Earnings summaries and quarterly performance for EOG RESOURCES.

Executive leadership at EOG RESOURCES.

Board of directors at EOG RESOURCES.

Research analysts who have asked questions during EOG RESOURCES earnings calls.

Neil Mehta

Goldman Sachs

5 questions for EOG

Scott Hanold

RBC Capital Markets

5 questions for EOG

Arun Jayaram

JPMorgan Chase & Co.

4 questions for EOG

Charles Meade

Johnson Rice & Company L.L.C.

4 questions for EOG

Leo Mariani

ROTH MKM

4 questions for EOG

Derrick Whitfield

Texas Capital

3 questions for EOG

Doug Leggate

Wolfe Research

3 questions for EOG

Phillip Jungwirth

BMO Capital Markets

3 questions for EOG

Neal Dingmann

Truist Securities

2 questions for EOG

Paul Cheng

Scotiabank

2 questions for EOG

Scott Gruber

Citigroup

2 questions for EOG

Stephen Richardson

Evercore ISI

2 questions for EOG

Steve Richardson

Evercore

2 questions for EOG

Derek Woodfield

Stifel

1 question for EOG

Douglas George Blyth Leggate

Wolfe Research

1 question for EOG

John Abbott

Wolfe Research

1 question for EOG

John Freeman

Raymond James Financial

1 question for EOG

Joshua Silverstein

UBS Group AG

1 question for EOG

Kaleinoheaokealaula Akamine

Bank of America

1 question for EOG

Kevin MacCurdy

Pickering Energy Partners

1 question for EOG

Nitin Kumar

Mizuho Securities USA

1 question for EOG

Recent press releases and 8-K filings for EOG.

- In 2025, EOG generated $5.5 billion of adjusted income, $4.7 billion of free cash flow (100% returned to shareholders), and ended the year with net debt/EBITDA of 0.4×.

- For 2026, the company set a $6.5 billion capital budget, targeting flat volumes to Q4 2025 (5% oil growth, 13% BOE growth y-o-y) with a bottom-cycle breakeven of $40 WTI ($50 including CapEx and dividends).

- Strategic portfolio moves include the $5.6 billion Encino acquisition (1.1 million Utica acres) now free cash flow positive with $150 million of synergies realized within six months , plus new unconventional concessions in the UAE and a JV with Bapco in Bahrain.

- EOG’s capital allocation prioritizes a sustainable $4.08/share dividend, opportunistic buybacks (10% share reduction over three years), and maintaining total debt below 1× EBITDA.

- EOG is holding volumes flat versus Q4 2025 with a $6.5 billion 2026 capital budget (up 5% YoY in oil) and a breakeven of $40 WTI (rising to $50 including dividend), aiming to maximize free cash flow.

- In 2025 the company generated $4.7 billion in free cash flow, returned 100% of FCF to shareholders via a $4.08/share dividend, and maintained a pristine 0.4× net debt/EBITDA balance sheet.

- Portfolio advances include the $5.6 billion Encino acquisition (1.1 million Utica acres), first onshore UAE unconventional concession, and a Bahrain gas JV, underpinning long‐lived multi-basin growth.

- Operational efficiency improvements delivered a 20% drop in Permian well costs, Utica synergies driving costs under $600/ft, and Dorado dry-gas growth supported by a 100-mile, 1 BCF/d EOG-owned pipeline.

- Sustainability targets set in 2020 were met two years early; new goals now focus on further GHG intensity reduction, near-zero methane emissions, and zero routine flaring.

- EOG will return 100% of free cash flow to shareholders, including a $2.2 billion regular dividend ($4.08/share) and ongoing share buybacks, while maintaining net debt/EBITDA below 1× at bottom-cycle pricing.

- The 2026 capital budget is $6.5 billion, funding a 5% oil production increase with volumes held flat to Q4 2025; implied breakeven is $40 WTI (rising to $50 including dividend).

- The Encino acquisition expanded the Utica footprint by 1.1 million acres, delivered $150 million of synergies in under six months, and cut well costs to below $600/foot.

- A multi-basin portfolio spans seven U.S. divisions and international assets (including first-ever onshore concessions in UAE and Bahrain), underpinned by 12 billion barrels of resource at >100% after-tax IRR at $55 oil.

- Operational improvements cut Delaware Basin well costs by 20%, while Dorado gas play recovery per foot rose 13%, targeting a 1 BCF/day exit rate in 2026.

- Vitesse Energy will make an all-stock acquisition of non-operated Powder River Basin assets in Wyoming for $35 million, effective January 1, 2026 and expected to close early in Q2 2026.

- The deal adds over 6,000 net acres, roughly 1,400 Boe/d of expected 2026 production, and 29 net undeveloped locations primarily operated by EOG and Continental.

- In full-year 2025, Vitesse reported net income of $25.3 million, adjusted EBITDA of $179.3 million, and average production of 17,444 Boe/d, with proved reserves up 19% to 47.8 million Boe.

- Management issued 2026 production and capital-expenditure guidance reflecting the expanded non-operated footprint.

- EOG generated $5.5 billion in adjusted net income ( $10.16/share) and $4.7 billion in free cash flow for 2025; returned 100% of free cash flow via $2.2 billion in dividends ( $3.95/share, +8%) and $2.5 billion in share repurchases.

- The Encino acquisition closed, driving $150 million of synergies ahead of schedule; the Janus gas plant in the Delaware Basin began operations; and EOG entered UAE and Bahrain exploration.

- For 2026, EOG guides $6.5 billion in capital spending to deliver ~$4.5 billion in free cash flow at strip pricing, returning 90–100% to shareholders, with a $50 WTI breakeven.

- Operational plan includes keeping oil production flat at Q4 2025 levels to achieve 5% annual oil growth and 13% total production growth, completing 585 net wells across core basins.

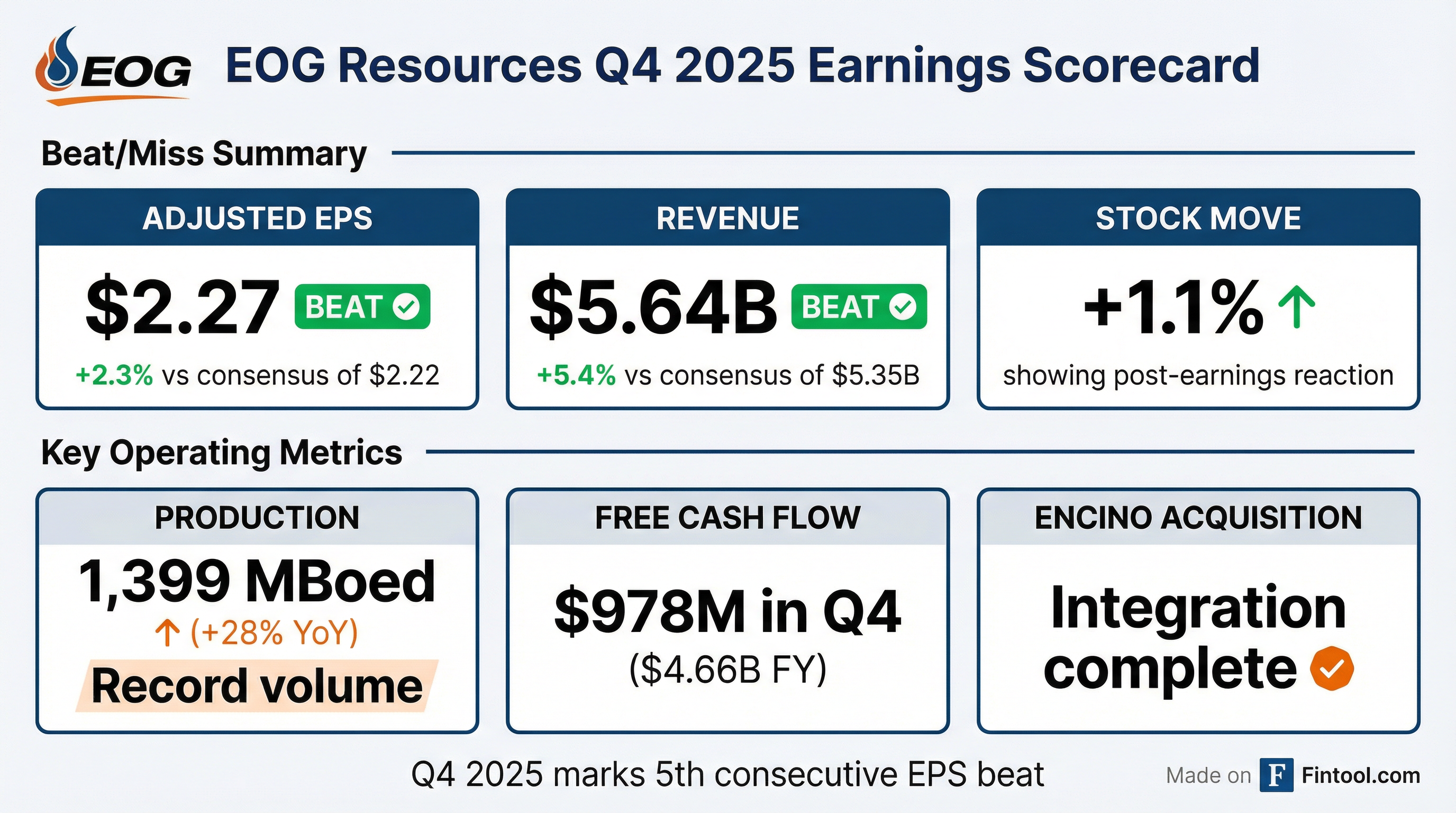

- EOG generated $4.7 billion in free cash flow and reported adjusted EPS of $10.16 for 2025 (Q4 adjusted EPS of $2.27), delivering a 19% ROCE and building nearly $1 billion in Q4 free cash flow.

- The company returned 100% of free cash flow through an 8% dividend increase to $3.95/share and $2.5 billion in share repurchases, finishing 2025 with $3.4 billion cash, $7.9 billion debt, and ~$6.4 billion total liquidity.

- For 2026, EOG plans $6.5 billion in capital spending, expects $4.5 billion in free cash flow, will return 90–100% of FCF, and forecasts 5% oil growth and 13% total production growth while completing 585 net wells.

- Operational excellence drove 7% well cost reductions, pre-reserves grew 16% to 5.5 BBOE with 254% production replacement, and the strategic Encino acquisition was completed in 2025.

- Key 2025 financials: EOG delivered $5.5 billion in adjusted net income ($10.16/share) and $4.7 billion in free cash flow, achieving a 19% return on capital employed.

- Q4 2025 performance: Adjusted EPS of $2.27, cash flow from operations of $4.86/share, and nearly $1 billion in free cash flow; returned $1.2 billion to shareholders in Q4 (including $675 million in share repurchases).

- Shareholder returns: For the full year, paid $2.2 billion in dividends (8% increase to $3.95/share) and repurchased $2.5 billion in shares, representing 8.2% of market capitalization, with $3.3 billion of buyback authorization remaining.

- Balance sheet strength: Ended 2025 with $3.4 billion cash, $7.9 billion long-term debt, and an undrawn $3 billion revolver, totaling $6.4 billion liquidity; leverage remains below 1× EBITDA.

- 2026 guidance: Plans $6.5 billion in capital spending to generate $4.5 billion in free cash flow at strip prices, targeting 90–100% of free cash flow returned to shareholders; breakeven at $50 WTI.

- EOG delivered $5.5 Billion adjusted net income, $10.16 adjusted EPS, and $20.07 adjusted CFPS in 2025, achieving a 19% ROCE.

- The company generated $4.7 Billion free cash flow and returned 100% of FCF to shareholders via $2.2 Billion regular dividends and $2.5 Billion share repurchases in 2025.

- EOG closed 2025 with a 0.4x net debt/EBITDA ratio, rated A- by S&P and A3 by Moody’s, underpinning a $2.2 Billion dividend commitment for 2026.

- The 2026 plan targets $4.5 Billion free cash flow, double-digit ROCE, and 1,396 MBoed total volume (versus 1,232 MBoed in 2025), funding the regular dividend and additional cash returns.

- EOG Resources recorded Q4 2025 net income of $701 million (diluted EPS $1.30) and full-year 2025 net income of $4.98 billion (diluted EPS $9.12).

- Q4 2025 operating revenues were $5.638 billion (versus $5.585 billion in Q4 2024), with full-year revenues of $22.632 billion.

- Net cash provided by operating activities in Q4 2025 was $2.612 billion, contributing to $10.044 billion for the full year.

- The company issued first-quarter and full-year 2026 financial forecasts and benchmark commodity pricing assumptions in its February 24 press release.

- Delivered Q4 net income of $701 million (US$1.30/share) and adjusted net income of $1.2 billion (US$2.27/share); full-year net income was $5.0 billion (US$9.12/share) and adjusted net income $5.5 billion (US$10.16/share).

- Generated net cash from operations of $2.6 billion in Q4 and $10.0 billion for 2025; free cash flow of $1.0 billion in Q4 and $4.7 billion for the full year.

- Returned capital through a Q4 dividend of $1.02 per share (annualized $4.08) and $675 million of share repurchases (total $2.5 billion repurchased in 2025).

- Announced a $6.5 billion capital plan for 2026 to hold Q4 2025 oil production flat, targeting 5% oil and 13% total production growth year-over-year.

Quarterly earnings call transcripts for EOG RESOURCES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more