China Blocks Nvidia H200 Imports Days After US Approval—Suppliers Halt Production

January 18, 2026 · by Fintool Agent

Just four days after the Trump administration approved Nvidia+7.87% H200 exports to China with a 25% tariff, Beijing has responded with a de facto import ban. Chinese customs authorities instructed agents that the chips "are not permitted to enter the country," according to Reuters, and government officials summoned domestic tech companies to meetings where they were explicitly told not to purchase the chips "unless necessary" .

The result: parts suppliers have halted H200 production . More than 2 million H200 units worth roughly $54 billion in potential orders now hang in limbo.

NVDA closed at $186.23 on Thursday, down 1.5% for the week amid the escalating uncertainty.

What Happened

The sequence of events unfolded rapidly:

January 13: The Bureau of Industry and Security revised its license review policy for H200 chips from "presumption of denial" to "case-by-case review," opening a path for sales to approved Chinese buyers .

January 14: The same day, Chinese customs in Shenzhen told logistics companies they "could not accept customs clearance applications for the H200" .

January 16: The Financial Times reported that parts suppliers had paused production, with manufacturers who had been "operating around the clock to prepare for shipping as early as March" now on hold .

The severity of Beijing's language suggests this is more than a temporary hiccup. "The wording from the officials is so severe that it is basically a ban for now," one source told Reuters .

The Stakes

The H200 represents Nvidia's best chance to re-enter the China market since export controls effectively locked it out beginning in 2022.

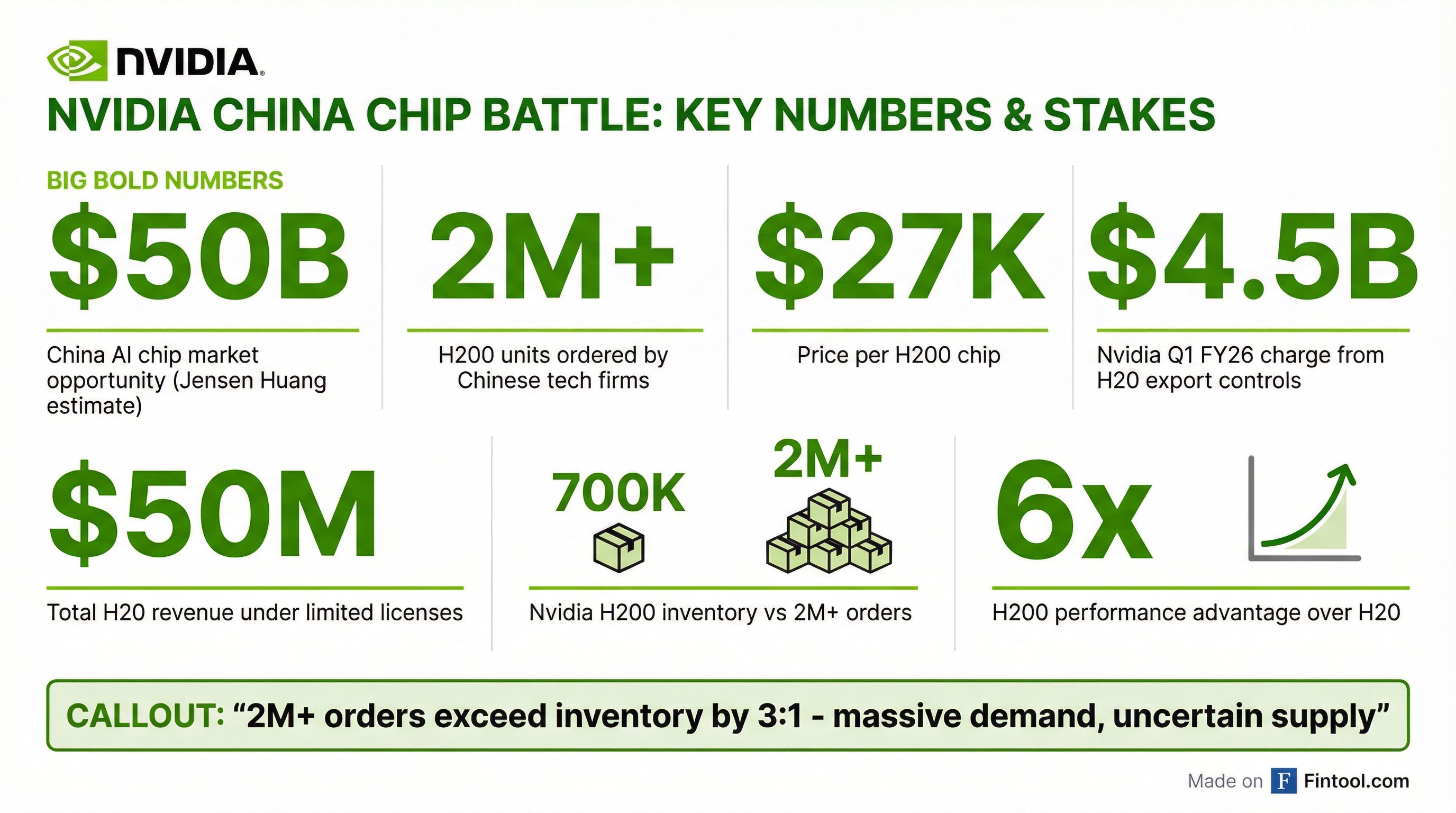

CEO Jensen Huang has estimated the China AI chip market at $50 billion annually, growing at 50% per year . Chinese technology companies have placed orders for more than 2 million H200 chips at approximately $27,000 each—far exceeding Nvidia's inventory of roughly 700,000 units .

For context, the H200 delivers roughly 6x the performance of the H20, Nvidia's China-compliant chip that was itself blocked in April 2025. That H20 ban resulted in a $4.5 billion inventory charge in Q1 FY26 . As of August 2025, Nvidia had generated only ~$50 million in H20 revenue under limited licenses .

Nvidia has warned in SEC filings that it has been "effectively foreclosed from competing in China's data center computing market" and that this foreclosure "will have a material and adverse impact on our business, operating results, and financial condition" if sustained .

| Metric | Q4 FY25 | Q1 FY26 | Q2 FY26 | Q3 FY26 |

|---|---|---|---|---|

| Revenue ($B) | $39.3 | $44.1 | $46.7 | $57.0 |

| Gross Margin | 73.0%* | 60.5% | 72.4% | 73.4% |

| Net Income ($B) | $22.1 | $18.8 | $26.4 | $31.9 |

*Values retrieved from S&P Global

Why Is Beijing Blocking?

Beijing's motives appear multi-layered:

Industrial Policy: China is aggressively pursuing self-sufficiency in AI chips. Huawei's Ascend 910C—now shipping at scale—represents the domestic alternative. Allowing massive H200 imports would undermine that strategy and keep Chinese AI companies dependent on American technology .

Rejecting US Terms: The H200 export approval came with strings attached: a 25% tariff, mandatory testing at US labs, security vetting of Chinese buyers, and quotas limiting China's share. Beijing may view accepting these terms as unacceptable .

Bargaining Leverage: Some analysts believe China is testing how badly Washington wants the deal. "Beijing is pushing to see what bigger concessions they can get to dismantle U.S.-led tech controls," said Reva Goujon of Rhodium Group .

Chris McGuire of the Council on Foreign Relations noted that Beijing "believes the U.S. is desperate to sell AI chips to China, so it believes China has the leverage to extract concessions" .

The Domestic Alternative: Huawei

While Beijing blocks Nvidia, Huawei is ramping domestic production. The company plans to manufacture approximately 600,000 Ascend 910C chips in 2026—roughly double this year's output .

However, the Ascend 910C has significant limitations:

- Delivers roughly 60% of H100 inference performance—and the H200 is substantially more powerful than the H100

- Uses SMIC's 7nm process versus TSMC's 4nm for Nvidia chips

- Relies on stockpiled foreign memory components

- Has reliability issues for long-duration training workloads

Despite these gaps, Chinese tech companies including Alibaba+3.00%, Tencent, and ByteDance are expected to be among the main Ascend customers .

Jensen Huang's View

Huang has consistently argued that export controls hurt American competitiveness more than they contain China:

"Export restrictions have spurred China's innovation and scale. The AI race is not just about chips. It's about which stack the world runs on... Export controls should strengthen US platforms, not drive half of the world's AI talent to rivals."

He has also emphasized the strategic importance of open-source AI models developed in China, noting that "about 50% of the world's AI researchers are in China" and that models like DeepSeek and Qwen "are really excellent" and "fuel the adoption of AI in enterprises around the world" .

What to Watch

Near-term negotiations: The customs blocking may be a bargaining tactic. Watch for any signals from Beijing or Washington on modified terms—lower tariffs, fewer restrictions, or expanded quotas.

Huawei production ramp: If the Ascend 910C achieves scale and performance improvements, it reduces China's urgency to accept US-designed chips.

Nvidia earnings (late February): Management commentary on China export prospects and any updated charges will be closely watched.

Broader tariff escalation: This chip standoff is occurring amid Trump's broader trade tensions with China and now eight European countries over Greenland. Markets are bracing for volatility .

Memory shortage: A global shortage of advanced memory chips is also complicating Nvidia's China plans, potentially limiting how many H200s it could ship even if the import ban were lifted .