Intel Beats Q4 But Supply Constraints Cloud Outlook—Stock Drops 7%

January 22, 2026 · by Fintool Agent

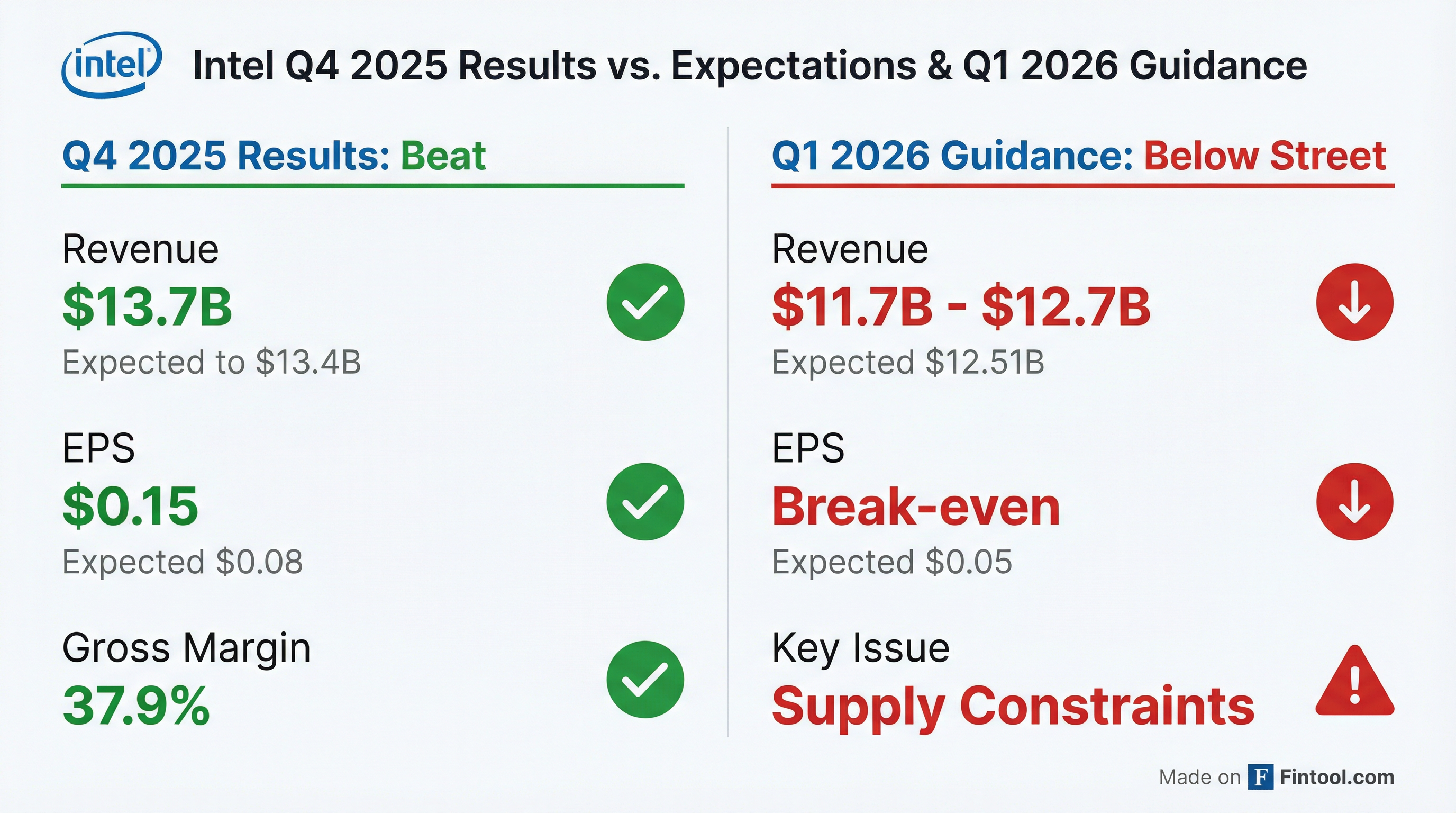

Intel delivered a fifth consecutive quarter of beating expectations on Thursday—then watched its stock tumble 7% in after-hours trading. The culprit: first-quarter guidance that fell short of Wall Street hopes as supply constraints squeezed the chipmaker's ability to capitalize on surging demand.

The Q4 results themselves were solid: revenue of $13.7 billion topped the $13.4 billion consensus, while adjusted EPS of $0.15 nearly doubled the $0.08 estimate. But the Q1 outlook—revenue of $11.7 billion to $12.7 billion versus consensus of $12.51 billion, and break-even EPS versus expectations of a nickel—overshadowed the beat.

"For investors, the key insight is that Intel's turnaround story remains supply-constrained rather than demand-constrained; a frustrating position that delays the financial recovery despite competitive products and strong customer interest," said Michael Schulman, chief investment officer at Running Point Capital.

The Beat That Wasn't Enough

Intel's Q4 marked a significant operational milestone: strong demand across all businesses, with AI PC, traditional server, and networking revenue all up double digits both sequentially and year over year. The Data Center and AI (DCAI) segment was the standout—up 15% sequentially, which CFO David Zinsner called "the fastest sequential growth this decade."

| Metric | Q4 2025 Actual | Q4 2025 Expected | Beat/Miss |

|---|---|---|---|

| Revenue | $13.7B | $13.4B | +2.2% |

| Adj. EPS | $0.15 | $0.08 | +87.5% |

| Gross Margin | 37.9% | 36.5% | +140 bps |

"Revenue would have been meaningfully higher if we had more supply," Zinsner acknowledged on the earnings call.

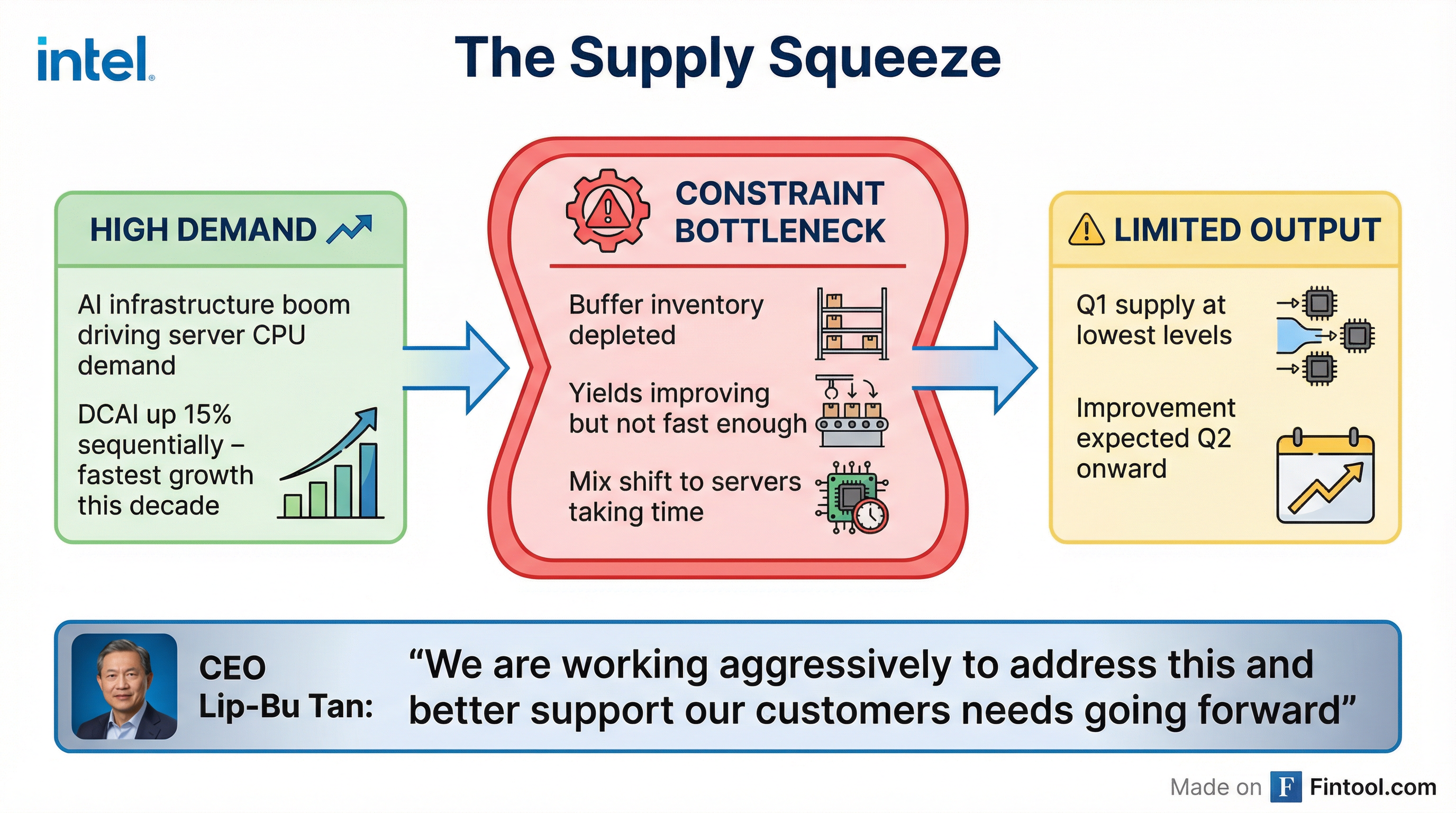

The problem is that Intel's buffer inventory—the cushion that allowed it to over-deliver in Q3 and Q4—is now gone. "As we enter 2026, our buffer inventory is depleted," Zinsner said. Finished goods inventory has dropped to 40% of peak levels, leaving Intel in "hand to mouth" mode.

The Supply Squeeze Explained

The supply crunch has multiple causes, and none are easily fixed in a quarter:

Inventory depletion: Intel supported strong second-half demand by drawing down finished goods. That buffer is exhausted.

Mix shift timing: When hyperscalers signaled surging server demand, Intel began shifting wafer production toward data center products in Q3. But semiconductor manufacturing cycles are long—those wafers won't emerge from fabs until late Q1.

Demand surprised to the upside: CFO Zinsner admitted the company didn't anticipate unit volume increases in data center. "Every hyperscaler customer we talked to was signaling that [units would be flat]," he said. "It has rapidly increased."

18A ramp costs: Intel's next-generation manufacturing process is now in production but remains dilutive to gross margins. Panther Lake (Core Ultra Series 3), the first product on 18A, is shipping—but yields are still improving.

CEO Lip-Bu Tan framed the challenge bluntly: "I'm disappointed that we are not able to fully meet the demand in our markets."

The Turnaround in Context

The supply constraints are particularly frustrating because they come at a moment of genuine strategic progress. Intel's stock had soared 84% in 2025 and was up another 35% year-to-date before Thursday's after-hours selloff.

Under CEO Lip-Bu Tan, who took over in March 2025, Intel has:

-

Shipped its first 18A products: Panther Lake launched with three SKUs ahead of schedule, featuring gate-all-around transistors with backside power—the most advanced process manufactured on U.S. soil.

-

Secured strategic capital: Nvidia's $5 billion investment closed in Q4, adding to the $2 billion from SoftBank and a U.S. government equity stake. Intel exited 2025 with $37.4 billion in cash.

-

Hit foundry milestones: Intel 14A development is on track, with 0.5 PDK released and active customer engagements. Customer decisions are expected in H2 2026 through H1 2027.

-

Scaled custom ASICs: Intel's ASIC business reached a $1 billion annualized run rate in Q4, growing more than 50% in 2025.

Q1 Guidance: The Details

The math behind the guidance miss is stark:

| Metric | Q1 2026 Guidance | Consensus | Gap |

|---|---|---|---|

| Revenue | $11.7B-$12.7B | $12.51B | -5% at midpoint |

| Adj. EPS | $0.00 | $0.05 | -100% |

| Gross Margin | 34.5% | — | Down 340 bps QoQ |

"The midpoint of $12.2 billion reflects a lower end of seasonal Q1," Zinsner explained. "We'd be well above seasonal if we had all the revenue or supply."

The gross margin decline has two drivers: lower revenue spreading across a largely fixed cost base, and the continued ramp of Panther Lake on 18A, which remains dilutive to corporate margins.

Intel is prioritizing server shipments over client PCs, which means the Client Computing Group (CCG) will see a more pronounced decline than DCAI. "Within client, we're focusing on the mid and high end and not as focused on the low end," Zinsner said.

The Path Forward

Management outlined how supply improves from here:

Q2 inflection: Zinsner expects available supply to improve beginning in Q2 and in each remaining quarter of 2026.

Yield gains: Intel is seeing 7-8% monthly yield improvement on 18A. "It's more in focus in the variation, make sure that we can be more consistent delivery," Tan said.

Tool investments: While overall CapEx will be flat to slightly down, Intel is significantly increasing spending on tools (versus clean room space) to boost output. "Every quarter, we're seeing kind of wafer start increases pretty much across the board across Intel 7, Intel 3, and 18A," Zinsner said.

2026 revenue trajectory: The company expects to be "better than seasonal" through the year if supply improves as planned. DCAI is positioned for a "strong year of growth" based on customer feedback.

For gross margins, management acknowledged 34.5% is "by no means an acceptable level." The near-term target is 40%, with Panther Lake cost structure improving as yields rise.

What to Watch

The Q4 results confirm the demand story is intact—Intel's x86 architecture remains essential to AI infrastructure build-out, and hyperscaler customers are signaling long-term supply commitments. The question is how quickly Intel can convert that demand into revenue.

Key catalysts for 2026:

- Q2 supply improvement: Whether Intel can exit "hand to mouth" mode by mid-year

- Panther Lake ramp: Cost structure improvements that make 18A accretive to margins

- 14A customer commits: Firm foundry orders expected H2 2026 through H1 2027

- Advanced packaging revenue: Could exceed $1 billion on several customer opportunities

- Investor Day: Planned for H2 2026 in Santa Clara, with more detail on long-term targets

The stock's 7% after-hours drop leaves Intel trading around $50—erasing much of January's gains but still roughly 150% above its 2024 lows. For believers in the turnaround, the supply constraints are a timing issue, not a fundamental one. For skeptics, it's another reminder that Intel's comeback requires not just good products but flawless execution on manufacturing.

As Tan put it: "We are on the multi-year journey. It will take time and resolve."