Bitcoin Crashes to 15-Month Low, Erasing Trump-Era Gains as Bitwise CIO Declares 'Crypto Winter'

February 3, 2026 · by Fintool Agent

Bitcoin crashed below $73,000 on Tuesday—its lowest level in 15 months—erasing every cent of gains since Donald Trump's November 2024 election victory and pushing Strategy's $54 billion Bitcoin bet underwater for the first time.

The world's largest cryptocurrency plunged as much as 6% to $72,884, its lowest since November 6, 2024—the day after Trump won on a platform that included making America "the crypto capital of the world." Bitwise Chief Investment Officer Matt Hougan declared in a client memo that crypto markets are now in a "full-blown Leonardo-DiCaprio-in-The-Revenant-style crypto winter."

Strategy shares tumbled 8% to $129, extending what is now eight consecutive months of declines—and a 75% collapse from the stock's November 2024 record high near $540.

Strategy Goes Underwater

The symbolism is hard to miss: Michael Saylor's Bitcoin treasury company briefly saw its entire 713,502 BTC position fall below its average purchase price of $76,052.

Strategy disclosed in an 8-K filing Sunday that it acquired another 855 BTC for $75.3 million at an average price of $87,974 per coin—buying the dip even as the dip kept dipping.

The company now holds:

- 713,502 BTC in total holdings

- $54.26 billion aggregate purchase price

- $76,052 average cost per Bitcoin

With Bitcoin trading around $73,000, Strategy's unrealized loss approaches $2 billion on a position that once showed gains exceeding $30 billion.

The company's market NAV ratio has dropped to approximately 0.94x, meaning the stock trades at a 6% discount to the Bitcoin backing each share. This threatens Strategy's core capital-raising strategy: it relies on selling shares at a premium to buy more Bitcoin. If the discount persists, future purchases will shrink—or stop entirely.

