BellRing Chairman Vitale Gets Just 74% Shareholder Support as Stock Languishes 68% Below Peak

January 28, 2026 · by Fintool Agent

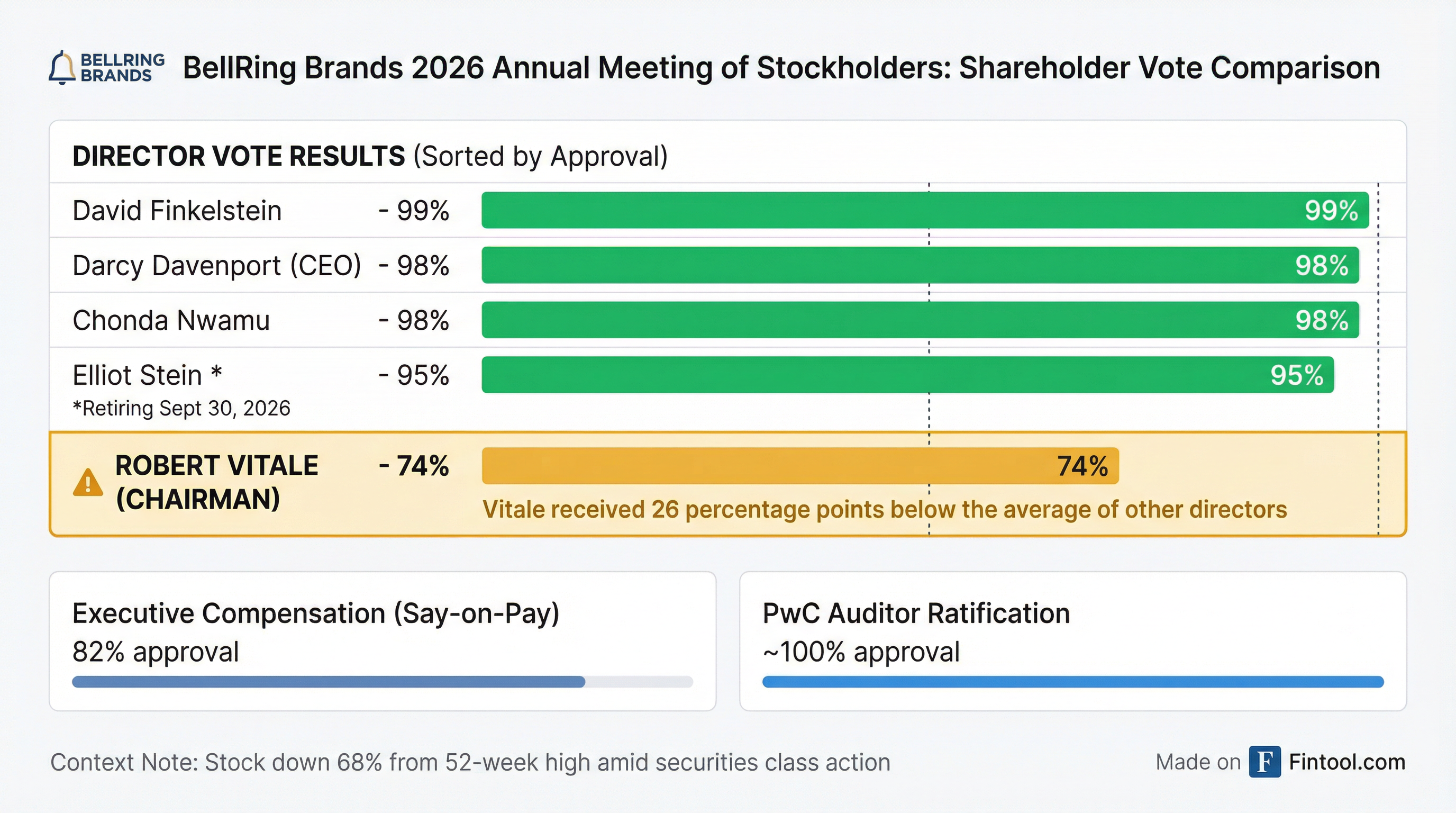

Bellring Brands Chairman Robert Vitale received just 74% shareholder support at the company's 2026 Annual Meeting of Stockholders today—a stark rebuke compared to the 95-99% approval garnered by the four other director nominees and a signal of growing investor frustration as shares trade 68% below their 52-week high amid a pending securities class action.

