Chevron and Quantum Team Up for $22 Billion Lukoil Asset Grab

January 7, 2026 · by Fintool Agent

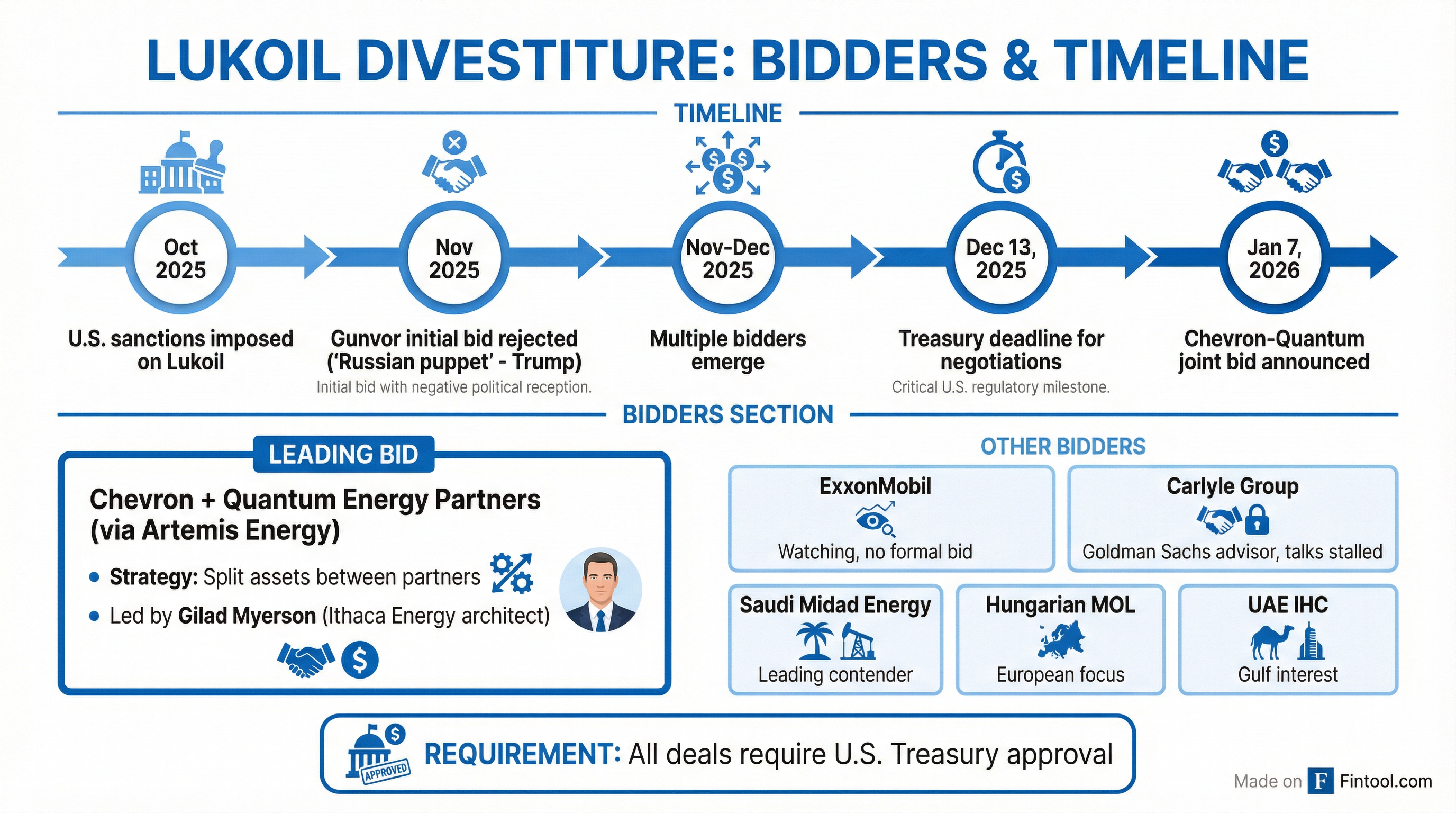

Chevron and private equity firm Quantum Energy Partners are preparing a joint $22 billion bid for the international assets of sanctioned Russian oil giant Lukoil—a deal that would mark one of the largest energy transactions since Western sanctions reshaped the global oil landscape.

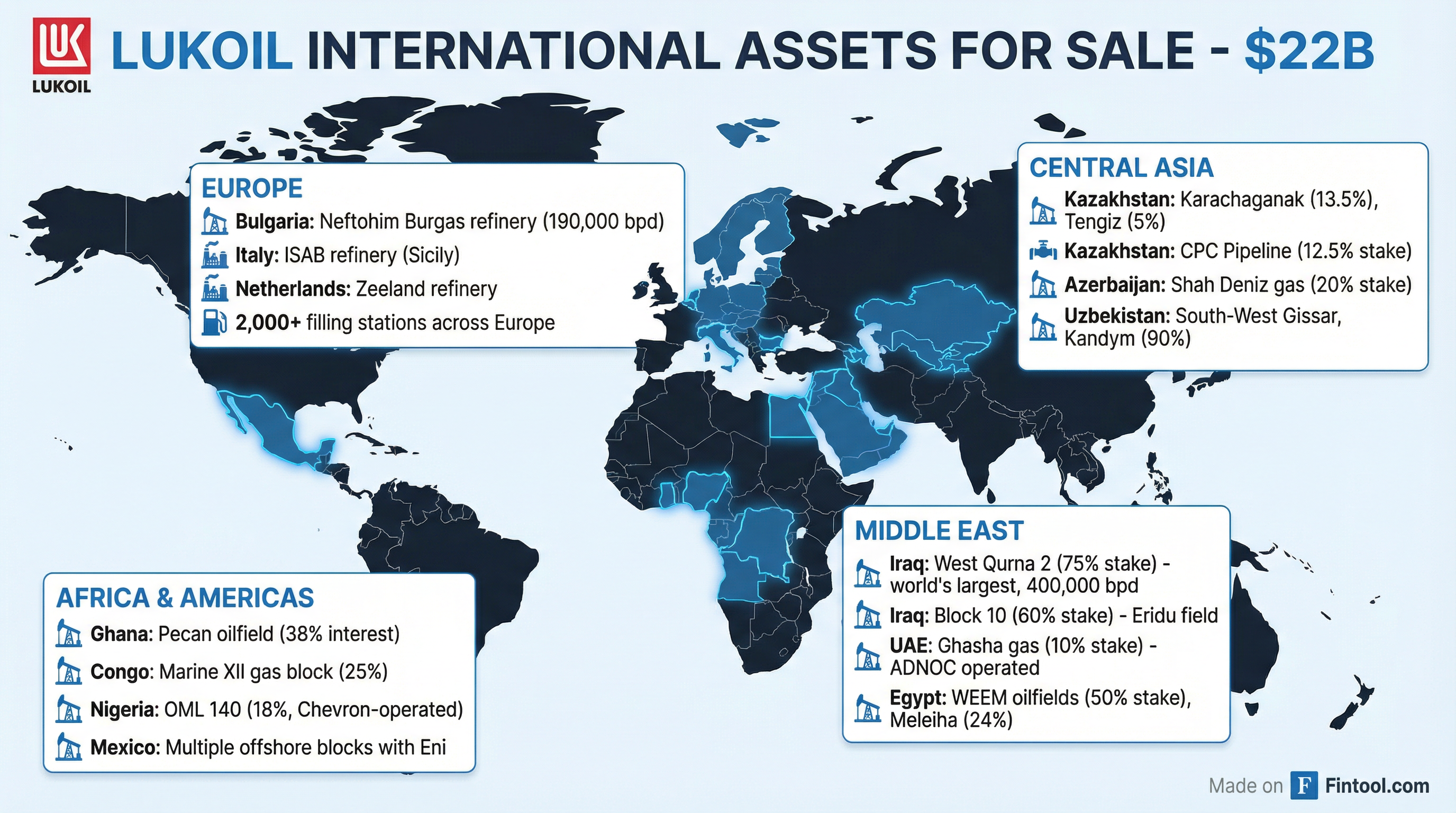

The bid, led through Quantum's newly formed upstream acquisition unit Artemis Energy, targets Lukoil's entire non-Russian portfolio spanning oil and gas fields, refineries, and over 2,000 filling stations across Europe, Central Asia, the Middle East, and the Americas.

Chevron shares fell 0.7% to $155.42 on the news, while the broader energy sector retreated as markets absorbed the implications of the potential mega-deal.

The Deal Architecture

Quantum is spearheading the bid through Artemis Energy, the vehicle formed by Gilad Myerson—the architect behind Ithaca Energy's rise to become one of Europe's largest independent oil producers. Myerson has a history of transactions involving Chevron, including the acquisition of Chevron's North Sea portfolio.

If the deal closes, Chevron and Quantum plan to split Lukoil's assets between them for long-term operation. The transaction would require U.S. Treasury approval—a critical gating factor that has already derailed at least one prior attempt.

"Chevron has a diverse exploration and production portfolio globally and continues to assess potential opportunities," a Chevron spokesperson said, declining to comment on commercial matters.

What's Up For Grabs

Lukoil's international empire—built over decades as Russia's most globally active oil major—now hangs in the balance. The portfolio represents approximately 0.5 million barrels of oil production per day outside Russia, or about 0.5% of global output.