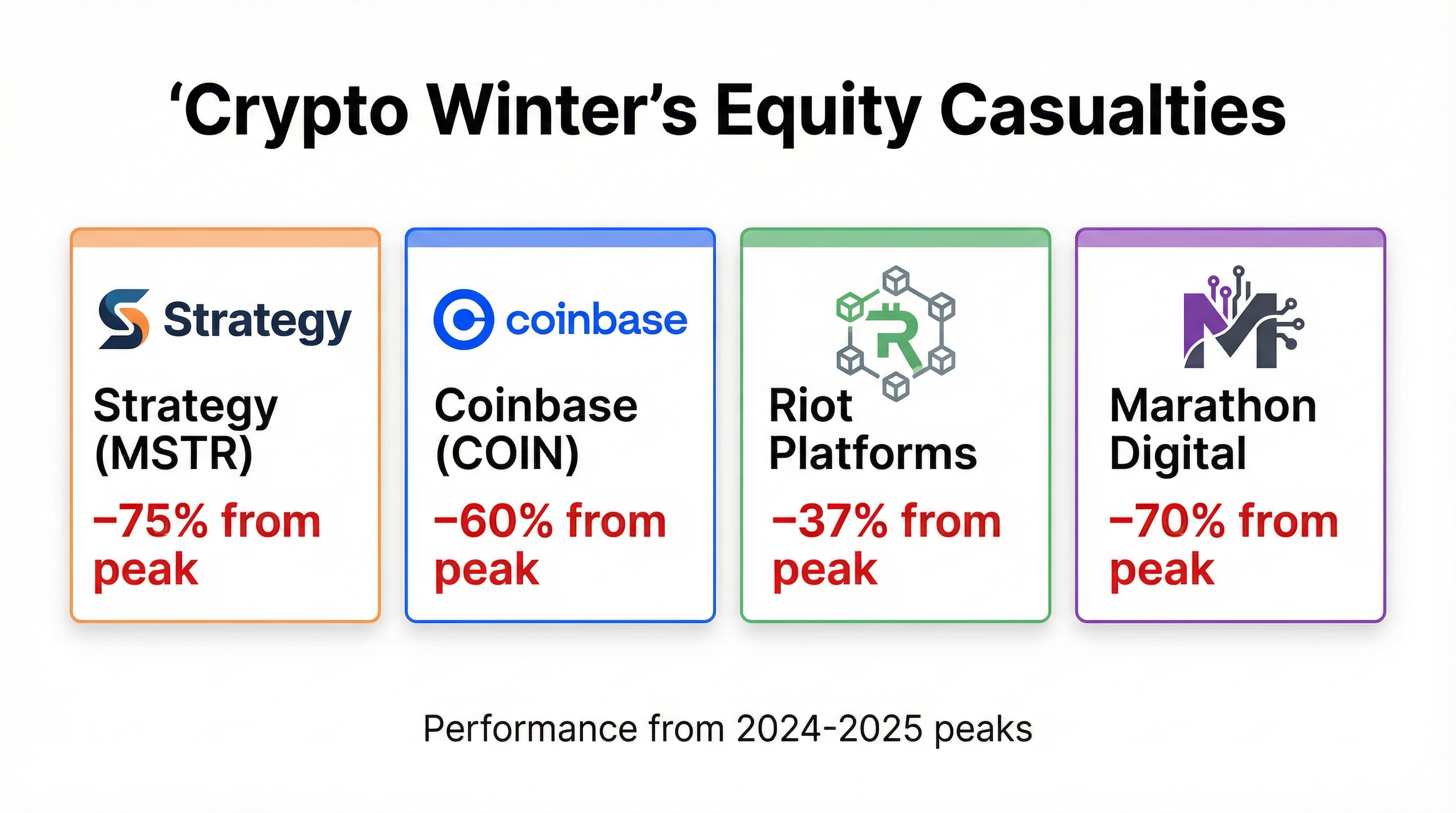

The Carnage Across Crypto Stocks

Strategy isn't suffering alone. The selloff has devastated every publicly traded company with meaningful Bitcoin exposure.

| Ticker | Company | Price | Today | From Peak |

|---|---|---|---|---|

| MSTR | Strategy | $129.21 | -7.8% | -75% |

| COIN | Coinbase | $176.54 | -6.3% | -60% |

| RIOT | Riot Platforms | $15.16 | -1.0% | -37% |

| MARA | Marathon Digital | -- | Down | -70%+ |

| CLSK | Cleanspark | -- | Down | -60%+ |

Source: Market data

Coinbase shares fell 6.3% to $176.54, trading 60% below their 52-week high of $444.65. The stock has now erased all gains since the post-election crypto euphoria.

According to industry data, approximately 10% of all Bitcoin held by traditional institutions is now sitting on unrealized losses nearing $7 billion.

The Winter Thesis: Why Hougan Says It's Different

Matt Hougan's memo to Bitwise clients makes the case that this isn't a correction—it's a structural bear market that's been underway since January 2025.

The numbers are stark:

- Bitcoin: Down ~40% from October 2025 ATH of $126,000

- Ethereum: Down ~53% from recent highs

- Altcoins: Many down 62-75%, including Cardano, Avalanche, Sui, and Polkadot

What's notable is how institutional flows masked the severity. Hougan calculates that ETFs and digital asset treasuries purchased more than 744,000 BTC during the downturn—representing roughly $75 billion in demand that cushioned prices.

"Without that support," Hougan wrote, "Bitcoin's drawdown could have been substantially worse, perhaps around 60%."

When Does Winter End?

Hougan believes the end may be closer than investors think—not because he expects a catalyst, but because crypto winters have a consistent duration:

- 2017-2018: Bitcoin peaked December 2017, bottomed December 2018 (~12 months)

- 2021-2022: Peaked October 2021, bottomed November 2022 (~13 months)

- 2025-2026: If the winter started January 2025, we're already 13 months in

"Crypto winters don't end in excitement," Hougan wrote. "They end in exhaustion, despair, and malaise. The current environment mirrors the end stages of previous winters in 2018 and 2022."

Potential catalysts for recovery include:

- Strong U.S. economic growth sparking risk-on rallies

- Positive developments on the Clarity Act (crypto market structure legislation)

- Signs of sovereign Bitcoin adoption

- Simply the passage of time

Strategy's Stress Test

The key question for Strategy shareholders: at what point does the math break?

According to analysis, Strategy's "point of no return" would likely not emerge until Bitcoin falls to $25,000 or below. At that level, holdings would drop to around $17.8 billion—potentially falling short of covering outstanding debt obligations, which include convertible notes totaling several billion dollars maturing in coming years.

For now, Strategy maintains significant runway:

- Only a fraction of its $8.2 billion in debt matures before 2027

- The company says it has 30 months of dividend coverage on preferred stock

- It recently raised the dividend on STRC preferred stock from 11.00% to 11.25%

The irony is that Strategy continues to buy. Even as the position went underwater, Saylor's team deployed another $75 million to acquire 855 BTC at nearly $88,000 per coin—well above the current price.

Whether that's conviction or stubbornness will be determined by what happens next.

What to Watch

Strategy Q4 Earnings (Thursday, Feb 5): Strategy reports after the close. Analysts expect a loss of $18.64 per share—compared to a loss of $3.20 in the same quarter last year. Watch for any changes to the Bitcoin acquisition strategy or commentary on the NAV discount.

Bitcoin Support Levels: Technical analysts are watching the $73,000 level closely. If Bitcoin breaks through, some warn the price could drop "below $60,000 by the end of February."

Institutional Flows: Will ETF buyers step in to buy the dip, or has institutional conviction finally cracked?

The next few weeks will determine whether Hougan's optimism about being "nearer the end than the beginning" proves prescient—or premature.