JPMorgan Posts $57B Profit, Takes Over Apple Card as Goldman Exits Consumer

January 13, 2026 · by Fintool Agent

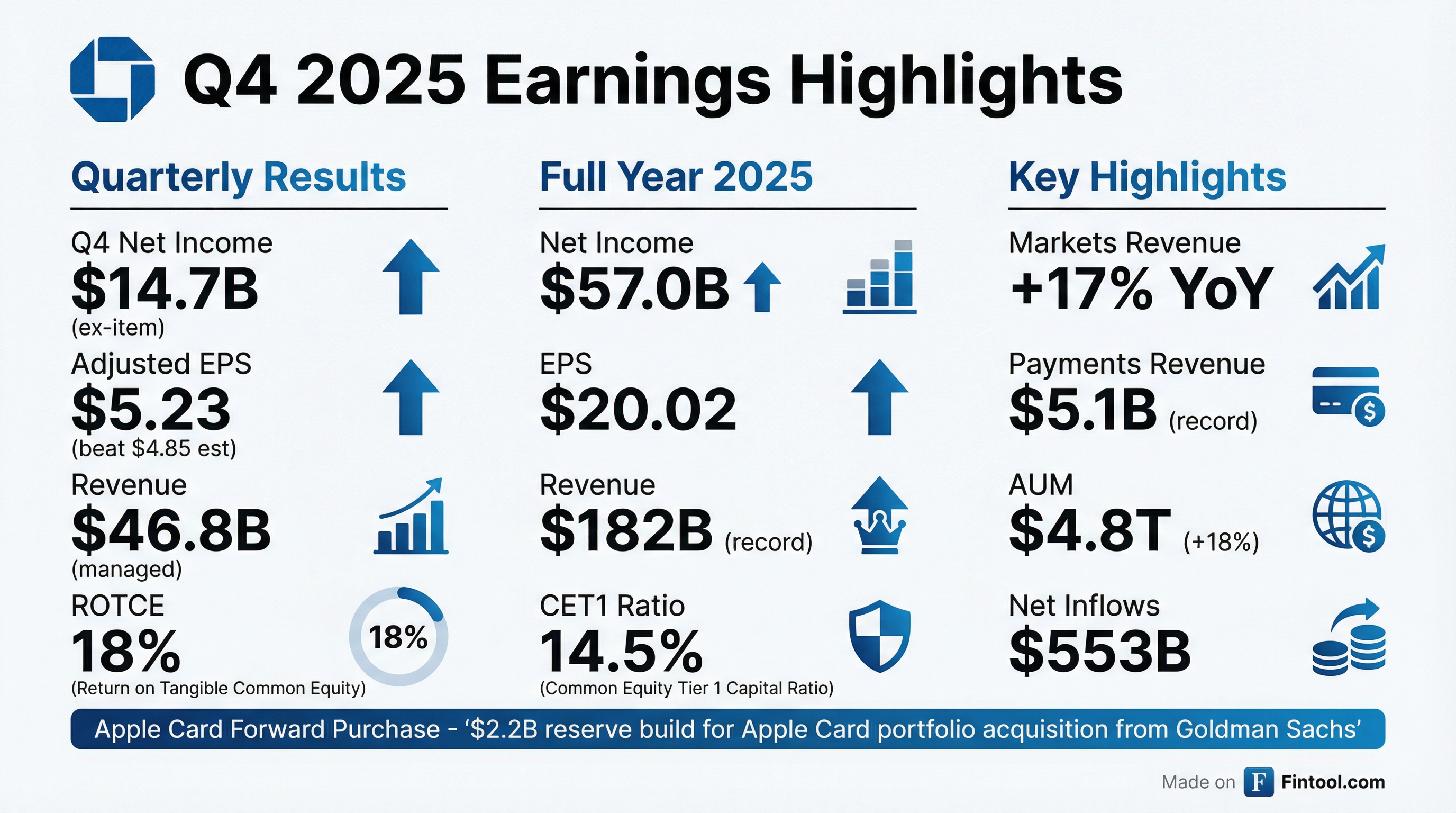

JPMorgan Chase+3.95% kicked off Q4 earnings season with a beat on adjusted profits, a record $182 billion revenue year, and one of the largest credit card portfolio acquisitions in history. The nation's biggest bank will take over the Apple Card from Goldman Sachs+4.31%, marking the final exit of Goldman's ill-fated consumer banking experiment—and cementing JPMorgan's dominance in cards.

Adjusted earnings per share of $5.23 beat consensus estimates of $4.85. But on a GAAP basis, the bank earned $4.63—dragged lower by a $2.2 billion credit reserve build to account for the $20 billion Apple Card portfolio it's acquiring.

Full-year net income came in at $57 billion—strong by any measure, though slightly below the $59 billion record set in 2024.

