The CLARITY Act Hits the Senate Floor: Crypto's Regulatory Moment Arrives Thursday

January 14, 2026 · by Fintool Agent

The most significant crypto legislation in American history goes to markup Thursday with 137 amendments on the table, a provision that could declare XRP and Solana legal equals to Bitcoin, and a stablecoin yield ban that has divided the industry—all as Bitcoin surges past $97,000 on the biggest ETF inflows since October.

The Senate Banking Committee released the full bipartisan negotiated text of the Digital Asset Market CLARITY Act late Monday, ending months of speculation about what compromises Chairman Tim Scott (R-SC) and Ranking Member Elizabeth Warren (D-MA) had reached behind closed doors. The answer: a 200-page framework that would fundamentally reshape how the United States regulates digital assets, from Bitcoin to DeFi protocols.

The market's response was immediate. Bitcoin broke above $97,000 Wednesday morning for the first time since November, while U.S. spot Bitcoin ETFs absorbed $754 million on Monday—the largest single-day inflow since the October rally. Coinbase shares rose 1.2% to $256, and Robinhood held near $120 as investors positioned for a potential regulatory tailwind.

But the path to the President's desk remains treacherous. The Thursday markup features 137 proposed amendments—a sign that consensus remains elusive even within the Banking Committee. And the Senate Agriculture Committee, which has jurisdiction over the CFTC components, has postponed its own hearing until January 27, citing a need for additional time.

The ETF Provision: XRP, Solana, Dogecoin Join Bitcoin's Legal Status

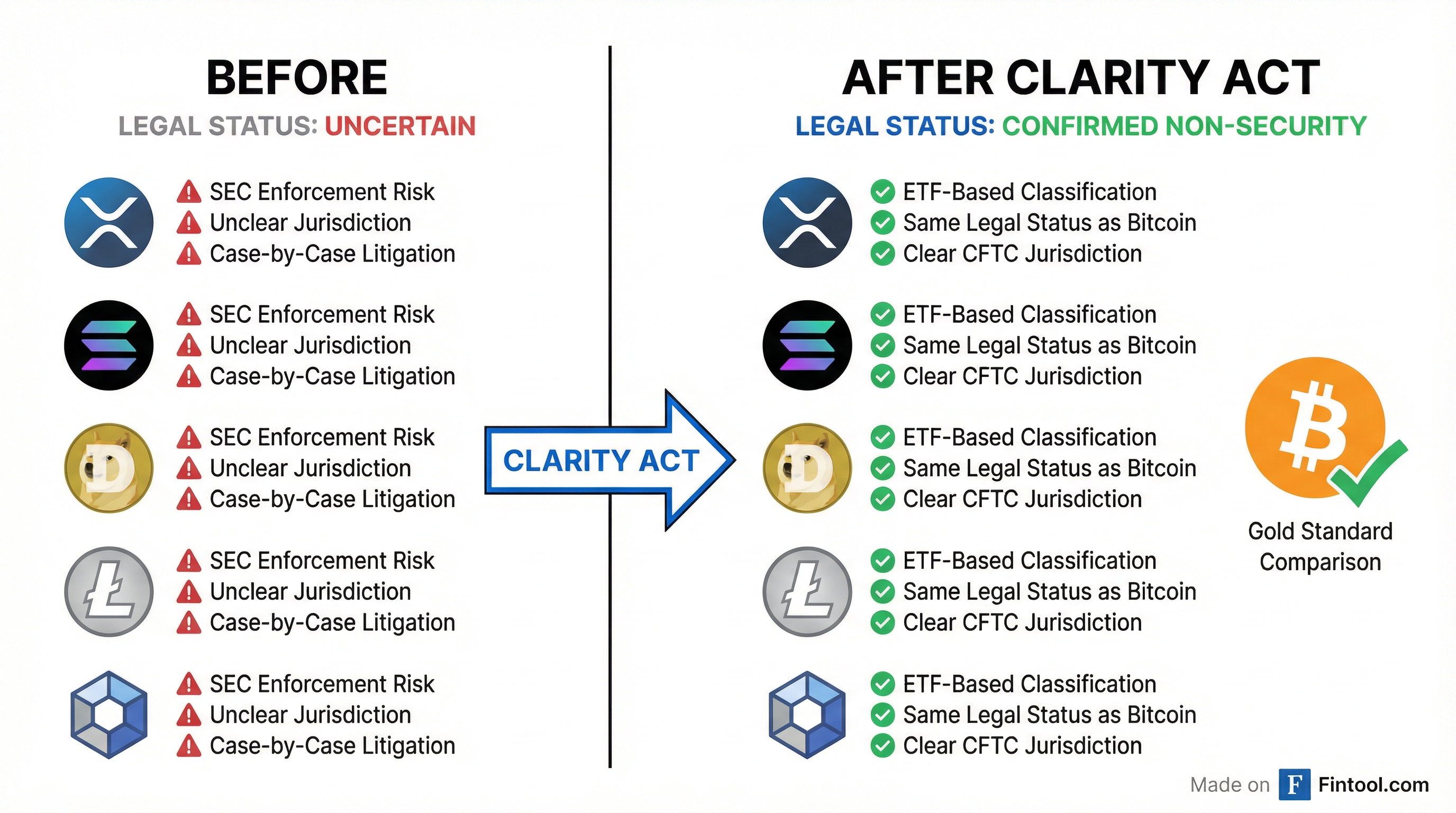

The most market-moving provision in the draft may be a technical clause buried in the definitions section—one that could resolve years of regulatory ambiguity for several major cryptocurrencies in a single stroke.

The bill defines "network tokens" as digital assets that would not be considered securities under federal law. Critically, it includes a provision stating that any token that was "the principal asset of an exchange-traded product listed and traded on a national securities exchange" as of January 1, 2026, would automatically qualify as a network token—and therefore not a security.

Based on existing ETF listings, this would immediately apply to:

- XRP ($2.15)

- Solana ($145)

- Dogecoin ($0.18)

- Litecoin ($85)

- Hedera ($0.12)

- Chainlink ($14)

For Ripple and Solana in particular, this represents a dramatic reversal. Both faced SEC enforcement actions under the Gensler administration that argued their tokens were unregistered securities. While those cases were dismissed following the change in SEC leadership, the legal status of these assets remained technically unsettled. The CLARITY Act would codify their non-security status by statute.

"By default, cryptocurrencies like XRP, Solana and Chainlink, among others, would be deemed not securities," noted legal analysis of the draft.

The Stablecoin Yield Controversy

The bill's stablecoin provisions have generated the most industry pushback—and could be the focus of Thursday's amendment battles.

The draft prohibits digital asset service providers from "paying interest or yield solely for the holding of payment stablecoins." However, it explicitly allows rewards tied to specific activities: transacting, staking, providing liquidity, or posting collateral.

Coinbase CEO Brian Armstrong addressed this nuance directly in the company's most recent earnings call: "In the GENIUS Act, there is a prohibition by the issuer of stablecoins on paying interest and yield. First, we are not the issuer. And second, we don't pay interest and yield. We pay rewards. Long story short is we can—we plan to continue to pay rewards to our customers."

The provision has been characterized as favorable to traditional banks, which cannot compete with high-yield stablecoin products and have lobbied for tighter restrictions. Industry groups argue the activity-based carve-out preserves legitimate DeFi use cases while addressing concerns about shadow banking.

DeFi Developer Protections

In a significant concession to the crypto industry, the bill includes developer protections pushed by Senator Cynthia Lummis (R-WY) that would shield software developers from direct regulatory liability.

The framework distinguishes between:

- Software developers: Protected from securities law obligations when creating DeFi protocols

- Centralized intermediaries: Subject to full compliance requirements when interacting with DeFi

"By focusing regulatory efforts on control rather than code, the legislation draws a clear line that balances innovation with investor protection," according to the Banking Committee's fact sheet.

The bill also directs the SEC and Treasury to develop rules clarifying how DeFi trading protocols must comply with applicable regulatory obligations, including disclosure, recordkeeping, and securities law requirements. This represents "one of the most explicit legislative efforts to date to integrate DeFi activity within a formal regulatory perimeter."

SEC vs. CFTC: The Jurisdiction Split

A core purpose of the CLARITY Act is to end the turf war between the SEC and CFTC over crypto oversight. The bill establishes clear boundaries:

SEC Jurisdiction:

- "Ancillary assets" that derive value from the entrepreneurial or managerial efforts of an issuer

- Securities token offerings and related disclosures

- Investor protection and anti-fraud enforcement

CFTC Jurisdiction:

- Digital commodities (including Bitcoin and Ethereum, already confirmed)

- Network tokens that qualify under the ETF provision

- Derivatives and futures markets

The jurisdictional clarity addresses what Coinbase CEO Brian Armstrong described as a "regulation by enforcement" model that held the industry hostage to case-by-case litigation rather than clear rules.

Market Implications: The $754 Million Signal

The Monday ETF inflow figure—$754 million into U.S. spot Bitcoin ETFs—represents more than routine positioning. It was the largest single-day amount since October, when Bitcoin was rallying toward $120,000.

| Metric | Value | Change |

|---|---|---|

| Bitcoin Price | $97,000 | +4% weekly |

| ETF Inflows (Jan 13) | $754M | Highest since October |

| Total ETF Net Assets | $123B | 6.5% of Bitcoin supply |

| Coinbase (COIN) | $255.82 | +1.2% |

| Robinhood (HOOD) | $119.62 | -0.5% |

Fidelity's Wise Origin Bitcoin ETF (FBTC) led inflows with $358 million, followed by BlackRock's iShares Bitcoin Trust (IBIT) at $262 million.

For crypto-exposed equities, the regulatory clarity represents a structural tailwind. Coinbase has already seen SEC lawsuits dismissed under the new administration. Robinhood is expanding tokenized equities internationally while awaiting U.S. regulatory green lights.

"With growing regulatory clarity, we believe crypto rails are poised to power an increasing share of global GDP and update every aspect of the financial system over time," Armstrong said.

The 137 Amendments: What Could Change

Thursday's markup is not a vote on final passage—it's the beginning of a legislative process that could substantially alter the bill. Key battlegrounds include:

Ethics Provisions: Some Democrats pushed for provisions barring public officials from profiting off crypto businesses while in government—a direct response to President Trump's family crypto ventures. The current draft is silent on the issue.

State Authority: The North American Securities Administrators Association (NASAA) has raised concerns about federal preemption of state enforcement powers, calling for "clear, robust anti-fraud savings clauses" to preserve state authority.

Definition Inconsistencies: NASAA highlighted "fundamental inconsistencies" between the bill's definitions of "network token" and "ancillary asset," warning they create an "unworkable separation" that could generate future litigation.

Stablecoin Yield: The industry is expected to push for broader activity-based reward exemptions, while traditional banking interests may seek to tighten the prohibition further.

The Path Forward

Even if Thursday's markup produces a committee-approved bill, the legislative gauntlet remains formidable:

- Senate Banking Committee Markup: Thursday, January 15

- Senate Agriculture Committee Markup: Postponed to January 27

- Reconciliation: Both Senate versions must be merged

- House Conference: The House passed its own version (Digital Asset Market Clarity Act) last summer—differences must be resolved

- Floor Votes: Both chambers must pass identical text

- Presidential Signature: President Trump has signaled strong support

The administration's crypto enthusiasm, combined with unified Republican control of Congress, creates the most favorable legislative environment the industry has ever faced. But 137 amendments, intercommittee rivalries, and Democratic objections over ethics provisions suggest the final bill may look substantially different from Monday's draft.

For investors, the Thursday markup provides the first real test of whether regulatory clarity is a 2026 reality—or just another deferred promise.

What to Watch

- Thursday, January 15: Senate Banking Committee markup—amendment debates and potential votes

- January 27: Senate Agriculture Committee markup of CFTC-focused provisions

- ETF Flows: Continued institutional positioning ahead of regulatory clarity

- Stablecoin Stocks: Watch Coinbase for commentary on reward program implications

- XRP, SOL Price Action: Market pricing in non-security status confirmation