Banijay and All3Media in Talks to Create €6B TV Production Empire

January 13, 2026 · by Fintool Agent

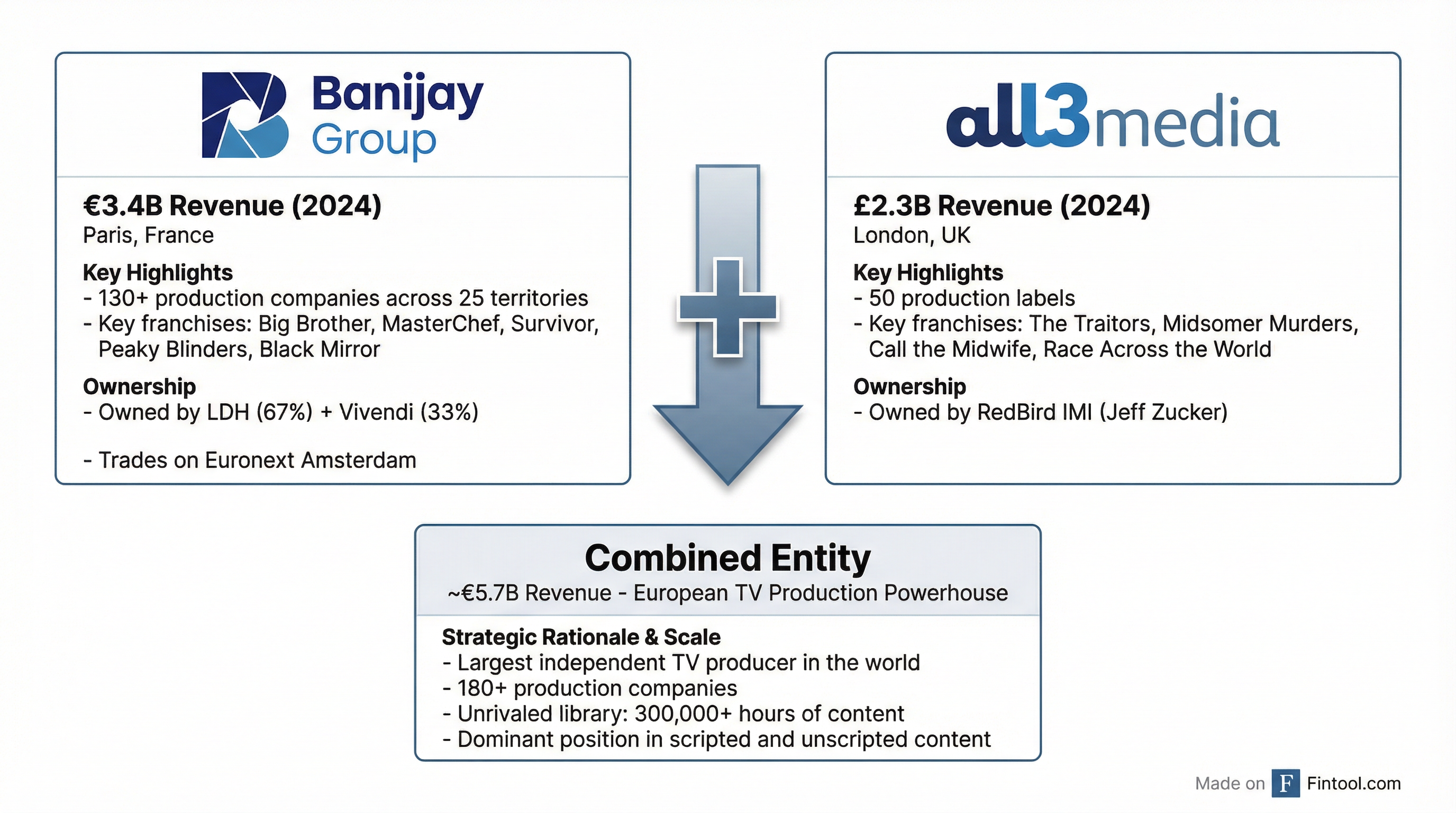

The makers of Big Brother and The Traitors are merging. Banijay Group confirmed Monday that it is in advanced discussions with RedBird IMI to combine its TV production business with All3Media, potentially creating one of the world's largest independent content companies with approximately €5.7 billion in combined revenue.

"The company confirms that it has entered into discussions with the All3Media owner regarding a potential combination between Banijay and All3Media," Banijay said in a statement. "At this stage, the company wishes to emphasise that no decision has been taken and that there can be no assurance that a transaction will be concluded."

