Fox Corporation Posts Blowout Q2 as Ad Demand Defies Post-Political Slowdown

February 4, 2026 · by Fintool Agent

Fox Corporation-3.61% delivered a fiscal Q2 earnings beat that Wall Street didn't see coming—adjusted EPS of $0.82 crushed the $0.52 consensus by 58%, while revenue of $5.18 billion topped estimates by 3%. The outperformance came despite lapping a year-ago quarter stuffed with political advertising, as the media company's news, sports, and streaming operations each set records.

Yet shares fell 6% on Wednesday, closing at $67.73. The disconnect between beat and stock reaction tells a story about what investors are actually focused on: net income plunged 39% to $229 million, and adjusted EBITDA dropped 11% to $692 million as sports rights costs and Fox One investment weighed on the bottom line.

The Advertising Boom

CEO Lachlan Murdoch didn't mince words: "We are experiencing the most robust advertising market we have seen for some time." The numbers back it up across the entire portfolio.

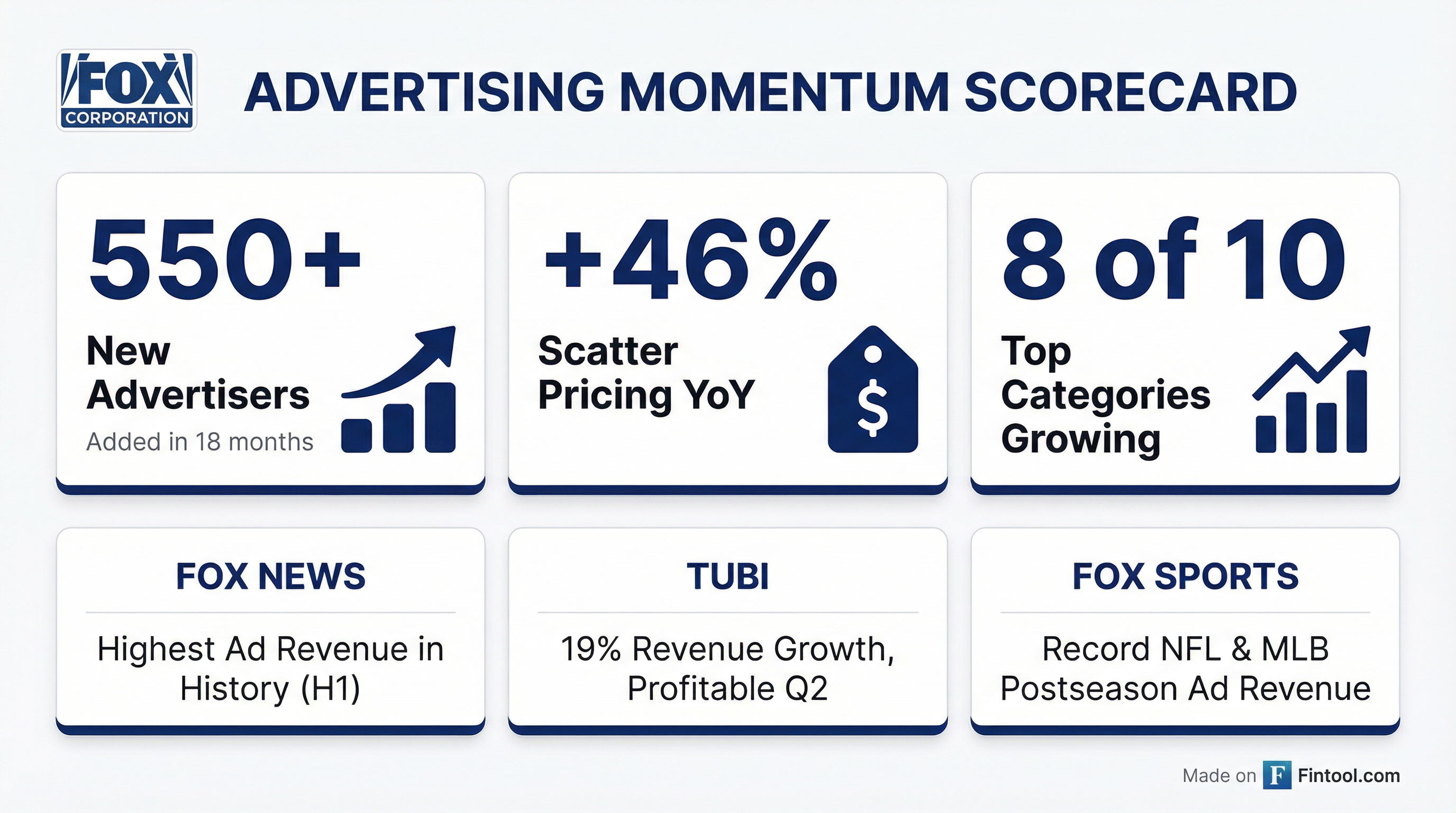

Fox News posted its highest second-quarter advertising revenue in history and its highest first-half ad revenue ever. The network added roughly 200 new advertisers in the first half of fiscal 2026, building on 350 new advertisers added the prior year—a cumulative gain of 550 brands in 18 months.

The pricing power is striking: scatter advertising rates rose 46-47% year-over-year, while direct response pricing remained strong. Of the top 10 advertising categories Fox tracks nationally, eight posted significant growth, led by financial services (particularly insurance companies).

Fox Sports set records across multiple franchises:

- Highest ad revenue for any Sunday NFL package in history

- Highest postseason and NFC Championship ad revenue in Fox Sports history

- Highest full-season ad revenue on college football in Fox history

- Record Major League Baseball postseason ad revenue

Tubi delivered its highest quarterly, weekly, and daily ad revenue ever, with revenue growing 19% year-over-year.

Tubi Hits Profitability, Again

The free ad-supported streaming service achieved EBITDA profitability for the second consecutive quarter while posting its most-streamed quarter ever. Total view time surged 27% year-over-year, driven overwhelmingly by on-demand content (over 95% of consumption).

Murdoch emphasized Tubi's demographic advantage: "Tubi's audience is younger, it's more diverse, and it's hard to reach. 70% of Tubi's user base are cord cutters or cord nevers. This is higher than any of our competitive set."

The combination of audience quality and profitability marks a significant milestone in the streaming wars, where most services continue burning cash. Tubi's ad-supported model—no subscriptions, unlimited free content—appears increasingly viable.

Fox One Exceeds Expectations

Fox's direct-to-consumer streaming bundle, launched in September 2025, continues to outperform internal projections. Management maintains guidance for "low- to mid-single-digit millions of subscribers over the next 3 or 4 years" and says they're well on track.

Critically, Fox hasn't observed "any noticeable cannibalization of traditional subscribers"—a result of targeted marketing to cord-cutters and cord-nevers. About one-third of Fox One viewers primarily watch news, and these users engage nearly three times as many minutes per week as sports-only viewers.

The platform costs sit in the corporate segment, which saw its EBITDA loss widen from $81 million to $138 million. Fox One then pays affiliate fees to the cable and TV segments, meaning the streaming investment is temporarily pressuring consolidated profitability while building a future-proofed distribution channel.

The Numbers

| Metric | Q2 2026 | Q2 2025 | Change |

|---|---|---|---|

| Revenue | $5.18B | $5.08B | +2% |

| Adjusted EPS | $0.82 | $0.96 | -15% |

| Adjusted EBITDA | $692M | $781M | -11% |

| Net Income | $229M | $373M | -39% |

| Cable Revenue | $2.28B | $2.17B | +5% |

| Television Revenue | $2.94B | $2.97B | -1% |

The divergence between top-line strength and bottom-line pressure reflects deliberate investment choices: higher sports programming and production costs, continued growth spend at Tubi and Fox One, and the absence of prior-year political advertising at local stations.

What to Watch

World Cup 2026 (June): The FIFA Men's World Cup, co-hosted by the US, Canada, and Mexico, represents Fox's biggest sports catalyst of the year. When asked if it would be profitable, Murdoch was direct: "Yes, it will. There's a tremendous excitement around the World Cup by the sponsors and other traditional advertisers."

NFL Rights Renewal: The upcoming NFL contract renegotiation looms as both opportunity and risk. Jessica Reif Ehrlich of Bank of America pressed on potential cost increases; Murdoch said Fox would consider "balancing or rebalancing our portfolio" across sports if needed.

Midterm Elections: Political advertising revenue typically skews heavily to Fox's local stations. Management expects "robust political advertising" as the cycle progresses, with Fox News increasingly capturing national political ad spend.

Flutter/FanDuel Stake: Fox holds a 2.5% stake in Flutter Entertainment worth approximately $700 million, plus an option on 18.6% of FanDuel valued at roughly $2.1 billion based on buy-side estimates. Combined, that's $2.8 billion or $6-7 per share that Murdoch suggested isn't reflected in the current stock price.

Skinny Bundles: Management believes Fox benefits from the shift to skinnier cable packages because it sells its channels as a bundle to distributors. "We are not impacted by whether they choose to offer a sports bundle or a news bundle or another type of bundle."

Capital Return Machine

Fox has returned $10.4 billion to shareholders through buybacks and dividends since the company was established in 2019. Year-to-date, Fox repurchased $1.8 billion in stock, bringing cumulative buybacks to $8.4 billion—approximately 35% of total shares outstanding.

The company announced a $0.28 per share semiannual dividend, payable March 25 to shareholders of record on March 4, 2026.

With $2 billion in cash and $6.6 billion in debt, the balance sheet supports continued capital returns alongside growth investments.

The Bottom Line

Fox's Q2 demonstrates that live news and sports remain advertising magnets even as the broader media landscape fractures. The company's strategy of leaning into must-see live content—while building streaming optionality through Tubi and Fox One—appears to be working.

But investors are pricing in the margin pressure from sports rights inflation and streaming investment. The stock trades at $67.73 versus a consensus target of $73, suggesting limited near-term upside until bottom-line improvement catches up with top-line strength.

The World Cup could prove the catalyst that changes the narrative. Until then, Fox remains a story of strategic positioning for a post-cable world—at the cost of current profitability.