Cboe Explores Binary Options Revival to Challenge $17B Prediction Market Boom

February 2, 2026 · by Fintool Agent

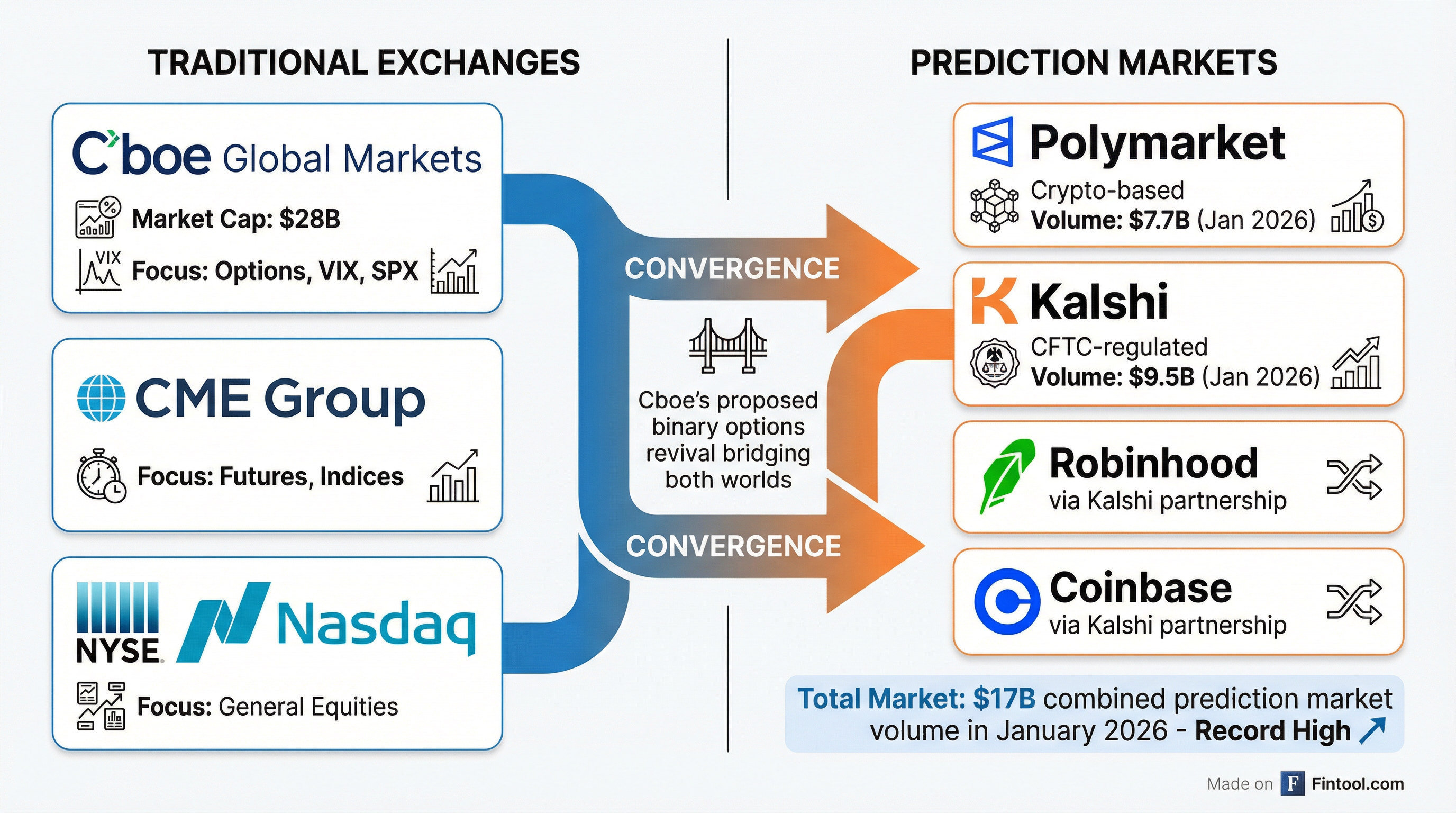

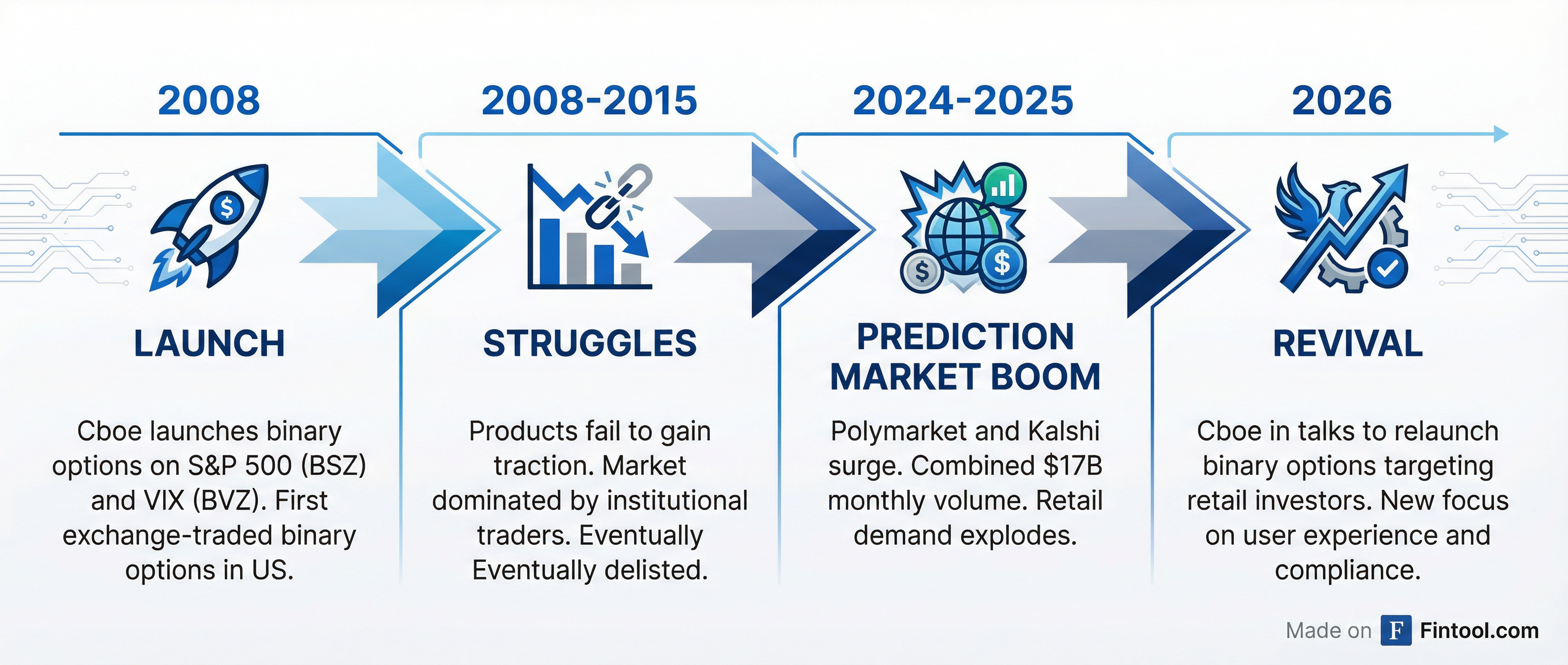

Cboe Global Markets, the exchange famous for creating the VIX volatility index, is in early-stage discussions with retail brokerages and market makers to relaunch "all-or-nothing" binary options contracts—a direct challenge to the surging prediction markets that logged a record $17 billion in combined trading volume last month.

The $28 billion exchange operator previously launched binary options in 2008, offering contracts tied to the S&P 500 and VIX. But the products struggled to gain traction in a market then dominated by institutional professionals and were eventually delisted.

This time is different. Retail trading has exploded, prediction markets have gone mainstream, and platforms like Polymarket and Kalshi are capturing billions in trading volume that Cboe believes should flow through regulated exchange infrastructure.

"This could be the new starting point for many people in terms of how to get into the options space," JJ Kinahan, Cboe's head of retail expansion, told the Wall Street Journal, adding that the exchange will "go through a lot of rigor" on legal and compliance requirements before listing any new contracts.

The Prediction Markets Explosion

The timing of Cboe's exploration isn't accidental. Prediction markets have surged from a niche crypto curiosity to a mainstream financial product category commanding serious Wall Street attention.

Kalshi and Polymarket together logged more than $17 billion in January 2026 trading volume—an all-time monthly high. Kalshi recorded $9.55 billion in January, up 45% from December 2025. Polymarket posted $7.66 billion, a 44% gain from the prior month. January marked the fifth consecutive month of rising activity across the sector.

The platforms allow users to buy and sell contracts tied to the outcomes of real-world events—everything from Federal Reserve rate decisions to NFL game outcomes. Contracts typically trade between $0.01 and $0.99 and settle at $1 for the correct outcome. The payoff structure mirrors exactly what Cboe is now considering.

Galaxy Research recently wrote that prediction markets have "entered a new phase of mainstream visibility and capital formation," though liquidity constraints persist even as participation broadens.

How Binary Options Work

Binary options—also known as fixed-return contracts or digital options—offer a simplified betting structure. Unlike traditional options with variable payoffs, binaries are all-or-nothing:

- If correct: The contract pays a fixed amount (typically $100)

- If wrong: The contract settles at zero

For example, a binary call option tied to the S&P 500 closing at or above 7,000 would pay $100 if the index hits that level at expiration, and nothing if it closes below.

This structure appeals to retail traders who want clear, defined-risk bets on market outcomes without the complexity of traditional options Greeks.

The 2008 Experiment

Cboe's binary options history is a cautionary tale of timing.

In July 2008—at the dawn of the financial crisis—Cboe launched binary call options tied to the S&P 500 (ticker BSZ) and VIX (ticker BVZ). The products paid $100 if the underlying index closed at or above the strike price at expiration, and zero otherwise.

Initially, Cboe listed only binary calls in three consecutive near-term expirations, with strike prices at $5 intervals for S&P 500 binaries and $1 intervals for VIX contracts.

But the products failed to gain traction for several reasons:

- Market timing: 2008 was defined by crisis-driven volatility, not conducive to new product adoption

- Institutional dominance: The options market was still largely professional territory

- Product complexity: Even "simple" binaries required options market knowledge

- Limited distribution: Retail brokerage penetration was minimal

The products were eventually delisted, leaving the binary options space largely to unregulated offshore platforms that drew widespread fraud complaints and SEC warnings.

Cboe's Strategic Position

Cboe enters this conversation from a position of strength. The company's Options segment has been on fire, with Q3 2025 revenues up 21% year-over-year to $616 million driven by a 31% increase in multi-listed options average daily volume and a 15% increase in index options volume.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $1,108 | $1,195 | $1,174 | $1,142 |

| Net Income ($M) | $197 | $251 | $235 | $301 |

| EBITDA Margin | 29.8% | 32.0% | 32.7% | 35.4% |

*Values retrieved from S&P Global

The Options segment alone generated $380.8 million in revenues less cost of revenues in Q3 2025, up 19% year-over-year, with an EBITDA margin of 73.8%—among the most profitable segments in financial services.

The exchange operates multiple venues including Cboe Options (its primary Chicago-based market), C2 Options, BZX Options, and EDGX Options—all-electronic platforms with different market models and fee structures.

The Competitive Landscape

Cboe isn't the only traditional exchange eyeing the prediction markets opportunity.

Cme Group has partnered with FanDuel and DraftKings to offer event contracts on sports and financial outcomes, with Piper Sandler analysts estimating the FanDuel partnership alone could generate over $300 million in annual revenue for CME.

Robinhood launched prediction markets through a partnership with Kalshi, seeing event contracts traded more than double sequentially in Q3 2025 to 2.3 billion contracts. October alone saw 2.5 billion contracts—more than all of Q3.

Coinbase acquired prediction markets startup The Clearing Company in December 2025 and launched its own contracts through Kalshi, positioning itself as an "everything exchange."

What makes Cboe's approach different is its focus on bringing the product in-house with full SEC/CFTC regulation. The exchange would offer binary options through traditional brokerage relationships rather than standalone apps—a potentially significant distribution advantage.

Regulatory Minefield

Binary options carry significant regulatory baggage. The SEC warned investors in 2013 about potential losses, and U.S. regulators have logged numerous fraud complaints against unregulated binary options websites over the years.

Cboe is framing its approach around compliance from day one. Any new contracts would be regulated by either the SEC or CFTC, depending on the underlying events. The exchange has emphasized it will go through rigorous legal and compliance review before any launch.

The regulatory clarity could be Cboe's competitive moat. While Coinbase has filed lawsuits against Michigan, Illinois, and Connecticut challenging state-level restrictions on prediction markets, Cboe's products would trade on fully licensed exchanges with established clearing infrastructure.

What's at Stake

For Cboe, the potential prize is significant. If prediction markets continue growing at current rates—January's $17 billion was up from roughly $12 billion in December—the annual market could approach $250-300 billion in trading volume.

Cboe's typical capture rate on options trading is roughly $0.28-$0.29 per contract. Even capturing a fraction of the prediction market opportunity could add meaningfully to the exchange's $4.6 billion annual revenue run rate.

More strategically, binary options could serve as an on-ramp to Cboe's more complex products. As Kinahan suggested, they could be "the new starting point" for retail investors entering the options market—eventually graduating to SPX options, VIX products, and other Cboe proprietary offerings.

What to Watch

Timeline uncertainty: Cboe has not set a launch date, and discussions with brokerages remain at an early stage. Don't expect products in 2026.

Product design: The specific events covered (financial indices only, or broader?) will determine the competitive positioning versus Polymarket and Kalshi.

Brokerage adoption: Which retail brokers sign on will determine distribution. A partnership with Schwab, Fidelity, or E*Trade would be transformational.

Regulatory approval: SEC or CFTC sign-off is required. The regulatory path will signal how quickly other exchanges might follow.

Prediction market response: Expect Polymarket, Kalshi, and Robinhood to defend their turf—potentially with lower fees or broader event coverage.