KLA Posts Record Quarter as AI Process Control Boom Defies Chip Cycle

January 30, 2026 · by Fintool Agent

Kla Corporation delivered its largest quarter ever, posting record revenue of $3.30 billion and non-GAAP EPS of $8.85 as insatiable demand for AI chips fueled a process control boom across foundry, memory, and advanced packaging.

Yet the semiconductor equipment maker's stock dropped roughly 5% on Thursday despite the beat-and-raise quarter, a stark reminder that even the clearest AI beneficiaries face a high bar when valuations have already priced in perfection.

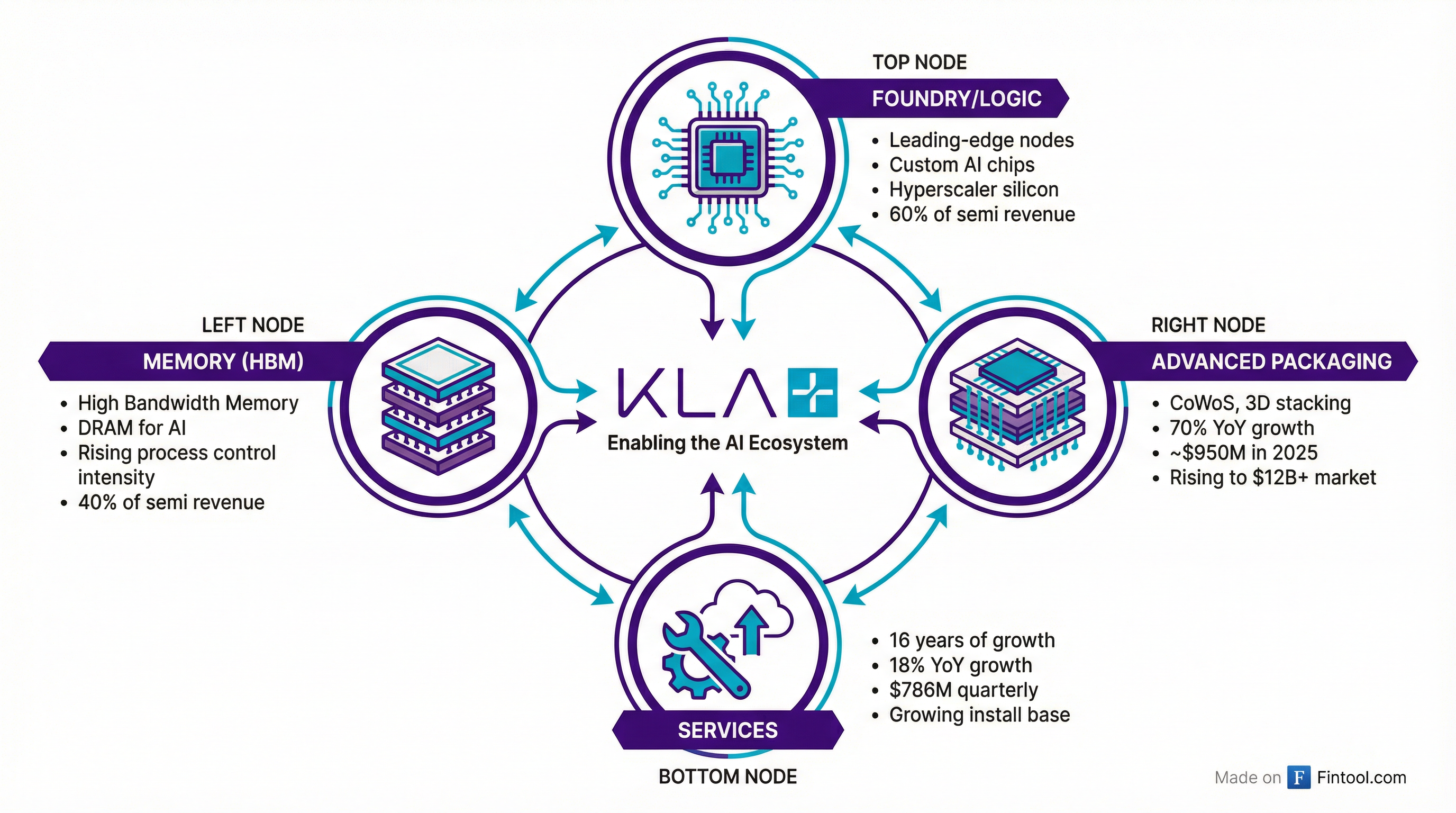

"KLA delivered a record quarter and calendar 2025 for revenue, non-GAAP operating income, and free cash flow generation," CEO Rick Wallace said on the earnings call. "As we look forward to calendar year 2026, KLA is a key enabler of the AI ecosystem and continues to uniquely benefit from the AI infrastructure buildout across all major growth vectors."

The Numbers

| Metric | Q2 FY2026 | Q1 FY2026 | Q2 FY2025 | YoY Change |

|---|---|---|---|---|

| Revenue | $3.30B | $3.21B | $3.08B | +7.2% |

| GAAP EPS | $8.68 | $8.47 | $6.16 | +41% |

| Non-GAAP EPS | $8.85 | $8.81 | $8.20 | +8% |

| Gross Margin | 62.6% | 61.3% | 60.3% | +230 bps |

| Free Cash Flow | $1.26B | — | — | Record |

KLA beat analyst expectations across the board: revenue topped the $3.25 billion consensus while EPS of $8.85 exceeded estimates of $8.79. The company guided Q3 revenue of $3.35 billion +/- $150 million, above Street expectations of $3.28 billion.

The AI Process Control Flywheel

KLA's outperformance reflects a structural shift in semiconductor manufacturing: as AI chips grow larger, more complex, and more valuable, the economics of process control tilt decisively in KLA's favor.

The company operates across four AI growth vectors, each reinforcing the others:

1. Leading-Edge Foundry/Logic (60% of semi revenue): Custom AI chips from hyperscalers and leading-edge nodes require rigorous inspection and metrology. "The growing investment in custom silicon, particularly among hyperscalers developing their own custom chips, has led to a proliferation of new, higher-value design starts," CFO Bren Higgins noted.

2. High-Bandwidth Memory (40% of semi revenue): HBM for AI accelerators is transforming memory manufacturing. DRAM process control intensity is rising sharply as layers increase and tolerances tighten. "The value of these devices is higher, so there's less willingness to give away real estate to redundancy," Wallace explained.

3. Advanced Packaging: KLA's advanced packaging revenue hit approximately $950 million in calendar 2025, up more than 70% year-over-year. The company's share of this market jumped from roughly 10% in 2021 to nearly 50% in 2025.

4. Services: Revenue reached $786 million, up 18% year-over-year—the company's 16th consecutive year of service revenue growth, compounding at 12%+ annually.

Why the Stock Fell

Despite the record quarter, KLAC shares dropped approximately 5% in Friday trading to around $1,470—down from Wednesday's close of $1,540 and well below the post-earnings high of $1,693.

"The problem is that the stock had already sprinted into the print, hitting fresh highs with expectations that were arguably loftier than the published consensus," said Michael Ashley Schulman, CIO of Running Point Capital Advisors.

Three factors weighed on sentiment:

Supply Constraints: KLA is "virtually sold out across most of our products" for the first half, with optical components creating the longest lead times. "What KLA offered for the March quarter looks like steady growth rather than renewed acceleration," Schulman added.

China Headwinds: While China revenue is expected to be "flattish, maybe slightly positive" in 2026, the company faces competitive disadvantages when U.S. export restrictions block KLA but allow non-U.S. competitors to sell to the same customers.

Margin Pressures: Surging DRAM chip prices used in KLA's systems are creating a 75-100 basis point gross margin headwind for 2026. Tariff impacts add another 50-100 basis points.

Calendar 2026 Outlook

Management laid out an increasingly bullish view for the full year:

| Metric | 2025 | 2026E | Change |

|---|---|---|---|

| Core WFE Market | $110B | $120B+ | +10% |

| Advanced Packaging Market | $11B | $12B+ | +10% |

| Total WFE (incl. Packaging) | $120B | $130B+ | +10% |

| KLA Gross Margin | 62.8% | 62% ± 50 bps | Slight compression |

"Our view today is that the first half of 2026 revenue will grow mid-single digits compared to the second half of 2025, with accelerating growth in the second half of the calendar year," Higgins said.

The company's Investor Day on March 12 will provide a detailed 2030 outlook and expanded market share targets.

The Bottom Line

KLA's record quarter validates the thesis that AI's hardware buildout requires ever-more-sophisticated process control at every layer—from leading-edge logic to HBM stacks to advanced packaging. The company controls critical chokepoints that competitors cannot easily replicate.

But the stock's reaction illustrates the challenge facing AI infrastructure plays: with shares up dramatically over the past year, even strong results leave little room for error. Supply constraints, China risks, and margin pressures give investors plenty to worry about, even as the long-term structural story remains compelling.

For KLA, the question isn't whether AI will drive demand—it's whether growth can accelerate fast enough to justify valuations that already price in considerable success.

Related: