AT&T and Amazon Forge 'Fiber-to-Space' Alliance to Challenge Starlink Dominance

February 4, 2026 · by Fintool Agent

AT&T, Amazon Web Services, and Amazon Leo announced a sweeping strategic partnership today that will combine America's largest fiber network with Amazon's nascent satellite constellation—a direct challenge to SpaceX's Starlink dominance in the space-to-ground connectivity race.

The deal marks AT&T's most significant pivot into satellite broadband, positioning the $185 billion telecom giant to compete with T-Mobile's Starlink partnership while potentially closing one of Amazon's most critical customer acquisition deals for its struggling Leo constellation.

The Three Pillars of the Partnership

The collaboration spans three interconnected agreements that touch cloud computing, terrestrial infrastructure, and satellite broadband:

1. Cloud Migration to AWS

AT&T will migrate workloads from on-premises systems to AWS Outposts, Amazon's managed hybrid cloud offering. The telecom is using Amazon Q Developer—the same AI coding assistant shaking up the software industry—to accelerate its network service enablement migration.

2. Fiber-to-Data Center Connectivity

AT&T will connect AWS data center locations with high-capacity fiber, enabling the cloud giant to scale its AI infrastructure as demand for compute continues to surge. This effectively makes AT&T a critical supplier to AWS's infrastructure buildout.

3. Satellite Broadband for Business

Amazon Leo will provide internet connectivity services to AT&T, enabling fixed broadband services to business customers in areas where terrestrial networks don't reach. This is Amazon Leo's first major U.S. telecom distribution partnership.

"Fiber is the foundation of that future – it delivers the speed, capacity, and reliability that modern networks demand," said Shawn Hakl, senior vice president of AT&T Business. "By pairing our expanding fiber infrastructure with AWS's cloud capabilities... we're creating a more resilient, scalable, and intelligent connectivity ecosystem."

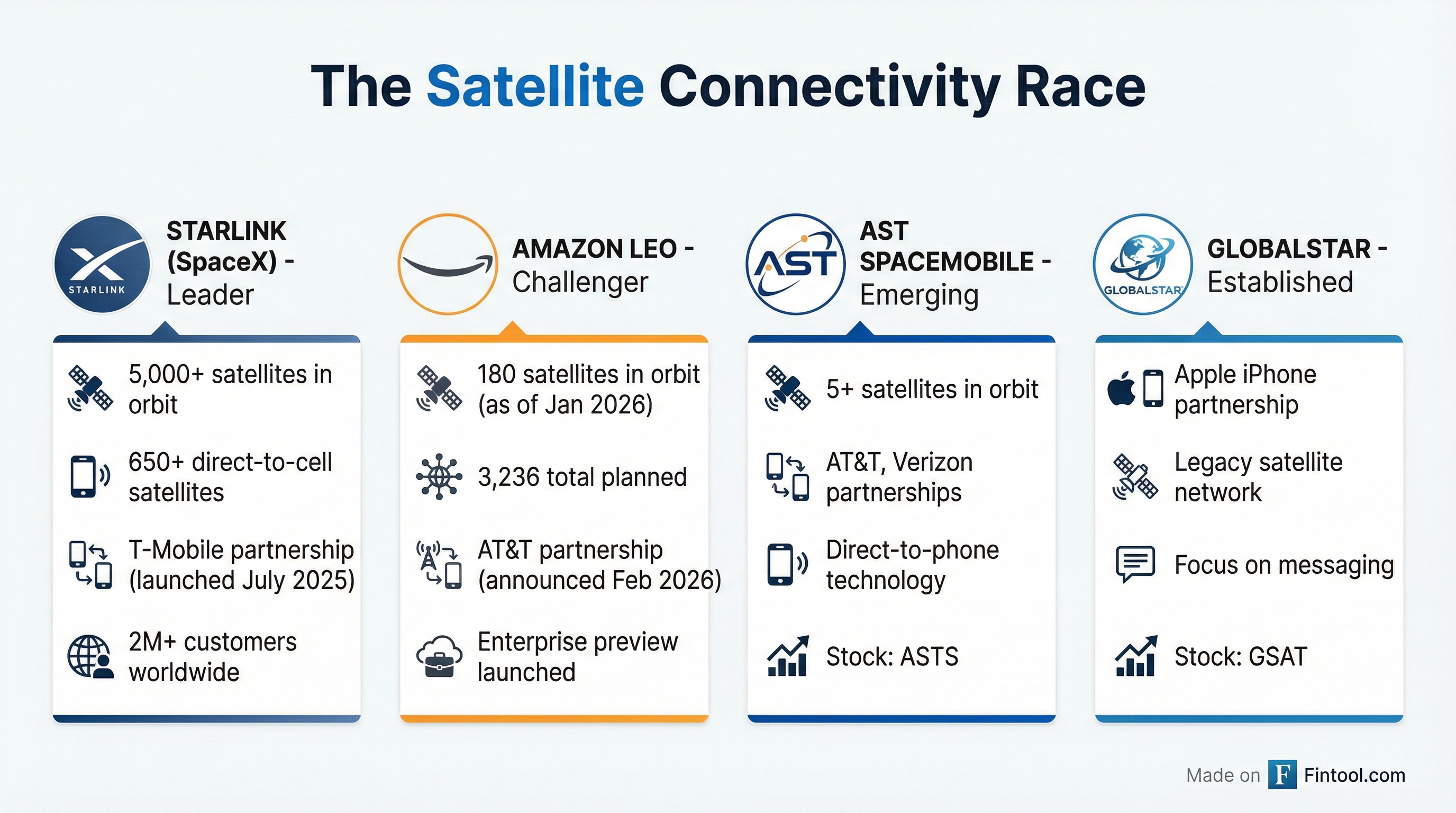

Amazon Leo: The Underdog Trying to Catch Starlink

The timing of this partnership is critical for Amazon. The Leo constellation—rebranded from Project Kuiper in November 2025—is running significantly behind schedule.

