Earnings summaries and quarterly performance for GREIF.

Executive leadership at GREIF.

Ole G. Rosgaard

President and Chief Executive Officer

Anthony J. Krabill

Vice President, Corporate Treasurer

Bala V. Sathyanarayanan

Executive Vice President, Chief Human Resources Officer

Dennis Hoffman

Senior Vice President, General Counsel and Secretary

Kimberly A. Kellermann

Senior Vice President, Chief Operations Officer

Lawrence A. Hilsheimer

Executive Vice President, Chief Financial Officer

Michael J. Taylor

Vice President, Corporate Controller

Patrick G. Mullaney

Senior Vice President, Chief Business Unit Officer

Timothy L. Bergwall

Senior Vice President, Chief Commercial Officer

Vivian E. Bouet

Senior Vice President, Chief Information and Digital Officer

Board of directors at GREIF.

B. Andrew Rose

Director

Bruce A. Edwards

Chairman of the Board

Frank C. Miller

Director

Jillian C. Evanko

Director

John W. McNamara

Director

Karen A. Morrison

Director

Kimberly T. Scott

Director

Mark A. Emkes

Director

Robert M. Patterson

Director

Research analysts who have asked questions during GREIF earnings calls.

Gabe Hajde

Wells Fargo & Company

6 questions for GEF

George Staphos

Bank of America

6 questions for GEF

Daniel Harriman

Sidoti & Company, LLC

4 questions for GEF

Ghansham Panjabi

Robert W. Baird & Co.

4 questions for GEF

Matthew Roberts

Raymond James

4 questions for GEF

Michael Roxland

Truist Securities

4 questions for GEF

Matt Roberts

Raymond James Financial

3 questions for GEF

Brian Butler

Stifel, Nicolaus & Company, Incorporated

2 questions for GEF

Mike Roxland

Truist Securities

2 questions for GEF

Aadit Shrestha

Stifel

1 question for GEF

Josh Vesely

Baird

1 question for GEF

Niccolo Piccini

Truist Securities

1 question for GEF

Richard Carlson

Wells Fargo

1 question for GEF

Recent press releases and 8-K filings for GEF.

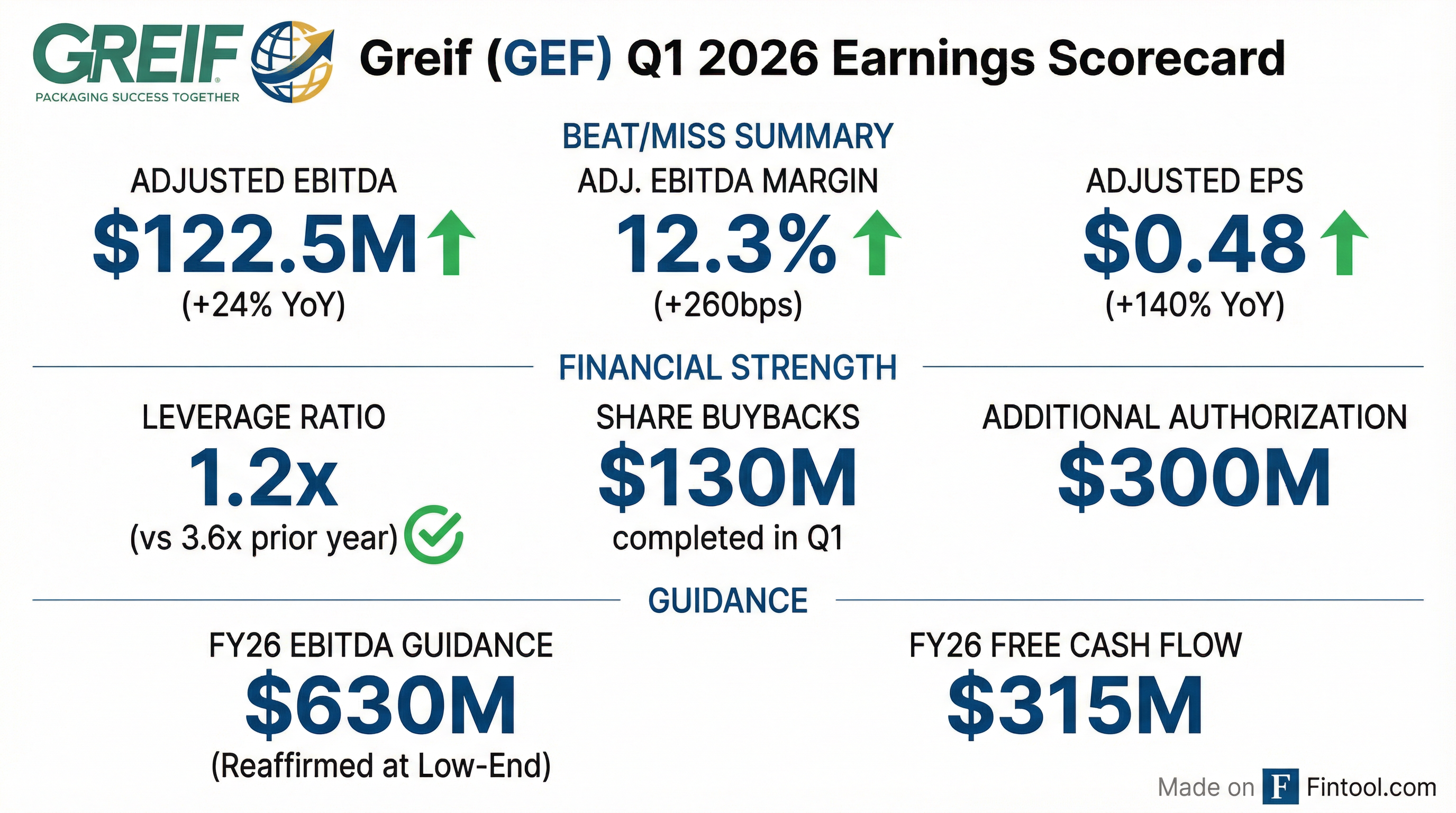

- Greif, Inc. reported a significant increase in net income to $176.6 million and Adjusted EBITDA to $122.5 million (up 24.0%) for Q1 2026.

- The company's total debt decreased by $1,896.2 million to $944.0 million, leading to a leverage ratio of 1.2x, primarily due to debt repayment from divestitures.

- During Q1 2026, Greif completed $130.0 million in share repurchases and authorized an additional $300.0 million for future repurchases.

- Management reaffirmed its low-end fiscal 2026 guidance, projecting $630.0 million in Adjusted EBITDA and $315.0 million in Adjusted Free Cash Flow, supported by $65.0 million in run-rate cost optimization.

- Greif reported strong Q1 2026 financial results, with adjusted EBITDA increasing 24% and adjusted EPS up 140% year-over-year, while EBITDA margins improved 260 basis points to 12.3%.

- The company reaffirmed its 2026 guidance for adjusted EBITDA of $630 million and adjusted free cash flow of $315 million, noting that Q1 performance was consistent with expectations despite continued softness in the industrial economy.

- Greif completed $130 million of a $150 million share repurchase program in Q1 2026 and authorized a new $300 million share repurchase program, with a commitment to repurchase up to 2% of shares outstanding annually.

- The company's run rate cost optimization reached $65 million in Q1 2026, contributing to its historically low leverage of 1.2 times.

- Greif reported strong Q1 2026 financial results, with Adjusted EBITDA increasing 24% year-over-year to $122.5 million and Adjusted Class A Earnings Per Share rising 140% to $0.48.

- The company reaffirmed its low-end FY26 guidance, projecting Adjusted EBITDA of $630 million and Adjusted Free Cash Flow of $315 million.

- GEF executed $130 million in share repurchases during Q1 2026 and has an additional $300 million share repurchase capacity authorized, while maintaining a 1.2x leverage ratio.

- Despite achieving $65 million in run-rate cost optimization, Q1 2026 saw volume softness across all segments, leading to a total company sales variance of -2.2% due to industrial demand weakness.

- Greif reported strong Q1 2026 financial results, with Adjusted EBITDA increasing 24% year-over-year and EBITDA margins improving 260 basis points to 12.3%. Earnings per share were up 140% year-over-year.

- The company reaffirmed its low-end 2026 guidance of $630 million in Adjusted EBITDA and $315 million in adjusted free cash flow, despite a muted industrial backdrop and soft demand environment.

- Greif completed $130 million of a $150 million share repurchase program in Q1 2026 and approved a new $300 million share repurchase authorization in December, with an intention to repurchase up to 2% of shares outstanding annually.

- Cost optimization efforts are progressing, with a current run rate of $65 million and a fiscal 2026 year-end commitment of $80 million-$90 million.

- Greif reported strong Q1 2026 results with Adjusted EBITDA increasing 24% and EBITDA margin improving 260 basis points to 12.3%, driven by cost optimization despite a muted industrial backdrop.

- The company reaffirmed its low-end 2026 guidance of $630 million in Adjusted EBITDA and $315 million in Adjusted Free Cash Flow, expecting volumes to normalize after a 5% decline in Q1.

- Greif completed $130 million of a $150 million share repurchase program in Q1 and authorized a new $300 million program, leveraging its historically low 1.2 times debt leverage to return capital to shareholders and fund organic growth.

- For the eleven-month fiscal year ended September 30, 2025, Greif, Inc. reported a 93.2% decrease in net income to $15.1 million or $0.28 per diluted Class A share, while Adjusted EBITDA increased 3.1% to $511.3 million and Adjusted free cash flow increased by $195.1 million to $338.8 million.

- The company significantly reduced its total debt by $1,538.1 million to $1,202.5 million, leading to a decrease in its leverage ratio from 3.48x to 1.63x.

- Greif completed the sale of its timberlands business for approximately $462.0 million on October 1, 2025, and plans an open market repurchase plan for approximately $150.0 million utilizing available authorization.

- Cost optimization efforts resulted in approximately $50.0 million in run-rate savings by the end of fiscal year 2025, and the anticipated fiscal year 2027 cumulative cost saving run rate commitment has been expanded to $120.0 million.

- For fiscal year 2026, the company provided low-end guidance of $630.0 million Adjusted EBITDA and $315.0 million Adjusted Free Cash Flow.

- Greif (GEF) concluded fiscal 2025, a short two-month Q4 due to a fiscal year change, by finalizing the sale of its land management business for $462 million and divesting its containerboard business, resulting in a pro forma leverage ratio under 1.0 times.

- For the two-month Q4 2025, Greif reported Adjusted EBITDA of $99 million, a 7.4% increase year-over-year, with EBITDA margins expanding by 140 basis points. Adjusted free cash flow improved by over 24.3%, while Adjusted EPS was $0.01.

- The company is accelerating its cost optimization program, achieving $50 million in run rate savings in fiscal 2025 and raising its cumulative cost-saving run rate commitment to $80 million-$90 million for fiscal 2026 and $120 million for fiscal 2027. This program included the elimination of approximately 8% of professional roles.

- Greif provided low-end guidance for fiscal 2026, projecting $315 million in free cash flow with a 50% conversion ratio and approximately $155 million in CapEx.

- The capital allocation strategy includes a planned $150 million open market share repurchase program and seeking board approval for ongoing repurchases of up to 2% per year of outstanding equity value.

- Greif completed the divestment of its Containerboard Business for $1.8 billion on August 31, 2025, with Q4 2025 results reflecting only two months of continuing operations.

- For the two-month Q4 2025, Adjusted EBITDA from continuing operations increased 7.4% to $98.9 million, and Adjusted Free Cash Flow improved 24.3% to $122.6 million. Adjusted Class A Earnings Per Share was $0.01.

- The company provided FY26 guidance, projecting Adjusted EBITDA of $630 million and Adjusted Free Cash Flow of $315 million. The proforma leverage ratio for Q4 2025 was <1.0x , a significant improvement from the 1.63x leverage ratio as of September 30, 2025, and 3.48x in Q4 2024.

- Greif initiated $150 million in share repurchases and is accelerating its cost optimization program with an increased savings commitment of $120 million by the end of FY27.

- Greif, Inc. reported its fiscal 2025 results, with a fiscal year-end change to September 30, making Q4 2025 a two-month period and FY 2025 an eleven-month period. For the two-month fourth quarter of 2025, Adjusted EBITDA from continuing operations increased by 7.4% to $98.9 million, while net income (loss) from continuing operations was $(38.6) million.

- For the eleven-month fiscal year 2025, Adjusted EBITDA from continuing operations increased by 3.1% to $511.3 million, and net income from continuing operations was $38.2 million.

- The company significantly reduced its total debt by $1,538.1 million to $1,202.5 million, leading to a decreased leverage ratio of 1.63x from 3.48x, primarily due to the divestment of its Containerboard Business for $1.8 billion and timberlands business for $462.0 million.

- Greif provided low-end guidance for fiscal 2026, projecting $630 million in Adjusted EBITDA and $315 million in Adjusted Free Cash Flow, and announced plans for an open market share repurchase of approximately $150.0 million.

- The Coca-Cola Company and Gutsche Family Investments (GFI) have agreed to sell their 75% majority stake in Coca-Cola Beverages Africa (CCBA) to Coca-Cola HBC AG.

- The transaction values CCBA at an equity value of $3.4 billion.

- The deal is expected to be completed by the end of 2026 and includes an option for Coca-Cola HBC to acquire the remaining 25% of CCBA from Coca-Cola within six years after closing.

- This sale is part of The Coca-Cola Company's ongoing re-franchising strategy, which is expected to reduce its bottling operation investments to approximately 5% of consolidated net revenue after the transaction.

Fintool News

In-depth analysis and coverage of GREIF.

Quarterly earnings call transcripts for GREIF.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more