Earnings summaries and quarterly performance for Post Holdings.

Research analysts who have asked questions during Post Holdings earnings calls.

Andrew Lazar

Barclays PLC

8 questions for POST

John Baumgartner

Mizuho Securities

8 questions for POST

Marc Torrente

Wells Fargo

8 questions for POST

Michael Lavery

Piper Sandler & Co.

7 questions for POST

David Palmer

Evercore ISI

6 questions for POST

Scott Marks

Jefferies

6 questions for POST

Carla Casella

JPMorgan Chase & Co.

4 questions for POST

Matt Smith

Bank of America

4 questions for POST

Tom Palmer

JPMorgan Chase & Co.

4 questions for POST

Kenneth Goldman

JPMorgan Chase & Co.

3 questions for POST

Matthew Smith

Analyst

3 questions for POST

Robert Dickerson

Jefferies

1 question for POST

Recent press releases and 8-K filings for POST.

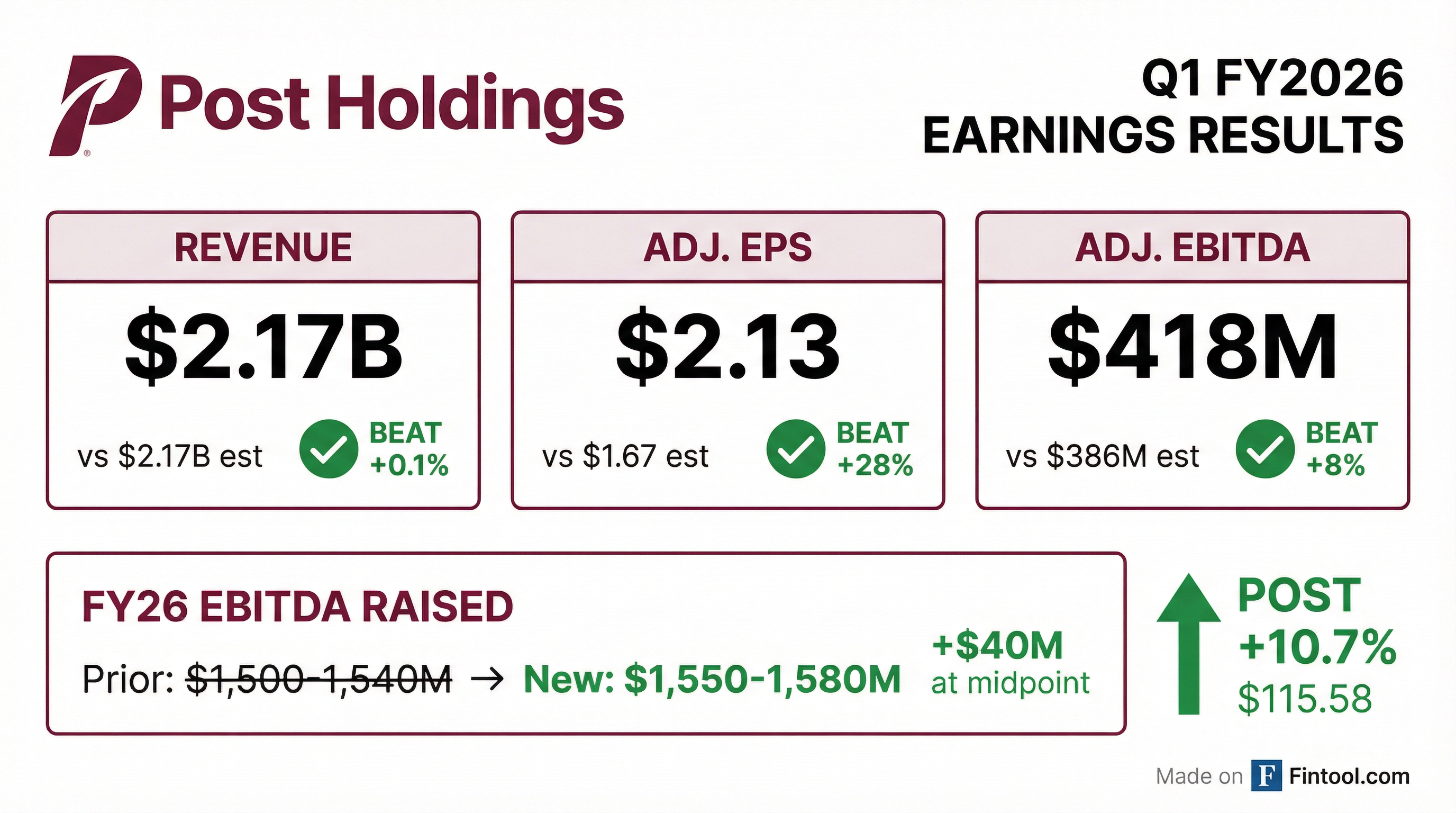

- Post Holdings' fiscal Q1 2026 adjusted EBITDA was well above expectations, leading to a significant increase in guidance.

