Amazon Secures First New U.S. Copper in a Decade for AI Data Centers

January 15, 2026 · by Fintool Agent

Amazon-5.55% Web Services has signed a two-year agreement with mining giant Rio Tinto+2.51% to secure copper from an Arizona mine that last year became the first new source of U.S. copper production in more than a decade—a deal that directly connects the AI infrastructure boom to the commodities supply chain in an unprecedented way.

The agreement makes AWS the first customer for copper produced using Rio Tinto's innovative Nuton bioleaching technology at the Johnson Camp mine in Cochise County, Arizona. The deal covers approximately 14,000 metric tons of copper cathode over four years from the Nuton process, with an additional 16,000 tonnes from conventional run-of-mine leaching—totaling nearly 30,000 tonnes.

Rio Tinto shares rose 0.55% to $86.35 on the news, while Amazon-5.55% gained 0.65% to $238.18. Copper miners broadly benefited, with Southern Copper+5.58% climbing 1.50% to $182.97.

The AI Industry's Copper Problem

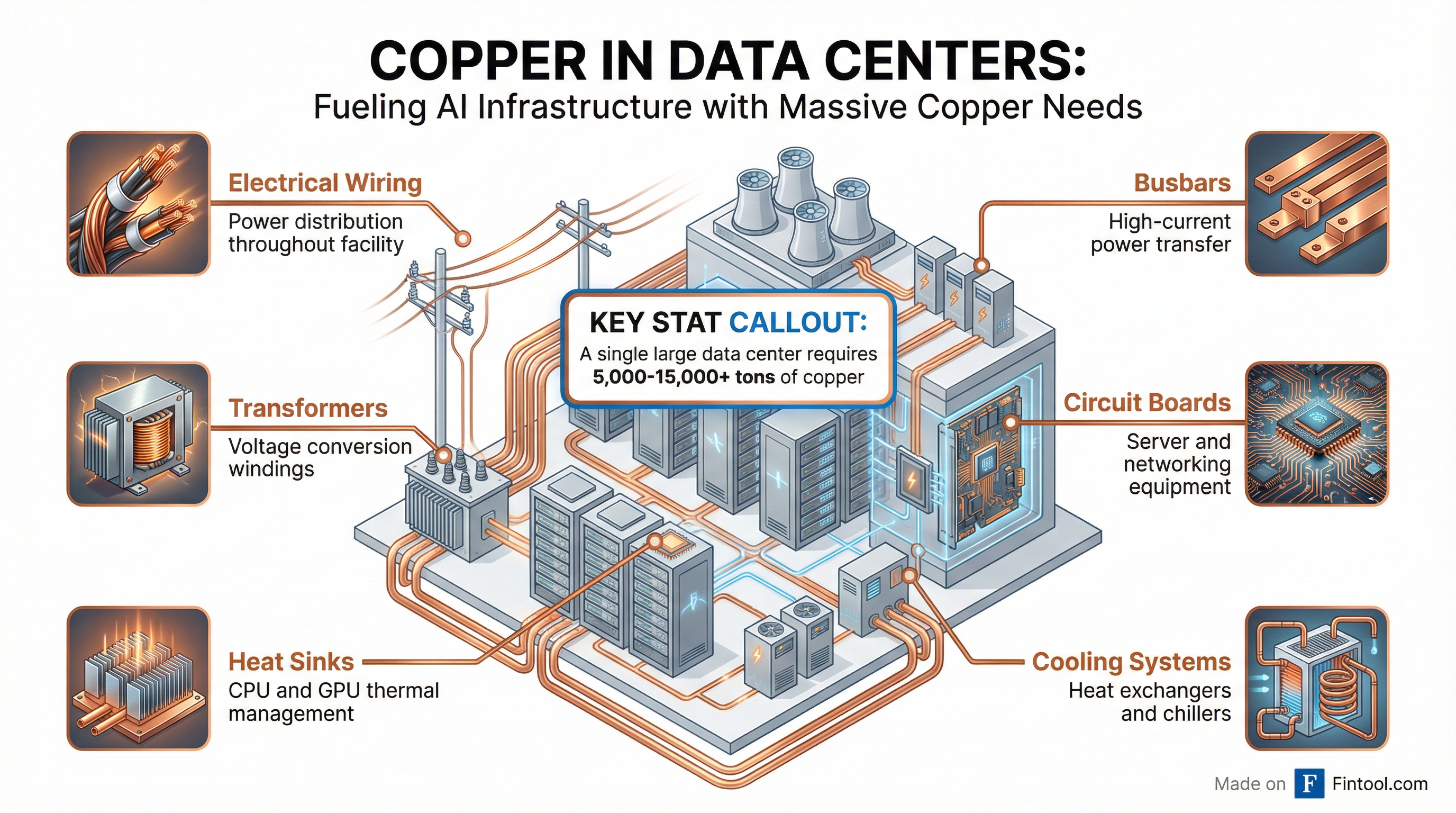

The average data center uses roughly 5,000 to 15,000 tons of copper, according to the Copper Development Association, though the largest hyperscale facilities can require tens of thousands more. This metal is critical for wiring, transformers, circuit boards, busbars, and cooling systems that power the computing revolution.

"We work at the commodity level to find lower carbon solutions to drive our business growth," Amazon's director of worldwide carbon Chris Roe told The Wall Street Journal. "That means steel, and that means concrete, and it absolutely means copper with regard to our data centers."

The deal underscores how Big Tech's voracious appetite for AI compute is rippling through supply chains in unexpected ways. While most attention has focused on chips and power, the physical infrastructure requires massive quantities of industrial metals—and copper sits at the heart of it all.

The Nuton Breakthrough

Rio Tinto's Nuton technology represents a potential game-changer for copper production. The bioleaching process uses bacteria and acid to extract copper from ore that was previously too low-grade to process economically. It produces 99.99% pure copper cathode directly at the mine gate, eliminating the need for traditional concentrators, smelters, and refineries that add cost, carbon emissions, and complexity to the supply chain.

"By bringing Nuton copper into AWS's U.S. data-centre supply chain, we're helping to strengthen domestic resilience and secure the critical materials those facilities need, closer to where they're used," said Katie Jackson, chief executive of copper at Rio Tinto.

The Johnson Camp mine outside Tucson was restarted last year as a proving ground for Nuton. While the volumes are modest relative to AWS's total needs—the 14,000 tonnes over four years wouldn't even supply one large data center—the partnership validates the technology and provides AWS with cloud computing and data analytics support to help optimize Nuton copper production and recovery.

