ASML Cuts 1,700 Jobs Despite €9.6B Profit as AI Chip Boom Reshapes Workforce

January 28, 2026 · by Fintool Agent

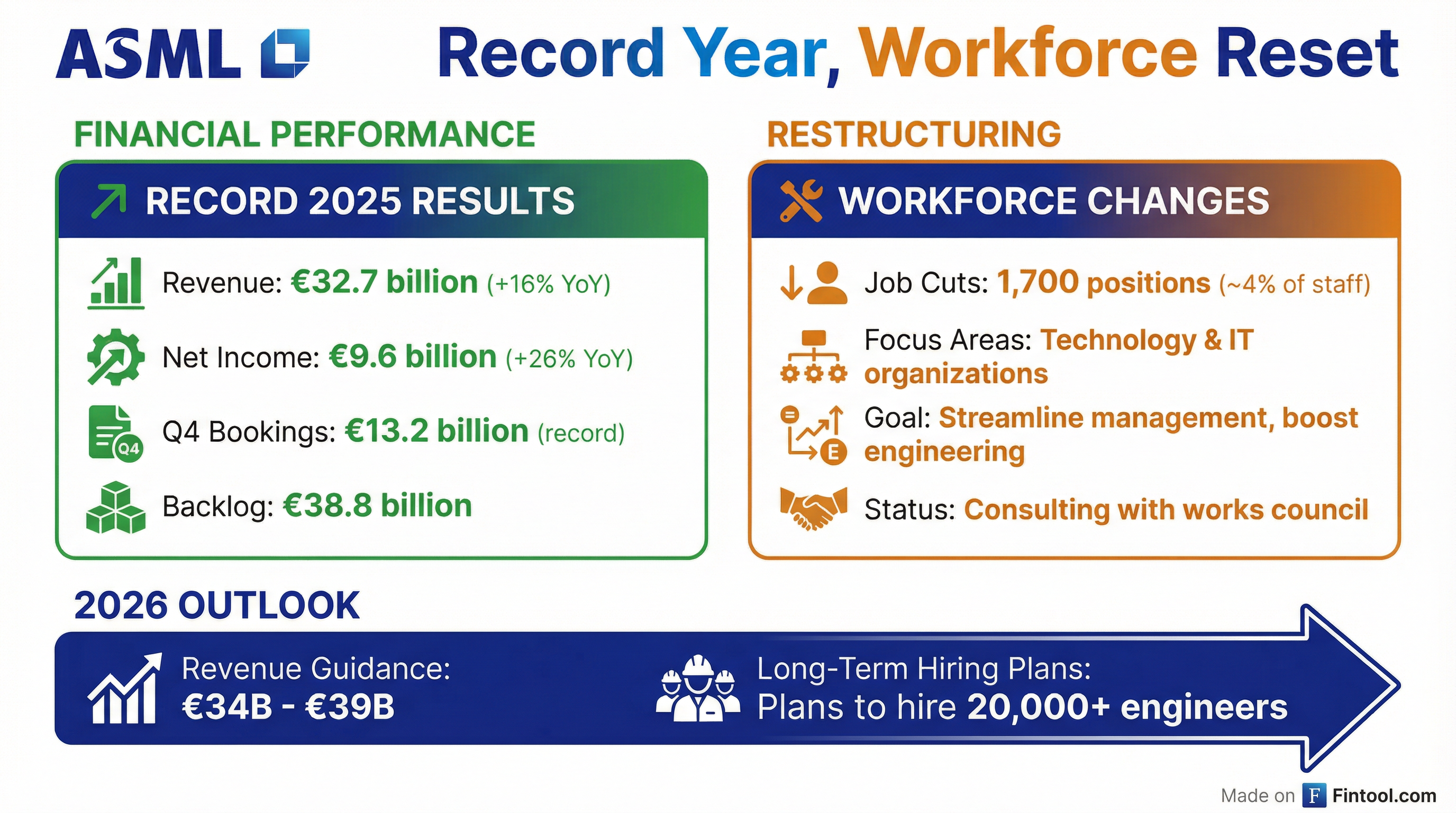

Asml Holding, the world's sole maker of extreme ultraviolet (EUV) lithography machines, announced plans to cut 1,700 jobs—roughly 4% of its workforce—on the same day it reported record annual profits and raised its 2026 outlook, underscoring a strategic pivot to prioritize engineering innovation amid unprecedented AI-driven demand.

The Dutch chip equipment giant delivered full-year 2025 net income of €9.6 billion—up 26.9% from €7.6 billion in 2024—on revenue of €32.7 billion, while Q4 bookings surged to a record €13.2 billion as customers scrambled to secure capacity for AI chip production.

Shares initially surged 7% before reversing late in the session as investors weighed the bullish demand outlook against questions about ASML's capacity to execute on accelerating orders.

The Paradox: Layoffs Amid Record Demand

The workforce reduction targets ASML's Technology and IT organizations, with cuts focused primarily on management roles rather than engineers. CFO Roger Dassen framed the move as necessary to restore organizational agility:

"In some cases, the company's way of working has become less agile... Engineers are spending excessive time on tasks unrelated to innovation."

The company plans to create 1,400 engineering positions to offset the cuts and expects to hire approximately 20,000 additional employees over the long term to support sustained growth.

Dutch unions reacted sharply. CNV negotiator Arjan Huizinga compared ASML to "The Very Hungry Caterpillar," stating: "Cash is flowing in, and the future looks very promising. Still, to increase profits further, they apparently feel the need to cut staff."

AI Demand Drives Record Orders

CEO Christophe Fouquet credited a "notably more positive assessment" from customers about the sustainability of AI-related demand for the surge in orders.

"The market outlook has improved notably over the last months, especially as related to the continued buildup of data centers and AI-related infrastructure... We see our customers in both segments increasing and accelerating capacity expansion plans."

Q4 bookings of €13.2 billion included €7.4 billion for EUV systems, with 56% coming from memory customers—a notable shift as DRAM makers adopt more EUV layers for their advanced nodes. The company ended 2025 with a backlog of €38.8 billion, providing strong visibility into 2026 and beyond.

Key customers driving demand include:

- TSMC: Expanding capacity for 3nm AI accelerators and preparing 2nm ramp

- Samsung and SK Hynix: Ramping HBM and DDR5 production with increasing EUV adoption

- Intel: Qualified its first High NA EUV system for leading-edge nodes

Financial Results: Record Quarter Caps Record Year

| Metric | Q4 2025 | Q4 2024 | FY 2025 | FY 2024 |

|---|---|---|---|---|

| Revenue (€B) | 9.7 | 9.3 | 32.7 | 28.3 |

| Net Income (€B) | 2.8 | 2.8 | 9.6 | 7.6 |

| Gross Margin | 52.2% | 51.7% | 52.8% | 51.3% |

| EPS (€) | 7.35 | 7.09 | 24.73 | 19.25 |

| Bookings (€B) | 13.2 | — | 28.0 | 18.9 |

EUV system sales jumped 39% year-over-year to €11.6 billion in 2025, with the company recognizing revenue on 48 EUV systems including its first High NA tools.

2026 Outlook: Another Growth Year

ASML raised its 2026 guidance to €34-39 billion in revenue—implying 4-19% growth—with gross margins of 51-53%.

The wide revenue range reflects uncertainty around:

- Customer fab readiness: Timing of when customers can accept tools depends on their fab construction progress

- ASML's capacity ramp: The company is gradually increasing its move rate quarter-over-quarter

- China normalization: China revenue expected at ~20% of sales, down from higher 2025 levels

"No one wants to be the bottleneck in the kind of growth that we're seeing in this industry," noted CFO Dassen, emphasizing that ASML is expanding capacity to meet demand through 2027 and beyond.

Shareholder Returns: €12B Buyback, 17% Dividend Hike

Alongside the results, ASML announced:

- New €12 billion share buyback program through December 2028

- 17% dividend increase to €7.50 per share for 2025

- €8.5 billion returned to shareholders in 2025 through dividends and buybacks

What to Watch

Near-term catalysts:

- SPIE Advanced Lithography Conference (February 2026): Management expects to share EUV performance data

- Investor Day updates on High NA adoption timeline and 2030 roadmap progress

- Q1 2026 results: Guidance calls for €8.2-8.9B revenue with 51-53% gross margin

Key risks:

- Capacity constraints: Can ASML ramp production fast enough to meet surging demand?

- Geopolitical tensions: Further restrictions on China sales could impact DUV revenue

- High NA adoption timing: Delays in customer qualification could push revenue into 2027

The juxtaposition of job cuts with record profits and raised guidance encapsulates ASML's strategic calculus: trimming bureaucratic weight to double down on the engineering innovation that maintains its monopoly position in EUV lithography—the technology enabling every cutting-edge AI chip on the planet.

Related Companies: Asml · TSMC · Nvidia · Intel · Micron · Samsung Electronics · SK Hynix