- The company continued aggressive share repurchases and maintained net leverage flat following the Q1 sale of the 8th Avenue pasta business, preserving significant flexibility for opportunistic capital allocation.

- The foodservice business saw an increase in its normalized run rate and experienced nice volume growth in eggs, with expectations for a 3%-4% growth rate.

- The cereal category is returning to its historical low single-digit decline pace , and benefits from cereal facility closures are expected to impact the P&L starting in Q3.

- Post Holdings reported Q1 FY 2026 adjusted EBITDA well above expectations, leading to a significant increase in guidance for the year.

- The company maintained net leverage flat through aggressive share repurchases and the Q1 sale of the 8th Avenue pasta business.

- The cereal category has recently returned to a low single-digit decline pace, a notable shift attributed to SNAP changes and consumer trade-down behavior.

- Price mix in the PCB segment was down primarily due to price testing on Nutrish in the pet business, with a brand relaunch expected to improve price per pound.

- Cost savings from cereal facility closures are projected to benefit the P&L starting in Q3.

- Post Holdings delivered Q1 2026 adjusted EBITDA well above expectations and significantly increased its guidance for the fiscal year.

- The company continued aggressive share repurchases and maintained net leverage flat due to strong operating performance and the Q1 sale of its 8th Avenue pasta business.

- The foodservice segment's normalized run rate was updated, with expectations for a 3%-4% growth rate and mix benefit, while the cereal category showed a return to historical low single-digit declines.

- Benefits from the closure of two cereal facilities are expected to impact the P&L starting in Q3 2026.

- Post Holdings, Inc. shareholders approved three amendments to the Company's Articles of Incorporation at the 2026 Annual Meeting held on January 29, 2026, which became effective the same day.

- These amendments lower certain supermajority voting thresholds related to corporate governance.

- Key changes include reducing the voting requirement for the removal of directors from two-thirds of outstanding shares to a majority of shares entitled to vote.

- The amendments also reduced the voting threshold for the approval of certain business combinations with interested shareholders and for amending related provisions from 85% of outstanding shares to a majority of shares represented (excluding interested shareholder's beneficial ownership).

- On December 15, 2025, Post Holdings, Inc. issued $1,300.0 million aggregate principal amount of 6.50% senior notes due 2036.

- These new notes bear interest at 6.50% per year, payable semi-annually, with the first payment due on March 15, 2026, and mature on March 15, 2036.

- The company may redeem up to 40% of the new notes prior to December 15, 2028, at 106.50% of the principal amount, and has various redemption prices for redemptions on or after March 15, 2031, starting at 103.250% in 2031 and decreasing to 100.000% in 2034 and thereafter.

- On December 17, 2025, Post Holdings completed the redemption of all its outstanding $1,235.0 million aggregate principal amount of 5.50% senior notes due 2029 at a redemption price of 101.833%.

- Post Holdings, Inc. announced its intention to redeem the remaining $1,235.0 million in aggregate principal amount of its 5.50% senior notes due December 2029.

- The redemption is scheduled for December 17, 2025, at a price of 101.833% of the principal amount, plus accrued and unpaid interest.

- This redemption is conditional upon the company completing financing sufficient to cover the redemption amount.

- To fund the redemption, Post Holdings plans to use the net proceeds from a private offering of $1,300.0 million in 6.50% senior notes due 2036, which is expected to close on December 15, 2025.

- Post Holdings, Inc. intends to redeem $1,235.0 million of its outstanding 5.50% senior notes due December 2029 on December 17, 2025, at a redemption price of 101.833% of the principal amount plus accrued interest.

- This redemption is contingent upon the company consummating sufficient financing, which it plans to achieve through the net proceeds from a recently priced offering of $1,300.0 million in 6.50% senior notes due 2036, expected to close on December 15, 2025.

- Post Holdings, Inc. completed the previously announced sale of the pasta business of 8th Avenue Food & Provisions, Inc.

- The sale was effective on December 1, 2025.

- Post Holdings, Inc. priced $1,300.0 million in aggregate principal amount of 6.50% senior notes due 2036 at par.

- The offering is expected to close on December 15, 2025.

- The primary use of net proceeds is to redeem all outstanding 5.50% senior notes due 2029.

- Any remaining net proceeds may be used for general corporate purposes, including acquisitions, debt retirement, or share repurchases.

- Post Holdings, Inc. priced $1,300.0 million in aggregate principal amount of 6.50% senior notes due 2036 at par.

- The offering is expected to close on December 15, 2025.

- The company intends to use the net proceeds primarily to redeem all outstanding 5.50% senior notes due 2029 and cover offering costs.

- Any remaining net proceeds may be used for general corporate purposes, which could include acquisitions, debt repayment, share repurchases, capital expenditures, and working capital.

Quarterly earnings call transcripts for Post Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more