Kerrisdale Capital Shorts Affirm, Calls BNPL Leader 'Subprime Lender in Fintech Clothing'

January 21, 2026 · by Fintool Agent

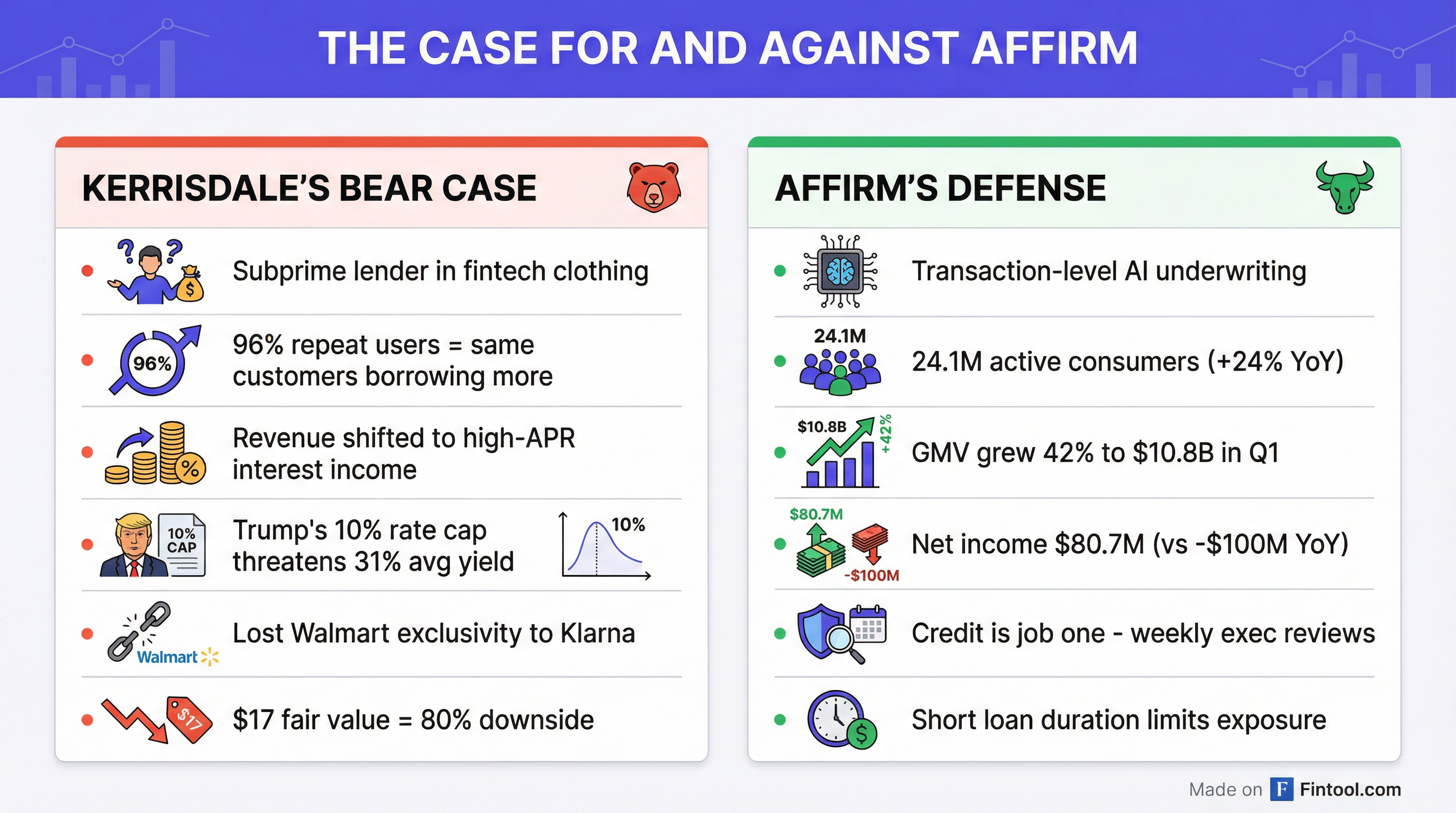

Short-selling firm Kerrisdale Capital has launched a blistering attack on Affirm Holdings, calling the Buy Now, Pay Later (BNPL) giant a "subprime lender in fintech clothing" and setting a $17 price target that implies 80% downside from current levels.

Affirm shares traded at $73.25 on Wednesday, initially dipping on the report before recovering 3.8% in early trading—a muted response that suggests investors may be skeptical of the short seller's thesis.

The Short Thesis: "The Bill Is Coming Due"

Kerrisdale's report paints a picture of a company whose "illusion of resilience" is built on aggressive credit extension to financially fragile borrowers. The core arguments:

Revenue Model Shift: The firm notes that roughly half of Affirm's income now stems from interest on high-APR loans rather than merchant fees. "When a business shifts from financing Pelotons to installment plans for groceries, it is no longer 'democratizing credit' but rather levering the financially fragile," the report states.

Customer Concentration: Kerrisdale points to what it calls a troubling pattern—96% of transactions in the most recent quarter came from repeat users. The firm likens this to "late-cycle patterns seen in failed subprime lenders," arguing growth is increasingly driven by "extracting more borrowing from the same customers" rather than expanding the user base.

