Hilton Launches Apartment Collection, Takes Aim at Airbnb's $80 Billion Empire

January 15, 2026 · by Fintool Agent

Hilton Worldwide Holdings ($70B market cap) unveiled its 26th brand Thursday, launching Apartment Collection by Hilton to compete directly with Airbnb in the $100 billion+ short-term rental market. The move signals Hilton's most aggressive expansion into residential-style accommodations, aiming to capture guests who want apartment space without Airbnb's inconsistency.

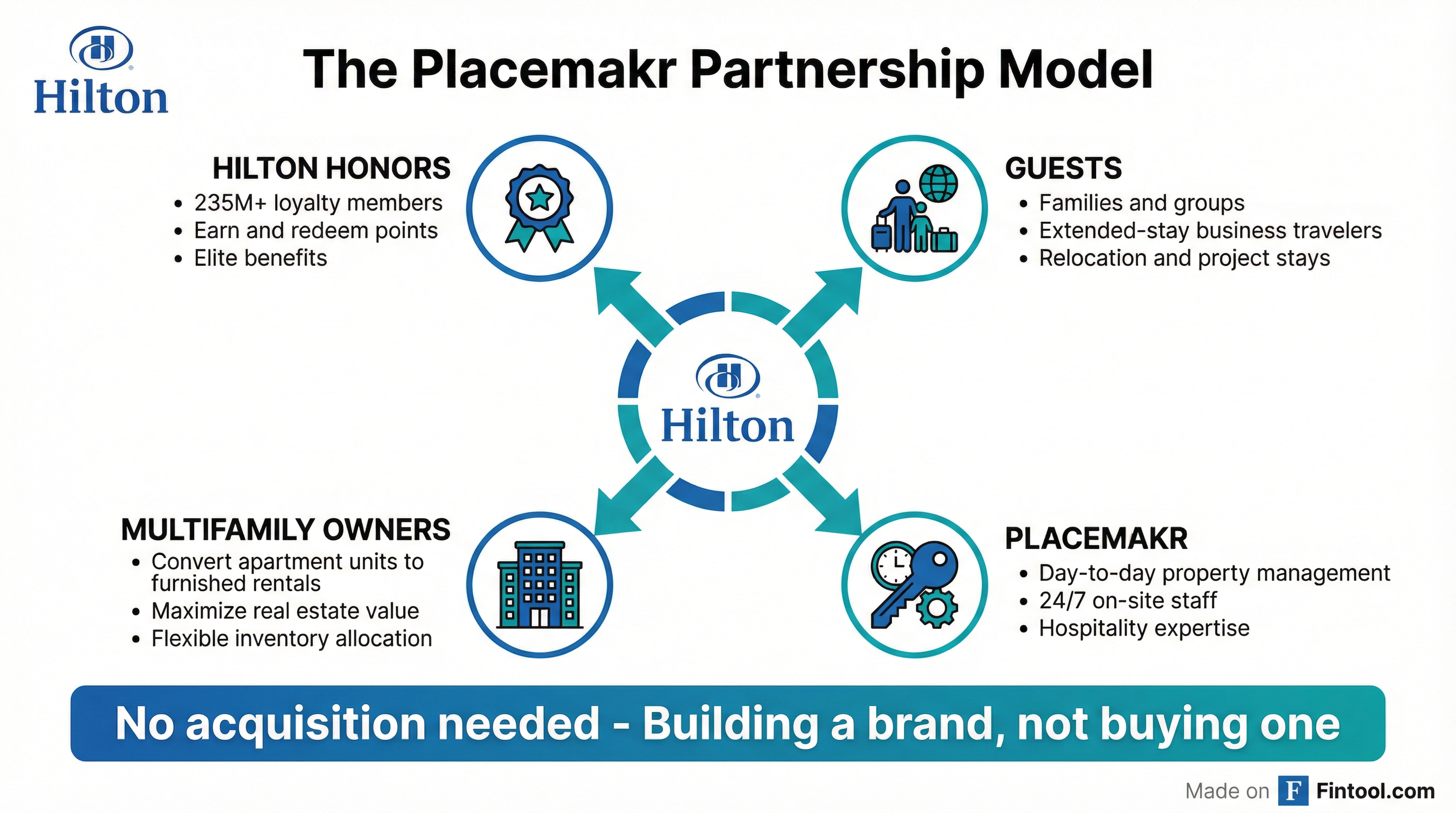

The collection debuts through a strategic partnership with Placemakr, a furnished apartment operator, adding up to 3,000 units in major U.S. cities including New York, Washington D.C., and Atlanta. Combined with Hilton's existing 10,000 apartment-style units globally, this positions the company as a formidable force in the extended-stay segment.

The Strategic Calculus

Hilton CEO Chris Nassetta framed the launch as "the next chapter in Hilton's growth story," targeting the fastest-growing segment of hospitality: homestyle stays.

The timing is strategic. Airbnb has faced growing "host fatigue" criticism—guests complaining about cleaning fees, inconsistent quality, and demanding checkout chore lists. Hilton's pitch: apartment flexibility with hotel reliability, backed by 235 million Hilton Honors loyalty members who can earn and redeem points.

Why This Isn't Another Sonder Story

Critically, Hilton is not acquiring Placemakr. This distinguishes its approach from Marriott International ($86B market cap), which integrated Sonder before it faced stock delisting threats and liquidity issues. Marriott's dual strategy—launching Apartments by Marriott Bonvoy while partnering with a struggling operator—created complexity.

Hilton's model is asset-light franchising:

- Placemakr handles day-to-day operations and on-site staffing

- Multifamily owners convert apartment units to furnished rentals

- Hilton provides brand standards, distribution, and loyalty integration

"By creating something under the collection banner, Hilton owns the standards. If a partner underperforms, the brand remains," noted industry analysts.

The Competitive Landscape

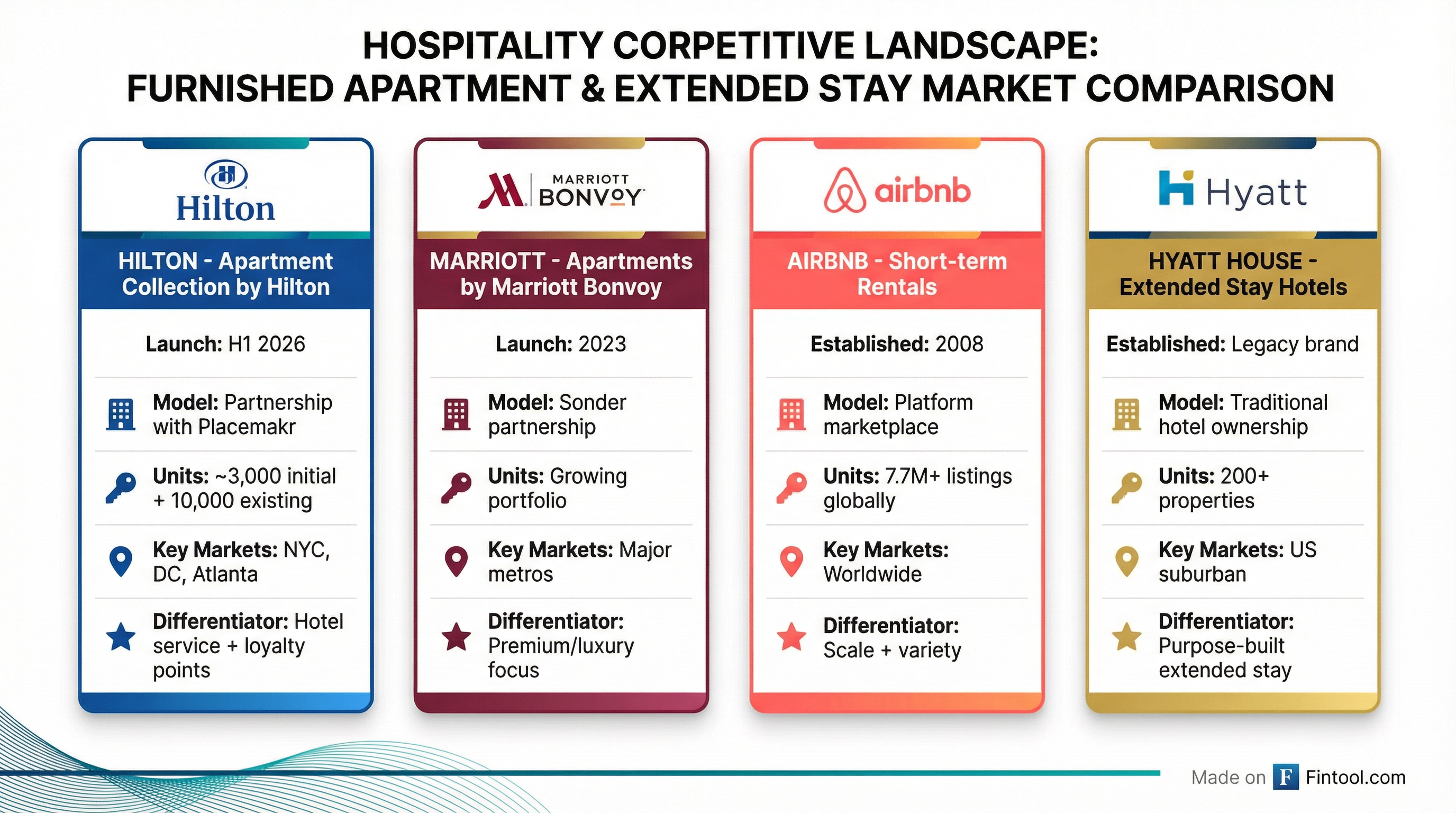

The furnished apartment market has become a battleground for hospitality's largest players:

| Company | Brand/Offering | Model | Scale |

|---|---|---|---|

| Hilton | Apartment Collection | Partnership franchise | 13,000 units (10K + 3K new) |

| Marriott | Apartments by Marriott Bonvoy | Direct + Sonder integration | Growing portfolio |

| Airbnb | Platform marketplace | Asset-light marketplace | 7.7M+ global listings |

| Hyatt | Hyatt House | Traditional ownership | 200+ properties |

Financial Context

Hilton enters this market from a position of strength. The company has delivered consistent profitability with industry-leading EBITDA margins:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $1,143* | $1,019* | $1,249* | $1,219* |

| EBITDA Margin | 44.0%* | 53.9%* | 61.7%* | 63.9%* |

*Values retrieved from S&P Global

Airbnb, by comparison, operates on a different scale but with more seasonality:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $2,480 | $2,272 | $3,096 | $4,095 |

| EBITDA Margin | 17.7%* | 2.8% | 20.4%* | 40.2%* |

*Values retrieved from S&P Global

What Guests Get

Apartment Collection by Hilton units will feature:

- Full kitchens (not kitchenettes)—enabling extended stays without dining out

- Studio to four-bedroom layouts for families and groups

- On-site laundry in each unit

- 24/7 staffing—a direct counter to Airbnb's self-service model

- Fitness centers, and at select locations, rooftop pools, terraces, and on-site dining

- Hilton Honors integration—earn/redeem points, elite benefits

Properties will be available through Hilton's booking channels in H1 2026. Pricing and specific elite benefits have not been disclosed.

What to Watch

Near-term catalysts:

- Booking window opening in H1 2026

- First Placemakr properties go live in NYC, DC, Atlanta

- Hilton's next earnings call for management commentary on uptake

Strategic questions:

- Can Hilton maintain quality control across converted multifamily units?

- Will Hilton expand partnerships beyond Placemakr?

- How will Airbnb respond to branded hotel competition in its core market?

Industry implications:

- More hotel chains may launch competing collection brands

- Multifamily owners gain a new revenue optimization lever

- Loyalty programs become bigger battlegrounds

Related: