Greif CFO Puts $1.6 Million Where His Mouth Is, Buying Stock Days After Earnings

February 8, 2026 · by Fintool Agent

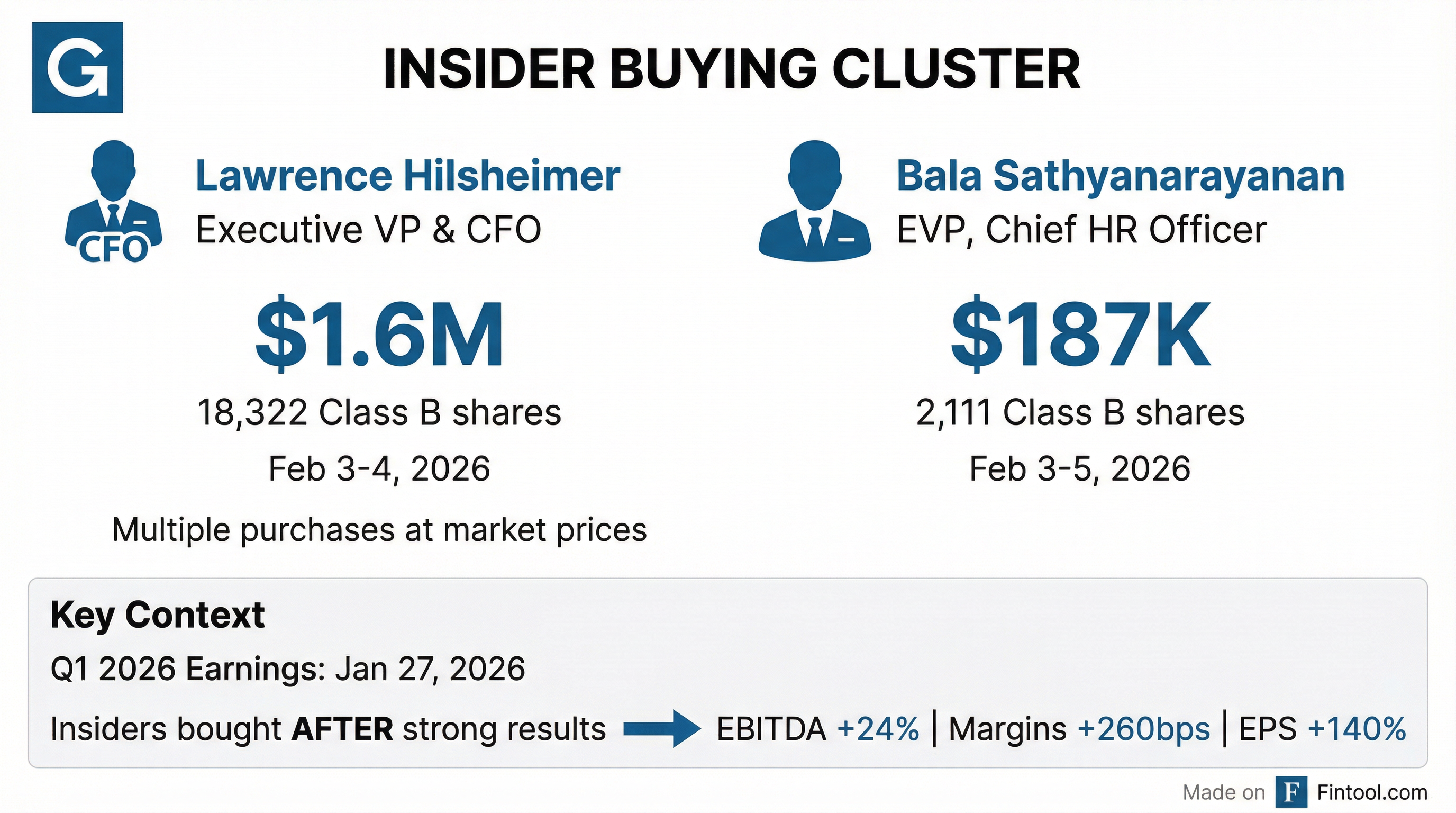

Greif CFO Lawrence Hilsheimer has made a statement that speaks louder than any earnings call commentary: he purchased approximately $1.6 million worth of company stock in open-market transactions on February 3-4, 2026—just one week after telling investors the stock was "one of the most compelling value propositions we can invest in."

The purchases, disclosed in Form 4 filings with the SEC, show Hilsheimer acquired 18,322 Class B shares across multiple transactions at prices ranging from $86.84 to $91.20 per share. He wasn't alone—Chief Human Resources Officer Bala Sathyanarayanan also purchased shares during the same period, creating a notable cluster of insider buying at the industrial packaging company.

The CFO's "Compelling Value" Claim Gets Personal

The timing is noteworthy. On January 28, 2026, during Greif's Q1 fiscal 2026 earnings call, Hilsheimer discussed the company's new $300 million share repurchase authorization:

"We continue to believe our stock is still one of the most compelling value propositions we can invest in, and as such, in December, our board approved a new $300 million share repurchase authorization."

Less than a week later, Hilsheimer backed those words with $1.6 million of his own capital. For a CFO—the executive with the deepest visibility into a company's financial health—to make such a significant personal investment immediately following strong earnings suggests genuine conviction, not just corporate optimism.

Strong Q1 Results Set the Stage

The insider buying comes on the heels of robust quarterly performance. Greif's Q1 2026 results, released January 27, showed meaningful improvement across key metrics :

| Metric | Q1 2026 | Q1 2025 | Change |

|---|---|---|---|

| Adjusted EBITDA | $122.5M | $98.8M | +24.0% |

| EBITDA Margin | 12.3% | 9.7% | +260 bps |

| Adjusted EPS | $0.48 | $0.20 | +140% |

| Net Debt | $700.5M | $2,639.1M | -73% |

| Leverage Ratio | 1.2x | 3.6x | -2.4x |

The company achieved $65 million in run-rate cost optimization by quarter end, up from $50 million at the end of Q4 2025. CEO Ole Rosgaard emphasized that the improvements are structural, not cyclical:

"The work we've done to transform Greif is not cyclical, it's structural, and it shows how we perform, how we invest, and how we allocate capital."

Balance Sheet Transformation Enables Capital Return

The dramatic leverage reduction—from 3.6x to 1.2x—stems from Greif's August 2025 sale of its containerboard business to Packaging Corporation of America for $1.8 billion. This divestiture, combined with an earlier timberland sale, allowed Greif to pay down approximately $1.86 billion in debt.

That balance sheet strength is now funding aggressive shareholder returns. During Q1, Greif completed $130 million of a $150 million buyback program, repurchasing 1.8 million Class A and 0.1 million Class B shares. The new $300 million authorization approved in December signals continued commitment to returning capital.

"We will execute on this new authorization in a disciplined manner, incorporating repurchases as part of our ongoing and balanced capital allocation, with a goal to repurchase up to 2% of our shares outstanding annually."

Industrial Weakness Persists, But Margins Expand

Management maintained a sober view of end-market conditions. CEO Rosgaard noted continued softness across segments :

- Customized Polymer Solutions: Demand essentially flat; large containers down mid-single digits

- Durable Metal Solutions: Remains under pressure, especially with chemical customers

- Sustainable Fiber Solutions: Volume declines in converting due to North America industrial softness

- Innovative Closure Solutions: Volumes down high singles

Yet despite muted volumes, margins expanded materially—evidence that the company's cost actions are working independent of macro conditions. Greif reaffirmed its low-end FY2026 guidance of $630 million in adjusted EBITDA and $315 million in adjusted free cash flow, reflecting "strong first quarter execution and confidence in our previously communicated assumptions."

Stock Near 52-Week Highs, CFO Still Buying

What makes this insider buying particularly interesting is the stock's recent performance. Greif Class A shares are trading near their 52-week high of $75.86, up approximately 40% over the past year. Class B shares, which the CFO purchased, reached $91.34 on February 4.

Typically, insider buying is most bullish when it occurs after a stock has declined or during periods of pessimism. The fact that the CFO is purchasing at elevated levels—after a 40% run and strong earnings—suggests he believes the stock remains undervalued despite recent gains.

The company trades at approximately 7.3x EV/EBITDA and 0.63x price/sales, modest multiples for a company generating significant free cash flow with historically low leverage.

What to Watch

Near-term catalysts:

- Q2 2026 earnings (expected late April/early May)

- Progress toward $80-90 million run-rate cost optimization target by fiscal year-end

- Execution on the new $300 million buyback authorization

- Any signs of industrial recovery in end markets

Key risks:

- Continued industrial weakness could pressure volumes further

- Raw material cost volatility (OCC, steel, resin)

- Integration challenges from segment reorganization

For investors, a CFO deploying $1.6 million of personal capital days after calling the stock "compelling" is a signal worth noting. Insiders can sell for many reasons—diversification, taxes, personal expenses—but they typically buy for only one: they believe the stock is going up.

Related: