Bitcoin Crashes Below $70K, Wiping Out Entire Trump Rally

February 5, 2026 · by Fintool Agent

Bitcoin plunged below $67,000 on Thursday—its lowest level in 15 months—erasing every dollar of gains accumulated since Donald Trump's election promised a new era for digital assets. The 46% collapse from October's $126,000 peak has inflicted billions in paper losses on corporate treasuries, triggered a cascade of forced liquidations, and shattered the narrative that Bitcoin serves as "digital gold."

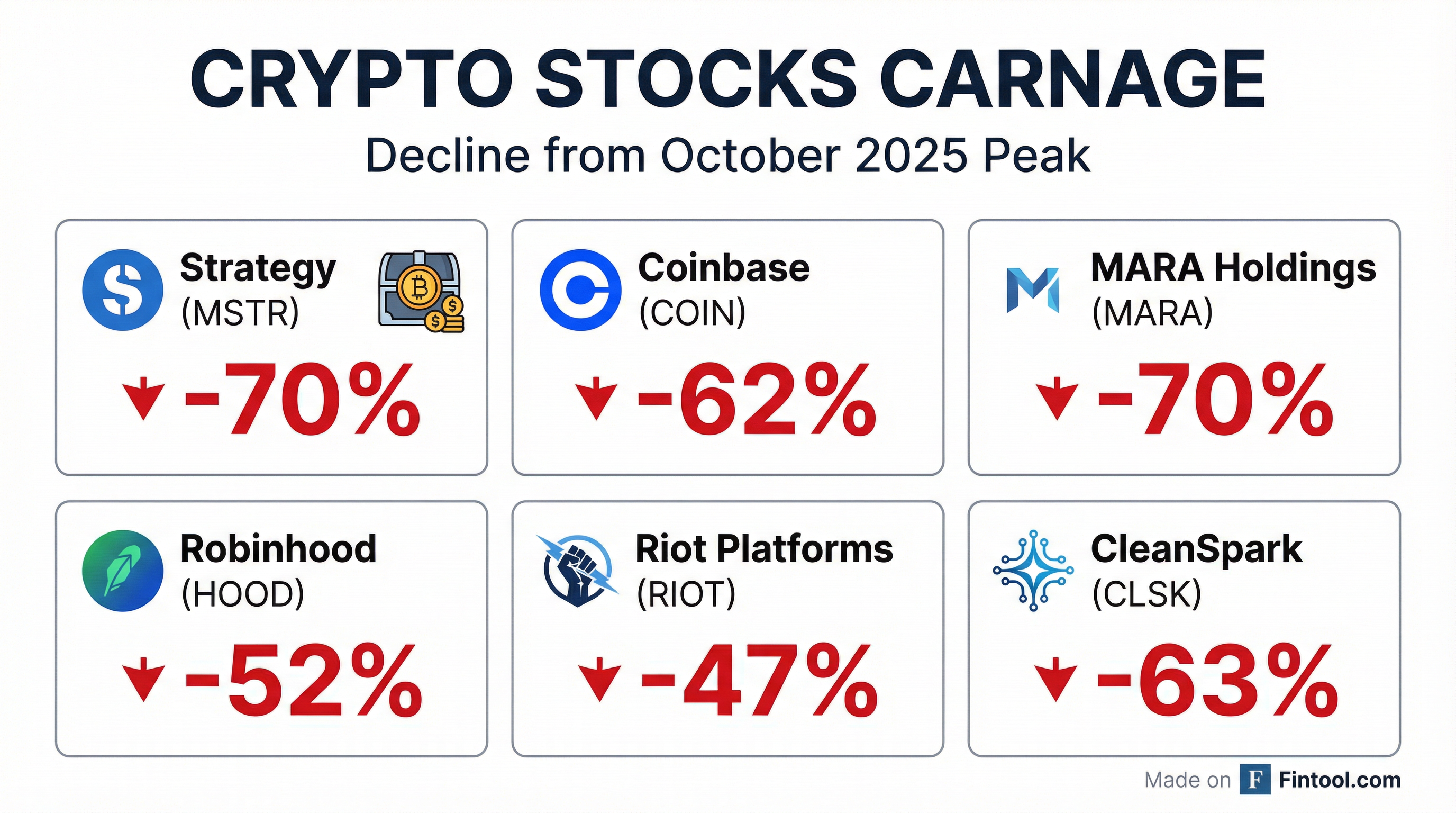

The rout isn't contained to Bitcoin. Strategy Inc., the Bitcoin treasury company formerly known as MicroStrategy, has seen its stock crater 70% from its October high. Coinbase is down 62%. The entire crypto ecosystem—from miners to exchanges to prediction markets—is bleeding as institutional investors flee and the "Trump bump" proves to be nothing more than speculative froth.

The Numbers Are Brutal

Bitcoin touched $65,344 intraday Thursday before stabilizing around $67,000—still down 11% on the day alone. The move erased the entire post-election rally that had lifted the cryptocurrency from roughly $70,000 to its October record.

The week's carnage has been relentless:

| Metric | Value |

|---|---|

| Current Price | $67,000 |

| October 2025 Peak | $126,210 |

| Decline from Peak | -46% |

| YTD 2026 Return | -20% |

| Week-to-Date Loss | -20% |

| Crypto Liquidations (Week) | $2+ billion |

Strategy's $6 Billion Problem

No company has bet bigger on Bitcoin than Strategy Inc.—and no company is suffering more from this crash.

