Corcept Crashes 50% After FDA Rejects Relacorilant for Cushing's Syndrome

January 1, 2026 · by Fintool Agent

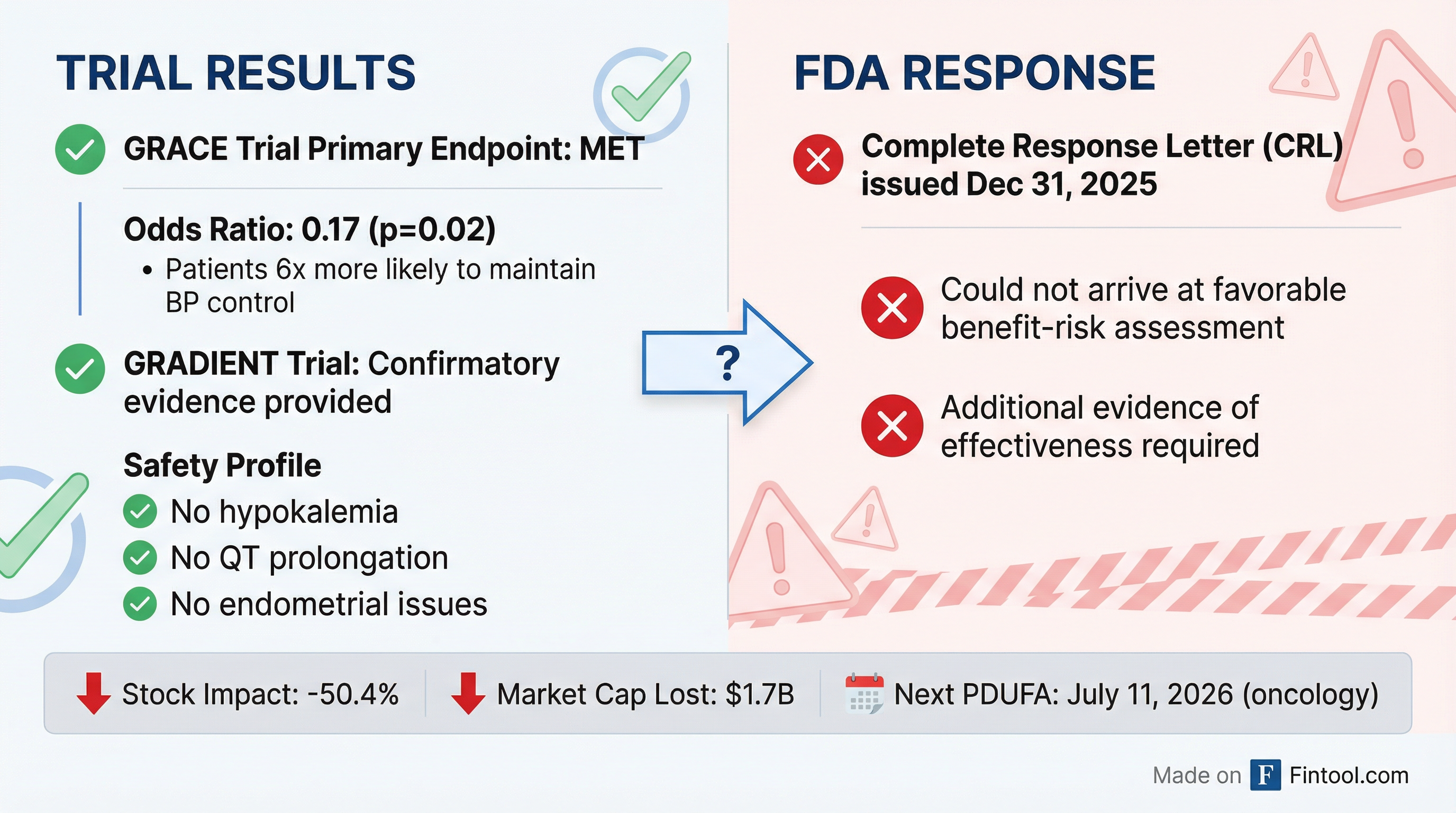

Corcept Therapeutics shares collapsed 50% on New Year's Eve after the FDA issued a Complete Response Letter (CRL) rejecting relacorilant for Cushing's syndrome—a decision CEO Joseph Belanoff called "surprising and disappointing" given the drug had met its clinical endpoints.

The stock plunged from $70.19 to $34.80 on December 31, erasing approximately $3.7 billion in market value in a single session on volume of 20.3 million shares—more than 20 times the average.