Regulatory Overhang: President Trump's recent call to cap credit card interest rates at 10% has placed Affirm's average loan yield of 31% "under immediate and intense scrutiny." Any legislative action extending such caps to BNPL providers could be existential for the model.

Competitive Pressure: The loss of Affirm's exclusive Walmart relationship to Klarna is cited as evidence that "merchant contracts are being won at increasingly thin or even negative margins."

Affirm's Operating Performance Tells a Different Story

Despite the bearish narrative, Affirm's recent financial performance has been strong by most conventional metrics:

| Metric | Q1 FY26 | Q4 FY25 | Q3 FY25 | Q1 FY25 | YoY Change |

|---|---|---|---|---|---|

| Revenue ($M) | $479.2* | $457.3* | $380.4 | $321.4* | +49% |

| Net Income ($M) | $80.7 | $69.2 | $2.8 | ($100.2) | N/M |

| Gross Margin (%) | 48.8%* | 48.5%* | 45.0%* | 40.8%* | +797 bps |

| GMV ($B) | $10.8 | — | — | $7.6 | +42% |

*Values retrieved from S&P Global

The company swung to profitability in Q3 fiscal 2025 and has posted net income for four consecutive quarters. Operating income reached $63.7 million in Q1 2026, compared to an operating loss of $132.6 million a year earlier.

Active consumers reached 24.1 million as of September 30, 2025, up 24% year-over-year, with transactions per active consumer increasing 20% to 6.1.

Management's Defense: "Credit Is Job Number One"

On the most recent earnings call, CEO Max Levchin addressed credit quality concerns directly: "The reason we don't give or didn't give an enormous amount of attention to the credit performance in this particular letter isn't because we forgot. It's because it's been highly consistent and performed really well."

Levchin emphasized the company's rigorous approach: "The executive team still gets a full credit performance update every single Monday. And any time the disturbance in the force, we move that from once a week to three times a week and daily if that warrants it."

CFO Rob O'Hare added context on the repeat user metric: "We're increasingly working with consumers that we've seen before. 95% of our transactions came from repeat borrowers this quarter. So that setup really allows us to focus on underwriting the consumer here today where they are."

The 10-K filing reinforces this point, stating that repeat consumers generally result in "lower provision for credit losses and processing and servicing expenses" compared to first-time users.

The Credit Quality Picture

Affirm's Q1 2026 10-Q reveals nuanced credit data. The allowance rate increased from 5.6% as of September 30, 2024 to 5.9% as of September 30, 2025, reflecting "changes in loan mix, including holding a higher percentage of seasoned and longer term loans on our balance sheet."

However, the company's loan modification activity—a potential red flag for credit stress—actually decreased. Loans modified for borrowers experiencing financial difficulty totaled $8.8 million in Q1 2026, down from $11.1 million in Q1 2025, representing just 0.12% of total loans outstanding versus 0.18% a year earlier.

| Credit Metric | Q1 FY26 | Q1 FY25 |

|---|---|---|

| Allowance Rate | 5.9% | 5.6% |

| Loan Modifications ($M) | $8.8 | $11.1 |

| Mods as % of Loans | 0.12% | 0.18% |

The provision for credit losses increased just 2% year-over-year to $162.8 million, despite a 19% increase in average loan balances—suggesting relatively stable loss rates.

Stock Performance and Short Interest

AFRM shares have retreated from their November peak above $85 following Q1 earnings, trading in a range of $70-$75 in recent weeks. The stock remains well above its 52-week low of $55 but significantly below the $92+ highs seen in mid-2025.

Short interest data shows elevated but not extreme levels:

| Date | Short Interest | Days to Cover |

|---|---|---|

| Dec 31, 2025 | 17.7M shares | 3.83 |

| Dec 15, 2025 | 18.2M shares | 3.89 |

| Nov 28, 2025 | 15.3M shares | 3.14 |

The current short interest represents roughly 5-6% of the float—meaningful but not the kind of crowded short that typically leads to violent squeezes.

The Regulatory Wild Card

Perhaps Kerrisdale's most compelling argument centers on regulatory risk. The CFPB has found that nearly two-thirds of BNPL borrowers have "subprime or deep subprime credit scores," and 24% of borrowers were late making a payment in 2024—a 6% increase from the prior year.

FICO's recent decision to include BNPL loans in credit score calculations could also alter consumer behavior. While Affirm frames its transaction-level underwriting as more sophisticated than traditional FICO-based models, the company acknowledged in a January 2026 update that it has enhanced underwriting to include "richer real-time signals like account balances and cash flow trends."

What to Watch

Earnings Cadence: Affirm reports Q2 fiscal 2026 results on February 5. Watch for commentary on credit trends, the impact of the holiday shopping season on GMV, and any update on the regulatory environment.

Rate Cap Legislation: Trump's 10% credit card rate cap proposal faces uncertain odds in Congress. Any movement on legislation that could extend to BNPL providers would be material for the sector.

Competitive Dynamics: Affirm's top five merchants and platform partners represented 44% of GMV in Q1, down from 47% a year earlier, suggesting diversification—but the Amazon relationship (21% of GMV) remains critical.

Consumer Health: With 63% of BNPL borrowers holding multiple simultaneous loans and delinquency rates ticking higher, any deterioration in employment data could quickly validate Kerrisdale's thesis—or the short loan duration and improved underwriting could prove the bears wrong.