A Systemic Supply Challenge

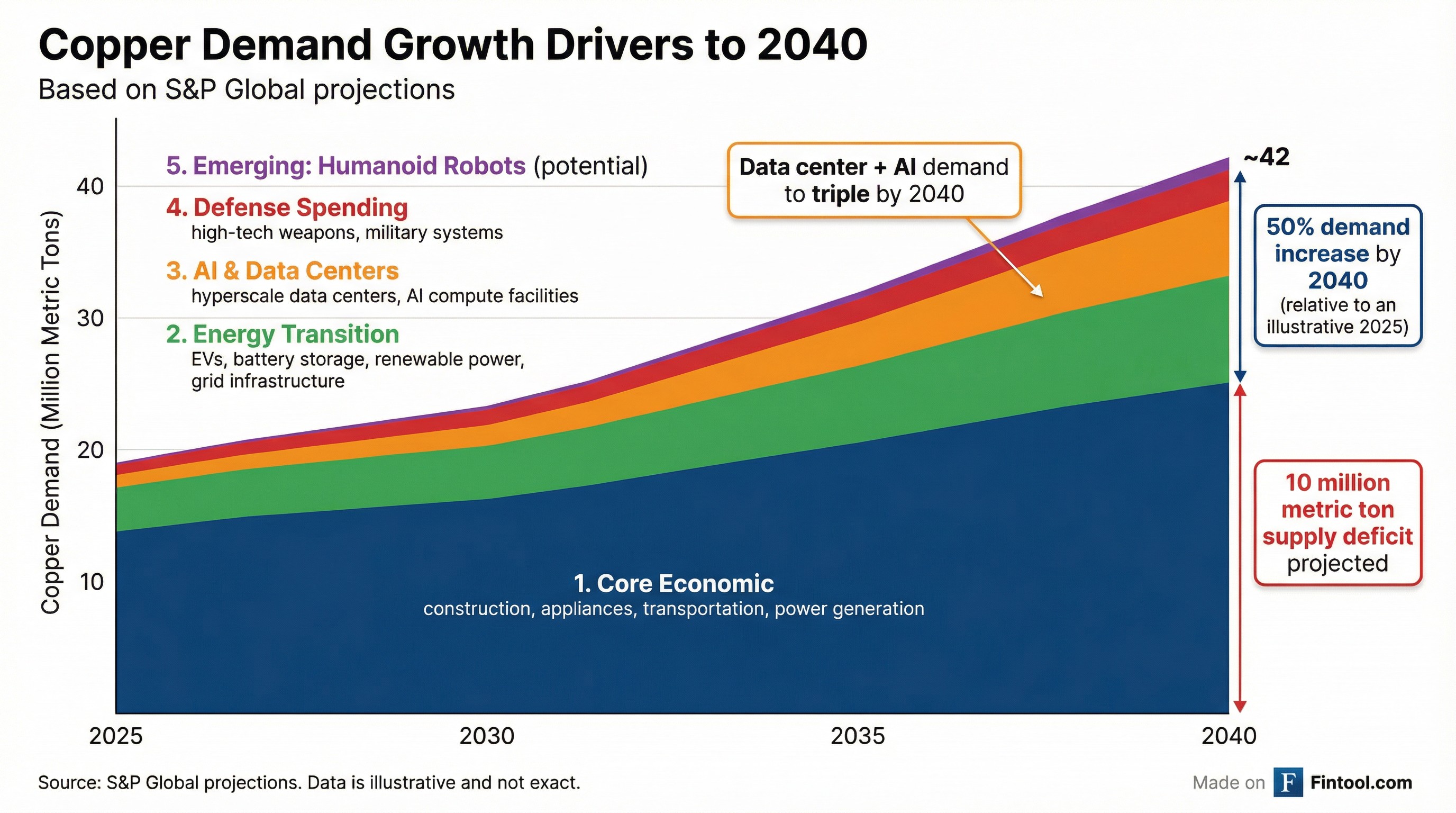

The deal arrives as the global copper market faces a structural squeeze. According to a January 2026 study by S&P Global, copper demand is projected to surge 50% by 2040 to 42 million metric tons, driven by five key vectors: core economic demand, energy transition applications, AI and data centers, defense spending, and potentially humanoid robots.

Without new mines or technological advancements, copper production is expected to peak in 2030, leaving the world short by more than 10 million metric tons by 2040—creating what S&P calls a "systemic risk for global industries, technological advancement and economic growth."

"AI and data centers really weren't even on the radar three years ago," said Aurian De La Noue, head of energy transition and critical metals consulting at S&P Global. "What this study shows is that the world is tracking toward a supply deficit even before you consider these new growth vectors."

The data center boom is just getting started. S&P Global expects total installed capacity for all data centers to reach roughly 550 gigawatts by 2040—more than five times the 2022 level. J.P. Morgan estimates data center copper demand could reach 475,000 metric tons in 2026 alone, up by approximately 110,000 metric tons year-over-year.

Investment Implications

Copper prices have surged to record highs above $13,000 per metric ton, rallying more than 44% in 2025. J.P. Morgan projects prices to reach $12,500/mt in Q2 2026, while Goldman Sachs sees an average of $5.17/lb (approximately $11,400/mt) under its base case.

| Analyst | 2026 Copper Price Forecast |

|---|---|

| J.P. Morgan | $12,075/mt (avg) |

| Citigroup | >$5.90/lb ($13,000/mt) by Q2 |

| Bank of America | $5.13/lb ($11,300/mt) avg |

| TD Cowen | $5.25/lb ($11,600/mt) avg |

Source: Argus Media, J.P. Morgan Research

For investors, the AWS-Rio Tinto deal signals several important trends:

- Supply chain verticalization: Tech giants are moving beyond software and chips to secure raw materials directly

- ESG premium: Lower-carbon production methods like Nuton command strategic value for companies with sustainability commitments

- Domestic resilience: The "made in USA" angle aligns with reshoring trends and tariff uncertainty

- Scarcity pricing: Structural deficits support elevated prices even amid economic volatility

"Governments are afraid that without enough copper, their economies won't remain competitive in a world where advanced technology is increasingly adopted," José Torres, chief economist at Interactive Brokers, told Business Insider.

What to Watch

The partnership is modest in volume but significant in signaling. Key catalysts ahead include:

- Nuton scale-up: Can Rio Tinto expand bioleaching to other deposits, and will more hyperscalers sign similar deals?

- Copper price trajectory: J.P. Morgan expects prices to hold above $10,000/mt through 2026 on tight supply

- New mine approvals: Long permitting timelines and environmental challenges constrain supply growth

- Substitution risk: Higher prices may accelerate engineering copper out of some applications, though data centers have limited alternatives

"A significant part of the incremental demand is tied to electrification, grid build, data centers/AI and defense, where copper's conductivity and reliability makes substitution harder in critical applications," said Rita Adiani, president and CEO of Titan Mining Corporation.

Related