Earnings summaries and quarterly performance for Ovintiv.

Executive leadership at Ovintiv.

Brendan McCracken

Chief Executive Officer

Corey Code

Executive Vice-President & Chief Financial Officer

Greg Givens

Executive Vice-President & Chief Operating Officer

Meghan Eilers

Executive Vice-President, Midstream & Marketing and General Counsel

Rachel Moore

Executive Vice-President, Corporate Services

Board of directors at Ovintiv.

Research analysts who have asked questions during Ovintiv earnings calls.

Arun Jayaram

JPMorgan Chase & Co.

6 questions for OVV

Neil Mehta

Goldman Sachs

6 questions for OVV

Doug Leggate

Wolfe Research

4 questions for OVV

Kevin MacCurdy

Pickering Energy Partners

4 questions for OVV

Neal Dingmann

Truist Securities

4 questions for OVV

Gabriel Daoud

Cowen

3 questions for OVV

Greg Pardy

RBC Capital Markets

3 questions for OVV

Josh Silverstein

UBS Group

3 questions for OVV

Kalei Akamine

Bank of America

3 questions for OVV

Kaleinoheaokealaula Akamine

Bank of America

3 questions for OVV

Phillip Jungwirth

BMO Capital Markets

3 questions for OVV

Betty Jiang

Barclays

2 questions for OVV

Dennis Fong

CIBC World Markets

2 questions for OVV

Douglas George Blyth Leggate

Wolfe Research

2 questions for OVV

Geoff Jay

Daniel Energy Partners

2 questions for OVV

Lloyd Byrne

Jefferies LLC

2 questions for OVV

Phillips Johnston

Capital One Securities, Inc.

2 questions for OVV

David Deckelbaum

TD Cowen

1 question for OVV

John Daniel

Daniel Energy Partners

1 question for OVV

Joshua Silverstein

UBS Group AG

1 question for OVV

Recent press releases and 8-K filings for OVV.

