Earnings summaries and quarterly performance for AerCap Holdings.

Research analysts who have asked questions during AerCap Holdings earnings calls.

Moshe Orenbuch

TD Cowen

9 questions for AER

Catherine O'Brien

Goldman Sachs

8 questions for AER

Jamie Baker

JPMorgan Chase & Co.

8 questions for AER

Terry Ma

Barclays

8 questions for AER

Hillary Cacanando

Not Mentioned in Transcript

6 questions for AER

Ronald Epstein

Bank of America

6 questions for AER

Kristine Liwag

Morgan Stanley

4 questions for AER

Chris Stathoulopoulos

Susquehanna

3 questions for AER

Stephen Trent

Citigroup Inc.

3 questions for AER

Arren Cyganovich

Truist

2 questions for AER

Christopher Stathoulopoulos

Susquehanna Financial Group

2 questions for AER

Ron Epstein

Bank of America Corporation

2 questions for AER

Shannon Doherty

Deutsche Bank

2 questions for AER

Christine Tu

Morgan Stanley

1 question for AER

Hillary Cacanando

Deutsche Bank

1 question for AER

James Kirby

JPMorgan Chase & Co.

1 question for AER

Recent press releases and 8-K filings for AER.

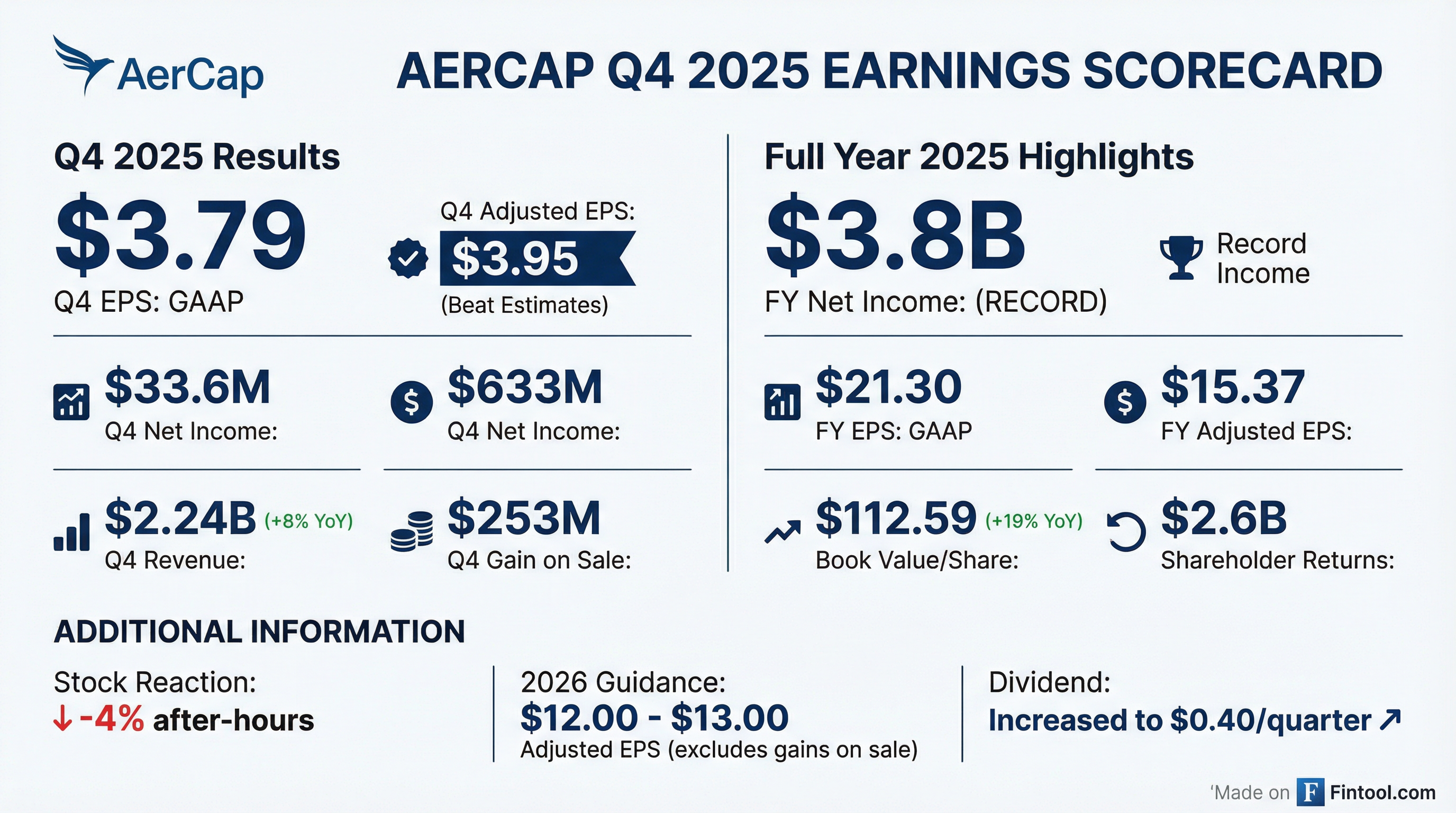

- AerCap reported a record year in 2025, with GAAP net income of $3.8 billion or $21.30 per share and adjusted net income of $2.7 billion or $15.37 per share, driven by $8.5 billion in full-year revenues and $5.4 billion in operating cash flow.

- The company returned a record $2.6 billion to shareholders in 2025 through share repurchases and dividends, and announced a new $1 billion share repurchase program and an increased quarterly dividend of $0.40 per share for 2026.

- AerCap provided 2026 adjusted EPS guidance of $12-$13 per share, excluding gains on asset sales, with projected total revenue of $7.6 billion.

- The balance sheet was strengthened, achieving a net debt-to-equity level of 2.1x at year-end 2025, and the company received $1.5 billion in Ukraine conflict-related recoveries in 2025, bringing total pre-tax recoveries since 2023 to $3 billion, exceeding the 2022 net charge.

- AerCap reported a record year in 2025 with GAAP net income of $3.8 billion ($21.30 per share) and adjusted net income of $2.7 billion ($15.37 per share), driven by $8.5 billion in full-year revenues and $5.4 billion in operating cash flow.

- The company returned a record $2.6 billion to shareholders in 2025, announced a new $1 billion share repurchase program, and increased its quarterly dividend to $0.40 per share. AerCap also strengthened its balance sheet, achieving a net debt-to-equity of 2.1x and a credit rating upgrade.

- For 2026, AerCap projects an adjusted EPS range of $12-$13 per share (excluding gains on asset sales) and anticipates total revenues of approximately $7.6 billion. The company expects the structural shortage of aircraft to persist at least through the end of the decade due to robust demand and constrained supply.

- AerCap Holdings reported a record year in 2025, with GAAP net income of $3.8 billion and adjusted net income of $2.7 billion, alongside $8.5 billion in revenues and $5.4 billion in operating cash flow.

- For 2026, the company projects an adjusted EPS range of $12-$13 per share, excluding gains on asset sales, with total revenue expected to be around $7.6 billion.

- In 2025, AerCap returned $2.6 billion to shareholders through repurchases and dividends, and announced a new $1 billion share repurchase program and an increase in the quarterly dividend to $0.40 per share.

- Key operational achievements in 2025 included executing 705 transactions, selling 189 assets with a 27% gain-on-sale margin, and receiving $1.5 billion in Ukraine conflict recoveries, bringing the total to approximately $3 billion since 2023.

- AerCap Holdings reported FY 2025 GAAP Net Income of $3.8 billion ($21.30 per share) and Adjusted Net Income of $2.7 billion ($15.37 per share).

- For Q4 2025, the company reported GAAP Net Income of $633 million ($3.79 per share) and Adjusted Net Income of $660 million ($3.95 per share).

- The company returned $2.6 billion to shareholders in 2025 through share repurchases and dividends, including $444 million for 3.5 million shares repurchased in Q4 2025.

- AerCap provided FY 2026 Adjusted EPS Guidance of $12.00 - $13.00, not including any gains on sale.

- As of December 31, 2025, book value per share was $112.59, an increase of 19% from December 31, 2024, and the adjusted leverage ratio was 2.1x.

- AerCap Holdings N.V. reported record financial results for the full year 2025, with net income of $3.8 billion and diluted earnings per share of $21.30. Adjusted net income for the full year was $2.7 billion, or $15.37 per share.

- The company returned $2.6 billion to shareholders during 2025, including an increase in the quarterly dividend to $0.40 per share and the announcement of a new $1 billion share repurchase program.

- AerCap's book value per share increased by 19% to $112.59 as of December 31, 2025.

- The company provided full-year 2026 adjusted EPS guidance of $12.00 - $13.00, not including any gains on sale.

- AerCap Holdings N.V. reported record net income of $3.8 billion, or $21.30 per share, for the full year 2025, and adjusted net income of $2.7 billion, or $15.37 per share.

- The company announced an increase in its quarterly dividend to $0.40 per share and returned $2.6 billion to shareholders during 2025 through share repurchases and dividends. A new $1 billion share repurchase program was also announced in December.

- AerCap achieved full-year sales of $3.9 billion with $819 million of gains on sale in 2025.

- Book value per share increased by 19% to $112.59 as of December 31, 2025.

- The company provided full-year 2026 adjusted EPS guidance of $12.00 - $13.00.

- On January 15, 2026, AerCap Ireland Capital Designated Activity Company and AerCap Global Aviation Trust, wholly-owned subsidiaries of AerCap Holdings N.V., issued a total of $1.75 billion in senior notes. This included $900 million of 4.125% Senior Notes due 2029 and $850 million of 4.750% Senior Notes due 2033.

- The gross proceeds from this issuance were $896,976,000 for the 2029 Notes and $844,560,000 for the 2033 Notes.

- The notes are guaranteed by AerCap Holdings N.V. and other subsidiary guarantors.

- The notes have credit ratings of Baa1 / BBB+ / BBB+ from Moody's / S&P / Fitch, respectively.

- On January 6, 2026, AerCap Holdings N.V.'s wholly-owned subsidiaries, AerCap Ireland Capital Designated Activity Company and AerCap Global Aviation Trust, priced an offering of $1.75 billion aggregate principal amount of senior notes.

- The offering consists of $900 million of 4.125% Senior Notes due 2029 and $850 million of 4.750% Senior Notes due 2033.

- The net proceeds from these notes are intended for general corporate purposes, including the acquisition, investment, financing, or refinancing of aircraft assets, and the repayment of indebtedness.

- AerCap Ireland Capital Designated Activity Company and AerCap Global Aviation Trust, wholly-owned subsidiaries of AerCap Holdings N.V., priced an offering of senior notes totaling $1.75 billion on January 6, 2026.

- The offering consists of $900 million aggregate principal amount of 4.125% Senior Notes due 2029 and $850 million aggregate principal amount of 4.750% Senior Notes due 2033.

- The net proceeds from the notes are intended for general corporate purposes, including to acquire, invest in, finance or refinance aircraft assets and to repay indebtedness.

- AerCap Holdings N.V. reported significant business activity in full year 2025, including signing 371 lease agreements, completing 145 purchases, and 189 sale transactions.

- For the full year 2025, AerCap signed financing transactions totaling approximately $13.2 billion and received cash insurance proceeds of approximately $1.5 billion, primarily from a judgment related to assets lost in Russia.

- The company repurchased approximately 22.1 million shares for a total of approximately $2.4 billion during the full year 2025, with 3.5 million shares repurchased in Q4 2025 for approximately $444 million.

- In the fourth quarter of 2025, AerCap signed 122 lease agreements, completed 40 purchases and 78 sale transactions, and declared a quarterly cash dividend of $0.27 per share.

Quarterly earnings call transcripts for AerCap Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more