Earnings summaries and quarterly performance for CONOCOPHILLIPS.

Executive leadership at CONOCOPHILLIPS.

Ryan Lance

Chief Executive Officer

Andrew O’Brien

Senior Vice President, Strategy, Commercial, Sustainability and Technology

Kelly Rose

Senior Vice President, Legal, General Counsel and Corporate Secretary

Nicholas Olds

Executive Vice President, Lower 48

William Bullock

Executive Vice President and Chief Financial Officer

Board of directors at CONOCOPHILLIPS.

Arjun Murti

Director

David Seaton

Director

Dennis Arriola

Director

Gay Huey Evans

Director

Jeffrey Joerres

Director

Katie McGinty

Director

Nelda Connors

Director

R.A. Walker

Director

Robert Niblock

Lead Independent Director

Sharmila Mulligan

Director

Timothy Leach

Director

William McRaven

Director

Research analysts who have asked questions during CONOCOPHILLIPS earnings calls.

Arun Jayaram

JPMorgan Chase & Co.

8 questions for COP

Scott Hanold

RBC Capital Markets

8 questions for COP

Stephen Richardson

Evercore ISI

8 questions for COP

Betty Jiang

Barclays

6 questions for COP

Kevin MacCurdy

Pickering Energy Partners

6 questions for COP

Lloyd Byrne

Jefferies LLC

6 questions for COP

Neil Mehta

Goldman Sachs

6 questions for COP

Paul Cheng

Scotiabank

6 questions for COP

Charles Meade

Johnson Rice & Company L.L.C.

5 questions for COP

Devin Mcdermott

Morgan Stanley

5 questions for COP

Ryan Todd

Simmons Energy

5 questions for COP

Bob Brackett

Bernstein Research

4 questions for COP

Doug Leggate

Wolfe Research

4 questions for COP

James West

Evercore ISI

4 questions for COP

Leo Mariani

ROTH MKM

4 questions for COP

Nitin Kumar

Mizuho Securities USA

4 questions for COP

Douglas George Blyth Leggate

Wolfe Research

3 questions for COP

Joshua Silverstein

UBS Group AG

3 questions for COP

Phillip Jungwirth

BMO Capital Markets

3 questions for COP

Alastair Syme

Citigroup

2 questions for COP

Charles Arthur Meade

Johnson Rice

2 questions for COP

Francis Lloyd Byrne

Jefferies

2 questions for COP

Jeoffrey Lambujon

TPH & Co.

2 questions for COP

Neal Dingmann

Truist Securities

2 questions for COP

Neil Singhvi Mehta

Goldman Sachs Group

2 questions for COP

Paul Chang

Scotiabank

2 questions for COP

Sam Margolin

Wells Fargo & Company

2 questions for COP

Wei Jiang

Barclays

2 questions for COP

David Deckelbaum

TD Cowen

1 question for COP

Douglas Leggate

Wolfe Research

1 question for COP

Kalei Akamine

Bank of America

1 question for COP

Kaleinoheaokealaula Akamine

Bank of America

1 question for COP

Phillips Johnston

Capital One Securities, Inc.

1 question for COP

Roger Read

Wells Fargo & Company

1 question for COP

Ryan M. Todd

Piper Sandler & Co.

1 question for COP

Recent press releases and 8-K filings for COP.

- BP plans an 8% increase in US shale production this year to roughly 500,000 barrels per day under its BPX Energy unit

- The company targets expanding shale output to 650,000 bpd by 2030—about 20% of its current global production—while cutting capital expenditure by $800 million

- Alongside shale, BP is boosting upstream exposure in Iraq through a deal with TPAO, beginning production in Angola’s Ndungu field, and eyeing Venezuela as sanctions ease

- BP shares trade around £4.743, reflecting a one-year return of ~14.7% and a five-year gain near 94.3%

- ConocoPhillips is exploring the sale of certain Permian Basin assets, largely in the Delaware Basin, that could fetch about $2 billion.

- The assets under review were acquired through deals with Concho Resources and Shell and span parts of West Texas and New Mexico.

- The process is part of a broader effort to streamline its portfolio and boost operational efficiency; deliberations are at an early stage and no sale decision is final.

- The company closed $3.2 billion in asset sales in 2025 and remains on track to meet a $5 billion disposition target by the end of 2026.

- ConocoPhillips holds a market capitalization of about $135.5 billion, trailing revenue of $58.9 billion, operating margin of 19.24%, net margin of 13.55%, current ratio near 1.3, and debt-to-equity of 0.36.

- CEO Ryan Lance said the company will focus on recouping roughly $10 billion from arbitration awards tied to nearly two-decade-old Venezuelan nationalizations before pursuing new oil investments there.

- ConocoPhillips has already recorded about $12 billion in write-downs on its Venezuela ventures.

- Production reached 2.32 million boe/d, marking 6.3% year-over-year growth.

- Shares slipped about 2.9% after Q4 adjusted earnings missed expectations.

- The company’s financial position includes a $129.29 billion market cap, $59.79 billion in trailing 12-month revenue, and an Altman Z-Score of 3.09.

- 2.5% pro forma production growth in 2025; Q4 production of 2.32 MM BOE/d.

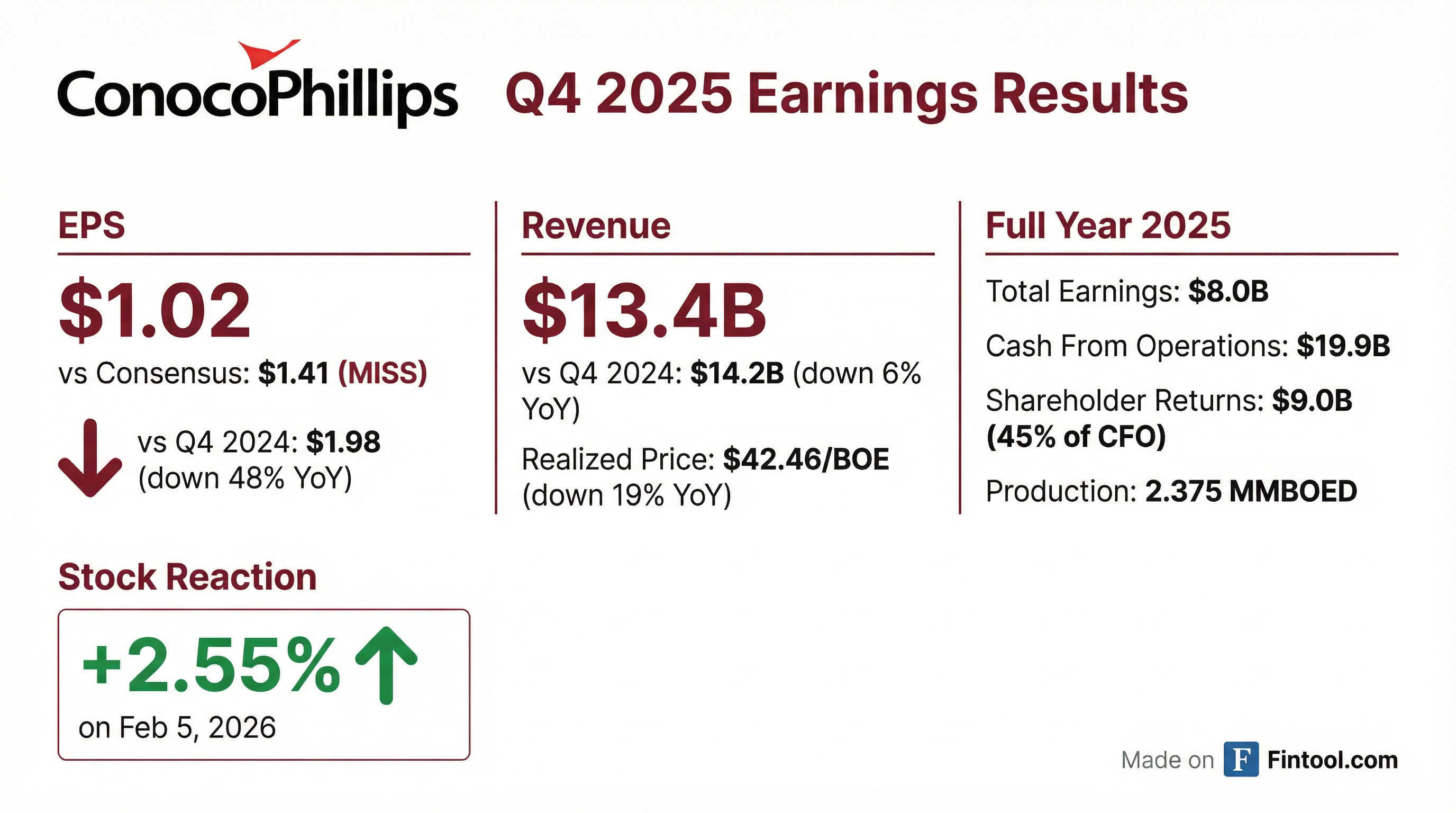

- Q4 adjusted earnings of $1.02 /share and $4.3 B cash from operations; full-year CapEx of $12.6 B and $3 B in asset sales.

- Returned $9 B of capital (45% of CFO) via $1 B buybacks and $1 B dividends in Q4; net debt down $2 B, cash at $7.4 B.

- 2026 guidance: CapEx $12 B, OpEx $10.2 B, production 2.23–2.26 MM BOE/d, and ~45% of CFO returned to shareholders.

- Integrated Marathon Oil, launched a $1 B cost-reduction initiative, grew LNG offtake to ~10 Mtpa, and advanced major projects to boost free cash flow through 2029.

- 2.32 MMboe/d production in Q4; $1.02 adjusted EPS; $4.3 B cash from operations; $3 B Q4 CapEx; returned $2.1 B in Q4 (incl. $1 B buybacks, $1 B dividends)

- Full-year 2025: $12.6 B CapEx; $9 B return of capital (45% of CFO); paid down $900 M debt; net debt down nearly $2 B; ending cash & ST investments $7.4 B; LT investments $1.1 B

- 2026 Outlook: $12 B CapEx (–$0.6 B YoY); $10.2 B OpEx (–$0.4 B); production 2.23–2.26 MMboe/d; Q1 2.30–2.34 MMboe/d; target $1 B combined CapEx & cost reduction; return ~45% of CFO

- Successfully integrated Marathon Oil: doubled synergy capture, realized $1 B one-time benefits, eliminated acquired CapEx while achieving pro forma production growth

- Advancing major projects: NFS LNG >80% complete for H2 2026 start-up; Willow ~50% complete, on track for early-2029 first oil; Lower 48 drilling/completion efficiency +15% in 2025

- ConocoPhillips delivered Q4 2025 production of 2.32 MMboe/d, adjusted EPS of $1.02, and $4.3 B of cash flow from operations; Q4 CapEx was $3 B, bringing full-year CapEx to $12.6 B.

- Returned $2.1 B of capital in Q4 (≈$1 B buybacks and $1 B dividends), reaching $9 B or 45% of CFO for 2025; net debt fell by ≈$2 B to strengthen the investment-grade balance sheet.

- 2026 guidance calls for $12 B of CapEx (down $0.6 B YoY), $10.2 B of operating costs (down $0.4 B), and production of 2.23–2.26 MMboe/d, with ~45% CFO return and continued dividend growth.

- Projects and cash flow outlook: targeting $1 B of incremental free cash flow annual improvement from 2026–28, leading to a $7 B inflection by 2029, including $4 B from Willow in 2029.

- Q4 2025 adjusted earnings fell ~50% to $1.02 per share, missing estimates as realized oil prices dropped to an average $42.46/boe, despite a 6.3% rise in production to 2.320 mmboe/d.

- The company maintained its 2026 guidance of $12 billion in capital spending, $10.2 billion in operating costs and production of 2.33–2.36 million boe/d, and announced a targeted $1 billion reduction in combined capital and operating costs.

- Management returned 45% of 2025 cash flow to shareholders—$9.0 billion ($5.0 billion in buybacks and $4.0 billion in dividends)—and the stock fell about 3.9%, hitting an intraday low of $103.15 on Feb. 5.

- ConocoPhillips reported Q4 2025 EPS of $1.17 and adjusted EPS of $1.02; FY 2025 EPS was $6.35 and adjusted EPS was $6.16.

- Generated CFO of $19.9 billion in 2025, returning 45% ($9.0 billion) to shareholders via $5.0 billion of buybacks and $4.0 billion of dividends; ended the year with cash and short-term investments of $7.4 billion and declared a Q1 2026 dividend of $0.84 per share.

- Completed the integration of Marathon Oil, doubling synergy capture to over $1 billion on a run-rate basis in 2025.

- Provided 2026 guidance including ~$12 billion of capital expenditures, $10.2 billion of adjusted operating costs and production of 2.33–2.36 MMBOED.

- Reported Q4 2025 EPS of $1.17 and full-year EPS of $6.35, with adjusted EPS of $1.02 in Q4 and $6.16 for the year.

- 2026 guidance: ~$12 billion in capital expenditures, ~$10.2 billion in adjusted operating costs and production of 2.33–2.36 MMBOED (Q1: 2.30–2.34 MMBOED).

- Declared Q1 2026 dividend of $0.84/share and plans to return 45% of CFO to shareholders.

- Generated $19.9 billion CFO in 2025 and distributed $9.0 billion (including $5.0 billion in buybacks and $4.0 billion in dividends).

- Completed Marathon Oil integration, capturing > $1 billion of run-rate synergies; delivered 2,375 MBOED in 2025 with 2.5% organic growth.

- On Dec. 22, 2025, Permian Resources announced a holding-company reorganization under which management and long-term holders will exchange Class C shares for Class A shares and the company privately issued 48.9 million new Class A shares to simplify its Up-C structure toward a single share class by 2027.

- The company executed an Eleventh Amendment to its credit agreement with JPMorgan Chase and a syndicate of lenders to permit the transaction and maintain access to existing credit facilities.

- Post-transaction share counts will be roughly 793.8 million Class A shares and 35.5 million Class C shares; management owns over 6% of the company.

- Reported financial metrics include a 30.1% three-year revenue growth, 39.09% operating margin, 15.65% net margin, an Altman Z-Score of 1.7 (in the distress zone), and both current and quick ratios of 0.67.

- Market capitalization is approximately $10.48 billion.

Quarterly earnings call transcripts for CONOCOPHILLIPS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more