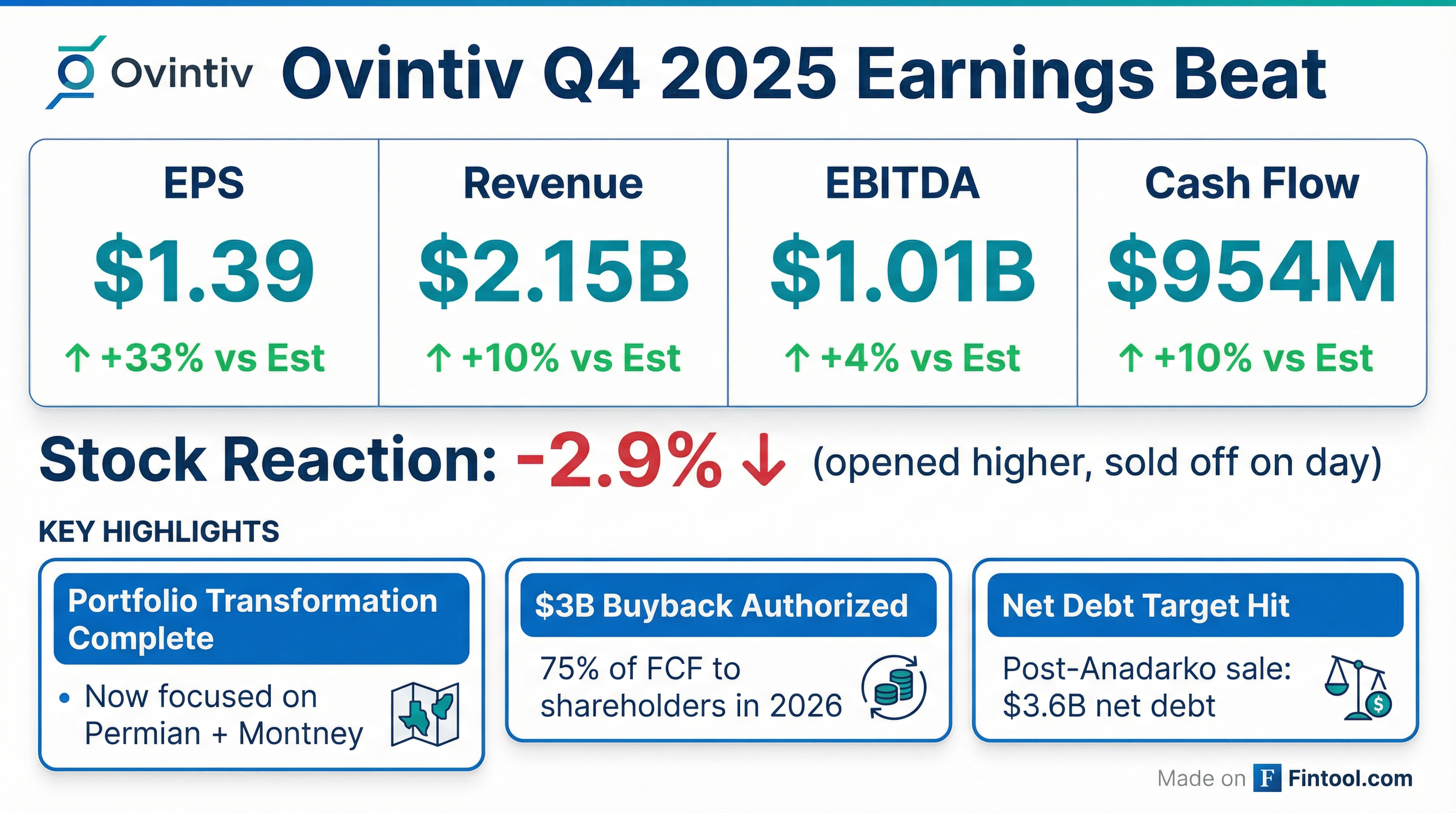

- Ovintiv has completed its portfolio transformation with the NuVista acquisition and agreement to sell Anadarko assets, resulting in a focused portfolio in the Permian and Montney. This will lead to net debt of approximately $3.6 billion after the Anadarko sale, achieving its debt target and generating $65 million in annualized interest savings from the repayment of 2028 and 2026 notes.

- The company unveiled a new shareholder return framework, planning to return at least 75% of free cash flows to shareholders in 2026, with a long-term range of 50%-100%. The board authorized a $3 billion share buyback program.

- Ovintiv reported full-year 2025 free cash flow of over $1.6 billion and Q4 2025 free cash flow of $508 million. For 2026, the company expects total production volumes of 620,000-645,000 BOE per day with approximately $2.3 billion in capital investment, and anticipates margin improvement.

- Ovintiv reported Q4 2025 free cash flow of $508 million and $3.81 cash flow per share, contributing to over $1.6 billion in free cash flow for the full year 2025.

- The company completed its portfolio transformation with the NuVista acquisition and an agreement to sell Anadarko assets, which is expected to reduce net debt to approximately $3.6 billion after closing in early Q2 2026. This is projected to generate $40 million of annualized interest savings from repaying 2028 notes, in addition to $25 million from 2026 notes.

- Ovintiv unveiled a new shareholder return framework, committing to return at least 75% of 2026 free cash flows to shareholders, with a long-term range of 50%-100%. The board authorized a $3 billion share buyback program, with buybacks commencing immediately.

- For 2026, the company forecasts total production volumes of 620,000-645,000 BOE per day and a capital investment of about $2.3 billion. Q1 2026 production is expected to be approximately 670,000 BOEs per day with capital spend around $625 million.

- Ovintiv has completed its portfolio transformation with the NuVista acquisition and agreement to sell Anadarko assets, focusing its portfolio on the Permian and Montney basins. This transformation is expected to reduce net debt to approximately $3.6 billion after the Anadarko sale closes in early Q2 2026, leading to $65 million in total annualized interest savings (comprising $40 million from 2028 notes repayment and $25 million from 2026 notes repayment).

- The company unveiled a new shareholder return framework, committing to return at least 75% of free cash flows to shareholders in 2026, with a long-term range of 50%-100%. Ovintiv's board of directors has authorized a $3 billion share buyback program, which will commence immediately.

- For 2026, Ovintiv plans an oil-directed maintenance program, forecasting total production volumes of 620,000-645,000 BOE per day and a capital investment of approximately $2.3 billion. In Q1 2026, production is projected to average approximately 670,000 BOEs per day, including about 223,000 barrels per day of oil and condensate, with capital spend estimated at about $625 million.

- For the full year 2025, Ovintiv generated $3.8 billion in Non-GAAP Cash Flow and $1.6 billion in Non-GAAP Free Cash Flow, with net earnings of $1.2 billion, or $4.78 per share diluted.

- The company returned more than $600 million to shareholders in 2025 and announced a new framework for 2026 to return at least 75% of full year Non-GAAP Free Cash Flow to shareholders, supported by a $3.0 billion share buyback program.

- Ovintiv completed the acquisition of NuVista Energy Ltd. for approximately $2.7 billion on February 3, 2026, and reached an agreement in February 2026 to sell its Anadarko assets for $3.0 billion.

- The 2026 outlook includes a capital program of approximately $2.25 to $2.35 billion, expected to deliver total production volumes of 620 to 645 MBOE/d.

- For full year 2025, Ovintiv reported net earnings of $1.2 billion ($4.78 per share diluted) and generated Non-GAAP Free Cash Flow of $1.6 billion.

- The company announced a new shareholder return framework for 2026, committing to return at least 75% of full year Non-GAAP Free Cash Flow to shareholders through dividends and share buybacks, and authorized a $3.0 billion share buyback program.

- Strategic actions included the acquisition of NuVista Energy Ltd. for approximately $2.7 billion (closed February 3, 2026) and the planned sale of its Anadarko assets for $3.0 billion.

- The 2026 outlook includes a capital program of $2.25 to $2.35 billion and projected total production volumes of 620 to 645 MBOE/d.

- Ovintiv Inc. has entered into a definitive agreement to sell its Anadarko assets, located in Oklahoma, to an undisclosed buyer for $3.0 billion in cash proceeds.

- The sale includes approximately 360 thousand net acres, representing substantially all of the company's acreage in the Anadarko play, with month-to-date February production of approximately 90 thousand barrels of oil equivalent per day.

- The transaction is expected to close early in the second quarter of 2026, with an effective date of January 1, 2026, and is intended to focus the portfolio, achieve debt targets, and increase shareholder returns.

- Ovintiv has agreed to sell its Anadarko basin assets for $3.0 billion in cash to an undisclosed buyer.

- The divested assets cover approximately 360,000 net acres and produce about 90,000 barrels of oil equivalent per day.

- The transaction has an effective date of January 1, 2026, and is expected to close early in the second quarter of 2026.

- This divestiture is part of Ovintiv's strategy to concentrate capital on higher-return positions in the Permian and Montney, meet its debt target, and unlock increased returns for shareholders.

- Ovintiv plans to issue full-year and first-quarter 2026 guidance and an updated shareholder return framework when it reports fourth-quarter and full-year 2025 results on February 23, 2026.

- Ovintiv Inc. has entered into a definitive agreement to sell its Anadarko assets in Oklahoma to an undisclosed buyer.

- The sale is for cash proceeds of $3.0 billion.

- The assets include approximately 360 thousand net acres and February month-to-date production of about 90 thousand barrels of oil equivalent per day.

- The transaction is expected to close early in the second quarter of 2026, with an effective date of January 1, 2026.

- The company stated this transaction will focus its portfolio, help achieve its debt target, and increase shareholder returns.

- Ovintiv Inc. completed the acquisition of NuVista Energy Ltd. on February 3, 2026, in a $2.7 billion cash and stock transaction.

- The acquisition involved a payment of C$1.57 billion in cash and the issuance of 30,076,903 shares of Ovintiv Common Stock.

- The acquired assets are expected to add approximately 930 net well locations and 140,000 net acres in the Alberta Montney, with an anticipated average production of 100 MBOE/d in 2026.

- Ovintiv expects to generate annual cost synergies of approximately $100 million from the acquisition.

- Ovintiv Inc. has completed its acquisition of NuVista Energy Ltd. in a $2.7 billion cash and stock transaction.

- The acquisition is expected to add approximately 930 net 10,000-foot equivalent well locations and 140,000 net acres in the Alberta Montney, with full year 2026 production from the acquired assets projected to average 100 MBOE/d.

- Ovintiv anticipates generating approximately $100 million annually in cost synergies and expects the transaction, combined with planned Anadarko asset divestiture, to streamline its portfolio and help meet debt targets.

- NuVista shareholders received consideration in cash, stock, or a combination, with a maximum aggregate cash consideration of approximately $1.57 billion (CAD) and a maximum aggregate share consideration of approximately 30.1 million Ovintiv Shares.

Fintool News

In-depth analysis and coverage of Ovintiv.

Quarterly earnings call transcripts for Ovintiv.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more