The Deployment Gap

| Metric | Amazon Leo | SpaceX Starlink |

|---|---|---|

| Satellites in Orbit | 180 | 5,000+ |

| Direct-to-Cell Satellites | N/A | 650+ |

| Total Planned | 3,236 | 15,000+ |

| Investment to Date | $10B+ | Undisclosed |

| Manufacturing Rate | 30/week | 100+/week |

Amazon asked the FCC in January for a 24-month extension to deploy half its constellation, pushing the milestone from July 2026 to July 2028. The company cited launch vehicle shortages, manufacturing disruptions, and spaceport capacity constraints.

"Amazon has reserved more than 100 launches and recently purchased additional rides from SpaceX and Blue Origin—a reliance observers call ironic given SpaceX's Starlink already operates thousands of satellites and holds a commanding market lead," according to industry reports.

The enterprise preview launched in late 2025, with Amazon's Ultra Antenna offering speeds up to 1 Gbps download and 400 Mbps upload—performance that matches Starlink's premium tiers.

The Competitive Landscape: Carriers Choose Sides

The announcement reshapes the U.S. telecom satellite landscape, where each major carrier now has a clear satellite strategy:

| Carrier | Satellite Partner | Status | Service Type |

|---|---|---|---|

| T-mobile | SpaceX Starlink | Launched July 2025 | Direct-to-cell (text, data, voice) |

| AT&T | Amazon Leo + AST SpaceMobile | Announced Feb 2026 | Fixed broadband + direct-to-cell |

| Verizon | AST SpaceMobile | Discussions | Direct-to-cell |

T-Mobile's partnership with SpaceX has a significant head start. The T-Satellite service launched commercially in July 2025, currently offers text and picture messaging, with voice and full data capabilities expanding as devices become compatible. The service is available to any carrier's customers for $10/month—including AT&T and Verizon subscribers.

AT&T maintains its relationship with Ast Spacemobile for direct-to-phone satellite connectivity, while the Amazon Leo partnership focuses on fixed broadband for enterprise customers. This dual-pronged approach hedges AT&T's satellite bets across different use cases.

What This Means for AT&T's Strategy

The partnership arrives just two days after AT&T closed its $5.75 billion acquisition of Lumen's Mass Markets fiber business, adding 1 million fiber subscribers and 4 million fiber locations across 11 new states.

AT&T's Fiber Footprint

| Metric | Current | 2030 Target |

|---|---|---|

| Fiber Locations Passed | 32M | 60M+ |

| Fiber Subscribers | 14.7M broadband connections | Growth acceleration expected |

| Convergence Rate | 42% of fiber households also wireless | Higher penetration |

The company reported Q4 2025 revenue of $33.5 billion and reiterated long-term guidance for Adjusted EBITDA growth of 3-4% in 2026, improving to 5%+ by 2028. AT&T expects to return $45 billion+ to shareholders through 2028 via dividends and buybacks.

The Amazon partnership extends AT&T's enterprise reach without requiring significant capital expenditure on satellite infrastructure—Amazon has already invested $10 billion+ in Leo. Instead, AT&T becomes a distribution partner, leveraging its sales force and customer relationships.

Investment Implications

For AT&T (T): The partnership de-risks satellite exposure while extending enterprise reach. The real test is whether Amazon Leo can catch up to Starlink's deployment—if delays persist, the business impact could be years away.

For Amazon (AMZN): Landing AT&T validates the Leo enterprise strategy but doesn't solve the deployment challenge. Amazon's Q4 results (reporting tomorrow) may provide updated capex guidance that includes satellite infrastructure.

For T-Mobile (TMUS): The first-mover advantage with Starlink remains significant. With 650+ direct-to-cell satellites already operational and commercial service launched, T-Mobile's lead is measured in years, not quarters.

For AST SpaceMobile (ASTS): AT&T's Amazon partnership doesn't replace the AST relationship—the two serve different use cases (fixed broadband vs. direct-to-phone). But it does signal AT&T is hedging its satellite bets.

What to Watch

- Amazon Q4 earnings (February 5): Look for Leo deployment updates and revised 2026 satellite capex guidance

- FCC response to Amazon's extension request: Approval would signal regulatory acceptance of the delayed timeline

- AT&T's enterprise satellite bookings: Early traction metrics will indicate market appetite

- Starlink's next moves: SpaceX has been expanding global carrier partnerships rapidly

The fiber-to-space alliance between America's largest telecom and its largest cloud provider represents a significant escalation in the connectivity infrastructure wars. Whether Amazon Leo can close the gap with Starlink will determine if this partnership delivers on its transformational promise—or remains a strategic hedge against SpaceX's growing dominance.