According to the company's latest 8-K filing, Strategy holds 713,502 Bitcoin purchased at an average price of $76,052 per coin, representing a total investment of $54.26 billion. At Thursday's price of approximately $67,000, those holdings are worth roughly $47.8 billion—leaving the company with an estimated $6.5 billion in unrealized losses.

The company is now underwater on its entire Bitcoin position.

Strategy's stock reflects the devastation:

| Metric | Value |

|---|---|

| Current Price | $107.41 |

| October 2025 Peak | $359.69 |

| Decline from Peak | -70.1% |

| YTD 2026 Return | -31.7% |

| Today's Decline | -10.7% |

Values from market data.

The company continued buying even as prices fell. During the week of January 26 to February 1, Strategy acquired 855 additional Bitcoin at an average price of $87,974—already worth 24% less just days later.

The Crypto Stock Carnage

Bitcoin's decline has been magnified across the crypto ecosystem. Companies with exposure to digital assets—whether through holdings, trading, or mining—have been crushed.

| Company | Ticker | Current Price | From Oct Peak | YTD 2026 |

|---|---|---|---|---|

| Strategy | MSTR | $107.41 | -70.1% | -31.7% |

| MARA Holdings | MARA | $6.81 | -70.2% | -31.3% |

| CleanSpark | CLSK | $8.51 | -63.3% | -26.3% |

| Coinbase | COIN | $147.83 | -61.8% | -37.5% |

| Robinhood | HOOD | $73.47 | -51.8% | -36.2% |

| Riot Platforms | RIOT | $12.25 | -46.7% | -13.5% |

Values from market data.

The declines far exceed Bitcoin's own 46% drop—reflecting the leveraged exposure these companies carry. Mining stocks like Mara Holdings and Cleanspark are down more than 60% as their operations become less profitable with each tick lower in Bitcoin's price.

Why "Digital Gold" Failed

The crash exposes a fundamental miscalculation. Crypto advocates long positioned Bitcoin as a hedge against uncertainty—a modern alternative to gold that would protect portfolios during turbulent times.

Instead, Bitcoin has behaved like a risk asset on steroids.

Since October, gold has been on a tear. The precious metal hit a record $5,595 per ounce last week—up roughly 65% year-over-year—as geopolitical tensions and monetary uncertainty drove flight-to-safety flows. Bitcoin, meanwhile, has moved in the opposite direction.

| Asset | Since Oct 2025 | 1-Year Return |

|---|---|---|

| Gold | +30%* | +65%* |

| Bitcoin | -46% | -30% |

| Silver | +120%* (volatile) | +145%* |

Approximate values; precious metals have seen extreme volatility in recent weeks.

"Bitcoin's four-month slump has come at a time when, in theory, it had everything going for it," noted CNN. "Crypto bulls have long advocated that investors treat bitcoin as 'digital gold,' a new safe haven investment where traders can store funds when times are tough. So now would be a logical time for a safe haven to surge... But bitcoin isn't coming along."

The Fed Factor

The crash accelerated after President Trump nominated Kevin Warsh as the next Federal Reserve Chair on January 30. Warsh, known for his hawkish monetary policy stance, signals a potential shift toward a smaller Fed balance sheet and sustained higher rates—both negative for risk assets like cryptocurrencies.

The nomination strengthened the dollar and prompted a repricing across speculative assets. Treasury Secretary Scott Bessent added fuel to the fire Wednesday, testifying that the Treasury has "no authority to stabilize crypto markets."

For an asset class that rallied on promises of regulatory embrace, the message was clear: Washington won't be catching falling knives.

Institutional Exodus

Perhaps more damaging than the price action is the shift in institutional sentiment.

U.S. spot Bitcoin ETFs, which absorbed billions in inflows during the Trump rally, have reversed course. CryptoQuant reports that ETFs purchased 46,000 Bitcoin this time last year but are now net sellers in 2026.

"Institutional demand has reversed materially," CryptoQuant said in a report Wednesday. "Bitcoin has broken below its 365-day moving average for the first time since March 2022 and has declined 23% in the 83 days since the breakdown—worse than the early 2022 bear phase."

The forced liquidation cascade has compounded the selling. Over $2 billion in crypto positions have been liquidated this week as leveraged traders hit margin calls.

What's Next

Analysts see more pain ahead before any recovery.

"$70,000 is shaping up as a key psychological level," said James Butterfill, head of research at CoinShares. "If we fail to hold it, a move toward the $60,000 to $65,000 range becomes quite likely."

Deutsche Bank analyst Marion Laboure struck a more bearish tone: "This steady selling in our view signals that traditional investors are losing interest, and overall pessimism about crypto is growing."

History offers cold comfort. Bitcoin has crashed before—74% in 2018, 65% in 2022—and eventually recovered. But those rebounds took years, not months. And the "digital gold" thesis that powered the Trump rally may never fully recover.

For companies like Strategy, which continued accumulating even as prices fell, the path forward is uncertain. The company's SEC filings warn of "fluctuations in tax benefits or provisions" and risks tied to its bitcoin holdings. With the entire position now underwater, those risks are no longer theoretical.