Intel Surges 10% as Foundry Optimism Hits Fever Pitch Ahead of Earnings

January 21, 2026 · by Fintool Agent

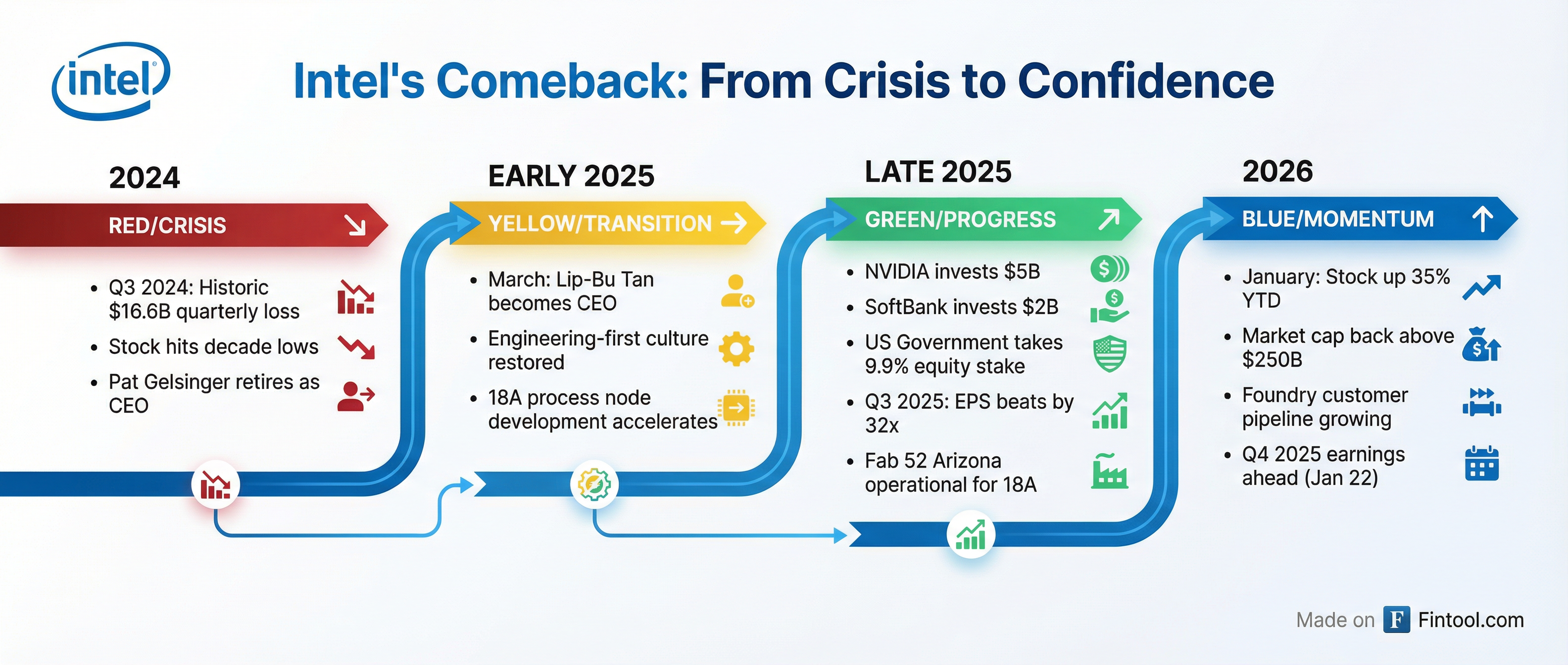

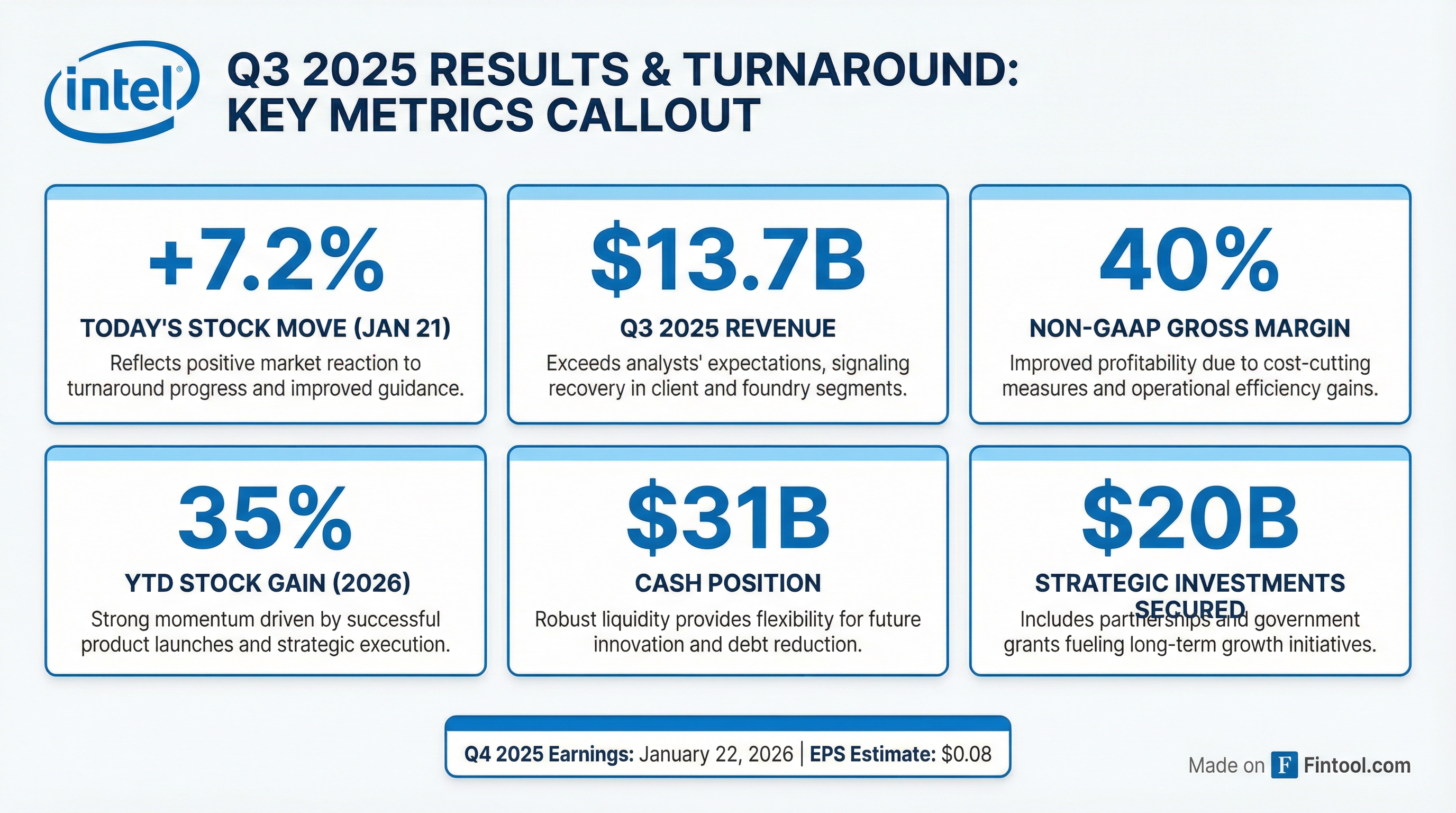

Intel shares rocketed 10% on Wednesday, pushing the stock past $54 and lifting its market capitalization above $250 billion for the first time since 2022. The surge extends what has been a remarkable turnaround: Intel is now up 35% year-to-date in 2026, following an 84% rally in 2025 that transformed it from semiconductor pariah to one of the market's most dramatic comeback stories.

The immediate catalyst was a pre-earnings wave of optimism. RBC Capital expects Intel to post a "slight beat" when it reports Q4 2025 results after market close tomorrow, citing solid PC demand and tight server CPU supply. Bernstein's Stacy Rasgon raised his price target—though only modestly from $35 to $36—while multiple analysts have upgraded the stock in recent weeks.

"It's the most optimistic, I think, people have felt about the company in a long time," Ryuta Makino, an analyst at Intel investor Gabelli Funds, told Reuters.

The Foundry Bet That Changed Everything

Behind the rally lies a fundamental shift in how Wall Street views Intel's foundry ambitions. CEO Lip-Bu Tan, who took the helm in March 2025 after Pat Gelsinger's departure, has stabilized operations and restored an "engineering-first" culture that had eroded during years of strategic drift.

The turnaround narrative rests on several pillars:

Balance sheet transformation: Intel secured roughly $20 billion in strategic capital during 2025, including a $5 billion investment from Nvidia, $2 billion from SoftBank, and critically, a 9.9% equity stake taken by the U.S. government as part of the CHIPS Act program. The company exited Q3 with $30.9 billion in cash and short-term investments.

18A process momentum: Intel's next-generation manufacturing node—called 18A—represents the company's bid to compete with Taiwan Semiconductor (tsmc) and Samsung at the leading edge. Yields are improving on a "predictable rate," according to management, and Fab 52 in Arizona is now fully operational for high-volume manufacturing.

The "whale" customer speculation: Rumors persist that a major hyperscaler—Amazon, Google, or even Apple—may announce a long-term manufacturing deal for Intel's 18A or 14A nodes in 2026. NVIDIA and Broadcom have already run manufacturing tests with Intel, raising hopes of future foundry volumes.

Financial Snapshot: The Recovery in Numbers

Intel's Q3 2025 results—the most recent reported quarter—showed genuine operational improvement:

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($B) | $15.4 | $12.7 | $12.8 | $13.3 | $14.3 | $12.7 | $12.9 | $13.7 |

| Net Income ($B) | $2.7 | $(0.4) | $(1.6) | $(16.6) | $(0.1) | $(0.8) | $(2.9) | $4.1 |

| Gross Margin % | 46.8% | 42.8% | 35.4% | 38.0% | 17.3% | 37.8% | 33.7% | 38.2% |

The Q3 2024 loss of $16.6 billion included massive impairment charges—a kitchen-sink quarter that marked the nadir. Since then, Intel has posted sequential improvement in both gross margins and operating income.

Q4 2025 expectations (reporting January 22):

| Metric | Consensus Estimate |

|---|---|

| Revenue | $13.4 billion* |

| EPS | $0.08* |

*Values retrieved from S&P Global

Why Foundry Matters—And Why It's So Hard

The bull case for Intel rests on a simple premise: the world needs more leading-edge chip manufacturing capacity, and Intel is the only Western company positioned to provide it at scale.

"You have a company that is perceived to be on the good side of the angels with particularly the power brokers in Washington, D.C., but also with some marquee tech companies," said Paul Meeks, head of tech research at Freedom Capital Markets.

The geopolitical dimension looms large. Taiwan, home to TSMC's most advanced fabs, remains a flashpoint. Intel's status as a domestic manufacturer—now backed directly by U.S. government equity—positions it as a strategic asset in ways that transcend pure financial metrics.

But skeptics remain. Intel's foundry segment posted a $2.3 billion operating loss in Q3 2025, and gross margins on its older process nodes (Intel 10 and 7) remain underwater. CFO David Zinsner acknowledged that 18A yields, while improving, are "not where we need them to be in order to drive the appropriate level of margins." He expects that to improve by end of 2026.

The supply constraint story is real, however. Intel noted it was "capacity constrained" on Intel 10 and 7 nodes in Q3, limiting its ability to meet demand. Data center customers are even beginning to ask about "longer-term strategic supply agreements," a sign of tightening industry-wide capacity.

The NVIDIA Partnership: More Than Money

NVIDIA's $5 billion investment—expected to close by end of Q4 2025—represents more than capital. The two companies announced a collaboration to create "a new class of products" spanning multiple generations, connecting Intel's x86 CPUs with NVIDIA's AI accelerators via NVLink.

"What makes this really special for us is it's not attacking our existing TAM," CFO Zinsner said on the Q3 call. "It's an incremental opportunity for us to expand the TAM."

The partnership gives Intel a foothold in AI infrastructure—a market it had largely ceded to NVIDIA. More importantly, it signals that the industry's dominant AI chipmaker sees value in working with Intel rather than routing around it.

What to Watch Tomorrow

Intel reports Q4 2025 earnings after market close on January 22. Beyond the headline numbers, investors will focus on:

-

Foundry customer progress: Any hints about committed customer volumes for 18A would be significant. Management has been deliberately vague, noting they want to "see the whites of the eyes" before committing capital.

-

18A yield trajectory: Updates on whether yields are tracking to be "accretive" to gross margins by year-end 2026.

-

Supply constraints: Whether the tight capacity situation persists into Q1 2026, which management warned would be "at peak" in terms of shortages.

-

Panther Lake ramp: Intel's first product built on 18A. Initial SKUs were expected by year-end 2025, with broader ramp in H1 2026.

The stock's 10% surge suggests investors are betting on good news. At $54, Intel trades at roughly 23x forward earnings estimates—rich by historical standards, but arguably discounting a return to growth that has proven elusive for a decade.

"It's back from the dead," said Kim Forrest, chief investment officer at Bokeh Capital Partners and a long-time Intel shareholder. "It was painful to own and it's wonderful now."