Bye America: Wall Street Exodus Hits 16-Year Record as $75 Billion Flees U.S. Stocks

February 20, 2026 · by Fintool Agent

U.S. investors are pulling money out of their own stock market at the fastest pace in at least 16 years. In the past six months, $75 billion has exited U.S. equity products, with $52 billion flowing out since the start of 2026 alone—the largest outflows in the first eight weeks of any year since at least 2010, according to LSEG/Lipper data.

The "buy America" trade that dominated global investing since the 2008 financial crisis is cracking. U.S. stocks now attract just $26 of every $100 flowing into global equity funds—the smallest share since 2020 and a dramatic decline from the $92 peak in 2022, according to Bank of America strategist Michael Hartnett.

What's Driving the Exodus

The shift comes despite years of U.S. market dominance. Three forces are converging to push capital overseas:

AI Bubble Fears: A record 35% of fund managers say corporations are "overinvesting"—the highest reading in 20 years of BofA survey data. With the four largest U.S. tech companies forecasting $650 billion in combined capital expenditure for 2026, 25% of investors now cite an "AI bubble" as the top tail risk to markets, and 30% see Big Tech AI spending as the most likely source of a credit crisis.

Dollar Weakness: The U.S. dollar index fell 9.4% in 2025—its worst year since 2017—and has dropped another 1.5% in 2026. The DXY recently hit 95.5, its lowest level since 2022. Goldman Sachs forecasts continued weakness, projecting the dollar index could fall to 94 by mid-2026 before recovering.

Relative Valuations: After years of outperformance, U.S. tech stocks look expensive relative to international alternatives. European and emerging market equities offer better value, and 85% of fund managers now expect Europe to outperform the U.S. over the next year.