The Vote Gap That Tells a Story

The voting results from BellRing's virtual annual meeting, held January 28, 2026, revealed a clear divide in shareholder sentiment:

| Director | Role | Approval |

|---|---|---|

| David Finkelstein | Director (New in 2026) | 99% |

| Darcy Davenport | President & CEO | 98% |

| Chonda Nwamu | Director | 98% |

| Elliot Stein | Director (Retiring Sept 2026) | 95% |

| Robert Vitale | Chairman | 74% |

Vitale's 74% approval stands 26 percentage points below the average of other directors—a gap that typically draws scrutiny from proxy advisors like ISS and Glass Lewis, who often recommend votes against directors receiving less than majority support in previous years.

The Post Holdings Connection

The governance dynamics at BellRing cannot be understood without recognizing Vitale's dual role. He serves simultaneously as:

- Chairman of BellRing Brands (since November 2024, formerly Executive Chairman from 2019-2024)

- President & CEO of Post Holdings (since November 2014)

- Chairman of Post Holdings' board (since December 2025)

BellRing was spun off from Post Holdings in 2022 after a 2019 IPO, and Vitale's continued chairmanship raises governance questions for investors who see potential conflicts of interest. The proxy statement explicitly notes that Vitale is not independent due to his Post relationship.

Vitale took a medical leave from BellRing in November 2023 and returned in January 2024, adding to the complexity of his role.

Stock Collapse Fuels Discontent

The shareholder frustration reflected in Vitale's vote comes against a brutal backdrop for BRBR stock:

| Metric | Value |

|---|---|

| 52-Week High | $80.67 (January 30, 2025) |

| Current Price | $25.74 |

| Decline from High | -68% |

| Market Cap | $3.07 billion |

The destruction began with two catastrophic earnings reports:

May 6, 2025 (Q2 FY2025): BellRing revealed that "several key retailers lowered their weeks of supply on hand," admitting retailers had been "hoarding inventory" during prior capacity constraints. The stock plunged 19% in a single day, from $78.43 to $63.55.

August 5, 2025 (Q3 FY2025): Management cut guidance, citing "several other competitors" gaining shelf space. Shares cratered another 33%, from $53.64 to $36.18.

Securities Class Action Looms

Multiple law firms have filed securities class action lawsuits against BellRing and its executives, alleging the company misled investors about inventory conditions and the competitive threat to Premier Protein.

The lawsuits allege that during the class period (November 19, 2024 – August 4, 2025), BellRing represented sales growth as reflecting "organic growth" and "distribution gains" while downplaying competitive threats, claiming the company had a "competitive moat" in the RTD category.

Key Dates:

- Class Period: November 19, 2024 – August 4, 2025

- Lead Plaintiff Deadline: March 23, 2026

- Case: Denha v. BellRing Brands, Inc., No. 26-cv-00575 (S.D.N.Y.)

Other Meeting Outcomes

Despite shareholder discontent with Vitale, other proposals passed:

- Executive Compensation (Say-on-Pay): 82% approval—acceptable but not resounding

- Auditor Ratification (PwC): ~100% approval

- Board Retirement: Director Elliot Stein will retire September 30, 2026, having announced his departure prior to the meeting

All five directors were elected despite Vitale's lower support, as the threshold for election was a plurality of votes cast.

Financial Snapshot

Despite the stock collapse, BellRing's underlying business remains profitable, though margins compressed significantly in Q3 FY2025:

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue | $532.9M | $588.0M | $547.5M | $648.2M |

| Net Income | $76.9M | $58.7M | $21.0M | $59.6M |

| EBITDA Margin | 22.5%* | 17.0%* | 9.0%* | 16.5%* |

*Values retrieved from S&P Global

The Q3 2025 margin compression to single digits—down from 22.5% in Q1—reflects the competitive and promotional pressures management has acknowledged.

What to Watch

-

Q1 FY2026 Earnings (February 3, 2026): Deutsche Bank has already warned of another difficult quarter, cutting its price target to $31 from $35 and citing Premier Protein tracked channel data that came in 1.5% below company guidance.

-

Class Action Developments: The March 23, 2026 lead plaintiff deadline will determine who leads the securities litigation, which could result in material settlements or judgments.

-

Governance Changes: Will the board respond to the Vitale vote by reconsidering his dual Chairman role? Investors may push for an independent chair given the 74% result.

-

Competitive Dynamics: The protein shake category continues to see new entrants, and BellRing's ability to defend Premier Protein's market share will be decisive for any recovery.

Related