"The Firm concluded the year with a strong fourth quarter, generating net income of $14.7 billion excluding a significant item," said Chairman and CEO Jamie Dimon. "Looking ahead, we are excited to become the new issuer of the Apple Card."

The Apple Card Takeover

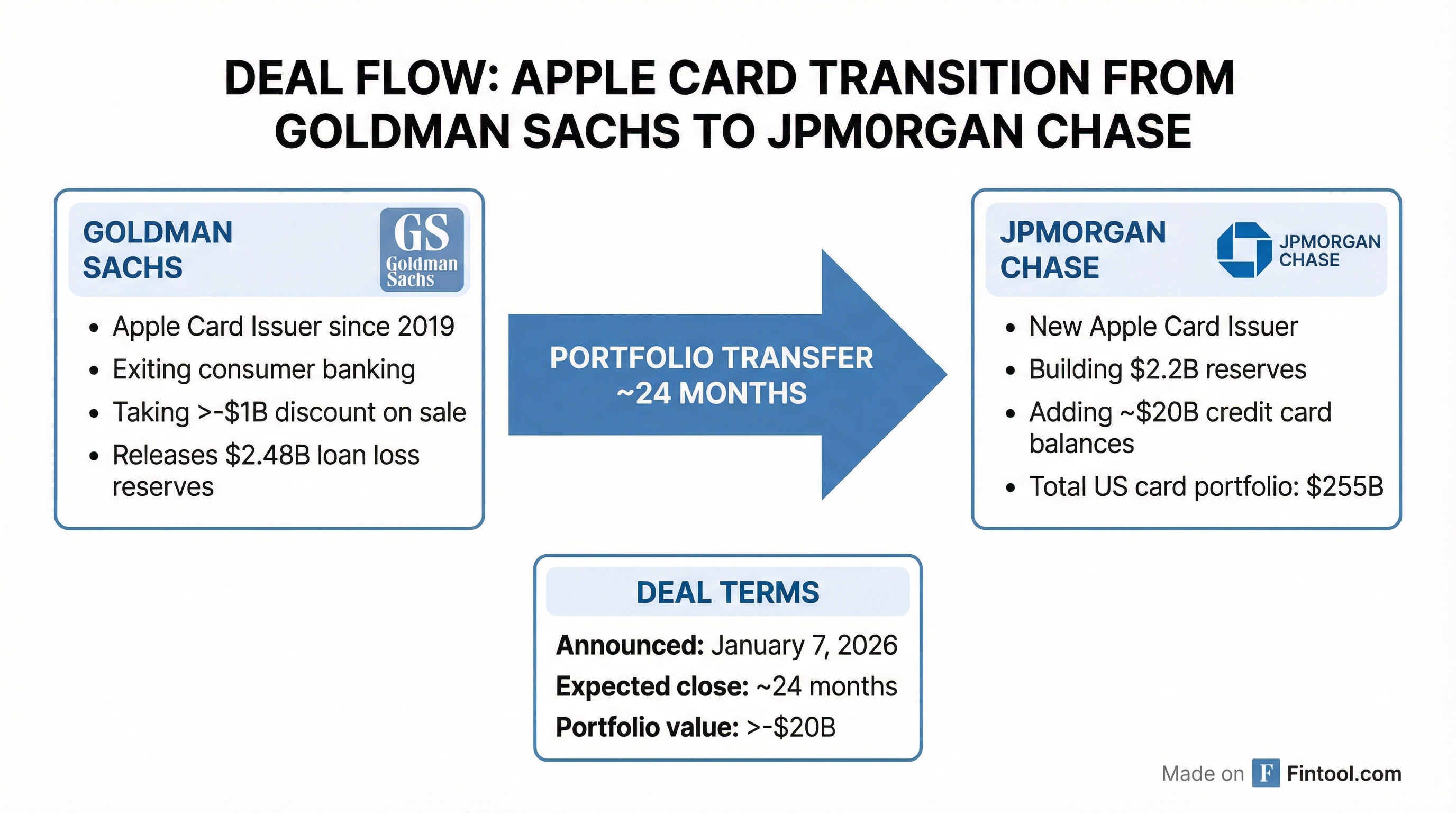

The deal—announced January 7—marks the end of Goldman Sachs' ambitious push into consumer banking. Goldman launched the Apple Card with Apple+0.80% in 2019 as a cornerstone of its Marcus consumer strategy. Six years later, it's taking more than a $1 billion discount to exit the relationship.

"This transaction substantially completes the narrowing of our focus in our consumer business," said Goldman CEO David Solomon.

For JPMorgan, it's strategic opportunism. The ~$20 billion portfolio brings the bank's total U.S. credit card balances to approximately $255 billion, edging past Capital One for the top spot. The transition will take roughly 24 months.

