Ford Unveils $30,000 Electric Pickup: Inside the 'Skunkworks' Platform Built to Beat China

February 17, 2026 · by Fintool Agent

Ford revealed the technical blueprint for its most important product in decades on Tuesday: a midsize electric pickup truck starting at approximately $30,000, built on a radically redesigned manufacturing platform led by a former Tesla engineer. The announcement comes just two months after Ford took a $19.5 billion writedown on its electric vehicle business and ended production of the F-150 Lightning.

Ford shares closed at $14.13, up 0.07% on the day, having recovered roughly 40% from post-writedown lows near $10.

A Clean-Sheet Approach After a $19.5 Billion Lesson

The Universal EV Platform (UEV) represents Ford's admission that its first-generation EVs—the Mustang Mach-E and F-150 Lightning—were adapted from existing architectures rather than purpose-built for electric powertrains. That approach proved costly: Ford's Model e segment lost billions annually and culminated in an $8.1 billion impairment charge in Q4 2025.

"We're still on a really steep decline of EV costs, and you can only get that by innovating," said Alan Clarke, who heads Ford's advanced EV development team in Long Beach, California. Clarke spent 12 years at Tesla, contributing to every volume vehicle the company produced: Model S, Model X, Model 3, Model Y, and Cybertruck.

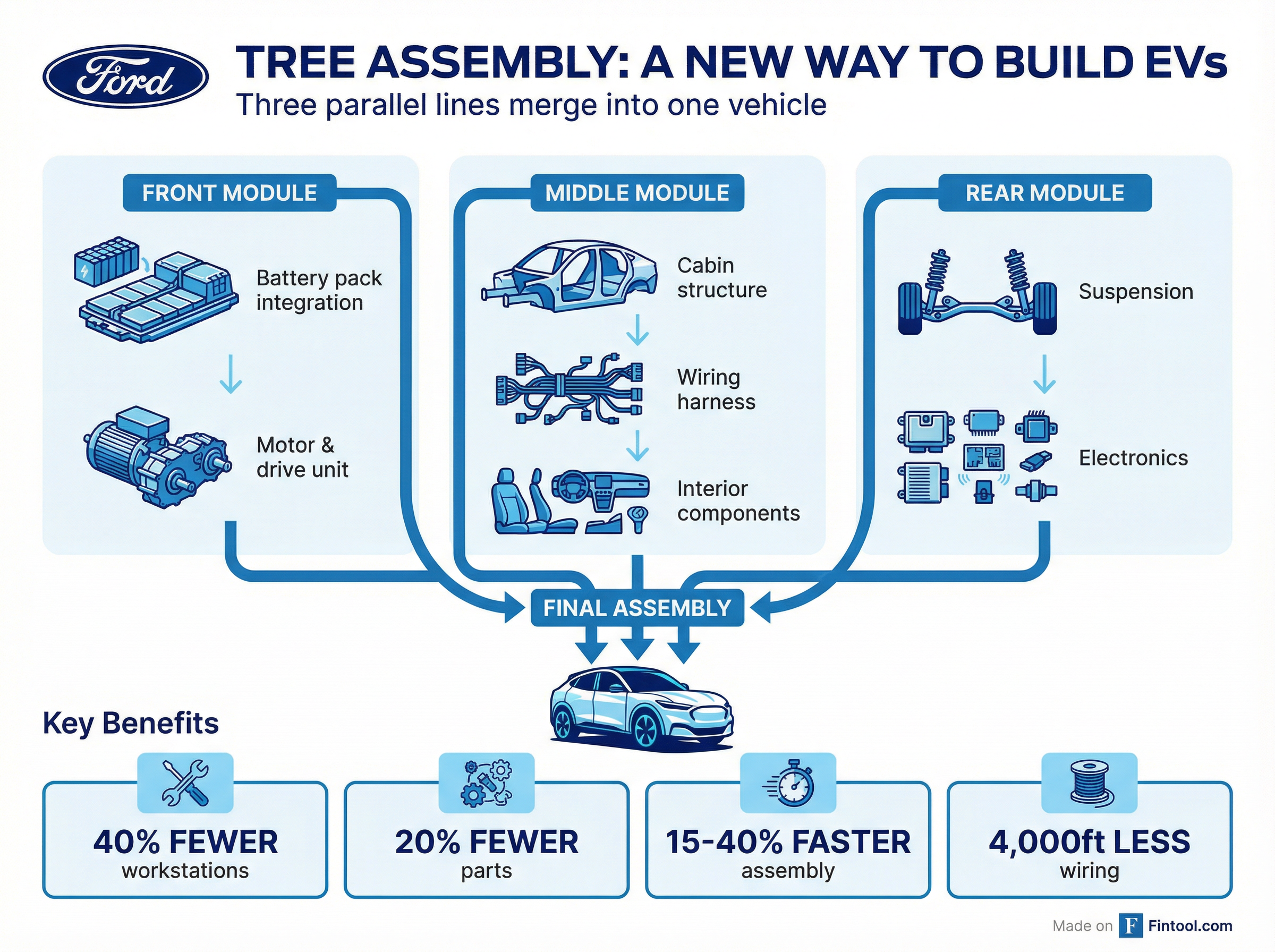

The skunkworks team threw out Ford's traditional assembly line playbook. Instead of building vehicles sequentially from start to finish, the UEV uses "tree assembly"—three parallel production lines that independently construct the front, middle, and rear sections before merging them in final assembly.

Manufacturing Metrics That Matter

The platform's efficiency gains are substantial:

| Metric | Improvement |

|---|---|

| Workstations | 40% fewer |

| Total Parts | 20% fewer |

| Fasteners | 25% fewer |

| Assembly Speed | 15-40% faster |

| Wiring Length | 4,000 feet shorter |

| Wiring Weight | 22 lbs lighter |

To track these improvements, Ford developed a bounty system that quantifies how any single engineering change affects weight, drag, rolling resistance, and assembly processes—ultimately calculating its contribution to vehicle cost and battery capacity. The system has since been adopted by other Ford divisions.

The Battery Bet: LFP Chemistry and Chinese Technology

Batteries represent more than 40% of an EV's total cost and roughly 25% of its weight. Ford's solution is lithium iron phosphate (LFP) chemistry—cheaper and safer than nickel-based alternatives, though with lower energy density.

The cells will be manufactured domestically at Ford's BlueOval Battery Park in Marshall, Michigan—part of a $3 billion investment in U.S. battery production. However, the batteries use licensed technology from China's CATL, which has drawn scrutiny from lawmakers concerned about Chinese involvement in the supply chain.

Ford also redesigned the vehicle's electrical architecture, replacing dozens of supplier-provided central processing units with just five Ford-designed ECUs. A new 48-volt power system for certain functions reduces resistance and copper requirements, improving efficiency while lowering cost.

Product Positioning: Maverick-Sized, RAV4 Interior

The first UEV vehicle will be a midsize pickup roughly comparable in exterior dimensions to Ford's gas-powered Maverick but with interior volume exceeding the Toyota RAV4—one of the world's best-selling vehicles. Ford estimates 0-60 mph acceleration of approximately 5.6 seconds.

The battery serves as part of the truck's structural floor, eliminating unnecessary parts while improving handling and reducing cabin noise. Ford has not disclosed range specifications or charging times, with those details expected later this year.

Production is scheduled to begin in 2026 at Louisville Assembly Plant in Kentucky, with sales launching in 2027 as a 2028 model year vehicle. Ford is investing nearly $2 billion to transform the facility.

CEO Farley: "Tesla Has Shown We Can Make Money"

On Ford's Q4 earnings call last week, CEO Jim Farley laid out the strategic logic: "Tesla has shown that we can make money in that market even without subsidy from the government at the right cost level."

Farley positioned the UEV as targeting "the majority of profitable EVs sold in the U.S., which are $35,000 EVs, high volume." The platform will spawn multiple vehicles—SUVs, commercial vans, and smaller cars—all sharing components and manufacturing processes.

The strategy marks a sharp contrast to Ford's earlier approach. The cancelled F-150 Lightning started at over $55,000 and bled money on every unit sold. The UEV platform is designed to be profitable from launch.

Financial Reality: Digging Out of a Deep Hole

Ford's fiscal 2025 results underscore the magnitude of its EV challenges:

| Metric | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Revenue | $165.9B | $172.7B | $174.0B* |

| Net Income | $4.3B | $5.9B | ($8.2B) |

| Capital Expenditure | $8.2B | $8.7B | $8.8B |

*Values retrieved from S&P Global

The FY 2025 net loss was driven almost entirely by Q4, when Ford recorded an $11 billion loss including the $8.1 billion Model e impairment.

Competitive Context: A Crowded Race to $30,000

Ford isn't alone in pursuing affordable EVs. Bezos-backed startup Slate is also targeting a $30,000 electric pickup. General Motors has signaled plans for lower-priced EVs, though without Ford's timeline specificity. Rivian continues to lose money on its premium trucks while working toward a smaller, cheaper platform.

Chinese automakers like BYD have already achieved profitability on EVs at aggressive price points, enabled by lower labor costs, government subsidies, and vertically integrated supply chains. Ford's UEV represents Detroit's most direct response to that competitive threat.

The stakes extend beyond Ford. If the company can prove that an American automaker can build a profitable $30,000 EV in domestic factories, it could reshape assumptions about the industry's transition timeline—and provide a template for peers still struggling with EV economics.

What to Watch

2027 Launch Execution: Can Ford hit its target price without sacrificing quality? The Maverick's success suggests demand exists for compact, affordable trucks.

CATL Technology Scrutiny: Political pressure on Chinese battery partnerships could force changes to Ford's supply chain or trigger cost increases.

Consumer Demand: Americans have shown tepid enthusiasm for EVs at current price points. A $30,000 truck could unlock latent demand—or face the same headwinds as pricier models.

Platform Expansion: Ford plans multiple vehicles on UEV. Success or failure of the first pickup will determine whether those follow-on products get green-lit.

Related Companies: Ford Motor Company · Tesla · General Motors · Rivian