Earnings summaries and quarterly performance for Galaxy Digital.

Research analysts who have asked questions during Galaxy Digital earnings calls.

Joseph Vafi

Canaccord Genuity - Global Capital Markets

4 questions for GLXY

Martin Toner

ATB Capital Markets

4 questions for GLXY

Patrick Moley

Piper Sandler & Co.

4 questions for GLXY

Bill Papanastasiou

Keefe, Bruyette & Woods (KBW)

3 questions for GLXY

Chris Brendler

Rosenblatt Securities

3 questions for GLXY

Devin Ryan

Citizens JMP

3 questions for GLXY

James Yaro

Goldman Sachs

3 questions for GLXY

Ed Engel

Compass Point

2 questions for GLXY

Garrett Roberts

Cantor Fitzgerald

2 questions for GLXY

Greg Lewis

BTIG

2 questions for GLXY

James Faucette

Morgan Stanley

2 questions for GLXY

Joe Vafi

Canaccord Genuity Group Inc.

2 questions for GLXY

Joseph Flynn

Compass Point Research & Trading, LLC

2 questions for GLXY

Kwun Sum Lau

Oppenheimer

2 questions for GLXY

Michael Colonnese

H.C. Wainwright & Co.

2 questions for GLXY

Thomas Shinske

Cantor Fitzgerald

2 questions for GLXY

Brett Knoblauch

Cantor Fitzgerald & Co.

1 question for GLXY

Edward Engel

Compass Point Research & Trading, LLC

1 question for GLXY

Gregory Lewis

BTIG, LLC

1 question for GLXY

Jon Petersen

Jefferies

1 question for GLXY

Mark Palmer

The Benchmark Company, LLC

1 question for GLXY

Matthew Galinko

Maxim Group

1 question for GLXY

Nick Giles

B. Riley Securities

1 question for GLXY

Patrick Mulvey

Piper Sandler

1 question for GLXY

William Nance

The Goldman Sachs Group, Inc.

1 question for GLXY

Recent press releases and 8-K filings for GLXY.

- Pomerantz LLP is investigating Galaxy Digital Inc. for potential securities fraud or unlawful business practices on behalf of investors.

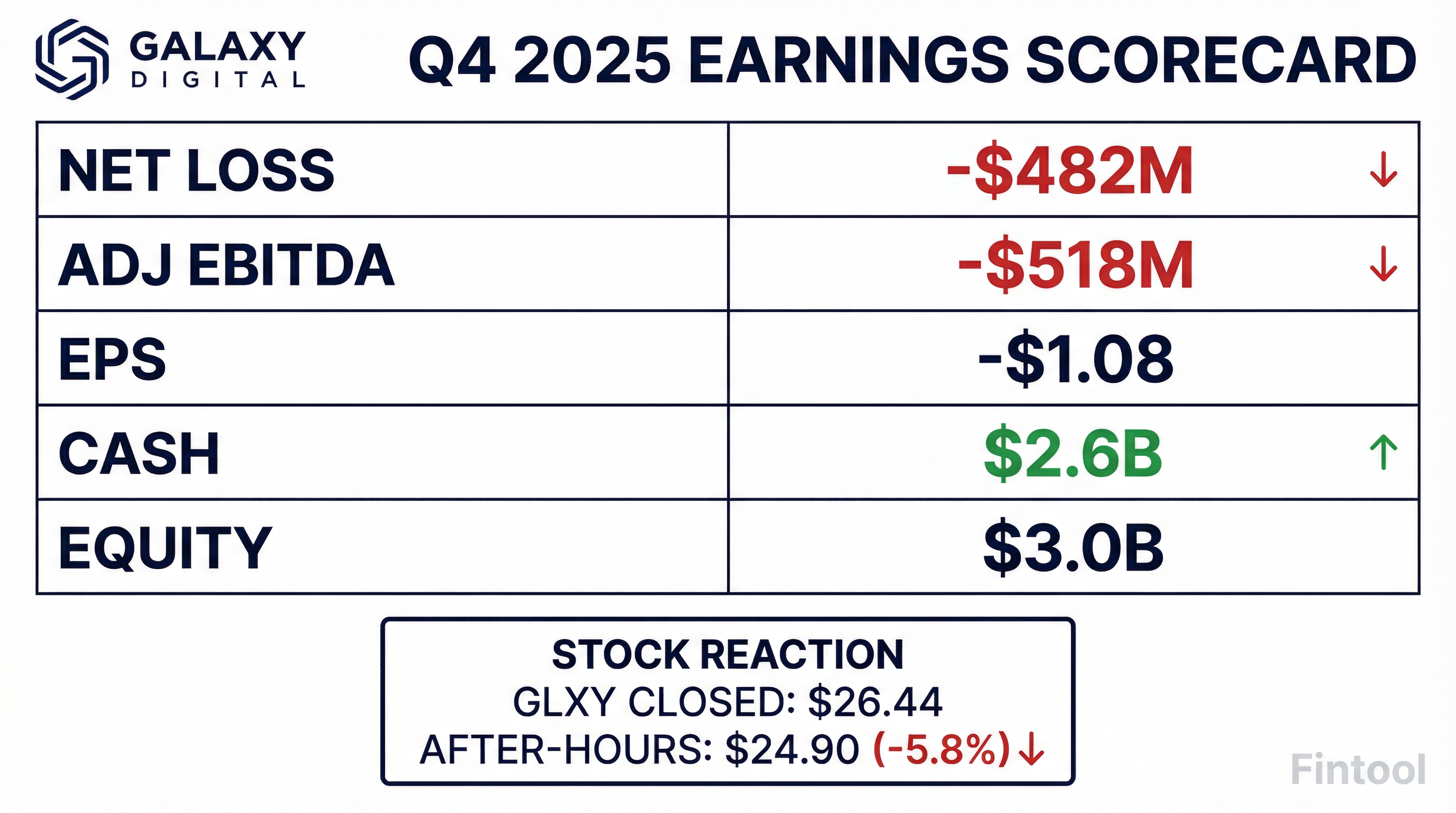

- This investigation follows Galaxy's report of a net loss of $482 million for the fourth quarter of 2025, which missed analyst expectations.

- The company attributed the loss primarily to the depreciation of digital asset prices during the quarter.

- Following this news, Galaxy's stock price fell 16.87% to $21.98 per share on February 3, 2026.

- Galaxy Digital has initiated a program to repurchase up to $200 million of its stock, believing the current share price is undervalued.

- The company reported a strong capital position, ending the quarter with $3 billion in equity capital and $2.6 billion in cash and stablecoins, following over $2 billion in capital raises during 2025.

- In its data center business, Galaxy was awarded an additional 830 MW of power in Texas and expects to deliver the first data halls by the end of Q1 and the remaining by the end of Q2. The six main power transformers required for the full 800 MW leased to CoreWeave are already on site.

- Management is evaluating strategies to enhance shareholder value, acknowledging that the market currently undervalues the company's dual business model, which includes both crypto and data center operations.

- Galaxy is considering delisting from the TSX, noting that over 90% of its trading volume now occurs on NASDAQ or other U.S. exchanges.

- Galaxy has a program to buy back up to $200 million of stock and maintains a strong capital position, ending the quarter with $3 billion in equity capital and $2.6 billion in cash and stablecoins after raising over $2 billion in 2025.

- The company is significantly expanding its data center business, having been awarded an additional 830 MW of power in Texas with energization planned from late 2028 through 2030. The first data halls for the existing 133 MW capacity are expected to be delivered by the end of Q1, with remaining halls by the end of Q2.

- Galaxy is actively pursuing new data center opportunities, anticipating $15 billion-$20 billion in CapEx over the next five years in this segment, and is evaluating its dual listing on the TSX given that over 90% of trading volume is now on NASDAQ or US exchanges.

- Management recognizes that the market is not currently valuing the combined crypto and data center businesses appropriately and is exploring strategies to unlock shareholder value.

- Galaxy Digital's Board of Directors approved a share repurchase program on February 6, 2026.

- The program authorizes the purchase of up to $200 million of the company's Class A common stock.

- The share repurchase program will have a term of 12 months.

- Repurchases may occur through open market purchases, privately negotiated transactions, or other means, including Rule 10b5-1 trading plans, subject to applicable securities laws and stock exchange requirements.

- CEO Mike Novogratz indicated the program is supported by a strong balance sheet and reflects confidence in Galaxy's long-term prospects, providing flexibility to return capital to shareholders.

- Galaxy Digital reported a GAAP net loss of $241 million or $0.61 per share for full year 2025, but achieved $34 million of adjusted EBITDA for the same period. The digital assets operating segment generated record adjusted gross profit of $505 million in 2025, representing a 67% year-over-year growth from $303 million in 2024.

- The company ended 2025 with $11.3 billion in total assets, over $3 billion in equity capital, and $2.6 billion of cash and stablecoins. This cash balance increased by approximately $700 million from Q3 due to $1.6 billion in net proceeds from a $1.3 billion exchangeable note issuance and a $325 million equity investment in Q4 2025.

- Galaxy Digital's data center business, Helios, now has over 1.6 gigawatts of approved power capacity, including a recent 830 megawatts approval from ERCOT. The first data halls for CoreWeave are expected to be delivered by the end of Q1 2026, with revenue recognition under the lease agreement anticipated to start later in Q1 2026.

- Despite a bear market in crypto, Galaxy's underlying digital assets business had a strong year, with record trading volumes and a growing loan book. CEO Mike Novogratz believes there is a 75%-80% chance of U.S. crypto legislation passing within the next 2-6 weeks, which is expected to accelerate on-chain activity and potential M&A.

- For Q4 2025, Galaxy reported revenues and gains / (losses) from operations of $10,224,023 thousand, with a net loss of $(481,666) thousand and Adjusted EBITDA of $(517,547) thousand.

- For the full year 2025, the company's revenues and gains / (losses) from operations were $61,355,667 thousand, resulting in a net loss of $(241,349) thousand and Adjusted EBITDA of $33,671 thousand.

- The Digital Assets business segment demonstrated growth, with revenues from operations reaching $505 million and Adjusted EBITDA of $247 million for the full year 2025.

- In its Data Centers segment, Galaxy secured a 15-year lease with CoreWeave for 526 MW of IT capacity, projected to generate over $1 billion in average annual revenue, with an additional 830 MW of uncontracted approved capacity as of January 15, 2026.

- Galaxy's balance sheet includes significant digital asset and investment exposure, with Bitcoin holdings of $577 million and Venture & Fund Investments of $617 million. Its Asset Management business reported $3.6 billion in Alternatives and $5.0 billion in Staked Assets.

- Galaxy Digital reported a GAAP net loss of $241 million or $0.61 per share for the full year 2025, which included approximately $160 million in one-time items, but achieved $34 million in adjusted EBITDA.

- The digital assets operating segment's adjusted gross profit grew 67% year-over-year to $505 million in 2025.

- The company's total assets reached $11.3 billion and equity capital exceeded $3 billion by year-end 2025, with cash and stablecoins increasing by $700 million in Q4 to $2.6 billion following $1.6 billion in net proceeds from strategic capital raises.

- Galaxy Digital secured approval for an additional 830 megawatts of power capacity at its Helios campus, expanding total approved capacity to over 1.6 gigawatts, with revenue from the CoreWeave lease expected to commence in Q1 2026.

- Despite a 10% decline in the total crypto market cap in 2025 and a 24% drop in Q4, the average loan book remained stable at $1.8 billion, and the company is prioritizing growth in on-chain credit and infrastructure solutions.

- For the full year 2025, Galaxy reported a GAAP net loss of $241 million or $0.61 per share, but achieved $34 million in adjusted EBITDA.

- The digital assets operating segment generated a record adjusted gross profit of $505 million in 2025, marking a 67% year-over-year increase from $303 million in 2024.

- The company ended 2025 with $11.3 billion in total assets, over $3 billion in equity capital, and $2.6 billion in cash and stablecoins, bolstered by approximately $1.6 billion in net proceeds from Q4 capital raises.

- Galaxy received approval for an additional 830 MW of power capacity at its Helios campus, more than doubling its approved footprint to over 1.6 GW, with the first data hall for CoreWeave expected to be delivered in Q1 2026. Assets on platform (AOP) declined 15% quarter-over-quarter to $12 billion at year-end, and digital asset trading volumes decreased approximately 40% quarter-over-quarter, primarily due to digital asset price depreciation and softer market activity.

- Galaxy Digital Inc. reported a net loss of $482 million for Q4 2025 and a full year 2025 net loss of $241 million, with diluted EPS of $(1.08) and $(0.61) respectively, primarily driven by the depreciation of digital asset prices.

- As of December 31, 2025, the company's total equity stood at $3.0 billion and cash and stablecoins holdings were $2.6 billion.

- For the full year 2025, Galaxy achieved adjusted gross profit of $426 million and adjusted EBITDA of $34 million.

- Key 2025 highlights include successfully completing its reorganization and Nasdaq listing, delivering record trading adjusted gross profit in Global Markets, and growing total assets on platform to $12 billion with $2.0 billion of net inflows in Asset Management.

- The company also strengthened its balance sheet by raising $325 million of equity capital and completing a $1.3 billion exchangeable senior notes offering to fund growth initiatives.

- Galaxy Digital reported a net loss of $482 million and diluted EPS of $(1.08) for Q4 2025, with a full year 2025 net loss of $241 million and diluted EPS of $(0.61).

- As of December 31, 2025, the company maintained a strong balance sheet with total equity of $3.0 billion (up 38% year-over-year) and cash and stablecoins holdings of $2.6 billion (up 168% year-over-year).

- The Asset Management & Infrastructure Solutions segment ended the year with $12 billion in total assets on platform, including $2.0 billion of net inflows in the Asset Management business.

- Strategic developments include the successful completion of reorganization and Nasdaq listing, execution of 800 megawatts of long-term agreements with CoreWeave, and approval for an additional 830 megawatts power capacity at Helios, doubling total approved capacity to over 1.6 gigawatts.

- The company also strengthened its balance sheet by raising $325 million in equity capital and completing a $1.3 billion exchangeable senior notes offering.

Quarterly earnings call transcripts for Galaxy Digital.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more