GM CFO Says Automaker Returning to 8-10% Margins 'Ahead of Expectations' Despite $3B+ Tariff Hit

February 4, 2026 · by Fintool Agent

General Motors is on track to restore North American adjusted EBIT margins to 8-10% in 2026—roughly 12-18 months ahead of investor expectations—even as the automaker absorbs $3-4 billion in annual tariff costs, CFO Paul Jacobson told attendees at the Federal Reserve Bank of Chicago's Automotive Insights Symposium on Tuesday.

The comments, delivered in a fireside chat moderated by Reuters US auto editor Mike Colias, underscore how GM has transformed its operating model through inventory discipline, manufacturing flexibility, and aggressive cost management. GM shares have more than doubled from their 52-week low of $41.60 to $85.57, touching all-time highs, yet Jacobson suggested the stock remains undervalued.

"We didn't earn a discount to the market overnight," Jacobson said. "We're not gonna earn our way out of that overnight. But what you've seen is a heightened level of confidence in our ability to maybe brush aside some of the uncertainties that historically would've had a material impact on the business."

The Tariff Reality

GM absorbed over $3 billion in tariff costs in 2025 and expects $3-4 billion again in 2026—a headwind that would have crippled the old GM. Instead, the company is offsetting the impact through:

- $5 billion in onshoring investments by 2027, producing nearly 2 million vehicles domestically

- Complete retooling of the Orion assembly plant from EV to ICE production for trucks and full-size SUVs

- USMCA adjustments including MSRP offsets to protect the integrated North American supply chain

"If you thought that tariffs were gonna be a temporary or single administration thing, you probably don't think about spending that kind of money," Jacobson said. "I think what we're seeing is a little bit of a shift."

The $1-1.5 billion of onshoring headwinds in 2026 is split roughly evenly between manufacturing ramp-up costs and software/services investments.

The Transformation Playbook

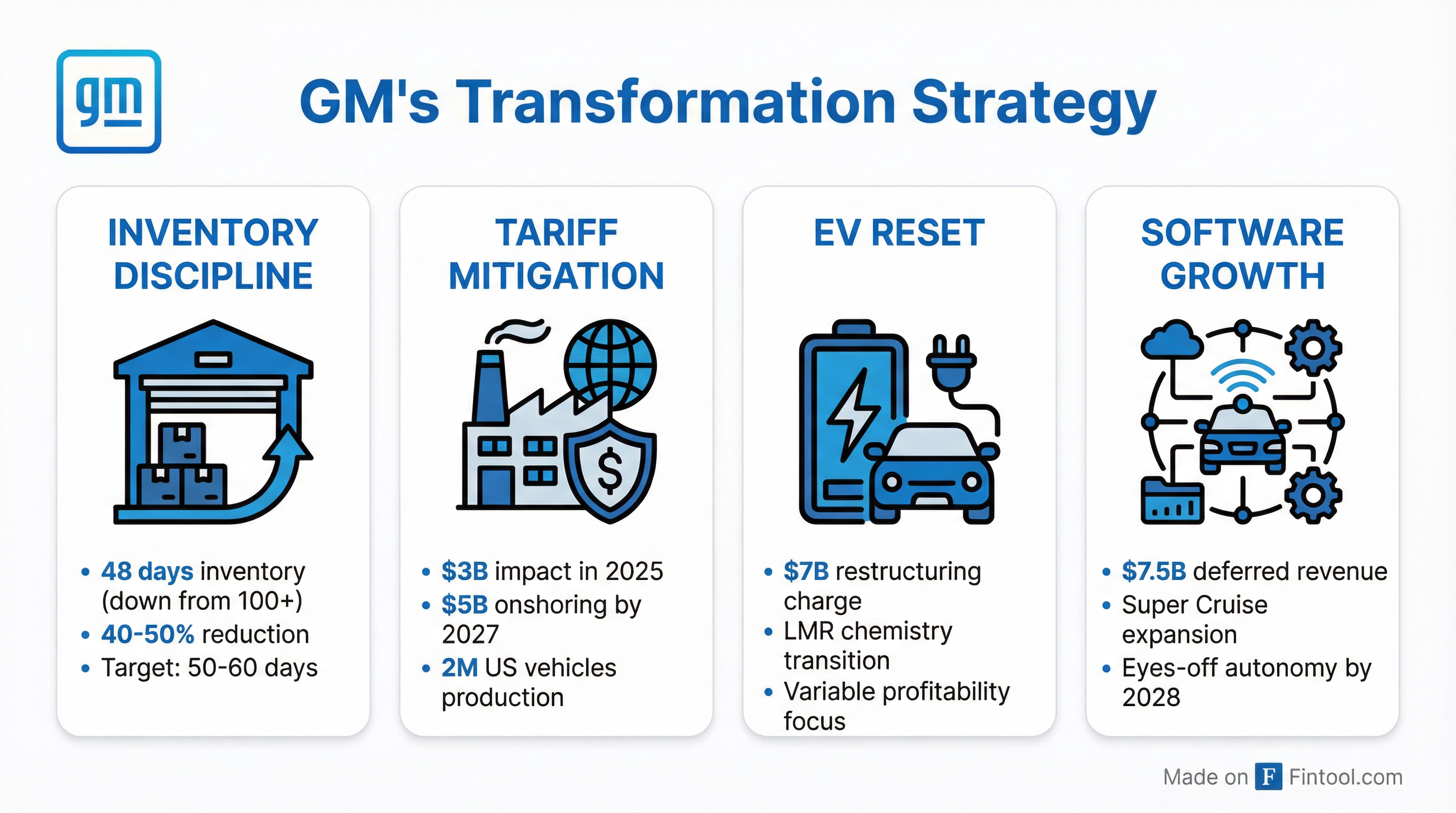

Jacobson outlined four pillars driving GM's resilience:

1. Inventory Discipline

GM ended 2025 with just 48 days of dealer inventory—down from the 100+ days that characterized the old auto industry. This seemingly technical change has profound implications:

| Metric | Historical | Current |

|---|---|---|

| Inventory Days | 100+ | 48 |

| Target Range | N/A | 50-60 days |

| Reduction | — | 40-50% |

"When the inevitable downturn or recession or weakness might hit, we're gonna be able to respond much, much faster because we're gonna be focused on the business forward, rather than trying to undo some of the inventory that we had built up over time," Jacobson explained.

2. Free Cash Flow Engine

The discipline has transformed GM from a $3 billion annual free cash flow generator to one consistently producing around $10 billion.

"That's our cushion. That's our safety blanket. So we can absorb short-term shocks to demand. We can absorb short-term shocks to the supply chain because we're operating from that free cash flow surplus."

3. EV Reset

GM took approximately $7 billion in restructuring charges in late 2025 to realign EV capacity. The infrastructure had been designed to produce 1 million EVs annually to meet regulatory requirements—but actual market penetration remains at 8-12%.

"Making sure that we're there for the customers gives us an opportunity to help bring the costs down at the same time volume is gonna ramp up naturally going forward," Jacobson said.

The company is transitioning to LMR chemistry and prismatic battery cans that will save "thousands of dollars" per vehicle.

4. Software & Services

GM disclosed $7.5 billion in deferred revenue on its balance sheet from connected services, and is expanding Super Cruise with eyes-off, hands-off autonomy targeted for 2028.

"Probably the single biggest transformational event that you're gonna see over the next several years... is that growth in software and services," Jacobson said.

Stock at Record Highs—But Still "Low"

Despite shares trading at all-time highs, Jacobson argued the stock remains undervalued:

"Some people, me included, would say it's still low. We're still, despite the improvement, trading at a double-digit free cash flow yield."

The company has aggressively returned capital to shareholders:

| Metric | Value |

|---|---|

| Share Count Reduction | 465M shares (35%) since 2023 |

| New Buyback Authorization | $6 billion |

| Dividend Increase | 20% |

| Shares Outstanding (Dec 2025) | 904 million |

The Affordability Story

Jacobson pushed back on the narrative that GM only makes money on expensive trucks and SUVs. The company sold over 700,000 vehicles priced under $30,000 in 2025—profitably.

"Historically, what you would have heard from a General Motors presentation is: 'You made all your money in trucks and SUVs, and you gave a little bit of it back at the low end,'" Jacobson said. "We've been able to create a portfolio where we can make money top to bottom."

Key affordable models include the Chevy Trax (named to Car and Driver's 10 Best for three consecutive years) and the Chevy Bolt. GM is also #1 in retail share in the top quarter of the market with products like the Cadillac Escalade (60% market share in full-size SUVs).

2026 Outlook

GM's official 2026 guidance, released January 27, calls for:

| Metric | 2026 Guidance |

|---|---|

| EBIT-Adjusted | $13.0-15.0 billion* |

| EPS-Diluted-Adjusted | $9.75-10.50* |

| Adjusted Automotive FCF | $12.5-14.5 billion* |

| Net Income | $10.3-11.7 billion* |

*Values retrieved from S&P Global

The guidance implies a return to 8-10% North America margins, which Jacobson confirmed at the Fed Chicago conference is "about 12-18 months ahead of when most investors would have thought."

What to Watch

Near-term catalysts:

-

USMCA renegotiation — Jacobson said a deal is "on the docket to get done this year" and the company needs the integrated North American supply chain to remain competitive

-

Memory chip costs — DRAM shortages from AI data center demand are creating "inflationary pressure" but GM sees this as a cost issue, not an availability issue

-

China stabilization — The restructured China JV is now profitable at smaller scale, though unlikely to return to the $2 billion annual equity contribution of prior years

-

EV demand clarity — "I don't think anyone really knows what the steady state EV demand will be in this new environment," Jacobson told analysts at the January earnings call

Key risks:

- Consumer weakness amid high vehicle ATPs ($52,000 average for GM)

- Chinese EV export competition in South America and potentially North America

- Tariff policy shifts that could undo onshoring investments

The Bottom Line

GM has executed one of the most impressive operational transformations in the auto industry. Under Jacobson's financial stewardship, the company has cut inventory in half, tripled free cash flow, absorbed $3 billion in tariffs without missing guidance, and returned the stock to record levels while reducing the share count by 35%.

The Fed Chicago appearance signals management's confidence that the playbook is working. Whether the market will finally close the valuation gap—GM still trades at roughly half Tesla's price-to-sales ratio despite producing 20x the vehicles—remains the key question for investors.

Related: