Frontier CEO Dempsey Outlines $200M Savings Plan at Barclays Conference, Sees 10%+ Q1 RASM Growth

February 17, 2026 · by Fintool Agent

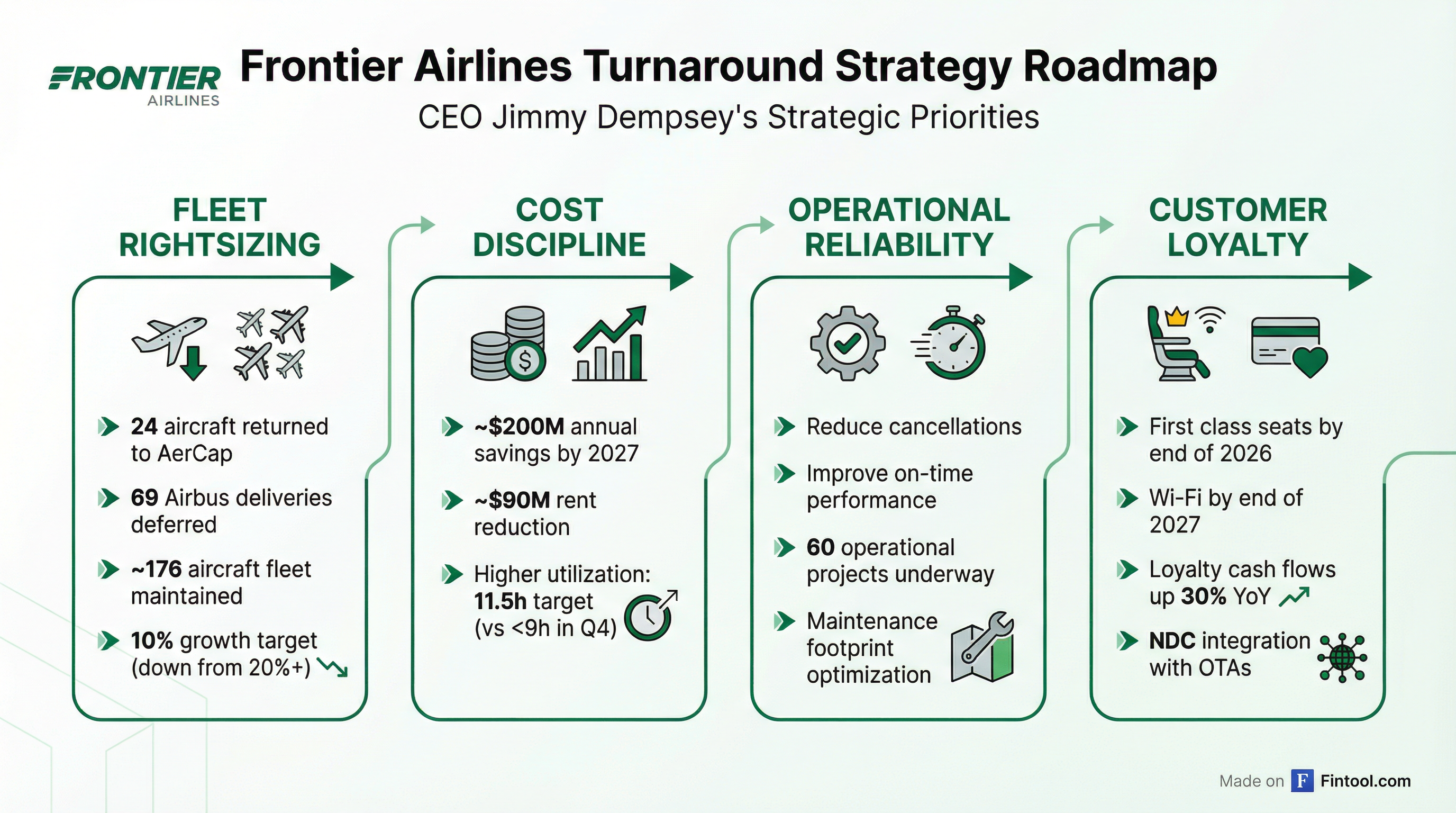

Frontier Airlines CEO Jimmy Dempsey laid out an aggressive turnaround strategy at the Barclays 43rd Annual Industrial Select Conference today, projecting more than 10% year-over-year improvement in unit revenues for Q1 2026 while targeting roughly $200 million in annual cost savings by 2027.

The ultra-low-cost carrier, trading at $5.35 after reporting its first profitable quarter in 2025 last week, is betting that a smaller, more productive fleet and Spirit Airlines' ongoing collapse will restore sustainable profitability.

"We're seeing about a 10%+ improvement in stage length adjusted RASM year-over-year, which is really positive into our business," Dempsey told analysts at the Miami conference, joined by CFO Mark Mitchell. "Half of that is linked to the supply-demand dynamic that exists, and half of it is through actions that we have made ourselves."

The Fleet Reset

Dempsey's turnaround centers on returning 24 A320neo aircraft to Aercap and deferring 69 Airbus deliveries—moves that will keep Frontier's fleet flat at 176 aircraft through 2027 while slashing ownership costs.

The AerCap transaction alone generates approximately $90 million in annual rent savings, with aircraft departures scheduled for April through early June. The 69 deferred aircraft, originally slated for 2027-2030 delivery, have been pushed to 2031-2033.

"The airline got out of sync from an aircraft perspective to the activity in the airline," Dempsey explained. "Our utilization rate dropped quite meaningfully to the point in Q4 where we had a utilization rate of less than 9 hours. We'll move that back towards 11.5 hours over the next 18-24 months."

Revenue Momentum Building

The unit revenue story may be more compelling than the cost cuts. Despite capacity growing 8% in March, Frontier expects RASM growth exceeding 10% in the month—its strongest seasonal revenue period.

Key drivers include:

- NDC integration with online travel agents, enabling customers to purchase bundles directly at booking rather than through Manage My Booking

- Spirit's retreat from overlapping markets, particularly in Las Vegas and the Western U.S.

- Load factor recovery without fare deterioration

"If you look at Frontier over the last three or four years, you've seen the overlap between Frontier and Spirit at somewhere between 40% and 50%. You're seeing that overlap reduce quite considerably, and we think that's actually quite structurally favorable to the business going forward," Dempsey said.

Spirit's second Chapter 11 bankruptcy filing in August 2025 has accelerated its capacity retreat. The carrier is cutting its network by 25% and plans to operate as few as 88-106 aircraft post-restructuring—less than half its 2024 peak fleet.

Financial Trajectory

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $845 | $950 | $910 | $978 | $884 | $898 | $854 | $962 |

| Net Income ($M) | -$26 | $31 | $26 | $54 | -$43 | -$70 | -$77 | $53 |

| EBITDA Margin % | -9.9%* | -3.5%* | -7.7%* | -1.2%* | -9.0%* | -9.5%* | -13.5%* | 7.3%* |

*Values retrieved from S&P Global

Frontier's Q4 2025 marked its first profitable quarter of the year with $53 million in net income, though full-year 2025 showed a $137 million loss. The company expects PDP (pre-delivery payment) balances to decline $170-210 million this year as deferrals reduce near-term capital requirements.

Analyst consensus expects losses to narrow through 2026:

| Forward Estimates | Q1 2026 | Q2 2026 | Q3 2026 | Q4 2026 |

|---|---|---|---|---|

| Revenue Consensus ($M) | $1,009 | $1,136 | $1,105 | $1,203 |

| EPS Consensus | -$0.30 | $0.00 | -$0.06 | $0.28 |

| EBITDA Consensus ($M) | $175 | $283 | $260 | $336 |

Estimates from S&P Global

Premiumization Strategy

In a notable shift from pure ULCC strategy, Frontier is adding premium products:

- First class seating: Full fleet installation expected by end of 2026, building on current "Up Front Plus" blocked middle seat offering

- In-flight Wi-Fi: Provider selection imminent, operational by end of 2027

- Loyalty program expansion: Cash flows up 30% year-over-year in Q4, averaging ~$7 per passenger from credit card, Go Wild, and Discount Den programs

"Our cash flows from loyalty assets, particularly the credit card program, are quite immature in comparison to the major airlines," Dempsey acknowledged. "But we certainly see real progression in terms of cash flows over the last two years as we've invested heavily in the loyalty program."

Operational Fixes

The turnaround plan includes 60 operational improvement projects targeting cancellations and on-time performance. Key initiatives include:

- Automated turn processes to recover time bleed of 1-2 minutes per aircraft turn

- Maintenance footprint optimization matching aircraft routing to service bases

- Network stability through 13 existing crew bases rather than adding new locations

November's government shutdown cost Frontier approximately $30 million in lost revenue from perishable seats and forward bookings, though demand recovered through December peak and into Q1.

Merger Question Remains

When pressed about industry consolidation, Dempsey deflected, emphasizing independent viability.

"We're very, very focused on building the sustainable, profitable path for Frontier as opposed to consolidation in the industry," he said, despite acknowledging Frontier's competitive disadvantage in loyalty programs versus network carriers.

The pilot union remains in mediation with the National Mediation Board, an overhang Dempsey acknowledged without providing a timeline for resolution.

What to Watch

Near-term catalysts:

- Q2 schedule refinement (capacity adjustments expected)

- AerCap transaction closing and aircraft departures (April-June)

- First class rollout timing

2026 execution risks:

- Pilot contract negotiations

- Maintaining fare discipline if Spirit capacity returns

- Q2/Q3 demand sustainability after March peak

The stock trades at $5.35, roughly 4% below the $5.56 analyst target price consensus, with a market cap of $1.2 billion. Shares have recovered 85% from the August 2025 low of $2.89 but remain 43% below the 52-week high of $9.44.