FDA Removes Suicide Warnings From Blockbuster Weight-Loss Drugs Wegovy and Zepbound

January 13, 2026 · by Fintool Agent

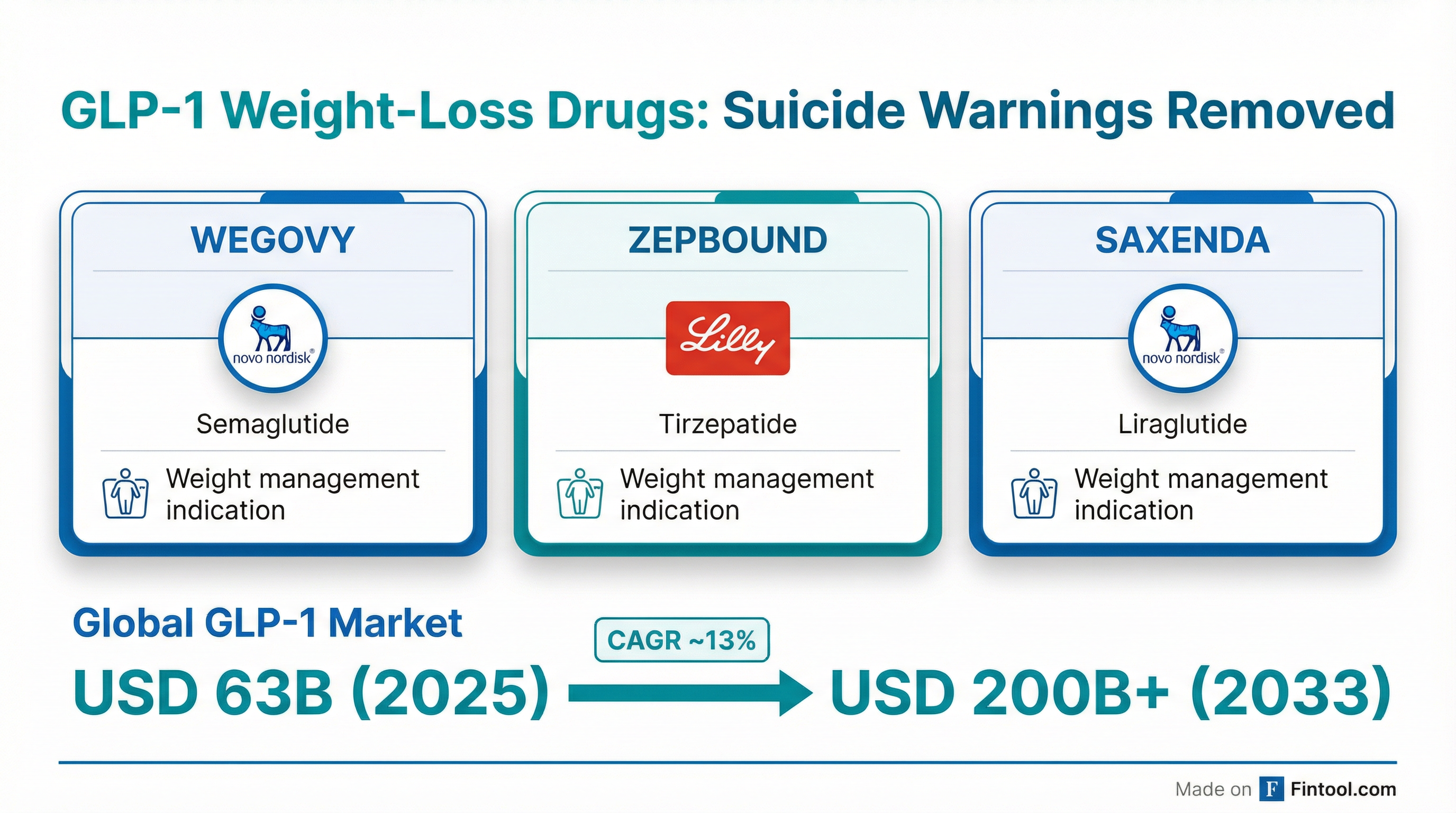

The FDA on Tuesday requested drugmakers remove warnings about suicidal thoughts and behavior from the labels of blockbuster GLP-1 weight-loss medications, concluding a nearly two-year investigation that found no evidence of increased risk—a regulatory victory for Eli Lilly+3.66% and Novo Nordisk+9.92% as they compete for dominance in the $63 billion obesity drug market.

The decision affects three approved weight-loss drugs: Novo Nordisk's Wegovy (semaglutide) and Saxenda (liraglutide), and Eli Lilly's Zepbound (tirzepatide). Notably, diabetes-focused versions of these drugs—Ozempic and Mounjaro—never carried the warnings, creating an inconsistency the FDA says it is now correcting.

"Today's FDA action will ensure consistent messaging across the labeling for all FDA approved GLP-1 RA medications," the agency stated.

Why the Warning Existed

The suicide-related language had been included in the original labeling of weight-loss formulations as a precautionary measure, based on adverse events observed with older weight-loss medications—not because of specific concerns about GLP-1 drugs themselves.

In July 2023, after receiving postmarketing reports of suicidal ideation in patients taking GLP-1 drugs, the FDA launched a formal investigation. The review examined clinical trial data, postmarketing surveillance, observational studies, and individual case reports. A preliminary report in January 2024 found no evidence of a link but indicated the investigation would continue.

The final conclusion: the warnings should be removed entirely.

What It Means for Investors

The regulatory clarification removes a potential overhang from drugs that have become the crown jewels of both Eli Lilly+3.66% and Novo Nordisk+9.92%. While the warning was largely a labeling formality—prescribers and patients had broadly continued using the drugs—the clean label eliminates one more barrier to adoption in a market projected to reach $200 billion by 2033.

The Revenue Stakes

These drugs have become the fastest-growing pharmaceutical products in history:

Eli Lilly's Tirzepatide Franchise (Mounjaro + Zepbound):

| Metric | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|

| Mounjaro Revenue | $4.3B | $5.2B | $6.5B |

| Zepbound Revenue | $2.3B | $3.4B | $3.6B |

| Combined YoY Growth | - | 85% / 172% | 109% / 185% |

In Q3 2025 alone, Eli Lilly's total revenue hit $17.6 billion, up 54% year-over-year, driven almost entirely by its cardiometabolic health segment.

Novo Nordisk's GLP-1 Obesity Care grew 125% in international operations during the first half of 2025, with Wegovy alone generating DKK 12.2 billion outside the United States—a 335% increase.

Stock Impact

Both stocks traded slightly lower on Tuesday, moving with the broader market rather than on the FDA news, which was released mid-session. At market close:

- Eli Lilly (LLY): $1,077.19, down 0.35% — market cap ~$968 billion

- Novo Nordisk (NVO): $59.64, down 0.37% — market cap ~$265 billion

The Bigger Picture: A $200B+ Market

The GLP-1 market is one of the fastest-growing segments in pharmaceuticals. Industry estimates put the current market at $63-78 billion, with projections ranging from $150 billion to $315 billion by the early 2030s—representing a compound annual growth rate of 13-17%.

Key market dynamics:

- North America dominates with approximately 76% market share

- Obesity indication expanding rapidly: While diabetes remains the largest segment, weight management in non-diabetic populations is the fastest-growing use case

- Supply constraints easing: Both companies have ramped manufacturing capacity after years of shortages

The Competition Heats Up

The FDA's label clarification comes as competition in the obesity space intensifies:

- CVS exclusion impact: Eli Lilly noted that CVS's decision to exclude Zepbound from its template formulary (effective July 1, 2025) has negatively impacted prescriptions and remains "a headwind to the rate of volume growth"

- Next-generation drugs: Both companies have higher-dose formulations and oral versions in development, with Novo Nordisk submitting a 7.2mg semaglutide formulation to European regulators

- New entrants: Companies like Pfizer, Amgen, and Viking Therapeutics are advancing their own GLP-1 programs

What to Watch

Near-term catalysts:

- Full-year 2025 earnings from both companies (late January/early February)

- Cardiovascular indication expansion for Mounjaro following positive SURPARS CVOT results

- Progress on oral GLP-1 formulations

Ongoing risks:

- Insurance coverage decisions and pricing pressure

- Manufacturing capacity vs. demand

- Competitive pipeline drugs approaching market

Related Companies: Eli Lilly+3.66% · Novo Nordisk+9.92%