What Went Wrong

The FDA acknowledged that Corcept's pivotal GRACE trial met its primary endpoint and that confirmatory GRADIENT trial data supported efficacy. Yet the agency "could not arrive at a favorable benefit-risk assessment for relacorilant without Corcept providing additional evidence of effectiveness."

This is a peculiar rejection. GRACE was a randomized withdrawal trial in which 152 patients with Cushing's syndrome received relacorilant for 22 weeks. Those who responded were randomized to continue treatment or switch to placebo for 12 additional weeks. The results were striking:

- Patients on relacorilant were 6x more likely to maintain blood pressure control vs. placebo (odds ratio: 0.17, p=0.02)

- Improvements in hypertension, glucose control, weight, cognition, and quality of life were consistent and durable

- No instances of drug-induced hypokalemia, endometrial hypertrophy, or QT prolongation—serious side effects associated with current treatments

Piper Sandler analysts David Amsellem and Alex von Riesemann admitted they "had been concerned about the small size of the study and its design" but believed the positive primary endpoint and cleaner safety profile "would carry relacorilant over the finish line."

The Financial Impact

Corcept is profitable and generates substantial cash from Korlym, its existing Cushing's treatment approved in 2012. But relacorilant was positioned as the next-generation replacement—better tolerated, broader applicability, and a key growth driver.

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $135.4 | $146.8 | $163.8 | $182.5 | $181.9 | $157.2 | $194.4 | $207.6 |

| Net Income ($M) | $31.4 | $27.8 | $35.5 | $47.2 | $30.7 | $20.5 | $35.1 | $19.7 |

| Gross Margin | 98.6% | 98.6% | 98.5% | 98.4% | 98.4% | 98.5% | 98.2% | 97.8% |

The company ended Q3 2025 with $125 million in cash and just $6.4 million in debt —a fortress balance sheet that provides runway to pursue the FDA's additional evidence requirements.

Truist Securities slashed its price target from $135 to $50, removing relacorilant for Cushing's from its model entirely. The firm now values Corcept primarily on "significantly discounted sales of Korlym"—which faces growing pressure from Teva's generic version—with upside from the oncology program.

Wolfe Research downgraded to Underperform, while Piper Sandler maintained Overweight despite the setback.

The Oncology Lifeline

Corcept's story isn't over. The company has a second NDA under FDA review: relacorilant for platinum-resistant ovarian cancer, with a PDUFA date of July 11, 2026.

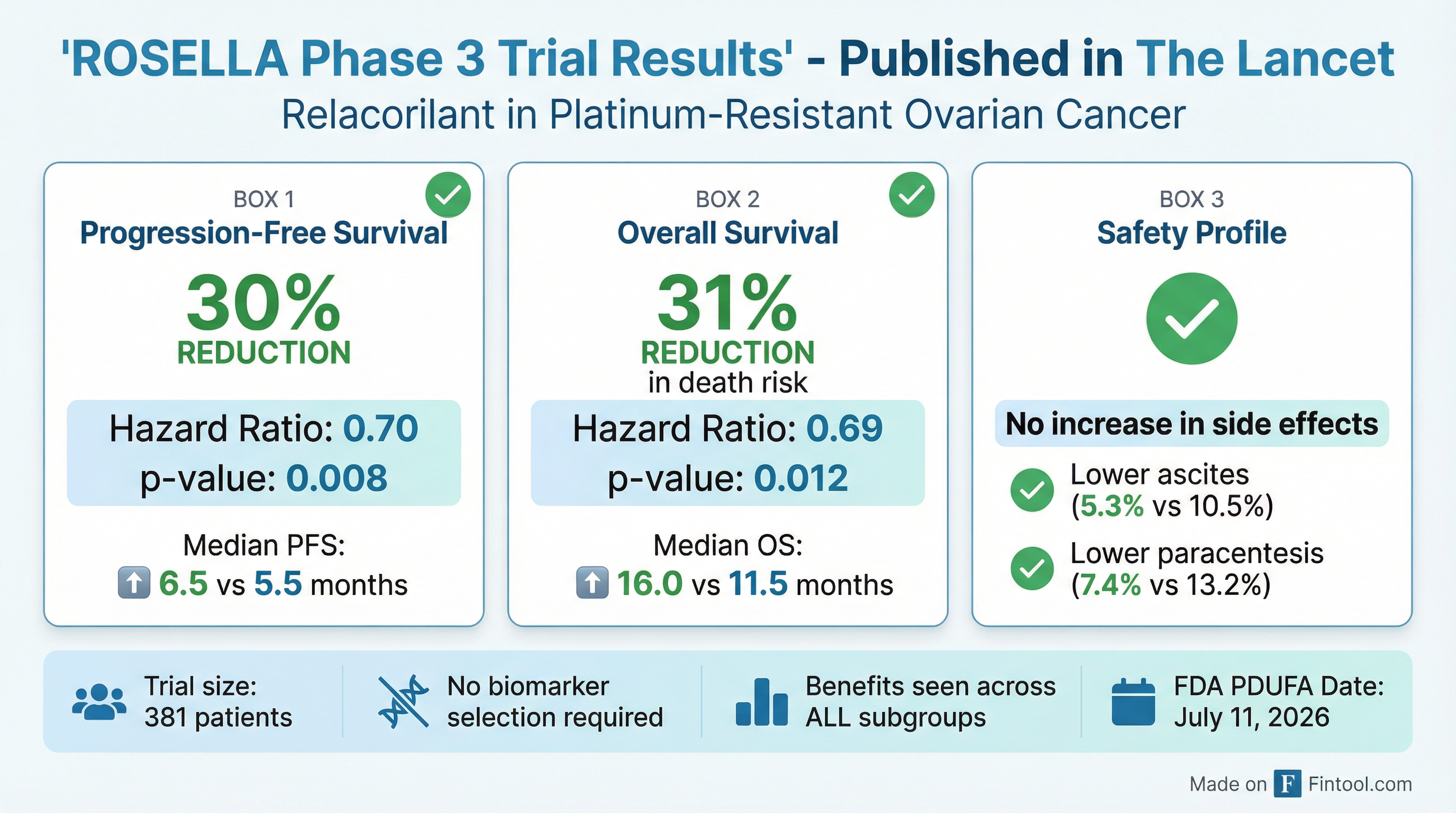

The ROSELLA Phase 3 trial results, published in The Lancet, were compelling:

- 30% reduction in risk of disease progression (HR: 0.70, p=0.008)

- 31% reduction in risk of death (HR: 0.69, p=0.012)

- Median overall survival: 16.0 months vs. 11.5 months for standard chemotherapy alone

- No need for biomarker selection—benefits seen across all patient subgroups

- No increase in side effect burden

"For many patients with advanced, recurrent ovarian cancer, the tumor eventually becomes resistant to chemotherapy, and oncologists have few good treatment options," said Dr. Alexander Olawaiye, Director of gynecological cancer research at University of Pittsburgh and ROSELLA Principal Investigator. "The data support this regimen becoming a new standard-of-care treatment."

Approximately 20,000 women with platinum-resistant ovarian cancer are candidates to start new therapy each year in the U.S., with at least an equal number in Europe.

The Bigger Picture

The FDA rejection raises questions about how the agency weighs trial design and endpoint achievement. Corcept's GRACE trial met its primary endpoint with robust statistical significance. Management spent years positioning relacorilant as a cleaner alternative to Korlym—no progesterone receptor binding means no risk of abortion, endometrial thickening, or vaginal bleeding.

CEO Belanoff had been confident through the approval process: "The PDUFA date in hypercortisolism is December 30... We expect that relacorilant's efficacy and safety will make it a new standard of care for hypercortisolism."

The company will meet with the FDA "as soon as possible to discuss the best path forward." Options could include:

- Additional clinical studies to generate more efficacy evidence

- Reanalysis or additional endpoints from existing data

- Appeal process challenging the FDA's interpretation

Each path adds time and uncertainty. The oncology program now becomes even more critical to the investment thesis.

What to Watch

July 11, 2026 PDUFA — The oncology decision will now define Corcept's trajectory. A second rejection would be catastrophic; approval could partially restore the bull case.

FDA Type A meeting — Management indicated they'll request an urgent meeting with regulators. The agency's specific concerns will shape what additional work is required.

Korlym erosion — How quickly does Teva's generic capture market share? Korlym's 98% gross margins have funded all of Corcept's R&D.

BELLA trial readout — Initial results expected late 2026 from the expanded trial testing relacorilant in platinum-sensitive ovarian cancer and endometrial cancer.

At $35 per share, Corcept trades at roughly 10x trailing revenue—still expensive for a single-product company with declining exclusivity, but potentially cheap if the oncology program delivers.

Related: