Cameco Says Uranium Already Trading at $100+ in Private Contracts Despite $86 Spot Price

January 7, 2026 · by Fintool Agent

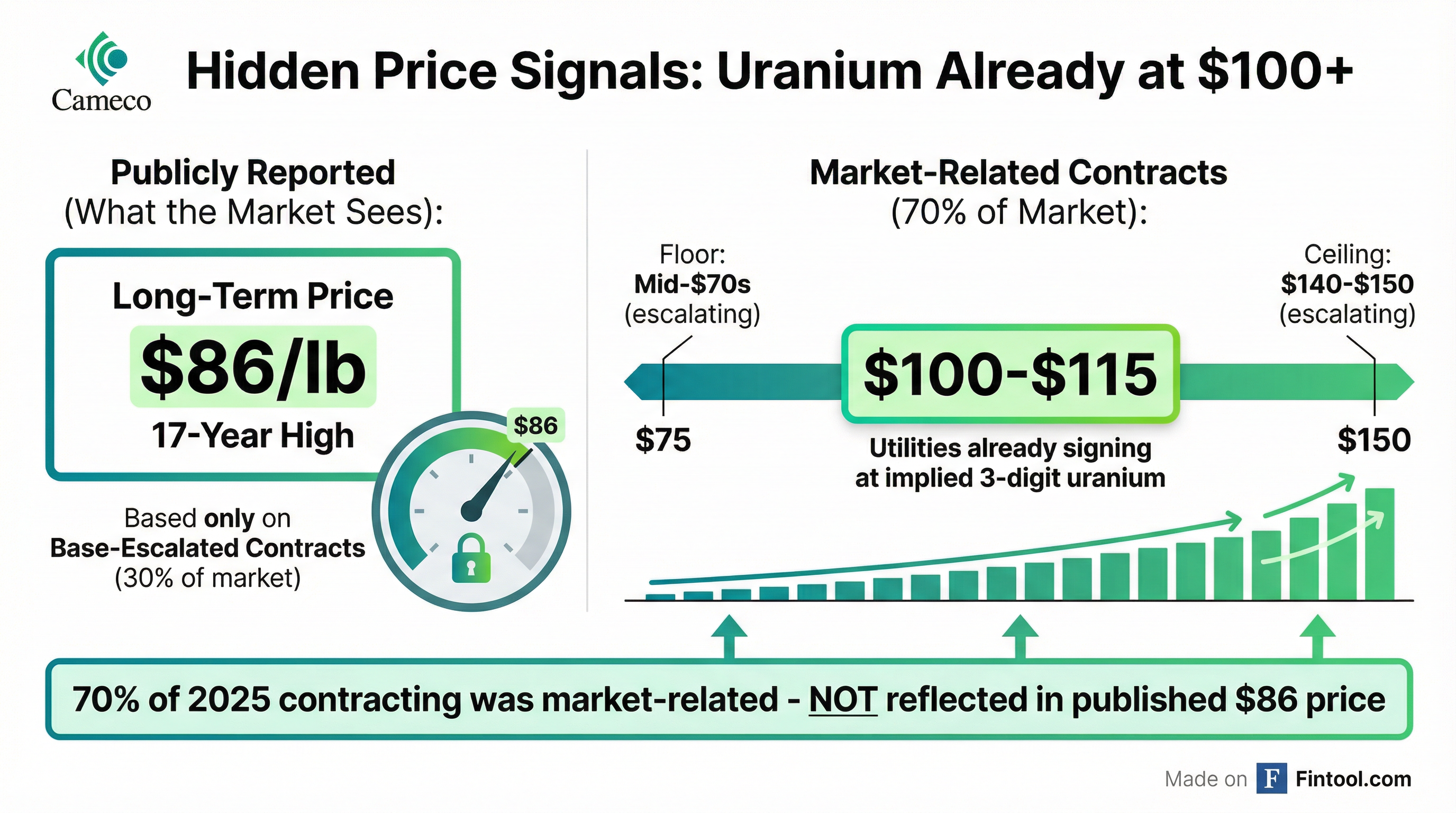

The reported $86 long-term uranium price is missing 70% of the story.

Cameco President and COO Grant Isaac dropped that revelation at the Goldman Sachs Energy, CleanTech & Utilities Conference today, explaining that market-related contracts—which comprised 70% of 2025's uranium contracting—already imply three-digit uranium prices that aren't captured in published benchmarks.

"We've had market-related contracts with floors, escalated floors in the mid-70s. We've had ceilings as high as $150 escalated," Isaac told attendees. "The midpoint between those floors and the ceilings are already $100 uranium, $115 uranium."

The disconnect matters because price reporters only capture base-escalated contracts—the other 30% of the market. Utilities signing market-related deals are running value-at-risk analysis at implied three-digit pricing, but that information never reaches published benchmarks.

Shares of Cameco closed at $103.94 Tuesday, up 1.8%, pushing toward the stock's 52-week high of $110.16. The stock has nearly doubled over the past year.

The Nuclear Renaissance Goes Parabolic

Isaac's presentation at Goldman's flagship energy conference painted a picture of demand acceleration that current supply forecasts dramatically understate.

"The demand forecast that most have out there... we believe they're actually understating demand," Isaac said. Current projections are built only on operating reactors, restarts like Diablo Canyon, and projects already at final investment decision (FID).

What's not included:

- The $80 billion U.S. program announced in October 2025—a partnership between the U.S. government, Westinghouse, Brookfield, and Cameco to build 8-10 AP1000 reactors

- Poland's six-reactor program and Bulgaria's two-reactor Kozloduy project, both approaching FID in 2026

- Ontario's plan for 14 gigawatt-scale reactors

- Nuclear capacity for data centers and AI—demand that trades closely with hyperscaler sentiment but isn't built into uranium forecasts

"It astonishes me a little bit how we trade off when the data story trades off a little bit because that's not even built into the forward demand story of nuclear yet," Isaac observed.

The Buyer Strike That Won't End—Until It Must

Here's the statistic that should make uranium bulls salivate: utilities haven't contracted at replacement rate since 2012.

The industry's rule of thumb: if utilities collectively enter new forward contracts that replace material they're burning on old contracts, that's replacement rate. If they're above, they're building inventory. Below, they're drawing down.

Since Fukushima, they've been drawing down. Hard.

"The world has chewed through that historic shock absorber," Isaac said. "We're at an $86 long-term price of uranium in U.S. dollars. And we're not even at replacement rate."

In 2025, contracting hit roughly 80 million pounds—less than 60% of the approximately 150 million pound replacement rate.

Isaac explained the perverse incentive structure: fuel buyers don't get rewarded for calling price bottoms. They pay an average price across multiple contracts spanning many years, then capitalize uranium into fuel bundles over reactor life. Two layers of averaging insulate them from price spikes.

"They're just rewarded for security of supply. That means generally our industry needs to be shocked into action."

Past shocks included the Cigar Lake flooding in 2006-2007, which sent uranium to $136/lb ($200 in today's terms), and China's massive entry into the term market in 2010 when they bought 152 million pounds in a single month.

The next shock's origin remains uncertain. But Isaac made one thing clear: "Because this market doesn't have the inventory position it used to have, this market has never been more vulnerable to a shock than it is today."

The $2.8 Billion Sovereign Signal

One recent event may already be catalyzing the contracting cycle Isaac anticipates.

Reports emerged in November that Canada and India are close to finalizing a $2.8 billion, 10-year uranium supply deal with Cameco as the supplier—representing about 10% of Cameco's annual sales volumes.

Isaac referenced the leaked negotiation: "I talked about the leaking of the Indian contract that we were negotiating. That's a lot of demand that people didn't realize was in the market."

Sovereign demand returning to the uranium market has historically signaled robust contracting cycles. India operates 24 nuclear reactors with six more under construction and 14 planned as it targets 100 GW of nuclear capacity by 2047.

"That has always been a leading indicator of a really robust contracting cycle about to begin, so 2026 is feeling very constructive," Isaac said.

Supply Discipline: 30% Still Shut In

Cameco isn't rushing to meet undefined demand with premature supply.

The company maintains 30% of its production shut in or curtailed—waiting for fuel buyers to "get serious about the prices required to create that next wave of supply."

"We never reward our investors by front-running demand with supply," Isaac explained. "In fact, we create the maximum reward for our owners when we're at or slightly late the market. Because when we're at or slightly late the market with our production, that's when fuel buyers trip over each other to buy material."

The approach reflects Cameco's view that supply forecasts are systematically overstated, just as demand forecasts are understated. The industry conflates preliminary economic assessments on potential resources with technical reports on operating properties.

"There's no license, there's no permit, there's no infrastructure, there's no workforce, there's no contractors," Isaac said of many projected supply sources. "When we back out our experience of how long it actually takes to bring in supply, we actually see the gap is bigger."

2026: The Year of Final Investment Decisions

Isaac sees 2026 as a pivotal year for the global reactor buildout—and by extension, uranium demand expectations.

Bulgaria and Poland FIDs: Both nations are advancing AP1000 projects through front-end engineering and accelerating toward FID. Poland wants six reactors; Bulgaria wants two at the Kozloduy site.

U.S. Long-Lead Items: The May 2025 Executive Order targeting 10 reactors under construction by 2030 requires long-lead items to be ordered in 2026.

"If we're going to hit that executive order of 10 under construction by 2030, long lead items will have to be ordered in 2026," Isaac confirmed. "We're going to have to identify sites and start moving sometime in 2026 as well."

Korea Partnership: South Korea is now a collaborator rather than competitor in the nuclear supply chain, expected to advance new build projects that benefit Westinghouse.

Isaac noted the math quickly goes parabolic: 10 U.S. reactors plus potential VC Summer completion (two more), plus Fermi, plus Bulgaria (two), plus Poland (six). "Are we talking about 16 reactors in the United States plus two in Bulgaria plus six in Poland? It goes parabolic really quickly when you start looking at the order book."

| Cameco Financial Summary | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $639* | $468* | $437* | $533* | $822* | $549* | $643* | $441* |

| EBITDA ($M) | $48* | $126* | $120* | $127* | $197* | $173* | $185* | $109* |

| EBITDA Margin (%) | 7.4%* | 26.9%* | 27.4%* | 23.9%* | 23.9%* | 31.5%* | 28.8%* | 24.7%* |

| Cash from Operations ($M) | $152* | $47* | $190* | $39* | $368* | $77* | $341* | $112* |

*Values retrieved from S&P Global

The Three S's: Standardize, Sequence, Simplify

Isaac outlined the operational philosophy that could make this nuclear buildout different from the fragmented 1960s-70s era that produced 55 different reactor models across 104 U.S. plants.

Standardize: "It's Vogtle 4 over and over again, right down to the color of the paint in the bathroom. Nothing changes."

Sequence: Don't start every project simultaneously. "We don't start a golf tournament by everybody teeing off on the first hole at the same time." Move civil work, nuclear island assembly, and turbine installation in sequence across projects.

Simplify: Learn the lessons of UAE's Barakah plant, Korean construction methods, and Ontario's component replacements. Pass learnings between programs.

At current capacity, Westinghouse could launch four reactors per year, meaning 20 reactors in flight by year five with ongoing rollover.

What to Watch

Contracting velocity: The first signal of a real bull market will be utilities contracting above replacement rate—something that hasn't happened since 2012.

FID announcements: Bulgaria and Poland decisions expected in 2026 would crystallize demand projections.

Long-lead item orders: U.S. orders for reactor pressure vessels, coolant pumps, and steam generators would signal program commitment.

Price discovery: Watch for base-escalated contracts pushing above $86 as Cameco deliberately walks up the benchmark to reflect market-related contract realities.

India deal closure: The $2.8 billion deal would represent significant new sovereign demand and validate the contracting cycle thesis.

Meanwhile, at the same Goldman Sachs conference, Eog Resources CFO Ann Janssen offered a contrasting energy narrative—U.S. shale showing signs of maturation while the company pivots toward international exploration in Bahrain and the UAE. EOG plans to spend $6.5 billion in 2026 with low-to-no oil growth, reflecting the discipline Isaac sees lacking in uranium contracting.

The contrast is telling: oil shale is returning capital as it matures; nuclear fuel is just waking up.

The Bottom Line

The reported $86 long-term uranium price understates reality. Market-related contracts already imply three-digit pricing. Demand forecasts exclude the $80 billion U.S. program, Ontario's 14-reactor plan, and AI data center requirements. Supply forecasts overstate greenfield project deliverability.

Cameco's supply discipline—30% production still curtailed—positions it to capture pricing when utilities finally must contract above replacement rate for the first time in 14 years.

"This is setting up really nicely," Isaac concluded. "Replacement rate has to be achieved. We have to go beyond replacement rate to start building inventories again. That's a very constructive setup for an incumbent uranium producer."

Related