CME Crypto Derivatives Hit Record $12 Billion Daily Volume as Institutional Adoption Accelerates

January 5, 2026 · by Fintool Agent

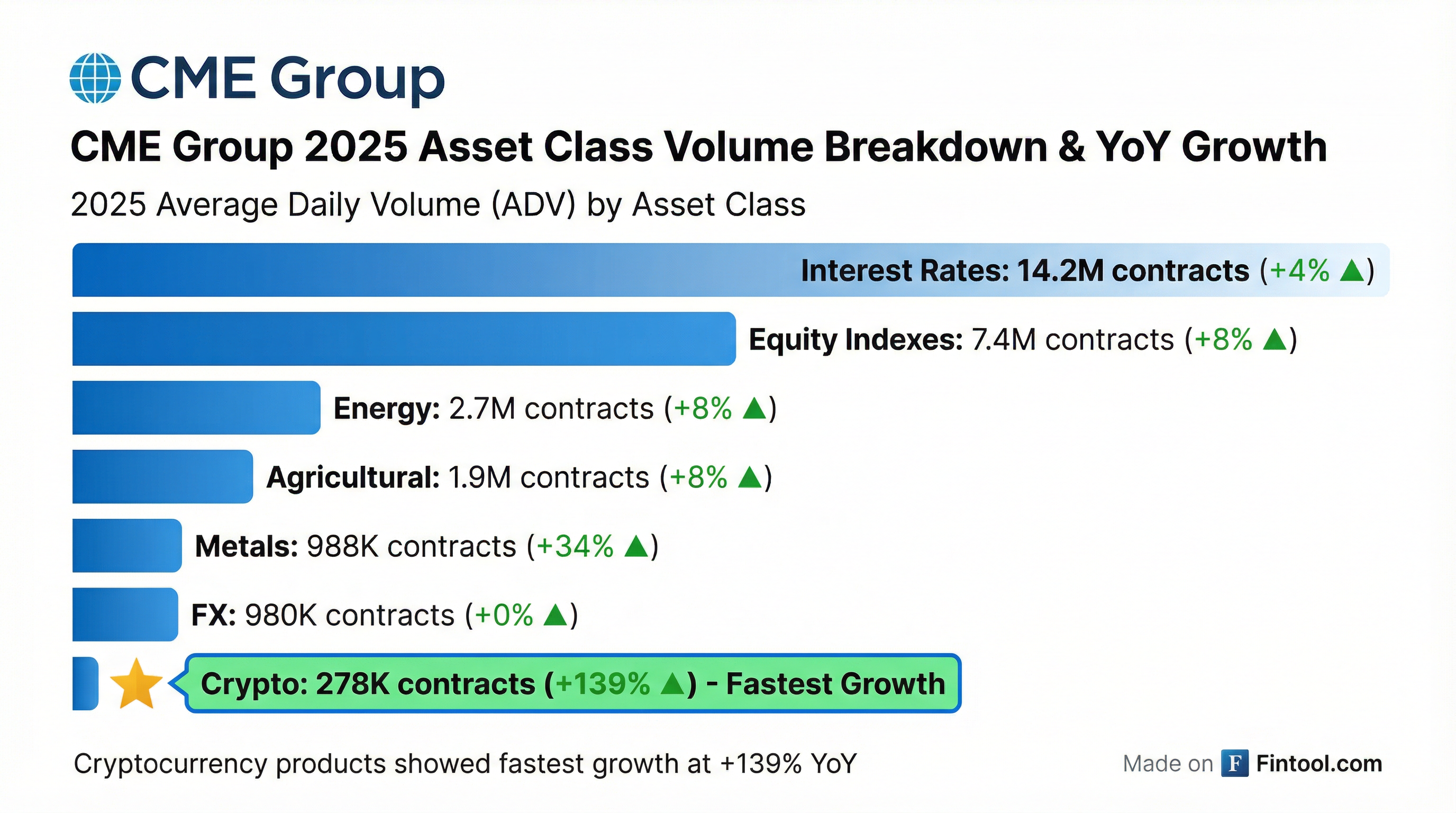

Cme Group reported record cryptocurrency derivatives trading volumes in 2025, with average daily volume surging 139% year-over-year to 278,000 contracts—equivalent to roughly $12 billion in daily notional value . The milestone marks the strongest annual performance for CME's crypto products since their 2017 debut, cementing the exchange's position as the venue of choice for institutional crypto exposure.