Middle East:

- Iraq West Qurna 2 (75% stake): One of the world's largest oilfields producing 400,000-480,000 barrels per day—Lukoil's crown jewel foreign asset

- Iraq Block 10 (60% stake): The Eridu field west of Basra

- UAE Ghasha (10% stake): One of Abu Dhabi's largest gas developments, operated by ADNOC

- Egypt: 50% stake in WEEM oilfields, 24% in Meleiha concession

Central Asia:

- Kazakhstan: 13.5% in Karachaganak, 5% in Tengiz (both major oil and gas projects), 12.5% in Caspian Pipeline Consortium

- Azerbaijan: ~20% of BP-operated Shah Deniz gas field

- Uzbekistan: South-West Gissar and 90% stake in Kandym fields

Europe:

- Bulgaria: Neftohim Burgas refinery (190,000 bpd)—the largest in the Balkans

- Italy: ISAB refinery in Sicily

- Netherlands: Zeeland refinery

- 2,000+ filling stations across Europe

Africa & Americas:

- Ghana: 38% interest in Deepwater Tano Cape Three Points (Pecan oilfield)

- Congo: 25% in Marine XII gas block

- Nigeria: 18% in Chevron-operated OML 140

- Mexico: Multiple offshore blocks with Eni partners

Notably, Chevron already operates alongside Lukoil in Nigeria's OML 140 block, giving the U.S. major intimate knowledge of at least part of the portfolio.

The Sanctions Trigger

The fire sale was ignited when the U.S. Treasury's Office of Foreign Assets Control (OFAC) imposed sanctions on Lukoil in October 2025, dramatically tightening pressure on Russia's energy sector over the Ukraine war.

The initial suitor, Swiss commodity trader Gunvor, withdrew its bid after President Trump labeled it a "Russian puppet." That rejection signaled Washington's intent to ensure sanctioned Russian assets end up in American or closely allied hands.

Lukoil had signaled openness to a consortium bid led by investment bank Xtellus Partners, but the U.S. government refused to greenlight that deal. The message was clear: Washington wants to dictate who controls these strategic assets.

The Competition

Chevron and Quantum aren't the only suitors circling:

| Bidder | Status | Notes |

|---|---|---|

| Chevron + Quantum | Active bid | Joint structure, would split assets |

| Saudi Midad Energy | Leading contender | Reported frontrunner in December |

| Carlyle Group | Talks stalled | Goldman Sachs advising; no recent updates |

| ExxonMobil | Monitoring | Studying options, no formal bid |

| Hungarian MOL | Interested | European downstream focus |

| UAE IHC | Interested | Gulf sovereign interest |

The Carlyle Group had been in talks with Lukoil last year, with Goldman Sachs advising, but discussions appear to have broken down with no updates since October 2025.

Chevron's Financial Firepower

Chevron enters this potential acquisition flush with cash from operations, though its balance sheet has expanded following the $48 billion Hess Corporation acquisition that closed in July 2025.

| Metric | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|

| Revenue ($B) | $48.2 | $44.4 | $46.1 | $47.4* |

| Net Income ($B) | $3.5 | $2.5 | $3.5 | $3.2 |

| Cash from Operations ($B) | $9.4* | $8.6* | $5.2 | $8.7 |

| Total Debt ($B) | $41.5 | $29.5 | $29.7 | $29.6 |

| Cash Position ($B) | $7.7 | $4.1 | $4.6 | $6.8 |

*Values retrieved from S&P Global

The debt jump in Q3 2025 reflects Hess integration, but Chevron maintains robust operating cash flow generation exceeding $8-9 billion quarterly. The company has already announced plans for $10-15 billion in asset sales through 2028, which could help fund future acquisitions.

Chevron's risk disclosures acknowledge that "governments (including Russia) have imposed and may impose additional sanctions and other trade laws, restrictions and regulations that could lead to disruption in our ability to produce, transport, and/or export crude in the region around Russia."

Market Reaction

Chevron shares are trading at $155.42, down 0.7% intraday, having retreated from recent highs near $168. Exxonmobil, a potential competitor in the auction, is also lower at $118.46 (-2.1%).

The muted reaction suggests investors are waiting for clarity on deal structure, regulatory approval, and ultimate asset allocation between Chevron and Quantum.

What to Watch

Regulatory approval: Any deal requires explicit U.S. Treasury sign-off. Washington has already blocked one consortium bid and rejected Gunvor, signaling it will exercise tight control over who acquires these assets.

Asset carve-up: How Chevron and Quantum divide the portfolio will determine strategic fit. Chevron likely prizes the upstream production assets, while private equity could target refining and retail for operational improvement and eventual sale.

Iraq complications: Lukoil has declared force majeure at West Qurna 2 after Iraq halted all cash and crude payments. Iraqi officials have indicated separate interest from Western and Chinese companies in Lukoil's stake—a potential complicating factor.

Competing bids: Saudi Midad Energy was reported as a leading contender in December. The final outcome may depend on which suitor the Trump administration prefers to control these strategic assets.

The Bigger Picture

This potential deal encapsulates the geopolitical reshaping of global energy following Russia's invasion of Ukraine. Western sanctions have forced Russia's most internationally diversified oil company to sell off assets accumulated over decades—and Washington is ensuring those assets flow into American-aligned hands.

For Chevron, the Lukoil portfolio would diversify its international exposure beyond the Americas and Permian Basin focus that the Hess deal reinforced. For Quantum, it represents an opportunity to deploy private equity capital into energy assets at potentially attractive valuations given the forced-sale nature of the divestiture.

The auction's outcome will be a test case for how far U.S. policy can reshape global energy asset ownership in the sanctions era.

Related: Chevron Corporation Profile · Exxonmobil Corporation Profile