The Rotation in Numbers

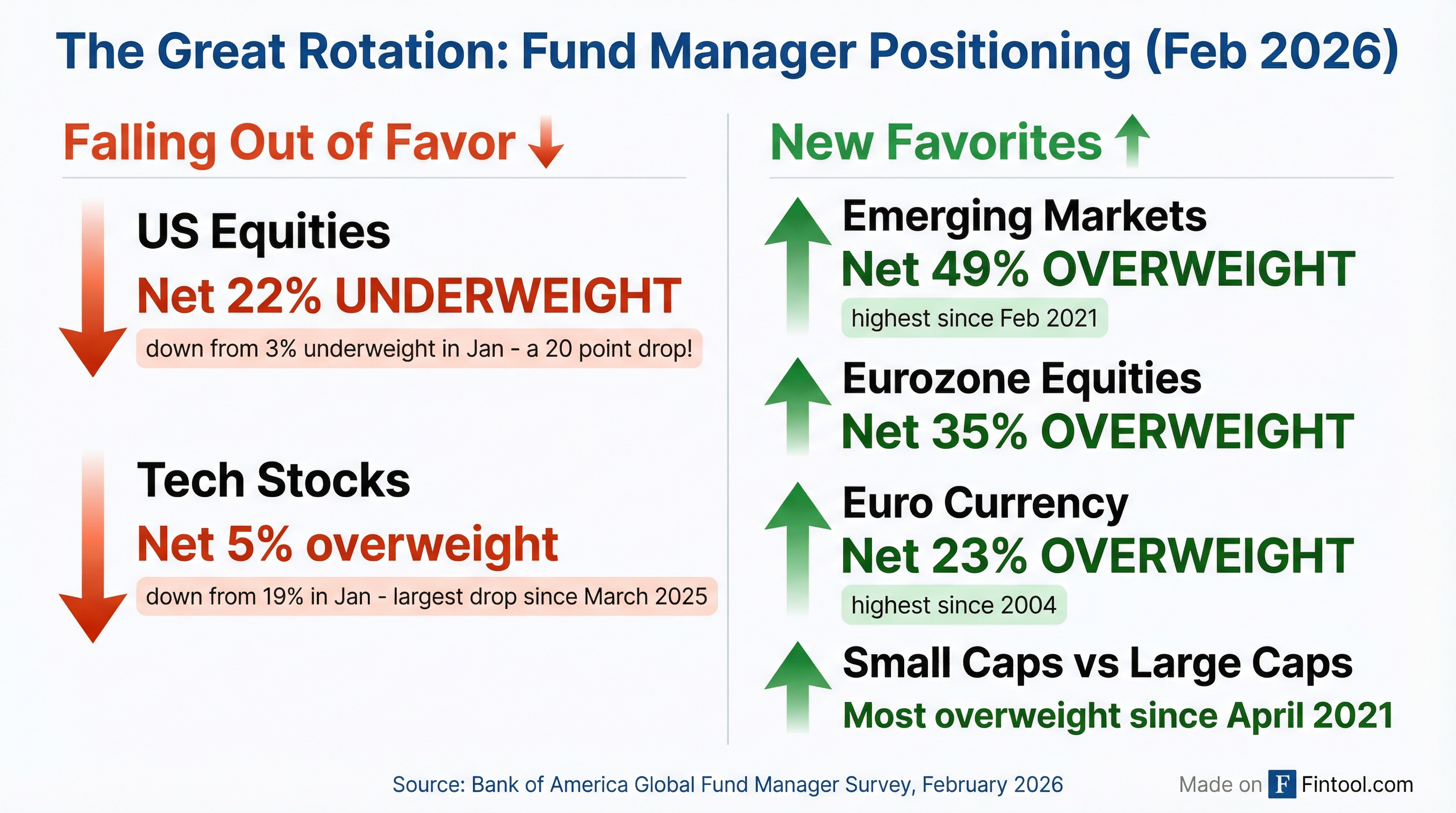

Bank of America's February 2026 Global Fund Manager Survey reveals the scale of the repositioning:

The survey, conducted February 6-12 with 162 participants managing $440 billion in assets, shows fund managers switched from U.S. equities to emerging markets at the fastest rate in five years.

| Allocation | February 2026 | Change from January | Historical Context |

|---|---|---|---|

| U.S. Equities | Net 22% underweight | -20 percentage points | Largest monthly drop on record |

| Emerging Markets | Net 49% overweight | +15 percentage points | Highest since Feb 2021 |

| Eurozone Equities | Net 35% overweight | +12 percentage points | Most bullish in 4 years |

| Euro Currency | Net 23% overweight | +8 percentage points | Highest since 2004 |

| Tech Stocks | Net 5% overweight | -14 percentage points | Lowest since March 2025 |

The tech sector saw particularly dramatic repositioning. Fund managers slashed their tech allocation from a net 19% overweight in January to just 5%—the largest single-month drop since March 2025. Meanwhile, allocations to energy, materials, and consumer staples surged in what BofA describes as "the strongest resources-led rotation since 2022."

Market Reaction

Despite the rotation out of U.S. stocks, Wall Street indices have held up surprisingly well—buoyed partly by today's Supreme Court ruling striking down President Trump's tariffs. The S&P 500 rose following the decision, with particular strength in import-sensitive sectors like retail and industrials.

However, the tariff victory may prove short-lived. With $52 billion already out the door in 2026 and fund managers positioned for continued outperformance overseas, the structural headwinds facing U.S. equities remain in place.

International markets have responded to the inflows. European indices have outperformed year-to-date, with the Euro Stoxx 50 gaining ground against the S&P 500. Emerging market ETFs have seen substantial inflows, with Ishares Core Msci Emerging Markets Etf and Vanguard Ftse Emerging Markets Etf both posting strong starts to 2026.

What Investors Are Watching

The contrarian case for U.S. stocks shouldn't be dismissed entirely. Bearish positioning on the dollar has reached 14-year extremes, creating conditions for a potential short squeeze if economic data surprises to the upside. The DXY has held its 96-100 trading range despite relentless selling pressure, and some analysts see the pessimism as overdone.

Several catalysts could shift sentiment:

Fed Policy: Markets are pricing in continued rate cuts, but any hawkish surprise could boost the dollar and slow the rotation. The February FOMC meeting reinforced perceptions that U.S. rates won't fall as quickly as previously anticipated.

Earnings Execution: If Big Tech's massive AI investments begin generating visible returns, the "overinvesting" narrative could reverse quickly. Microsoft plunged on capex concerns while Meta jumped 11% after laying out AI spending plans—showing how binary investor reactions can be.

Trade Policy: Today's Supreme Court ruling creates new uncertainty. With tariffs struck down, the administration may pursue other policy levers that could affect currency and equity flows.

The Bigger Picture

The rotation away from U.S. assets represents more than a tactical trade. Since the 2008 financial crisis, "buy America" has been the dominant investment thesis, rewarded by superior earnings growth, tech sector dominance, and dollar strength. That paradigm is now being questioned.

"The White House wants to take control of monetary policy and set the direction of rates—and that is toward more easing," said Vincent Reinhart at BNY. "Over the medium to longer term, there are lots of reasons the dollar depreciates."

For U.S. investors, the message is clear: geographic diversification matters more than it has in years. While the U.S. market may still outperform over any given period, the era of automatic U.S. dominance appears to be ending.