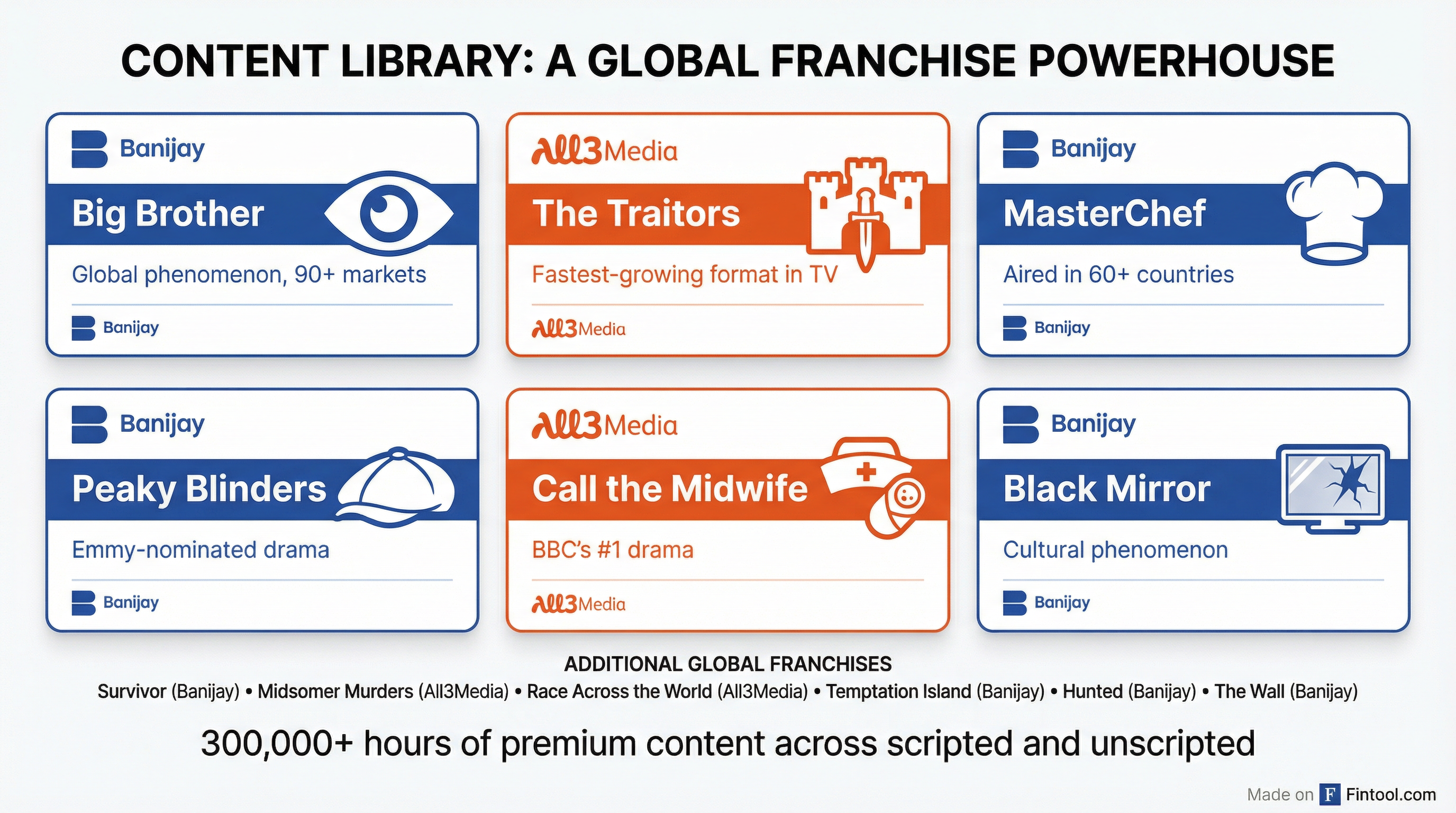

The deal would unite two of the most prolific content factories in global television—bringing together franchises that dominate both linear broadcast and streaming platforms worldwide.

The Combination

The merger would combine complementary strengths across scripted and unscripted content:

Banijay Group (Paris-based, Euronext-listed) owns more than 130 production companies across 25+ territories. Its portfolio includes some of television's most enduring formats: Big Brother, MasterChef, Survivor, Temptation Island, The Wall, and Hunted. On the scripted side, it controls Peaky Blinders, Black Mirror, and the Millennium Trilogy. The company traces its current scale to the 2020 acquisition of Endemol Shine Group for $2.2 billion, which transformed it into the world's largest independent producer.

All3Media (London-based) brings 50 production labels including Studio Lambert and IDTV—the companies behind The Traitors, the fastest-growing format in television. Its scripted portfolio spans Midsomer Murders, Call the Midwife, Fleabag, and Race Across the World. RedBird IMI, the Abu Dhabi-backed investment firm led by former CNN chief Jeff Zucker, acquired the company for £1.15 billion ($1.45 billion) in 2024 from Warner Bros. Discovery and Liberty Global.

| Metric | Banijay | All3Media | Combined |

|---|---|---|---|

| 2024 Revenue | €3.4B | €5.7-6.0B | |

| Production Companies | 130+ | 50 | 180+ |

| Territories | 25+ | 12 | 25+ |

| Major Franchises | Big Brother, MasterChef, Peaky Blinders | The Traitors, Call the Midwife, Midsomer Murders | Combined library |

Sources: Company filings, Reuters

A Content Powerhouse

The combined entity would control an unrivaled library of content that streams across virtually every major platform:

For Netflix: The streamer licenses shows from both companies, including Black Mirror (Banijay) and productions from Studio Lambert. The combination could strengthen the suppliers' negotiating position.

For Disney+/Hulu: Both companies supply content to Disney's platforms, with Banijay's Endemol Shine producing numerous unscripted series.

For BBC: All3Media is a primary supplier to the British broadcaster, with Call the Midwife ranking as BBC One's top drama and The Traitors becoming a cultural phenomenon.

For Peacock: The Traitors U.S. has become NBCUniversal's flagship reality franchise, produced by All3Media's Studio Lambert.

Strategic Rationale

The deal reflects an industrywide push toward consolidation as independent producers seek scale to compete with streaming giants that have internalized much of their content production.

Negotiating leverage: A €6 billion content supplier commands more favorable terms than smaller independents competing for platform dollars.

Format diversification: The combination brings both hit formats (The Traitors, Big Brother) and premium scripted content (Peaky Blinders, Call the Midwife) under one roof, reducing dependence on any single franchise.

Geographic breadth: Banijay's strength in France, Italy, and Southern Europe complements All3Media's dominance in the UK and English-language markets.

Streaming resilience: As linear TV declines, the combined entity's relationships across Netflix, Disney+, Max, Peacock, and Amazon Prime Video provide diversified revenue streams.

The talks began late in 2025 after Banijay abandoned its pursuit of ITV Studios, according to Reuters. ITV is now in talks to sell its broadcast arm to Comcast's Sky, which would leave ITV Studios as a standalone unit—potentially a future acquisition target.

Ownership Complexity

The deal would bring together complex ownership structures:

Banijay is controlled by LDH (67.1%), a holding company led by Stéphane Courbit's Financière LOV (52%), with Italian group De Agostini (36%) and Fimalac (12%) as co-investors. Vivendi, the French media conglomerate, owns the remaining 32.9% of Banijay Group.

All3Media is wholly owned by RedBird IMI, the joint venture between RedBird Capital Partners (U.S.) and IMI (International Media Investments, Abu Dhabi). RedBird Capital is also backing Paramount Skydance's competing bid for Warner Bros. Discovery—creating an interesting dynamic given the ongoing Netflix-WBD deal battle.

According to Reuters, All3Media and RedBird IMI may inject funds into the combined entity, with Banijay as the larger partner.

Regulatory Path

Any deal would face significant regulatory scrutiny:

UK Competition and Markets Authority: The combined entity would hold substantial market share in UK TV production, particularly in unscripted formats where both companies are dominant suppliers to ITV, Channel 4, and the BBC.

European Commission: Banijay's strong positions in France, Italy, and Germany—combined with expansion through All3Media—would likely trigger a full Phase II review.

The timeline for regulatory approval could stretch 12-18 months given the complexity and the need for concurrent reviews across multiple jurisdictions.

Second Time Around

This isn't Banijay's first attempt at All3Media. In 2023, Banijay made a binding offer to acquire the company from its then-owners Warner Bros. Discovery and Liberty Global. That bid ultimately lost out to RedBird IMI's £1.15 billion offer.

Two years later, the competitive dynamics have shifted. Banijay has grown through its gaming division (Betclic), All3Media has expanded under RedBird ownership, and the streaming landscape has become even more consolidated—making independent scale more valuable than ever.

What to Watch

Deal terms: How will RedBird IMI's investment be valued versus Banijay's contribution? The structure—whether a full acquisition or joint venture—will determine control and strategic direction.

Management: Banijay CEO Marco Bassetti has led the company through its Endemol Shine integration. All3Media CEO Jane Turton would be a natural co-leader, but the management structure remains unclear.

Regulatory timing: With both UK and EU reviews likely required, closing could extend well into 2027.

Streaming impact: How will Netflix, Disney, and other platforms respond to increased supplier concentration? The deal could accelerate in-house production investments.

For now, the company emphasized that "no decision has been taken"—but the confirmation of advanced talks signals that the world's two largest independent producers are serious about combining. If completed, the deal would reshape the global content landscape and create a supplier with unprecedented leverage in an era of streaming consolidation.