JPMorgan set aside $2.2 billion in credit reserves to cover potential losses from the acquired portfolio—accounting for the higher delinquency rates that plagued Goldman's management of the card. The reserve reduced the Q4 CET1 capital ratio by approximately 25 basis points under standardized rules.

Business Segment Breakdown

JPMorgan's diversified model delivered across the board:

Commercial & Investment Bank: Revenue rose 10% year-over-year. Markets revenue jumped 17%—with Fixed Income up 7% and Equities surging 40% on strong client activity and derivatives monetization. Investment banking fees declined 5%, dragged by weakness in debt and equity underwriting. Payments revenue hit a record $5.1 billion.

Consumer & Community Banking: Revenue up 6%. The franchise acquired 1.7 million net new checking accounts and 10.4 million new credit card accounts in 2025. Wealth management households crossed 3 million. Card outstandings grew on strong account acquisition and revolving balance growth.

Asset & Wealth Management: Record quarter with revenue of $6.5 billion, up 13%. AUM reached $4.8 trillion (+18% YoY). Client asset net inflows totaled $553 billion for the year—driving total client assets above $7 trillion.

| Segment | Q4 2025 Revenue | YoY Change | Key Metric |

|---|---|---|---|

| CIB | $19.5B | +10% | Markets +17%, IB Fees -5% |

| CCB | $18.3B | +6% | 10.4M new card accounts |

| AWM | $6.5B | +13% | $553B net inflows |

Dimon on the Economy—and the Fed

Dimon offered his characteristically measured view of the macro backdrop:

"The U.S. economy has remained resilient. While labor markets have softened, conditions do not appear to be worsening. Meanwhile, consumers continue to spend, and businesses generally remain healthy," he said in the earnings release.

But he added a warning: "Markets seem to underappreciate the potential hazards—including from complex geopolitical conditions, the risk of sticky inflation and elevated asset prices."

On the earnings call, Dimon also weighed in on the political attacks on Federal Reserve Chair Jerome Powell, who is facing a criminal investigation by the Justice Department over the Fed's headquarters renovation.

"I support the Fed's independence" and have "great respect for Chair Powell," Dimon told reporters, adding that political interference with the central bank could push up borrowing costs.

The comments came the same day 11 global central bankers—including ECB President Christine Lagarde and Bank of England Governor Andrew Bailey—issued a joint statement defending Fed independence.

Financial Highlights

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|---|

| Revenue ($B) | $43.7 | $44.0 | $45.7 | $45.4 | $46.8 |

| Net Income ($B) | $14.0 | $14.6 | $15.0 | $14.4 | $14.7* |

| Diluted EPS | $4.81 | $5.07 | $5.24 | $5.07 | $5.23* |

| ROE (%) | 16.2% | 16.8% | 16.9% | 16.1% | 15.0% |

| Total Assets ($T) | $4.0 | $4.4 | $4.6 | $4.6 | $4.4 |

*Adjusted, excluding Apple Card reserve build

2026 Outlook

JPMorgan guided to net interest income of approximately $95 billion for 2026 (excluding Markets), up about $3 billion from 2025 levels. The bank expects the Apple Card acquisition to be accretive over time as it cross-sells to acquired customers.

Credit quality remains a focus. Card Services net charge-off rate was 3.14% in Q4, reflecting seasoning of recent vintages. Management noted delinquencies and losses remain "in line with expectations."

What to Watch

Apple Card integration: The ~24-month transition means JPMorgan won't see full benefits until 2028. Watch for any additional reserve adjustments as the portfolio migrates.

Investment banking rebound: Dealmaking revenue declined in Q4 despite elevated client dialogue. Management cited uncertainty weighing on pipeline conversion. Any pickup in M&A or IPO activity would benefit JPMorgan's #1-ranked franchise.

Credit card normalization: Consumer credit trends bear monitoring. Spend data shows some softness in travel and front-loading ahead of tariffs. Lower-income segments show rotation but no signs of distress yet.

Political risk: The Trump administration's call for a 10% credit card rate cap and attacks on Fed independence create headline risk for all banks.

Bottom Line

JPMorgan delivered where it counts: beating adjusted earnings, posting record revenues, and positioning for future growth through patient capital deployment. The Apple Card acquisition is a signature Dimon move—buying an asset at a discount from a distressed seller with a long-term eye toward integration.

The $2.2 billion reserve build overshadowed what was otherwise a clean beat. But for a bank sitting on $1.5 trillion in cash and marketable securities with a 14.5% CET1 ratio, the short-term hit is a price worth paying for strategic optionality.

As Dimon put it: "The Apple Card is one example of patient and thoughtful deployment of our excess capital into attractive opportunities."

Related: JPMorgan Chase+3.95% | Goldman Sachs+4.31% | Apple+0.80%