The surge in regulated crypto trading came even as underlying token prices fell—Bitcoin dropped 6.3% and Ether lost 11% in 2025 . The divergence underscores a structural shift: institutions are trading crypto derivatives for hedging and speculation regardless of directional price moves.

Record Year Across the Board

CME's total average daily volume hit an all-time high of 28.1 million contracts in 2025, up 6% from 2024 . Multiple asset classes posted records:

| Asset Class | 2025 ADV | YoY Change |

|---|---|---|

| Interest Rates | 14.2M contracts | +4% (record) |

| Equity Indexes | 7.4M contracts | +8% |

| Energy | 2.7M contracts | +8% (record) |

| Agricultural | 1.9M contracts | +8% (record) |

| Metals | 988K contracts | +34% (record) |

| Cryptocurrency | 278K contracts | +139% (record) |

Within interest rates, U.S. Treasury futures and options reached a record 8.3 million contracts ADV, while SOFR futures and options hit 5.4 million—reflecting continued positioning around Federal Reserve policy .

Micro Contracts Drive Crypto Growth

The crypto volume explosion was led by capital-efficient micro contracts that appeal to both retail and institutional traders:

| Product | 2025 ADV | Performance |

|---|---|---|

| Micro Ether Futures | 144,000 contracts | Record |

| Micro Bitcoin Futures | 75,000 contracts | Record |

| Ether Futures | 19,000 contracts | Record |

In the Q2 2025 earnings call, CME's Tim McCourt noted the complex had reached "almost 260,000 contracts per day" by July, representing "over $12 billion of notional" daily . The momentum continued through year-end.

CME attributed the growth to "broader acceptance of cryptocurrency products, which includes the passing of federal legislation surrounding dollar-pegged stablecoins" —a reference to the GENIUS Act signed in mid-2025.

Institutional Participation Deepens

A key indicator of institutional adoption: CME reached a record 800 large open interest holders in its crypto complex by mid-2025 . Large traders—typically hedge funds, asset managers, and proprietary trading firms—are required to report positions above certain thresholds.

The shift toward regulated venues accelerated through 2025. CME overtook Binance in Bitcoin futures open interest during the year, signaling that institutions increasingly prefer the regulatory clarity and counterparty protections offered by traditional exchanges .

Q4 2025 saw even stronger momentum, with quarterly crypto ADV reaching a record 379,000 contracts ($13.3 billion notional). December alone recorded 339,000 contracts .

CME Group Financial Performance

CME's dominant position in derivatives continues to generate consistent profitability:

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $1,352 | $1,384 | $1,425 | $1,475 | $1,414 | $1,532 | $1,586 | $1,430 |

| Net Income ($M) | $815 | $855 | $883 | $913 | $875 | $956 | $1,025 | $908 |

| Diluted EPS | $2.24 | $2.35 | $2.42 | $2.50 | $2.40 | $2.62 | $2.81 | $2.49 |

CME shares rose 1.9% to $274.80 on Monday, pushing the market capitalization to approximately $99 billion. The stock trades near its 52-week high of $290.79.

Competitive Landscape

CME's regulated platform stands in contrast to offshore and unregulated crypto exchanges. The competitive advantages include:

- Regulatory oversight: CFTC-regulated, providing legal certainty for institutional mandates

- Counterparty credit: Central clearing eliminates bilateral counterparty risk

- Capital efficiency: Portfolio margining with other CME products

- Institutional infrastructure: Integration with prime brokers and custodians

The exchange recently expanded its crypto suite to include Solana (SOL) and XRP futures, and announced plans for 24-hour crypto trading—matching the always-on nature of spot crypto markets .

What to Watch

Several catalysts could sustain momentum in 2026:

- Bitcoin ETF inflows: Continued accumulation by spot ETFs (BlackRock's iShares Bitcoin Trust holds ~$50B) drives hedging demand at CME

- Regulatory clarity: Additional stablecoin and crypto market structure legislation

- Product expansion: CME's 24-hour crypto trading launch and additional token listings

- Institutional mandates: Growing allocation to crypto as an asset class by pensions and endowments

CME reports Q4 2025 earnings on February 4, 2026, which will provide the first complete picture of full-year performance.

Related Companies: