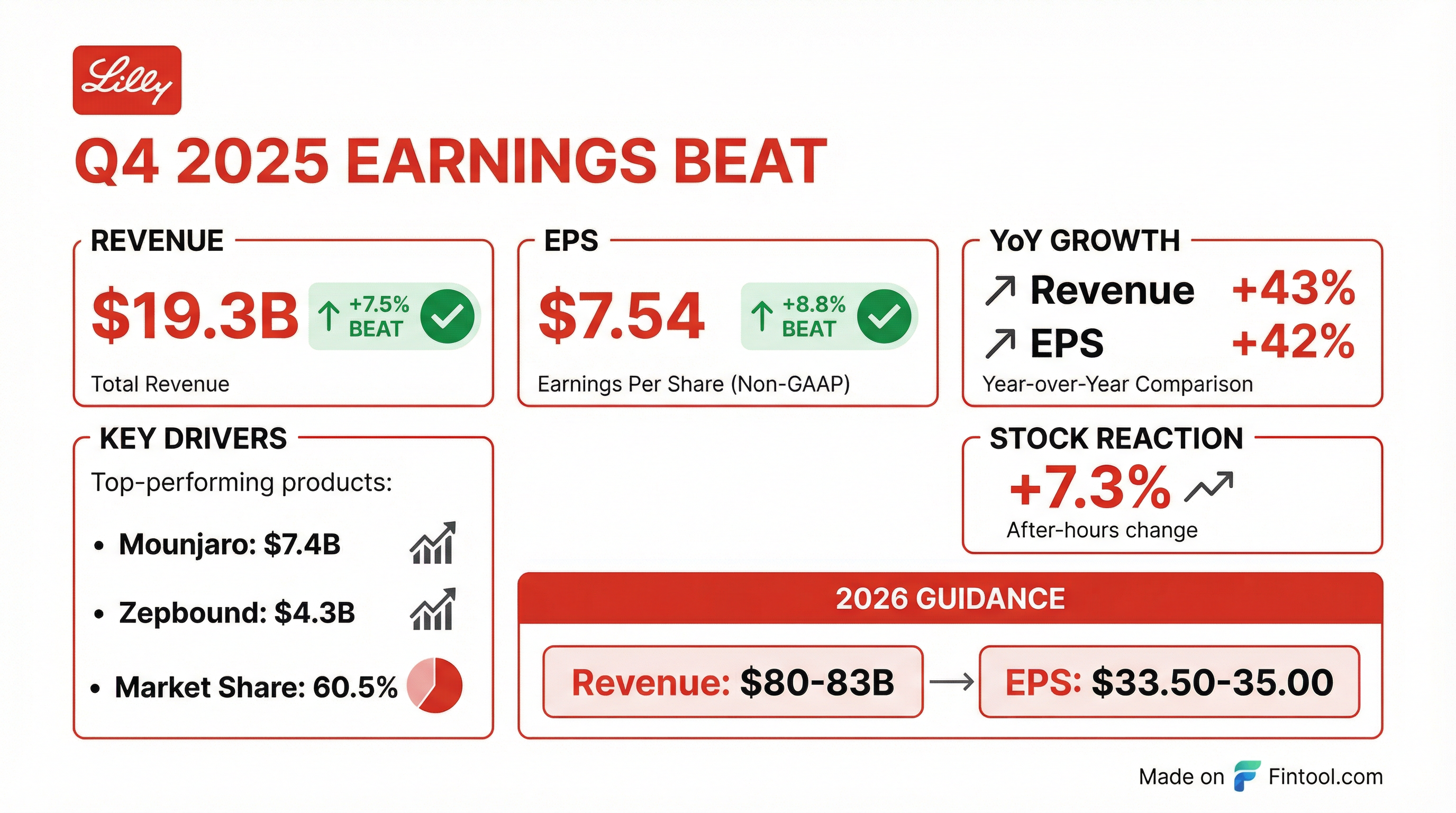

Earnings summaries and quarterly performance for ELI LILLY &.

Executive leadership at ELI LILLY &.

Board of directors at ELI LILLY &.

Erik Fyrwald

Director

Gabrielle Sulzberger

Director

Jamere Jackson

Director

Jon Moeller

Director

Juan Luciano

Lead Independent Director

Katherine Baicker

Director

Kimberly Johnson

Director

Mary Lynne Hedley

Director

Ralph Alvarez

Director

William Kaelin

Director

Research analysts who have asked questions during ELI LILLY & earnings calls.

Courtney Breen

AllianceBernstein

8 questions for LLY

Evan Seigerman

BMO Capital Markets

8 questions for LLY

Mohit Bansal

Wells Fargo & Company

8 questions for LLY

Seamus Fernandez

Guggenheim Partners

8 questions for LLY

Steve Scala

Cowen

8 questions for LLY

Terence Flynn

Morgan Stanley

8 questions for LLY

Akash Tewari

Jefferies

7 questions for LLY

Asad Haider

Goldman Sachs

6 questions for LLY

Christopher Schott

JPMorgan Chase & Co.

6 questions for LLY

Umer Raffat

Evercore ISI

6 questions for LLY

Alexandria Hammond

Wolfe Research

5 questions for LLY

Geoff Meacham

Citigroup Inc.

5 questions for LLY

David Risinger

Leerink Partners

4 questions for LLY

James Shin

Analyst

4 questions for LLY

Kerry Holford

Berenberg

3 questions for LLY

Tim Anderson

Bank of America

3 questions for LLY

Trung Huynh

UBS Group AG

3 questions for LLY

Alex Hammond

Sidoti & Company, LLC

2 questions for LLY

Chris Schott

JPMorgan Chase & Company

2 questions for LLY

Chris Shibutani

Goldman Sachs Group, Inc.

2 questions for LLY

Geoffrey Meacham

Citi

2 questions for LLY

James Chin

Deutsche Bank

2 questions for LLY

Michael Yee

Jefferies

2 questions for LLY

Timothy Anderson

BofA Securities

2 questions for LLY

Umar Rafat

Evercore

2 questions for LLY

Carter L. Gould

Barclays

1 question for LLY

Jeff Meacham

Citigroup Inc.

1 question for LLY

Kripa Devarakonda

Truist Securities

1 question for LLY

Rajesh Kumar

HSBC

1 question for LLY

Srikripa Devarakonda

Truist Financial Corporation

1 question for LLY

Recent press releases and 8-K filings for LLY.

- Lilly introduced the Employer Connect platform with over fifteen independent program administrators to offer flexible, transparent obesity management coverage, addressing inconsistent employer-sponsored plan coverage.

- Zepbound (tirzepatide) KwikPen is available at a discounted price of $449 across all doses for network pharmacies, designed to lower out-of-pocket costs for employees.

- Initial partnerships include administrators such as 9amHealth, Calibrate Health, Mark Cuban Cost Plus Drug Company, and others, with further expansion planned.

- orforglipron expected FDA approval in early Q2 2026 with U.S. launch shortly thereafter; shipments occur ~1 week post-approval.

- Pricing set at $149 introductory (scaling to $399) with Medicare coverage from July 1 and PBM negotiations underway.

- Built $1.5 billion pre-launch inventory for global supply resilience, though not correlated to 2026 revenue forecasts.

- Obesity/diabetes pipeline led by tirzepatide, with orforglipron driving oral market expansion and retatrutide targeting high-BMI (>37) patients after Q4 2025 data showed ~28–29% weight reduction.

- Non-incretin programs include cardiovascular Lp(a) therapies (lepodisiran, muvalaplin) and Alzheimer’s asset Kisunla (TRAILBLAZER-ALZ 3 event-driven readout in 2027); China business at $2 billion with new reimbursement unlocking growth.

- Lilly expects orforglipron FDA approval in early Q2 2026, with U.S. launch within a week, priced initially at $149 scaling to $399, and Medicare access effective July 1 for anti‐obesity coverage.

- Incretin portfolio hierarchy: tirzepatide remains the foundation, orforglipron expands oral treatment options, and retatrutide targets high‐BMI patients with up to 28–29% weight reduction in initial studies.

- Non‐incretin pipeline includes cardiovascular risk therapies lepodisiran and muvalaplin, and Alzheimer’s programs—Kisunla’s TRAILBLAZER-ALZ-3 readout in 2027 and remternetug dose‐finding supporting Phase III design.

- China operations (~$2 B of $65 B global revenue) are growing post–NIDL reimbursement for Mounjaro, with shrinking launch lags and a local lab in Beijing to accelerate innovation.

- AI implementation is improving efficiencies across SG&A (e.g., automated forecasting), manufacturing (site automation), and eventually R&D discovery, supported by a new supercomputer and the Conn Innovation Lab.

- Orforglipron is on track for FDA approval in early Q2 2026, with product expected to ship to patients within about one week post-approval and a full U.S. commercial launch, followed by broader ex-U.S. access in 2027.

- The oral obesity therapy will launch on LillyDirect at a starting dose price of $149, scaling up to $399, with Medicare coverage beginning no later than July 1 and active negotiations underway with PBMs for commercial reimbursement.

- Tirzepatide remains the foundation of Lilly’s diabetes/obesity platform; orforglipron is positioned to expand the oral market; and retatrutide is targeted at patients with BMI > 37, having demonstrated up to 28–29% weight reduction in early studies and supported by ongoing TRIUMPH dosing and tolerability trials.

- Beyond incretins, Lilly is advancing cardiovascular risk candidates lepodisiran and muvalaplin for elevated Lp(a), developing an oral SERD in metastatic and adjuvant breast cancer (readout by 2027), and pursuing Alzheimer’s trials with TRAILBLAZER-ALZ 3 event-driven readout in 2027.

- The EMA’s CHMP has issued a positive opinion recommending Olumiant (baricitinib) for treatment of adolescents (ages 12 to <18) with severe alopecia areata, advancing its use beyond adults.

- Filing supported by Phase 3 BRAVE-AA-PEDS data showing 42.4% of adolescents on 4 mg achieved ≥80% scalp hair coverage at 36 weeks versus 4.5% on placebo.

- The opinion is now with the European Commission for final approval, expected within 1–2 months; U.S. submission for adolescent use is under review with a decision due in H2 2026.

- If approved, Olumiant would be the first JAK inhibitor authorized in the EU specifically for adolescents with severe alopecia areata, following adult approvals in 2022.

- The U.S. FDA granted Fast Track designation to AKY-1189 for treating adult patients with locally advanced or metastatic urothelial cancer after prior systemic therapies.

- Aktis is conducting a multi-site Phase 1b trial (NCT07020117) of AKY-1189 in mUC and several other Nectin-4 expressing tumors, with Part 1 preliminary results expected in Q1 2027.

- AKY-1189 is a miniprotein radioconjugate designed to deliver actinium-225 to Nectin-4 positive tumors, which are expressed in approximately 80–90% of urothelial cancers.

- Aktis has a strategic collaboration with Eli Lilly and Company and is advancing a second radioconjugate program, AKY-2519, targeting B7-H3 expressing tumors.

- Jaguar Gene Therapy completed dosing of the initial five patients in its first‐in‐human trial of JAG201, a gene therapy for SHANK3 haploinsufficiency in Phelan-McDermid syndrome; dosing of dose-escalation Cohort 2 is expected to finish in Q2 2026.

- No treatment-related serious adverse events or dose-limiting toxicities have been reported to date, indicating a favorable safety profile.

- Early indications of clinical benefit have been observed across communicative, motor, cognitive, and social domains.

- JAG201 has received FDA Rare Pediatric Disease, Fast Track, and Orphan Drug designations, reflecting regulatory support for this potentially transformative therapy.

- In its first month post-launch, 73% of primary care physicians and 78% of endocrinologists prescribed the oral Wegovy Pill.

- Among non-prescribers, 98% of PCPs and 88% of endocrinologists plan to prescribe the therapy within six months of approval.

- Unaided awareness in February 2026 climbed to 60% of PCPs and 78% of endocrinologists, up from 14% and 11%, respectively, in November 2025.

- Early insights indicate the oral GLP-1 may drive net market growth, with gains in share exceeding expected losses from injectables.

- Competition is intensifying as Lilly’s oral GLP-1 candidate, orforglipron, targets FDA approval in Q2 2026.

- Omvoh (mirikizumab-mrkz) achieved 92.4% clinical remission and 91.2% corticosteroid-free remission at 152 weeks among VIVID-2 patients who were Week 52 responders in Crohn’s disease.

- Patients also sustained improvements in bowel urgency, with 82.1% achieving a ≥3-point reduction on the Urgency Numeric Rating Scale and 71.7% achieving a score ≤2 at three years.

- In VIVID-1, Omvoh reduced Crohn’s-related hospitalizations and/or surgeries by nearly 50% versus placebo in weeks 0–12 and by 70% in weeks 12–52.

- The long-term safety profile through Year 3 was consistent with prior data; common adverse events (≥5%) included COVID-19, nasopharyngitis, and upper respiratory tract infection.

- In the Phase 3b TOGETHER-PsO trial, combining Zepbound with Taltz achieved 27.1% complete skin clearance (PASI 100) plus ≥10% weight loss at 36 weeks versus 5.8% with Taltz alone (n=274).

- The combo delivered a roughly 40% relative increase in PASI 100 rates and adverse events were generally mild to moderate.

- In a parallel PsA study, 31.7% of patients on Taltz + Zepbound reached ≥50% PsA activity reduction and ≥10% weight loss versus 0.8% on Taltz monotherapy.

- Lilly shares rose about 0.25% in pre-market trading to $1,039 following the announcement.

Fintool News

In-depth analysis and coverage of ELI LILLY &.

Lilly Proves Zepbound Boosts Psoriasis Treatment: GLP-1s Expand Beyond Weight Loss

Eli Lilly Pays Up to $2.4 Billion for Orna Therapeutics, Joining In Vivo CAR-T Race

Eli Lilly Deepens China Bet with $8.85B Innovent Oncology and Immunology Deal

TrumpRx Goes Live: GLP-1 Drug Prices Slashed Up to 85%, Pharma Stocks React

Eli Lilly Crushes Q4 as Mounjaro and Zepbound Sales Double—Stock Surges 8%

Eli Lilly Bets $3.5 Billion on Pennsylvania to Build Retatrutide Arsenal

Quarterly earnings call transcripts for ELI LILLY &.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more