Copper Tops $12,000 for First Time as Supply Crunch Intensifies

December 25, 2025 · by Fintool Agent

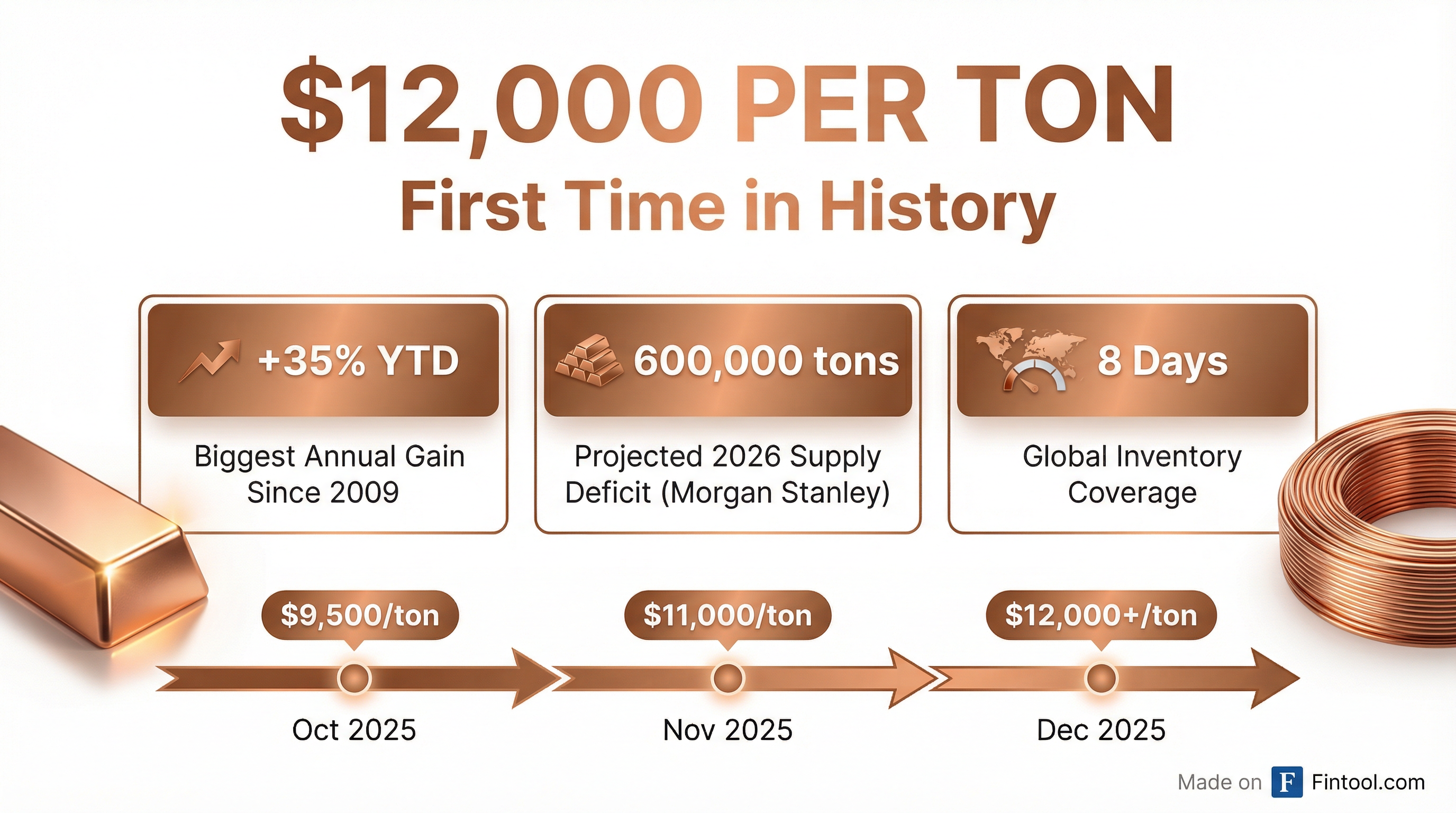

Copper surged past $12,000 per ton this week for the first time in history, extending the metal's remarkable 35% annual gain—the largest since 2009—as mine disruptions collide with insatiable demand from AI data centers, electric vehicles, and the global energy transition.

The red metal hit $12,159.50 on the London Metal Exchange, capping a year in which supply concerns have dominated headlines: Freeport-McMoRan's Grasberg mine in Indonesia—responsible for 3% of global supply—suspended operations after a fatal incident, while output has slowed across Chile and Peru due to strikes and environmental regulations.

The Perfect Storm

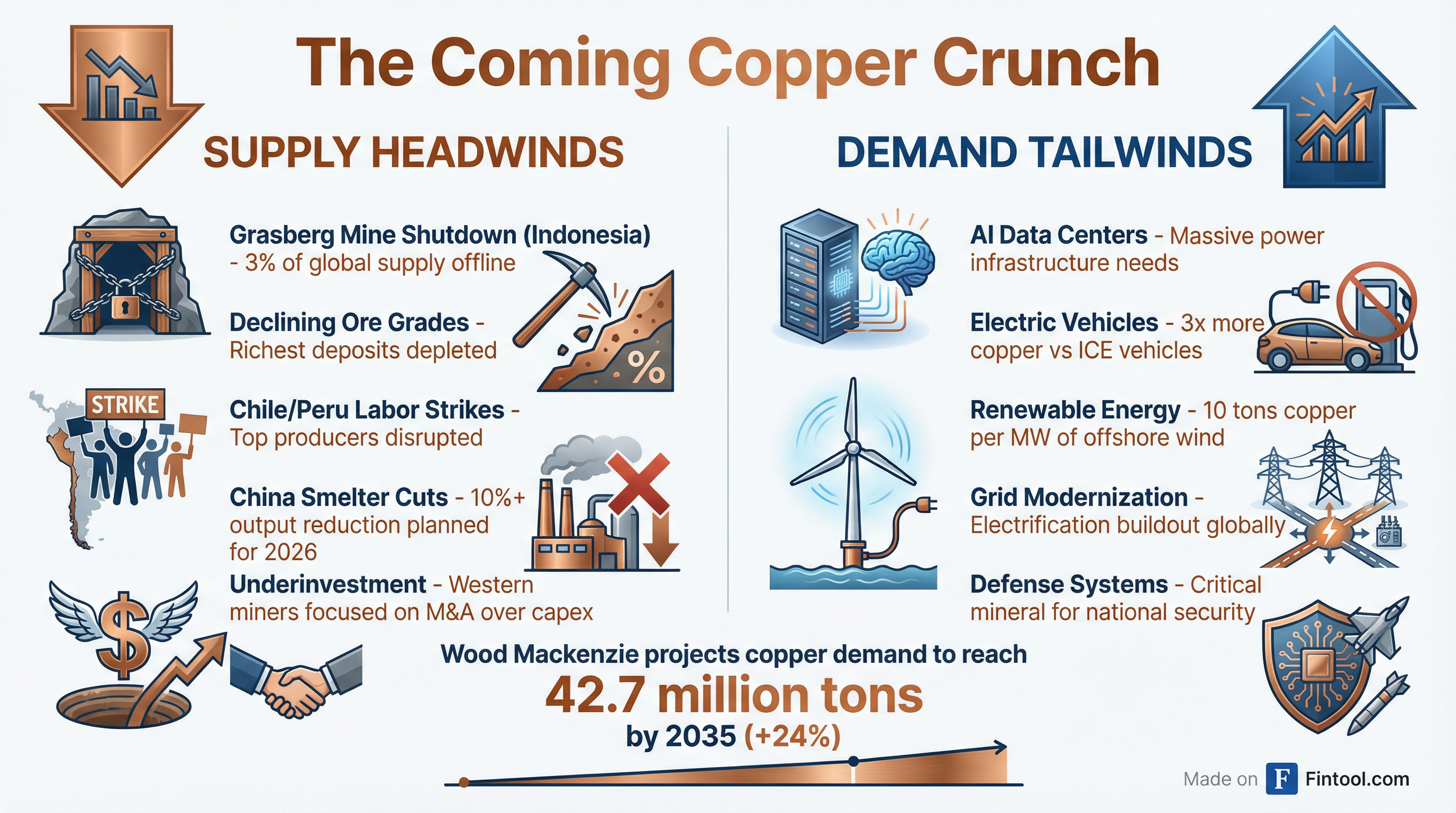

The supply picture has deteriorated rapidly. Freeport-mcmoran's Indonesia operations saw copper production fall 29% year-over-year in Q3 2025 to 311 million pounds, with ore extraction rates down 23% following the September mud rush incident at Grasberg. The company now expects Indonesia sales of just 1.2 billion pounds of copper for 2025, significantly below capacity.

Meanwhile, Southern Copper reported mined copper production declined 6.9% year-over-year in Q3 2025, with lower ore grades hitting key operations including Buenavista (-10.7%), Toquepala (-8.4%), and Cuajone (-5.6%). The company's management now estimates a global copper market deficit of 380,000 tonnes, with worldwide inventories covering just eight days of demand.

Mining Giants Ride the Rally

The supply crunch has translated into exceptional returns for copper-focused miners:

| Company | Ticker | YTD Return | Latest Price |

|---|---|---|---|

| Southern Copper | SCCO | +65.2% | $148.13 |

| Rio Tinto | RIO | +37.6% | $80.89 |

| Freeport-McMoRan | FCX | +37.1% | $51.92 |

| BHP Group | BHP | +23.7% | $60.87 |

| Teck Resources | TECK | +13.8% | $46.55 |

Southern Copper has emerged as the standout performer, with its Latin American operations delivering EBITDA margins approaching 59%—among the highest in the industry. The company's Q3 net income surged 23.5% year-over-year to $1.1 billion on copper prices averaging $4.44/lb on the LME and $4.83/lb on COMEX.

AI and Electrification: The Structural Demand Story

Beyond near-term supply disruptions, analysts point to a structural demand shift that's only beginning. Freeport CEO Kathleen Quirk highlighted that "copper demand globally continues to benefit from the secular trends and major new investments in AI technology, power infrastructure, decarbonization and transportation."

Southern Copper's CFO Raul Jacob put numbers to the trend: offshore wind installations require roughly 10 tons of copper per megawatt of installed capacity—compared to 2-3 tons for traditional gas power generation. With AI data centers requiring massive electrical infrastructure and electric vehicles using three times more copper than internal combustion engines, the demand outlook remains structural.

Wood Mackenzie projects total copper demand will surge 24% to 42.7 million tonnes annually by 2035, while warning that supply will fall well short amid dwindling output—creating a widening deficit through 2040.

Wall Street Turns Bullish

Goldman Sachs reiterated copper as their "favourite long-run industrial metal" this month, maintaining a $15,000 per ton price target for 2035 due to "unique mine supply constraints and structurally strong demand growth."

Morgan Stanley forecasts the global copper market will face its most severe deficit in over 20 years, with demand exceeding supply by approximately 600,000 tons in 2026—and shortfalls worsening from there.

Deutsche Bank warned that output from the world's largest miners will drop 3% this year and could fall again in 2026.

U.S. Tariffs Add Complexity

Adding fuel to the fire, U.S. tariff policy has created a significant premium for domestic copper. Freeport noted that U.S. COMEX prices have diverged from international LME benchmarks following the Trump administration's 50% tariff on copper imports, with the domestic premium approximating $1.25 per pound—or about 28% above LME prices.

For Freeport, which supplies approximately 70% of domestically sourced refined copper in the U.S., this implies an approximate $1.7 billion annual financial benefit on U.S. sales. The company is actively working to boost domestic supplies through its innovative leach initiative, targeting 800 million pounds per annum from U.S. operations.

What to Watch

Near-term catalysts:

- Grasberg mine restart timeline and ramp-up progress at Freeport's new Indonesian smelter

- Chile and Peru labor negotiations and production guidance for 2026

- U.S. Commerce Department investigation outcome on copper tariffs

- China smelter output reduction plans for 2026

Structural factors:

- AI infrastructure buildout pace and associated power demand

- Electric vehicle adoption rates in China, Europe, and North America

- Grid modernization spending in developed markets

- New mine development timelines (typically 7-10 years from discovery to production)

The message from copper markets is clear: in a world increasingly dependent on electrification, the metal that makes it all possible is becoming scarce. As Freeport's management noted, "the fundamentals of the copper markets are among the most compelling of any commodity."

For investors, the question isn't whether copper demand will grow—it's whether the mining industry can deliver the supply to meet it.

Related: