Earnings summaries and quarterly performance for CORCEPT THERAPEUTICS.

Executive leadership at CORCEPT THERAPEUTICS.

Joseph K. Belanoff, M.D.

Chief Executive Officer and President

Atabak Mokari

Chief Financial Officer and Treasurer

Charles Robb

Chief Business Officer and Secretary

Hazel Hunt, Ph.D.

Chief Scientific Officer

Joseph D. Lyon

Chief Accounting and Technology Officer

Sean Maduck

President, Corcept Endocrinology

William Guyer, Pharm.D.

Chief Development Officer

Board of directors at CORCEPT THERAPEUTICS.

Research analysts who have asked questions during CORCEPT THERAPEUTICS earnings calls.

David Amsellem

Piper Sandler Companies

6 questions for CORT

Swayampakula Ramakanth

H.C. Wainwright & Co.

5 questions for CORT

Joon Lee

Truist Securities

3 questions for CORT

Edward Nash

Canaccord Genuity

2 questions for CORT

Jing He

Truist Securities

2 questions for CORT

Asim Rana

Truist Securities

1 question for CORT

Matthew Kaplan

Ladenburg Thalmann

1 question for CORT

Ramakanth Swayampakula

H.C. Wainwright & Co., LLC

1 question for CORT

Recent press releases and 8-K filings for CORT.

- Corcept Therapeutics (CORT) is facing a class action lawsuit for investors who purchased securities between October 31, 2024, and December 31, 2025, with a lead plaintiff motion deadline of April 21, 2026.

- The lawsuit alleges that Corcept misrepresented the strength of its relacorilant New Drug Application (NDA), despite the FDA repeatedly raising concerns about the adequacy of clinical evidence.

- On December 31, 2025, the FDA issued a Complete Response Letter (CRL) for relacorilant due to insufficient evidence of effectiveness, causing Corcept's stock price to fall by more than 50%.

- Robbins LLP has filed a class action lawsuit against Corcept Therapeutics (CORT) on behalf of investors who purchased common stock between October 31, 2024, and December 30, 2025, alleging the company misled investors regarding the viability of its new product candidate, relacorilant.

- The lawsuit claims Corcept misrepresented the strength of clinical trials supporting relacorilant's New Drug Application (NDA) to the FDA, despite known concerns from the FDA about the adequacy of evidence.

- On December 31, 2025, the FDA issued a Complete Response Letter (CRL) for relacorilant's NDA, stating it could not achieve a favorable benefit-risk assessment without additional evidence of effectiveness.

- Following this disclosure, Corcept's common stock price declined 50.4%, from a closing price of $70.20 on December 30, 2025, to $34.80 on December 31, 2025.

- Corcept Therapeutics reported $761 million in revenue for full year 2025 and provided full year 2026 revenue guidance of $900 million-$1 billion. The company also repurchased $245 million worth of common stock in 2025.

- The FDA issued a Complete Response Letter for relacorilant as a treatment for Cushing's syndrome, which the company plans to discuss with the FDA in April 2026 to determine next steps.

- The company announced positive final results from the Phase 3 ROSELLA trial for relacorilant in platinum-resistant ovarian cancer, showing a 35% reduction in the risk of death and a 4.1-month longer median overall survival. The FDA PDUFA date for this indication is July 11th, 2026.

- Corcept's Cushing's syndrome business experienced a surge in demand in 2025, with a 61% increase in new prescriptions, and has addressed prior capacity issues by transitioning to a new specialty pharmacy. Additionally, a Federal Circuit Court of Appeals ruled against the company in its lawsuit to prevent Teva Pharmaceuticals from marketing a generic version of Korlym, a decision Corcept plans to appeal.

- Corcept Therapeutics reported full-year 2025 revenue of $761 million and net income of $99.7 million, and provided full-year 2026 revenue guidance of $900 million to $1 billion.

- The FDA did not approve relacorilant as a treatment for Cushing's syndrome, with the company planning to meet with the FDA in April 2026 to better understand its decision.

- The Federal Circuit Court of Appeals ruled against Corcept in its lawsuit to prevent Teva Pharmaceuticals from marketing a generic version of Korlym, a decision Corcept plans to appeal.

- The Phase 3 ROSELLA trial for relacorilant in platinum-resistant ovarian cancer met both primary endpoints, demonstrating a 35% reduction in risk of death and 4.1 months longer median overall survival; the FDA PDUFA date is July 11, 2026.

- The company's Cushing's syndrome business experienced a surge in demand in 2025 and expects to reach at least $2 billion in annual revenue by the end of the decade, with improved pharmacy capacity now in place.

- Corcept Therapeutics reported full-year 2025 revenue of $761 million and net income of $99.7 million, and provided 2026 revenue guidance of $900 million to $1 billion.

- The company received a Complete Response Letter from the FDA for relacorilant in Cushing's syndrome and experienced an adverse Federal Circuit Court ruling against Korlym patents.

- Positive Phase III ROSELLA trial results for relacorilant in platinum-resistant ovarian cancer showed a 35% reduction in the risk of death, with an FDA PDUFA date of July 11, 2026.

- Corcept repurchased $245 million worth of common stock in 2025 and ended the year with $532 million in cash and investments.

- The Cushing's syndrome business transitioned to a new specialty pharmacy, CURAD, to resolve prior capacity issues, with improved performance expected after initial disruptions.

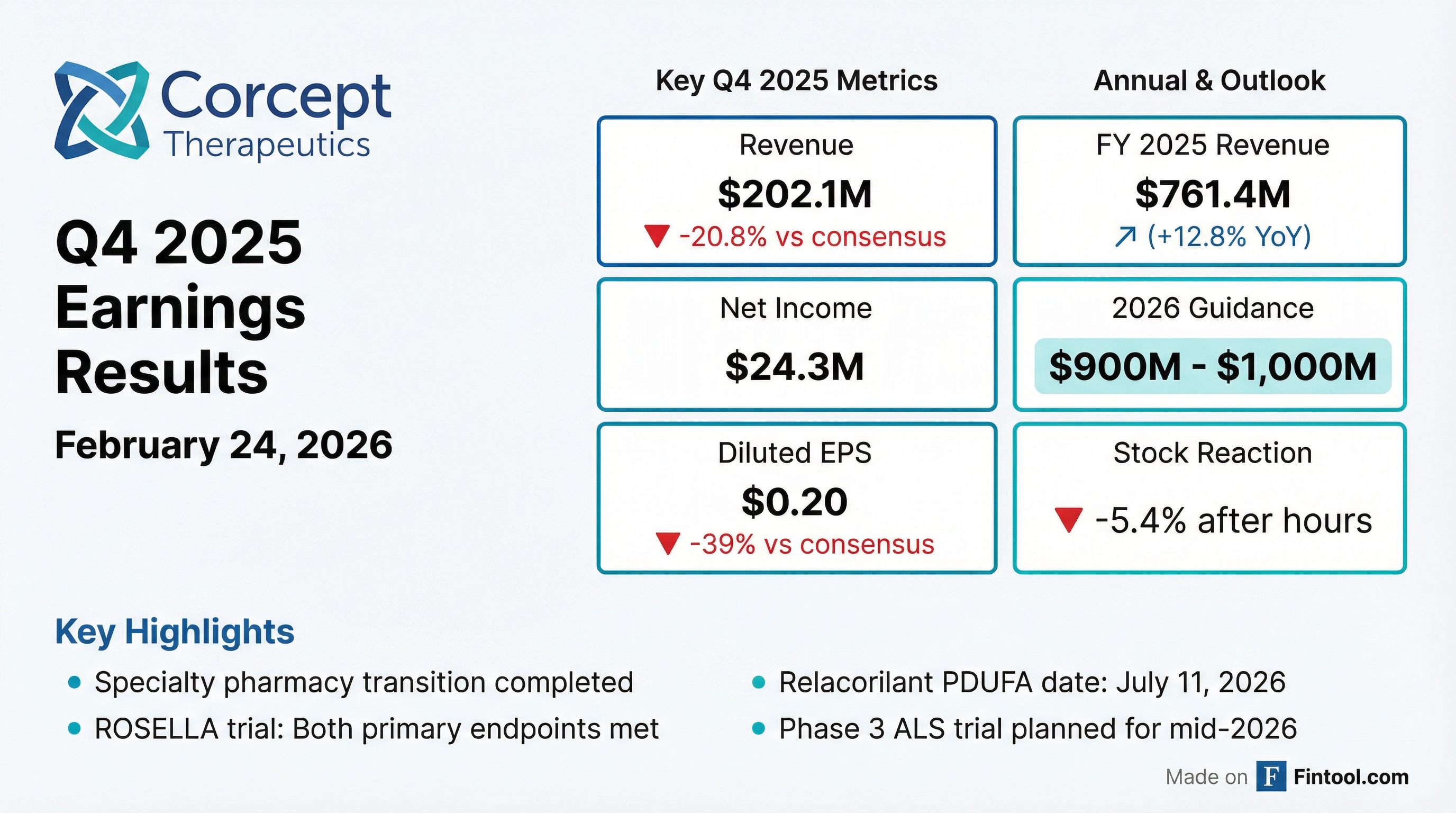

- Corcept Therapeutics announced its fourth quarter and full-year 2025 audited financial results on February 24, 2026.

- The company reported revenue, net income, and diluted EPS for Q4 and FY 2025, and provided 2026 revenue guidance, as detailed in the table below.

- Cash and investments totaled $532.4 million at December 31, 2025, and Corcept paid $245.9 million to purchase its common stock in 2025.

- The PDUFA date for the relacorilant New Drug Application (NDA) in platinum-resistant ovarian cancer is July 11, 2026.

| Metric | Q4 2025 | FY 2025 | FY 2026 Guidance | As of Dec 31, 2025 |

|---|---|---|---|---|

| Revenue ($USD Millions) | $202.1 | $761.4 | $900 - $1,000 | N/A |

| Net Income ($USD Millions) | $24.3 | $99.7 | N/A | N/A |

| Diluted EPS ($USD) | $0.20 | $0.82 | N/A | N/A |

| Cash and investments ($USD Millions) | N/A | N/A | N/A | $532.4 |

| Common Stock Repurchased ($USD Millions) | N/A | $245.9 | N/A | N/A |

- Corcept Therapeutics reported full-year 2025 revenue of $761.4 million and net income of $99.7 million, with diluted net income per common share of $0.82.

- The company provided full-year 2026 revenue guidance of $900 – $1,000 million.

- Cash and investments totaled $532.4 million at December 31, 2025, following the repurchase of $245.9 million of common stock in 2025.

- Key clinical development updates include a July 11, 2026 PDUFA date for relacorilant in platinum-resistant ovarian cancer and ongoing engagement with the FDA regarding the New Drug Application for relacorilant in Cushing's syndrome.

- A securities class action lawsuit has been filed against Corcept Therapeutics Incorporated (NasdaqCM: CORT) and certain executives for allegedly failing to disclose material information during the Class Period from October 31, 2024, to December 30, 2025.

- The lawsuit alleges that the company misrepresented the high likelihood of FDA approval for its new product candidate, relacorilant.

- On December 31, 2025, Corcept disclosed that the FDA issued a Complete Response Letter (CRL) for relacorilant's New Drug Application (NDA), concluding it required additional evidence of effectiveness.

- Following this disclosure, Corcept's share price plummeted by $35.40 per share, or 50.4%, from $70.20 on December 30, 2025, to $34.80 on December 31, 2025.

- Investors have until April 21, 2026, to file lead plaintiff applications in the lawsuit.

- The United States Court of Appeals for the Federal Circuit has ruled that Teva Pharmaceuticals' marketing of a generic version of Korlym® does not infringe two of Corcept's patents.

- These patents relate to methods of safely co-administering Korlym and drugs that inhibit the CYP3A4 enzyme.

- This ruling affirms a December 2023 verdict by the Federal District Court for the District of New Jersey.

- Corcept's CEO, Joseph K. Belanoff, expressed disappointment with the ruling and stated the company will vigorously defend its rights, considering judicial review of the decision.

- The Schall Law Firm is investigating Corcept Therapeutics Incorporated (NASDAQ: CORT) for potential violations of securities laws, focusing on whether the company issued false or misleading statements.

- This investigation follows Corcept's December 31, 2025, announcement that the FDA issued a Complete Response Letter (CRL) regarding the New Drug Application (NDA) for relacorilant.

- The FDA's CRL indicated that it could not achieve a favorable benefit-risk assessment for relacorilant without additional evidence of effectiveness, which resulted in a more than 50% drop in Corcept's share price.

Fintool News

In-depth analysis and coverage of CORCEPT THERAPEUTICS.

Quarterly earnings call transcripts for CORCEPT THERAPEUTICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more