Coca-Cola Abandons Costa Coffee Sale After £2 Billion PE Bids Fall Short

January 14, 2026 · by Fintool Agent

Coca-cola+0.66% has abandoned plans to sell Costa Coffee after private equity bids failed to meet expectations, ending a months-long auction process that laid bare just how much value has evaporated from the company's £3.9 billion coffee bet.

The U.S. beverage giant ended talks with remaining bidders in December, sources told the Financial Times, after offers came in below approximately £2 billion—roughly half what Coca-cola+0.66% paid Whitbread for Britain's largest coffee chain in 2018.

The decision caps a humbling chapter for Coca-cola+0.66%, which positioned the Costa acquisition as a strategic entry into the fast-growing coffee category. Instead, the business has struggled with rising costs, fierce competition, and persistently weak high street traffic in its core UK market.

The Investment Thesis That Unraveled

Coca-cola+0.66% CEO James Quincey's candid assessment on the company's Q2 2025 earnings call signaled the writing was on the wall. Costa, he said, "is not where we wanted it to be from an investment hypothesis point of view."

The original vision was ambitious: use Costa's brand to accelerate growth in ready-to-drink coffee, expand its express vending machines, capture the at-home market, and transform the store business. The reality proved far more difficult.

"The business remains more weighted towards stores," Quincey acknowledged, noting that despite improvements in store operations—refreshing locations, driving affordability, improving speed of service—the diversification strategy "has not played out despite the improvement in the store business."

Timeline: From £3.9 Billion Bet to Abandoned Sale

Costa's journey reflects the challenges of integrating a high-street retail business into a global beverage concentrate model:

1971: Italian brothers Sergio and Bruno Costa founded the company as a coffee roasting business in London.

1995: Whitbread acquired Costa for just £19 million when it operated roughly 40 stores.

2018: Coca-cola+0.66% purchased Costa for £3.9 billion, betting on coffee's growth potential and the brand's international expansion opportunities.

2024: Costa's operating losses more than doubled year-over-year to £13.5 million on revenues of £1.2 billion—just 1% higher than 2023. Management blamed "challenging conditions with soft footfall and growth of value-led competitors."

August 2025: Reports emerged that Coca-cola+0.66% was working with Lazard on a strategic review that could lead to a sale.

December 2025: Talks collapsed after final bids fell short of expectations.

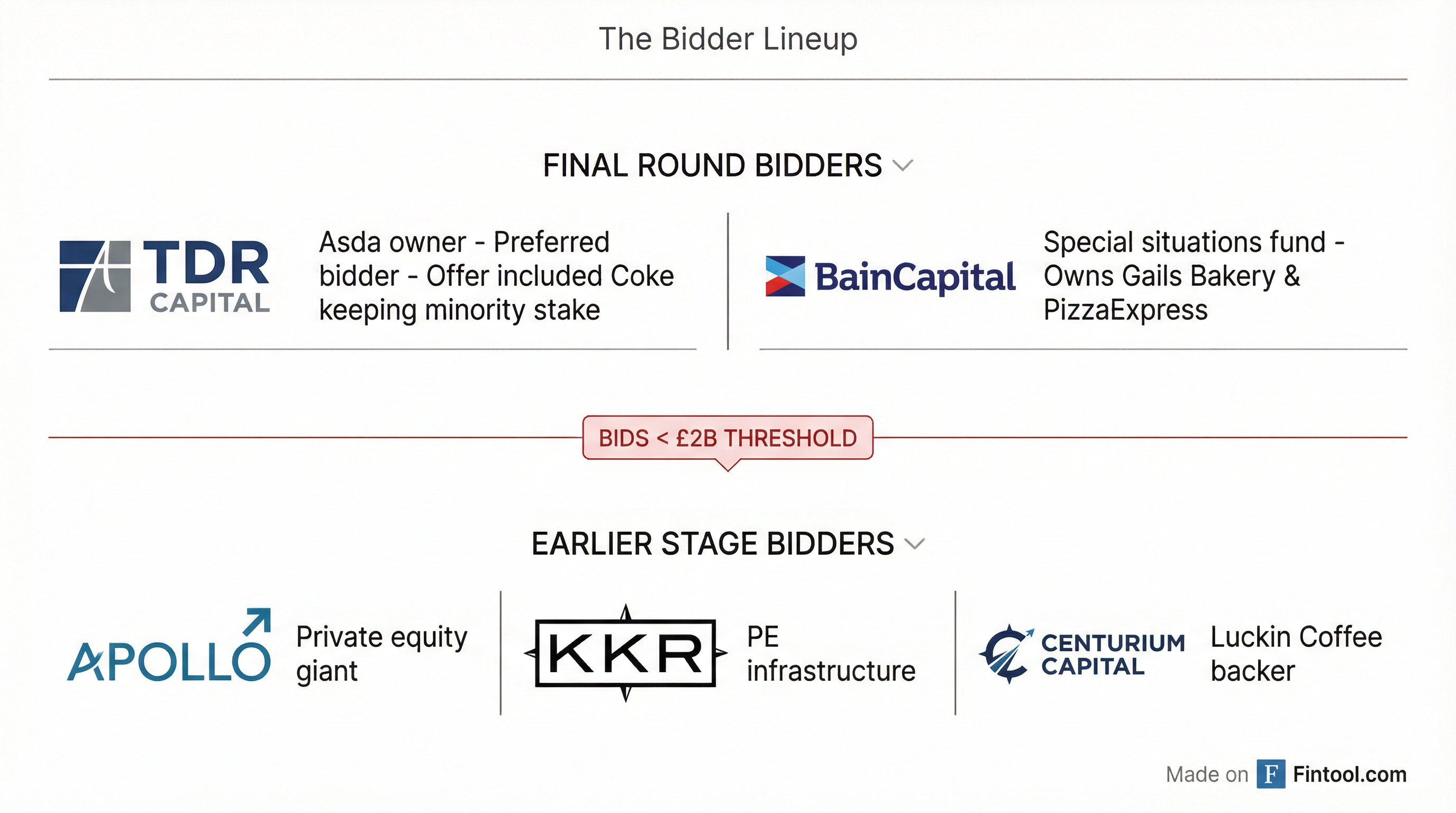

Who Was Bidding?

The auction attracted significant private equity interest, but no bidder was willing to pay what Coca-cola+0.66% sought.

Final Round Bidders:

- TDR Capital: The Asda owner emerged as the preferred bidder in a deal structure that would have seen Coca-cola+0.66% retain a minority stake

- Bain Capital Special Situations: The fund that owns Gail's Bakery and PizzaExpress

Earlier Stage Bidders:

- Apollo Global Management

- KKR

- Centurium Capital: Notably, the backer of Luckin Coffee, the fast-growing Chinese chain that has disrupted the coffee market with aggressive pricing

What Went Wrong

Costa's challenges mirror broader struggles in UK high-street retail, but the coffee chain faced company-specific headwinds:

Structural headwinds: Weak high street footfall has been exacerbated by the rise of remote work, while cost-conscious consumers have traded down to cheaper alternatives.

Coffee commodity surge: Global coffee bean prices have hit record highs, squeezing margins across the industry. Arabica futures have more than doubled since 2020, creating pressure on all coffee operators.

Competition intensifying: Premium competitors like Pret a Manger and independent specialty coffee shops have captured the high-end market, while value chains and supermarket coffee have pressured the mid-market where Costa operates.

RTD disappointment: Coca-cola+0.66%'s hopes of leveraging Costa into a major ready-to-drink coffee brand—competing with Starbucks' bottled offerings—have not materialized at scale. Costa's RTD products remain a small contributor.

Coca-Cola's Core Business Remains Strong

Despite the Costa disappointment, Coca-cola+0.66%'s overall business continues to perform. The company reported solid results through the first three quarters of 2025:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $11.5 | $11.1 | $12.5 | $12.5 |

| Net Income ($B) | $2.2 | $3.3 | $3.8 | $3.7 |

| EBITDA Margin | 28.2%* | 35.9%* | 36.9%* | 34.5%* |

| Gross Margin | 60.0%* | 62.6% | 62.4% | 61.5% |

*Values retrieved from S&P Global

Unit case volume in Europe, Middle East and Africa—where Costa's retail stores are reflected—grew 3% in the first half of 2025 and 4% in Q3, driven by Trademark Coca-Cola, sparkling flavors, and energy drinks.

What Happens Now

The sale abandonment does not mean Coca-cola+0.66% is done exploring options. Sources familiar with the matter indicated the company could revive sale plans in the medium term, particularly if market conditions improve or a strategic buyer emerges.

The timing is notable: Coca-cola+0.66% is undergoing a leadership transition, with Henrique Braun set to replace James Quincey as CEO in March 2026. Braun may take a fresh look at the coffee strategy or pursue different alternatives for the business.

For now, Coca-cola+0.66% remains committed to running Costa "successfully" while reflecting on what it has learned. As Quincey put it: "We want that money to work as hard as possible."

The bottom line: Six years after betting big on coffee, Coca-cola+0.66% is stuck with an underperforming asset that no one wants to buy at a fair price—a cautionary tale about the risks of diversification into unfamiliar retail formats.