Gold Breaks Through $4,600 to Record High as Fed Crisis, Iran Unrest Fuel Safe-Haven Surge

January 11, 2026 · by Fintool Agent

Gold smashed through $4,600 per ounce for the first time in history on Monday, as a perfect storm of threats to Federal Reserve independence, escalating unrest in Iran, and growing expectations of US rate cuts drove investors into safe-haven assets at an unprecedented pace.

Spot gold jumped 1.3% to hit a record high of $4,600.33 in early Asian trading before pulling back slightly, extending gains from Sunday night's rally after Fed Chair Jerome Powell confirmed a criminal investigation into his Congressional testimony. Silver surged 3.5% to an all-time high of $83.96 per ounce, while platinum and palladium also climbed to multi-month highs.

"Basically, what is impacting the metals for sure is the geopolitical risk factor, which is the main driver for the intraday bullish momentum that's been seen in both the gold and silver markets today," said Kelvin Wong, senior market analyst at OANDA.

The rally caps an extraordinary run for precious metals. Gold gained 65% in 2025—its best annual performance since 1979—and has already added another 7% in the opening days of 2026.

The Four Drivers

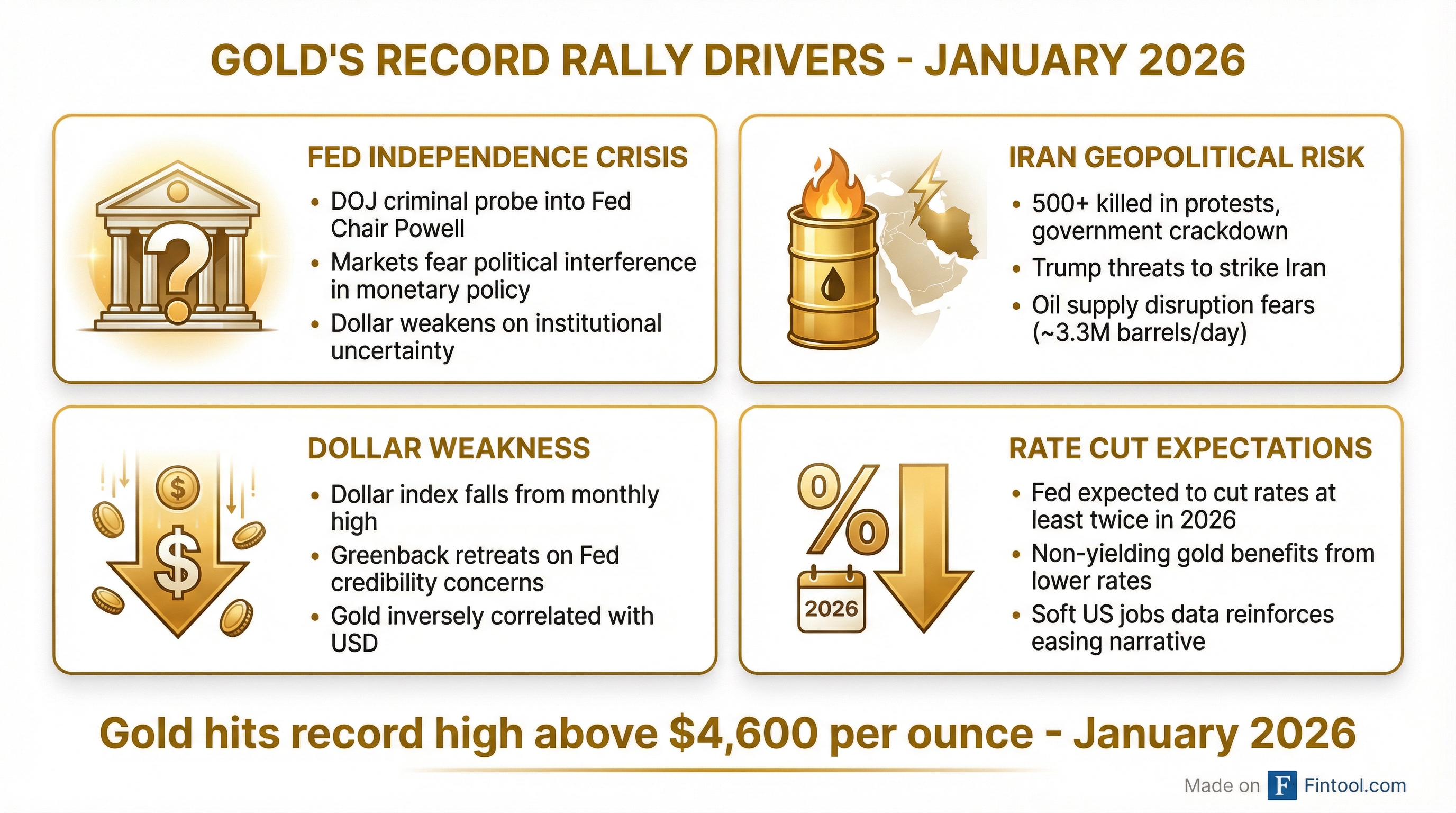

Four converging forces are propelling gold to uncharted territory:

1. Fed Independence Crisis

The Trump administration's criminal investigation into Fed Chair Powell—confirmed Sunday night—represents an unprecedented escalation in political pressure on the nation's central bank. Powell called the probe a "pretext" aimed at forcing the Fed to cut interest rates.

Markets are pricing significant risk that Fed independence could be compromised, with the dollar falling 0.2% against major currencies. Any perception that monetary policy will bend to political pressure historically undermines confidence in the US dollar, making gold more attractive as an alternative store of value.

2. Iran Geopolitical Risk

More than 500 people have been killed in Iran's escalating protests according to human rights group HRANA, as Tehran threatens to target US military bases if President Trump carries out renewed strike threats. Iran produces approximately 3.3 million barrels of oil per day and holds 9% of global proven reserves.

The unrest raises the specter of supply disruption from the fourth-largest oil producer, adding to broader Middle East tensions following Trump's moves to oust Venezuelan President Maduro and his stated interest in acquiring Greenland.

3. Dollar Weakness

The dollar index retreated from its strongest level in a month, falling after the Powell investigation news. A weaker greenback makes dollar-denominated gold cheaper for international buyers and typically supports precious metal prices.

4. Rate Cut Expectations

Investors currently expect at least two Federal Reserve rate cuts in 2026. Friday's jobs report showed US employment growth slowed more than expected in December, with job losses in construction, retail, and manufacturing reinforcing the case for policy easing.

Non-yielding assets like gold tend to perform well in a low-interest-rate environment, as the opportunity cost of holding bullion versus interest-bearing assets diminishes.

Wall Street Targets: $5,000 and Beyond

Major banks remain bullish on gold's trajectory:

| Firm | 2026 Target | Commentary |

|---|---|---|

| J.P. Morgan | $5,000+ by Q4 2026 | "The long-term trend of official reserve and investor diversification into gold has further to run" |

| HSBC | $5,050 (H1 high) | Sees wide $3,950-$5,050 range; expects correction in H2 if geopolitical risks subside |

| Bank of America | $5,000 average | "The White House's unorthodox policy framework should remain supportive" |

| Goldman Sachs | $4,900 by year-end | Cites central bank buying and Fed easing as primary drivers |

| UBS | $5,000 by Q1 2026 | Part of broader commodities rally thesis |

J.P. Morgan forecasts prices averaging $5,055 by Q4 2026, potentially rising toward $5,400 by end of 2027.

Silver's Explosive Outperformance

While gold grabbed headlines, silver's performance has been even more dramatic. The white metal surged 147% in 2025—its best year in decades—driven by:

- Critical Mineral Designation: The US designated silver as a critical mineral, supporting strategic stockpiling

- Supply Constraints: Mine production has struggled to keep pace with demand

- Industrial Applications: Solar panel manufacturing and electronics continue to drive physical demand

- Investment Flows: ETFs saw substantial inflows as retail investors sought leverage to gold's rally

Platinum also rose 3.2% to $2,345 per ounce after setting a record high of $2,478.50 in late December. Palladium gained 3.3% to $1,875.68.

How to Play the Rally

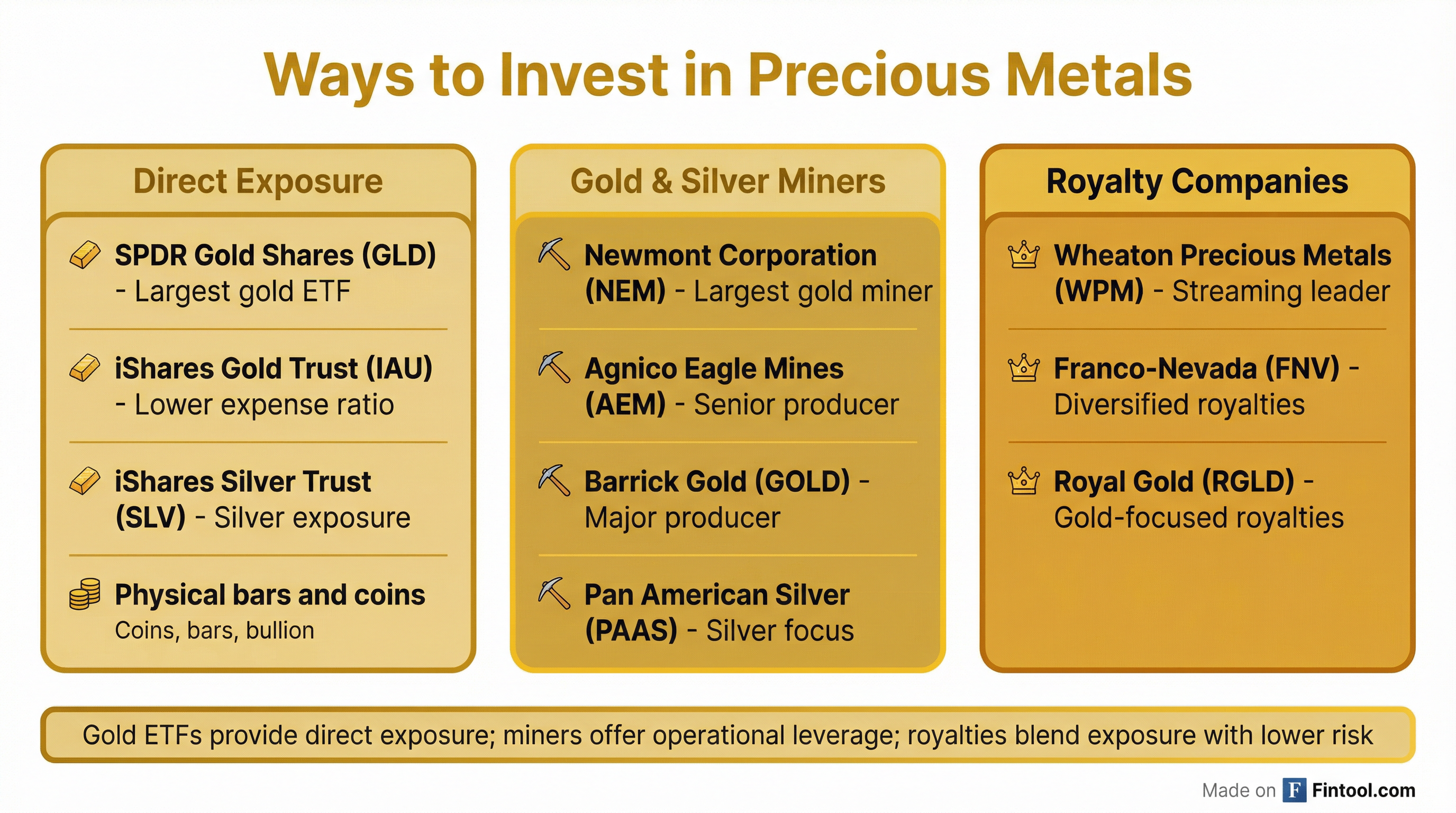

Investors have multiple ways to gain exposure to precious metals:

Direct Exposure: ETFs

| ETF | Ticker | Expense Ratio | Focus |

|---|---|---|---|

| SPDR Gold Shares+3.07% | GLD | 0.40% | Largest gold ETF, high liquidity |

| Ishares Gold Trust+2.99% | IAU | 0.25% | Lower cost gold exposure |

| Ishares Silver Trust+5.25% | SLV | 0.50% | Direct silver exposure |

Mining Stocks: Operational Leverage

Mining stocks offer leveraged exposure to gold prices, as their earnings amplify when metal prices rise faster than costs:

- Newmont Corporation+6.26% (NEM) - World's largest gold producer

- Agnico Eagle Mines+3.77% (AEM) - High-quality senior producer with premium valuation

- Barrick Gold+9.87% (GOLD) - Major global producer

- Kinross Gold+2.64% (KGC) - Lower-cost producer

- Pan American Silver+5.34% (PAAS) - Silver-focused miner

Royalty & Streaming: Lower Risk Exposure

Royalty companies provide exposure to gold without the operational risks of mining:

- Wheaton Precious Metals+3.88% (WPM) - Leading streaming company

- Franco-nevada+3.43% (FNV) - Diversified royalty portfolio

- Royal Gold+4.79% (RGLD) - Gold-focused royalties

Central Bank Demand: The Structural Bid

Beyond headline-driven trading, a structural shift in central bank demand continues to support gold prices. J.P. Morgan forecasts central bank buying will average 585 tonnes per quarter in 2026, as reserve managers diversify away from dollar assets.

This trend accelerated following Western sanctions on Russia's reserves after the 2022 Ukraine invasion, which prompted many central banks—particularly in emerging markets—to reconsider the safety of holding dollar-denominated assets.

ETF inflows are also expected to remain robust, with J.P. Morgan forecasting around 250 tonnes of inflows in 2026. Physical bar and coin demand is projected to surpass 1,200 tonnes.

What to Watch

This Week: Major bank earnings from Goldman Sachs+4.31%, JPMorgan+3.95%, Bank of America+2.89%, and Citigroup+5.98% may include commentary on precious metals outlook.

January 15: December CPI data could influence Fed rate expectations and gold positioning.

January 21: Supreme Court hears arguments on Trump's bid to fire Fed Governor Lisa Cook—a case with implications for Fed independence.

Iran Situation: Any escalation in US-Iran tensions or further supply disruption concerns could drive additional safe-haven flows.

May 2026: Powell's term as Fed Chair expires. The transition period will be closely watched for signals on future monetary policy direction.

For investors, the record-breaking rally in gold reflects a convergence of acute geopolitical risks and structural shifts in how the world views the US dollar. Whether prices continue toward $5,000 or pull back depends largely on whether the Fed independence crisis escalates—and whether Iran's unrest spirals into a broader regional conflict.

Related Companies: SPDR Gold Shares+3.07% | Ishares Gold Trust+2.99% | Ishares Silver Trust+5.25% | Newmont+6.26% | Agnico Eagle+3.77% | Wheaton Precious Metals+3.88% | Franco-nevada+3.43% | Royal Gold+4.79% | Barrick Gold+9.87% | Kinross Gold+2.64% | Pan American Silver+5.34%